2189 Divided By 4 Compare a Roth IRA vs a traditional IRA with this comparison table Understand the income requirements tax benefits as well as contribution limits that can help with your retirement needs

The best IRA for you a Roth IRA or a traditional IRA depends on the timing of their tax breaks their eligibility standards and the access they offer Secure your financial future with Vanguard s Roth IRA tax free growth potential for retirement savings Discover the benefits and how to open a Roth IRA

2189 Divided By 4

2189 Divided By 4

https://i.ytimg.com/vi/D6UoWwqXmLs/maxresdefault.jpg

3 Divided By 15 3 15 YouTube

https://i.ytimg.com/vi/0HFsfY7PZ_A/maxresdefault.jpg

5 Divided By 1 5 Five Divided By One Fifth YouTube

https://i.ytimg.com/vi/4wIssrPXl_s/maxresdefault.jpg

Traditional and Roth IRAs have distinct requirements including eligibility and contribution limits Here s a guide to help you decide which may be better for you Roth IRAs are individual retirement accounts that allow tax free investment growth and distributions

A Roth IRA is a retirement account option funded with after tax dollars that can offer flexibility and help you save for retirement Learn more about Roth IRAs A Roth IRA is an individual retirement account IRA under United States law that is generally not taxed upon distribution provided certain conditions are met The principal difference between

More picture related to 2189 Divided By 4

22 Divided By 4 22 4 Long Division YouTube

https://i.ytimg.com/vi/lFjdPwb4Zik/maxresdefault.jpg

60 Divided By 4 Divide Karna Kaise Sikhe Step By Step By Surendra

https://i.ytimg.com/vi/BLL5YJKkgtU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgYyhSMA8=&rs=AOn4CLDZNMjmVKwYyNjH-jR7xJ1XyA6kHg

28 Divided By 4 28 4 Value Of 28 4 YouTube

https://i.ytimg.com/vi/5flYHOftOck/maxresdefault.jpg

Use a comparison chart to learn how to save money for your retirement with traditional and Roth IRAs A Roth IRA is a type of investment account that can provide you with tax free income in retirement You contribute after tax dollars to a Roth IRA in return withdrawals in

A Roth IRA is a special individual retirement account IRA in which you pay taxes on contributions and then all future withdrawals are tax free Roth IRAs are easy to set up simple to maintain and come with tax advantages that help you build wealth and boost your retirement savings over the long haul In fact we re

Q40 Solve Z 3 5 4 Z Divided By 3 5 Divided By 4 Z By 3 5 By 4

https://i.ytimg.com/vi/fza3EaCqkxQ/maxresdefault.jpg

20 Divided By 2 Long Division How To Divide 20 By 2 Find 20 2

https://i.ytimg.com/vi/AxFEGCQ21_4/maxresdefault.jpg

https://www.fidelity.com › retirement-ira › ira-compar

Compare a Roth IRA vs a traditional IRA with this comparison table Understand the income requirements tax benefits as well as contribution limits that can help with your retirement needs

https://www.investopedia.com › retirement › roth-vs...

The best IRA for you a Roth IRA or a traditional IRA depends on the timing of their tax breaks their eligibility standards and the access they offer

Divide Karne Ka Sahi Tarika 1232 Divided By 3 Division YouTube

Q40 Solve Z 3 5 4 Z Divided By 3 5 Divided By 4 Z By 3 5 By 4

336 Divided By 6 Three Hundred Thirty Six Divided By Six YouTube

When A Number Is Successively Divided By 3 4 And 7 The Remainder

When A Number Is Divided By 63 The Remainder Is 25 When The Number Is

Lauren Observes A Marble Travel Along A Horizontal Path At A Constant

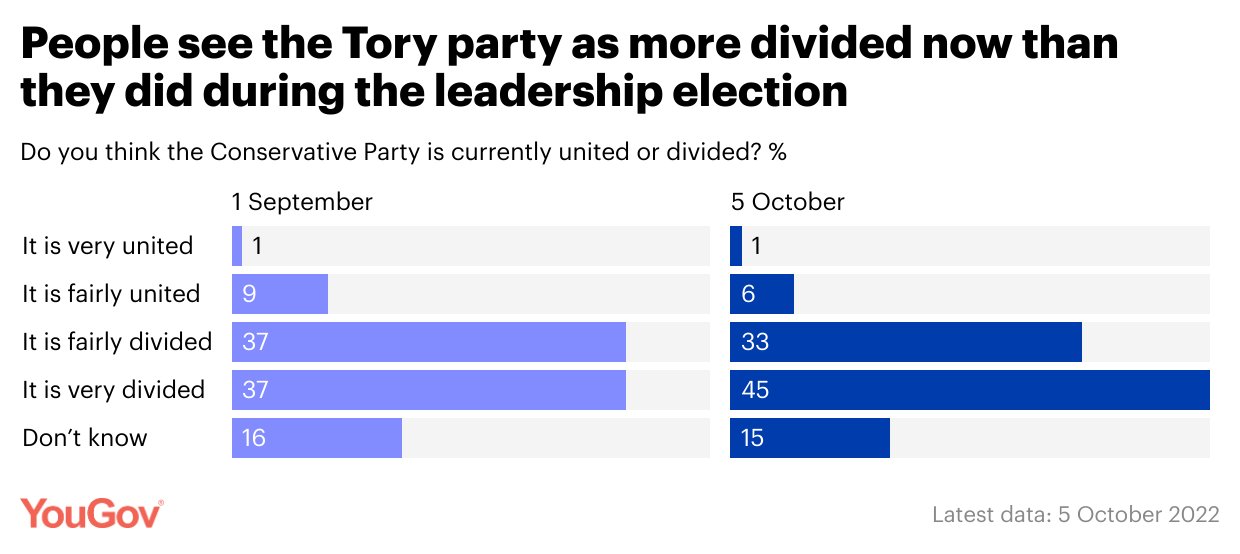

YouGov On Twitter After A Contentious Leadership Election The Tories

Check Solve The Equation g 37 27g 73 72 G Minus Start Fraction 3

2189 Divided By 4 - A Roth IRA is a retirement account option funded with after tax dollars that can offer flexibility and help you save for retirement Learn more about Roth IRAs