1256 Divided By 9 1256 Contracts are instruments that fall under an IRC section which is a provision offered to taxpayers in the US It highlights the process of filing and reporting derivative contracts

In other words Section 1256 contracts allow an investor or trader to take 60 of the profit at the more favorable long term tax rate even if the contract was only held for a year For purposes of this title gain or loss from trading of section 1256 contracts shall be treated as gain or loss from the sale or exchange of a capital asset

1256 Divided By 9

1256 Divided By 9

https://image.cnbcfm.com/api/v1/image/108057175-1730744796825-Untitled-9.jpg?v=1730919406&w=1920&h=1080

7 Divided By 9 7 9 YouTube

https://i.ytimg.com/vi/qgQv-njWupc/maxresdefault.jpg

Divide 1232 By 3 Most Common Mistake While Dividing YouTube

https://i.ytimg.com/vi/wAGlxQtPUGQ/maxresdefault.jpg

What Is a Section 1256 Contract A Section 1256 contract is a type of investment defined by the Internal Revenue Code IRC as a regulated futures contract foreign currency Section 1256 contracts have special tax rules including the 60 40 tax treatment and mark to market accounting making them different from other investments These

Section 1256 of the internal Revenue code classifies certain types of contracts as Section 1256 contracts These include regulated futures contracts foreign currency What Is Section 1256 and How Does It Impact Tax Reporting Explore how Section 1256 affects tax reporting for certain financial instruments with unique mark to market

More picture related to 1256 Divided By 9

Mr Jeff Divided His Money Into Ratio Of 4 2 Between Jon And Jack Jon

https://hi-static.z-dn.net/files/d33/b7f31cce07d8a3ed07834014acd73d1b.png

6 27 31 Divided By 18 1 1 4 Divided By 5 15 4 3 8 Divided By 2 1 3

https://ph-static.z-dn.net/files/d7e/67a704cb76b90e3df9c4c3ab638e8ab9.jpg

SAFETY PACKAGES Made In The Shade We ve Got You Covered

https://s42280.pcdn.co/wp-content/uploads/2024/11/logo25-02.png

Tax advantages Any gain or loss from a 1256 Contract is treated for tax purposes as 40 short term gain and 60 long term gain regardless of holding period Section 1256 contracts stand as a distinctive tax treatment vehicle recognized by the Internal Revenue Code IRC They are named after the IRC section that prescribes their

[desc-10] [desc-11]

10

https://kolobook.org/wp-content/uploads/2023/03/img_20230331_100256.jpg

Album Photos Campagne 32242 AS BURGER

https://cdn.sortiraparis.com/images/80/105061/1012597-campagne-32242-as-burger-dsc-1256.jpg

https://www.wallstreetmojo.com

1256 Contracts are instruments that fall under an IRC section which is a provision offered to taxpayers in the US It highlights the process of filing and reporting derivative contracts

https://www.investopedia.com › terms

In other words Section 1256 contracts allow an investor or trader to take 60 of the profit at the more favorable long term tax rate even if the contract was only held for a year

28 Divide By 30

10

28 Divide By 30

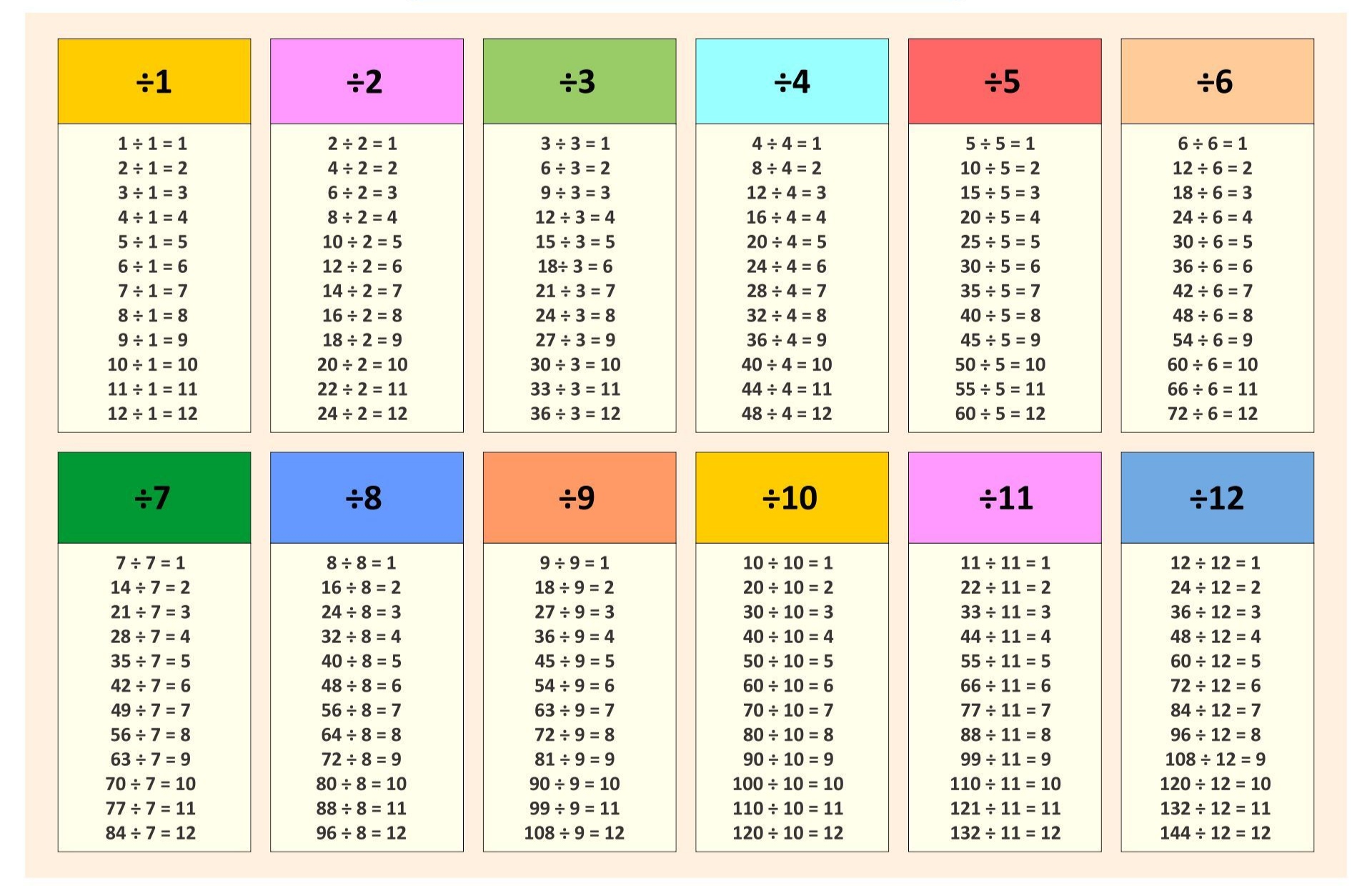

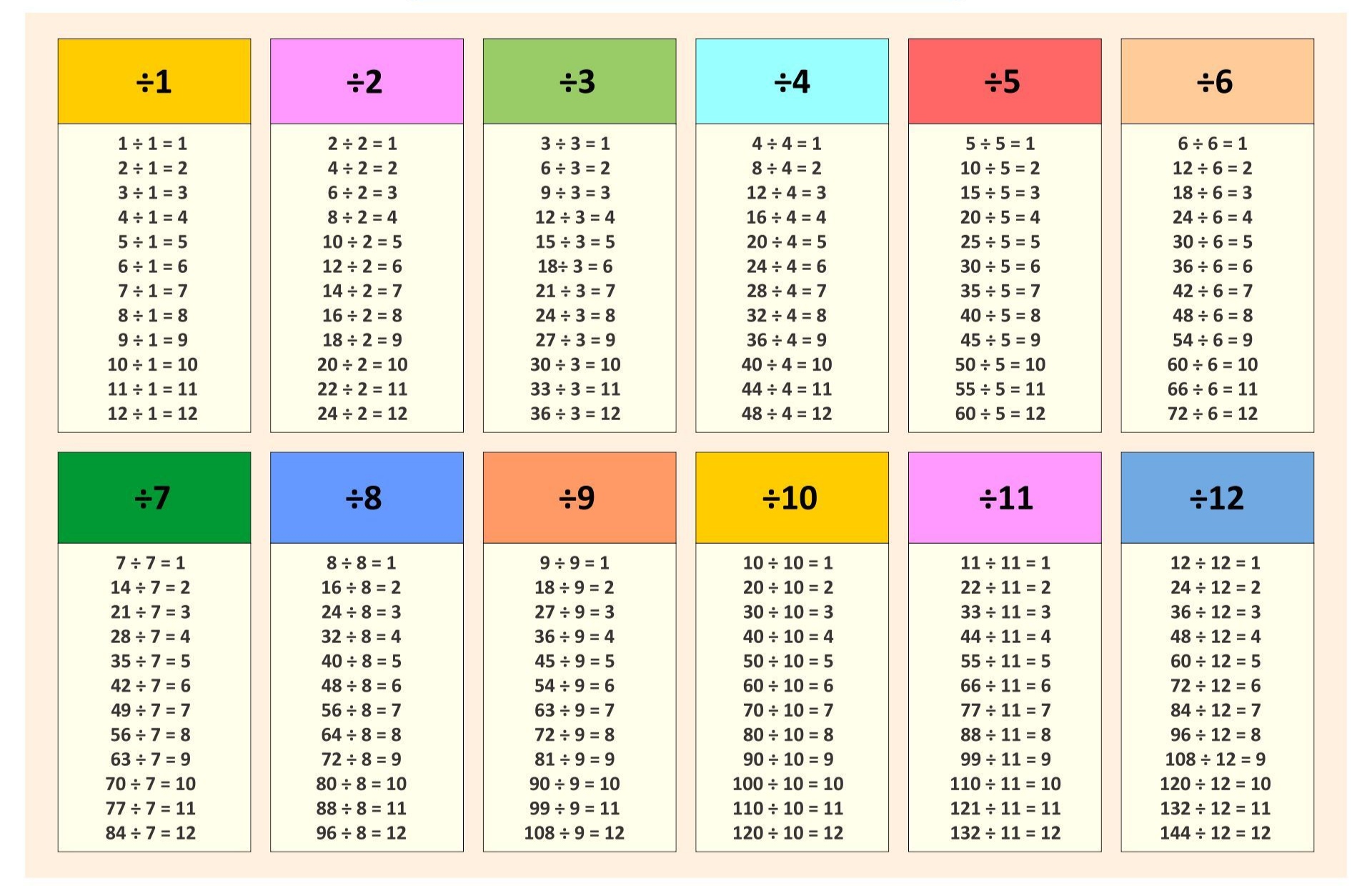

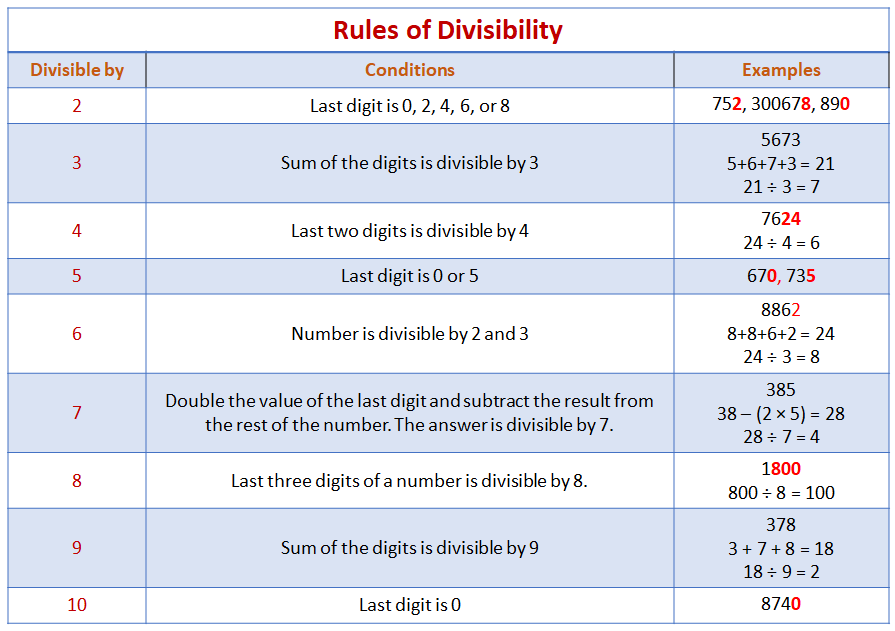

Divisibility Rules examples Solutions Videos

The Of All Two Digit Positive Numbers Which When Divided By 7 Yield 2

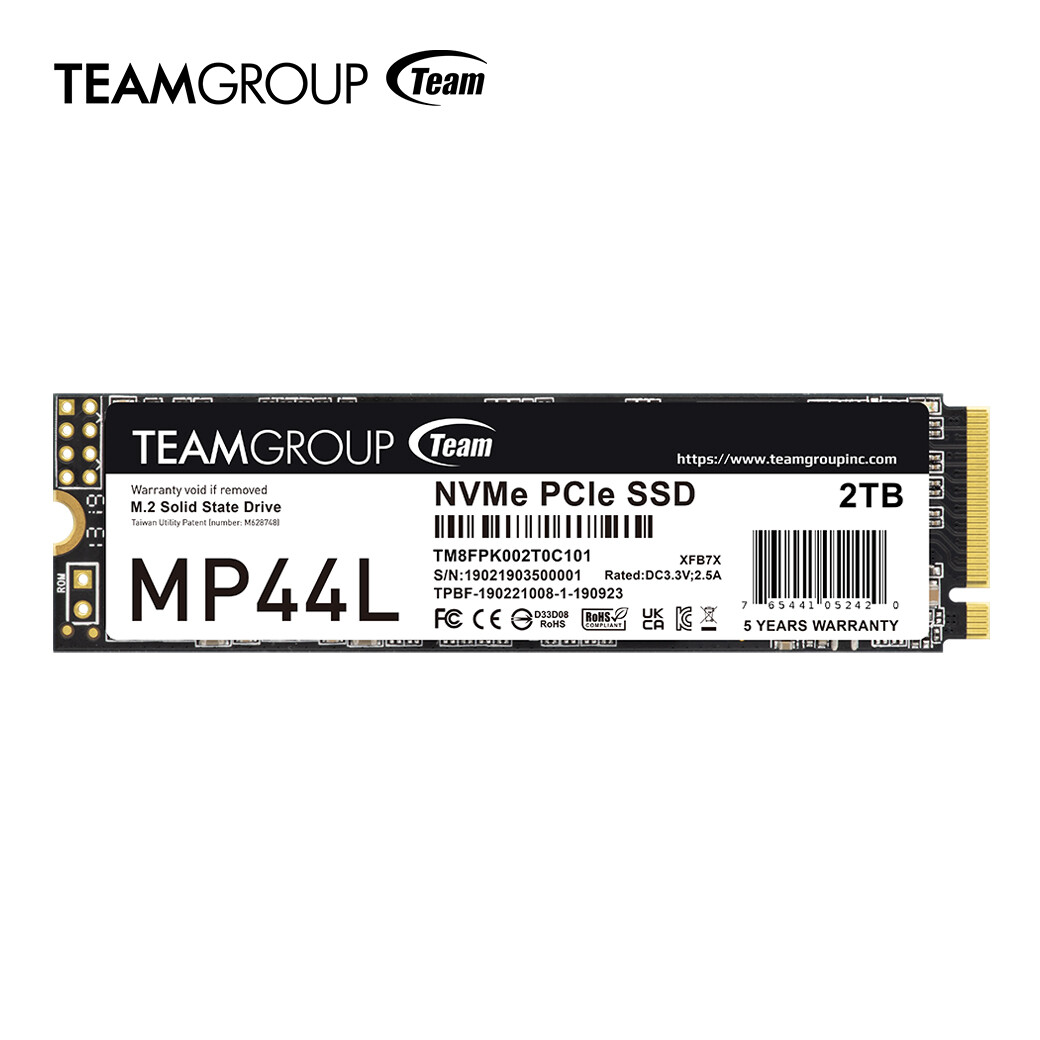

Team Group Announces Collaboration With ASI Computer Technologies

Team Group Announces Collaboration With ASI Computer Technologies

culos De Grau Hugo Boss 1256 2M2 Dourado Preto

Elon Musk Reinstates Reporters Twitter Accounts After Suspending Them

Mais Crimes Do Diddy S o Expostos Not cias Musicais BCharts F rum

1256 Divided By 9 - What Is Section 1256 and How Does It Impact Tax Reporting Explore how Section 1256 affects tax reporting for certain financial instruments with unique mark to market