80000 Divided By 52 Divided By 40 Posted Thu 23 Jan 2025 07 42 55 GMT by HMRC Admin 25 Response Hi Bruce Maginnis In your letter include proof from your pension provider of payments made for each

The HMRC App is a quick and easy way to get information about your tax National Insurance tax credits and benefits Watch our YouTube videos These short information Posted Fri 29 Dec 2023 15 28 09 GMT by HMRC Admin 2 Response Hi You can view or print your tax returns through your Personal Tax Account by selecting Self Assessment within the

80000 Divided By 52 Divided By 40

80000 Divided By 52 Divided By 40

https://i.ytimg.com/vi/D9Tv4dX1J7A/maxresdefault.jpg

8 Divided By 3 8 3 YouTube

https://i.ytimg.com/vi/PKyAiNEicYE/maxresdefault.jpg

2 Divided By 9 2 9 YouTube

https://i.ytimg.com/vi/jWTaBLvUf7Q/maxresdefault.jpg

Hi BJONES24 If you have submitted an FPS twice you will need to amend one of the submission to NIL This isn t something HMRC can help with and your software provider Hi I spoke to a web chat agent in May earlier this year to raise a query about my self assessment I was advised to write a letter to the PAYE and Self Assessment department

Yes thanks HMRC Admin I ve looked and can confirm my VAT Certificate says March June September and December My next VAT Return is due by 7 March That s for Posted Tue 10 Dec 2024 10 46 12 GMT by HMRC Admin 19 Response Hi Capital contributions are payments made towards the cost of the car or any qualifying accessory and are deducted

More picture related to 80000 Divided By 52 Divided By 40

6 Divided By 7 6 7 YouTube

https://i.ytimg.com/vi/2s8-vH1Qa7M/maxresdefault.jpg

Divide 52 By 5 Most Common Mistake While Dividing YouTube

https://i.ytimg.com/vi/a2PnyT9BTDg/maxresdefault.jpg

4 Divided By 5 4 5 Or 4 5 YouTube

https://i.ytimg.com/vi/bDm-iq3rB-k/maxresdefault.jpg

Dear HMRC Team I have lost my old phone and cannot access the Authenticator App I used to generate access codes When trying to log into the web service after selecting Using HMRC s advisory fuel rates for petrol cars with engines up to 1400cc at 0 12 per mile 0 12 x 3000 miles 360 for business use 0 12 x 800 miles 96 for

[desc-10] [desc-11]

Divide 525 By 5 Many Get This Quotient Wrong YouTube

https://i.ytimg.com/vi/lbE57vJbIIk/maxresdefault.jpg

36 2 36 Divided By 2 long Division How To Divide 36 By 2 YouTube

https://i.ytimg.com/vi/S5lZynH3Uss/maxresdefault.jpg

https://community.hmrc.gov.uk › customerforums › sa

Posted Thu 23 Jan 2025 07 42 55 GMT by HMRC Admin 25 Response Hi Bruce Maginnis In your letter include proof from your pension provider of payments made for each

https://community.hmrc.gov.uk › customerforums

The HMRC App is a quick and easy way to get information about your tax National Insurance tax credits and benefits Watch our YouTube videos These short information

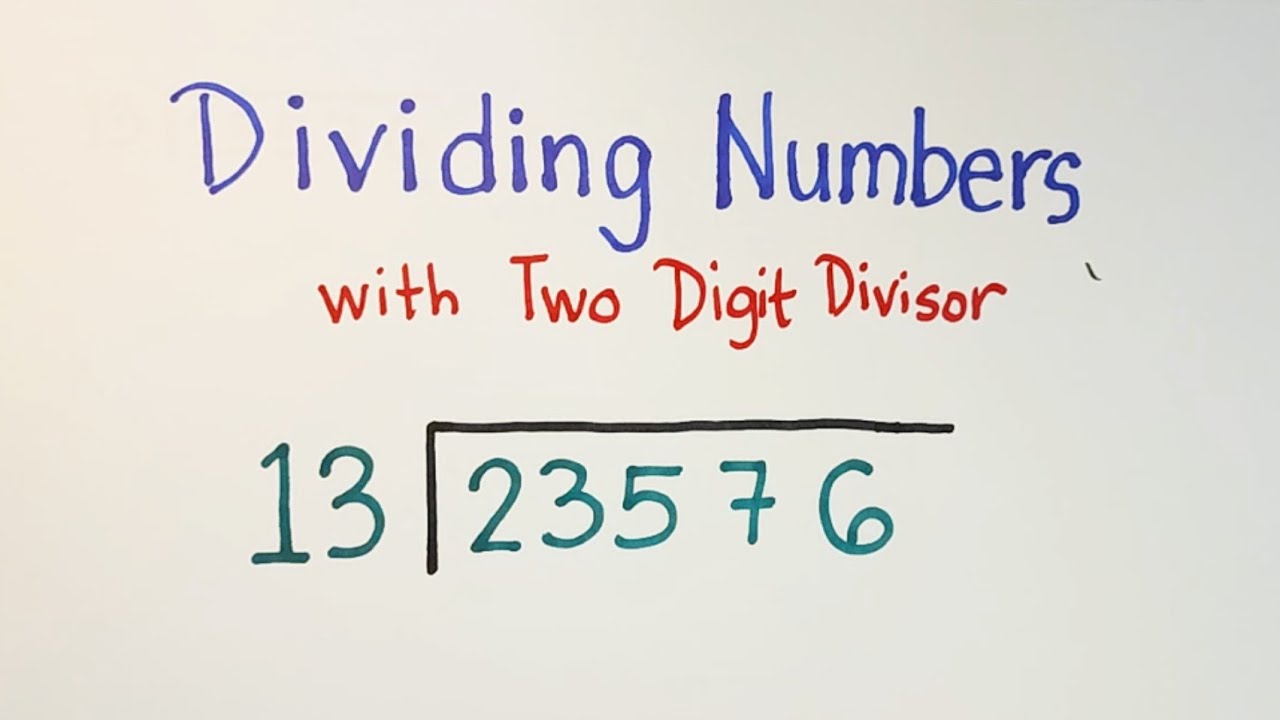

How To Divide Numbers With Two Digit Divisor Long Division Of Numbers

Divide 525 By 5 Many Get This Quotient Wrong YouTube

10

Division Symbole Signe Division TURJN

What Is 394 Divided By 15 With Remainder As Decimal Etc

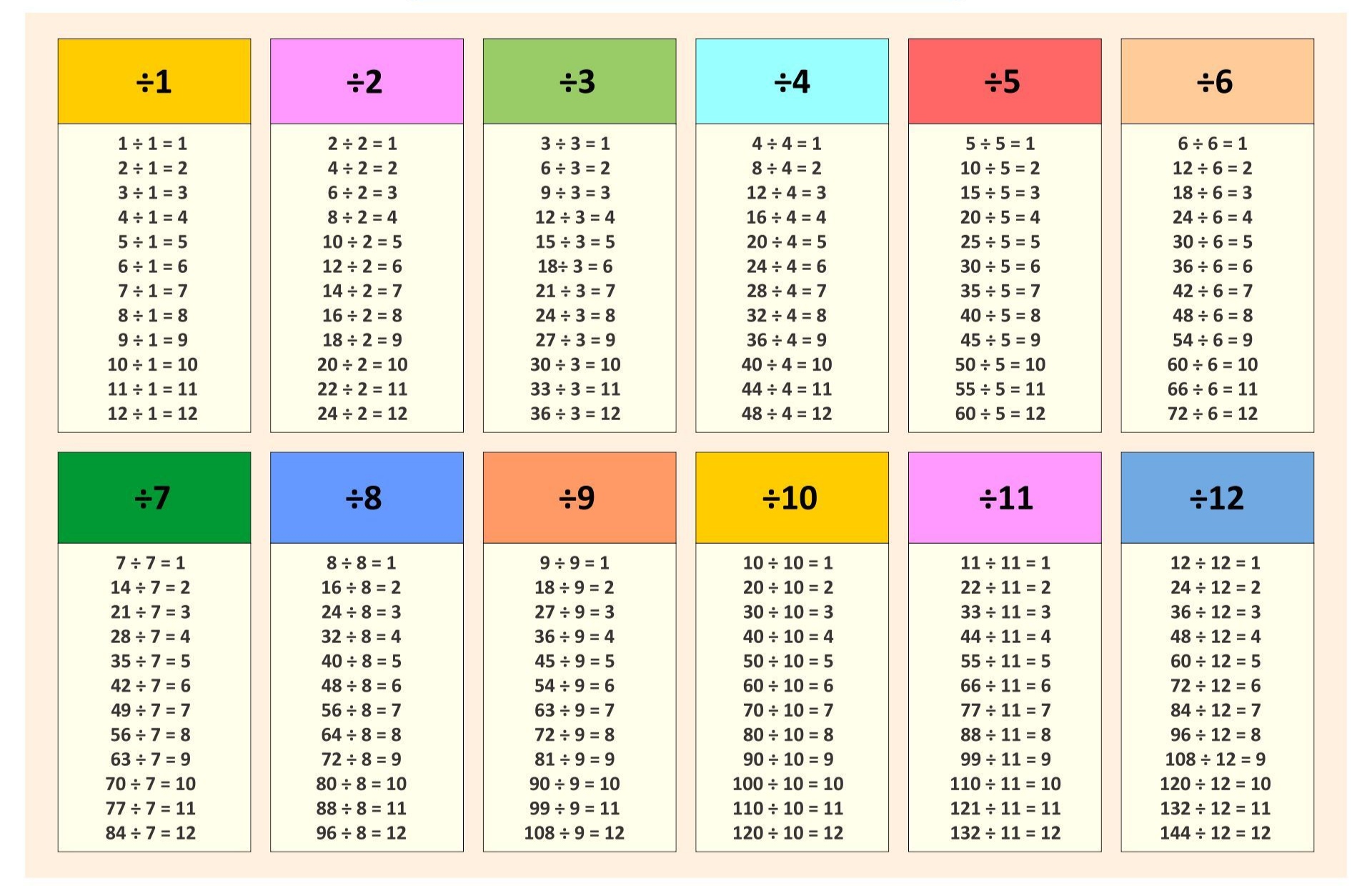

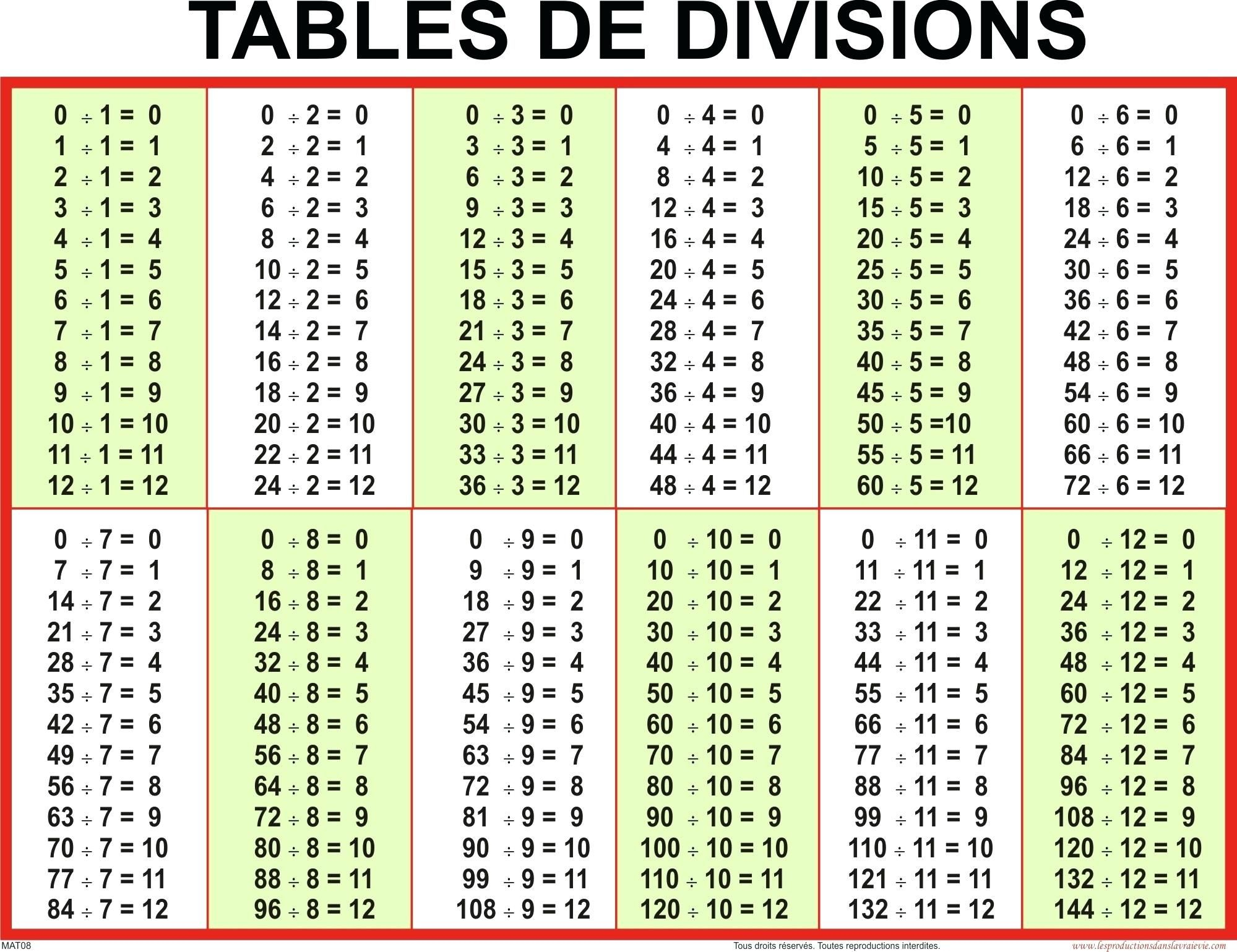

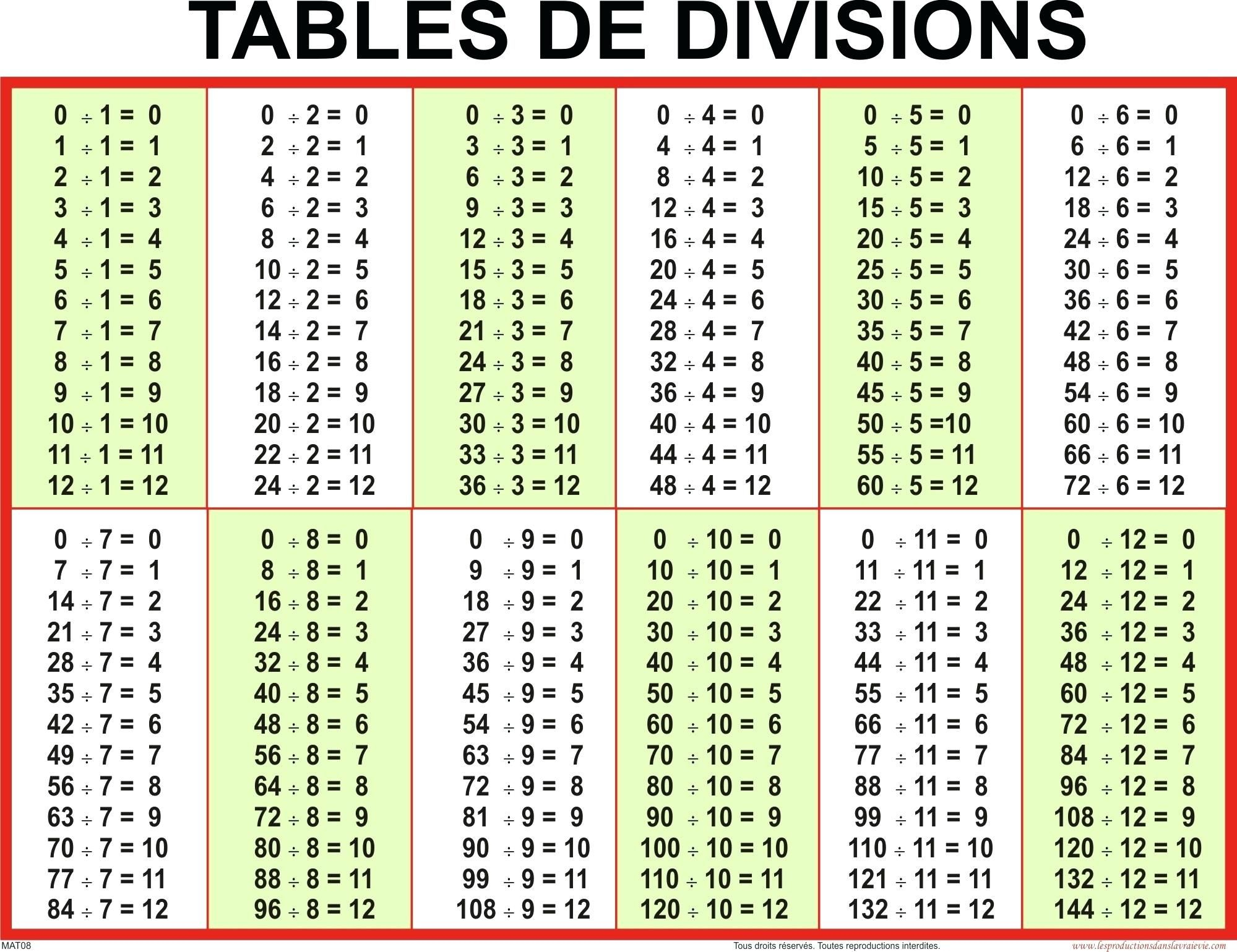

7 Divide Tables

7 Divide Tables

Divide Table Chart

28 Divide By 30

What Is 461 Divided By 4 With Remainder As Decimal Etc

80000 Divided By 52 Divided By 40 - Posted Tue 10 Dec 2024 10 46 12 GMT by HMRC Admin 19 Response Hi Capital contributions are payments made towards the cost of the car or any qualifying accessory and are deducted