Are 501c3 Exempt From Sales Tax In Washington State A 501 c 3 organization is a United States corporation trust unincorporated association or other type of organization exempt from federal income tax under section 501 c 3 of Title 26 of the

A 501 c 3 organization is a tax exempt nonprofit organization subject to many IRS rules Learn the requirements and costs of setting up a 501 c 3 A 501 c organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code 26 U S C 501 c Such organizations are exempt from some

Are 501c3 Exempt From Sales Tax In Washington State

Are 501c3 Exempt From Sales Tax In Washington State

https://zamp.com/wp-content/uploads/2023/01/Washington-Sales-Tax-2023-1400x853.png

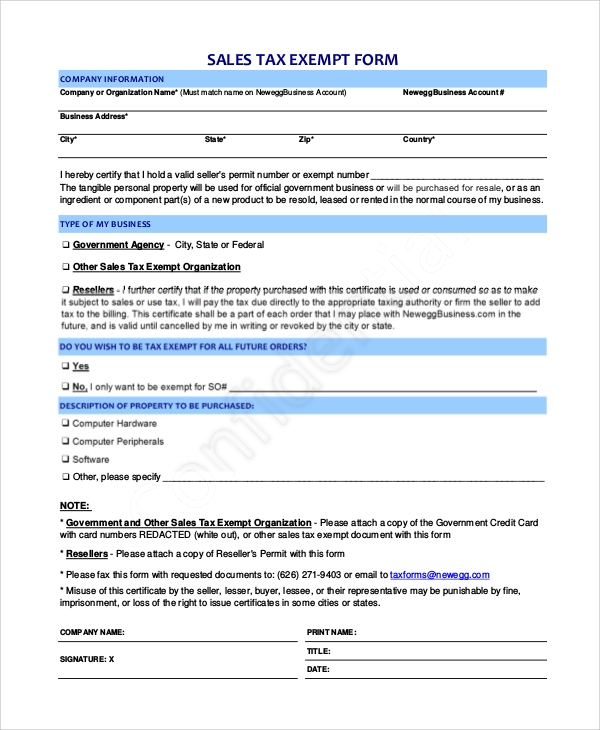

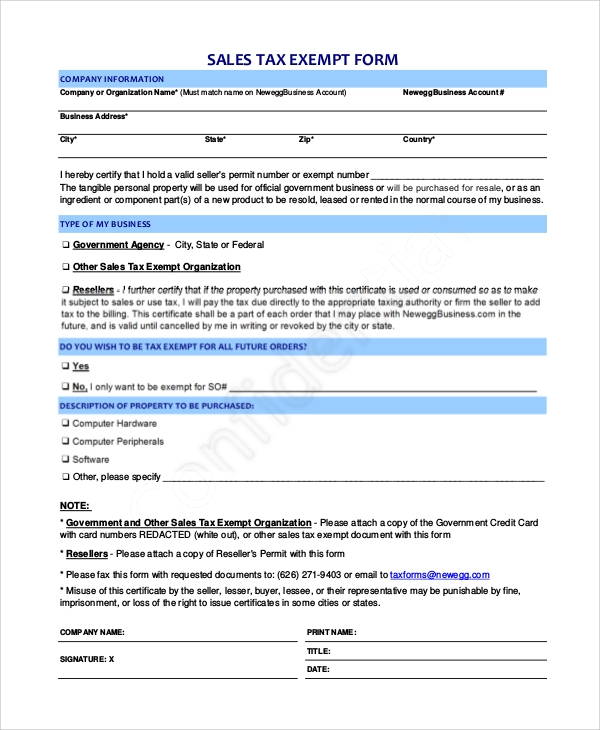

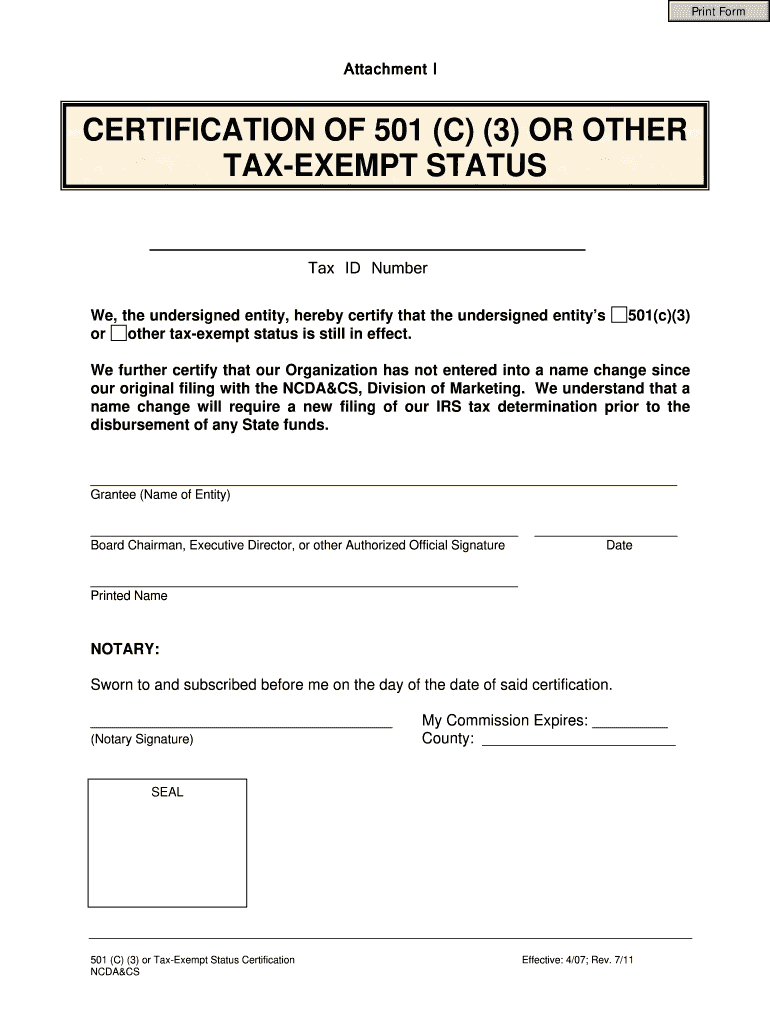

Tax Exempt Form 2025 Ethan Phillips

https://www.exemptform.com/wp-content/uploads/2022/08/free-10-sample-tax-exemption-forms-in-pdf-15.jpg

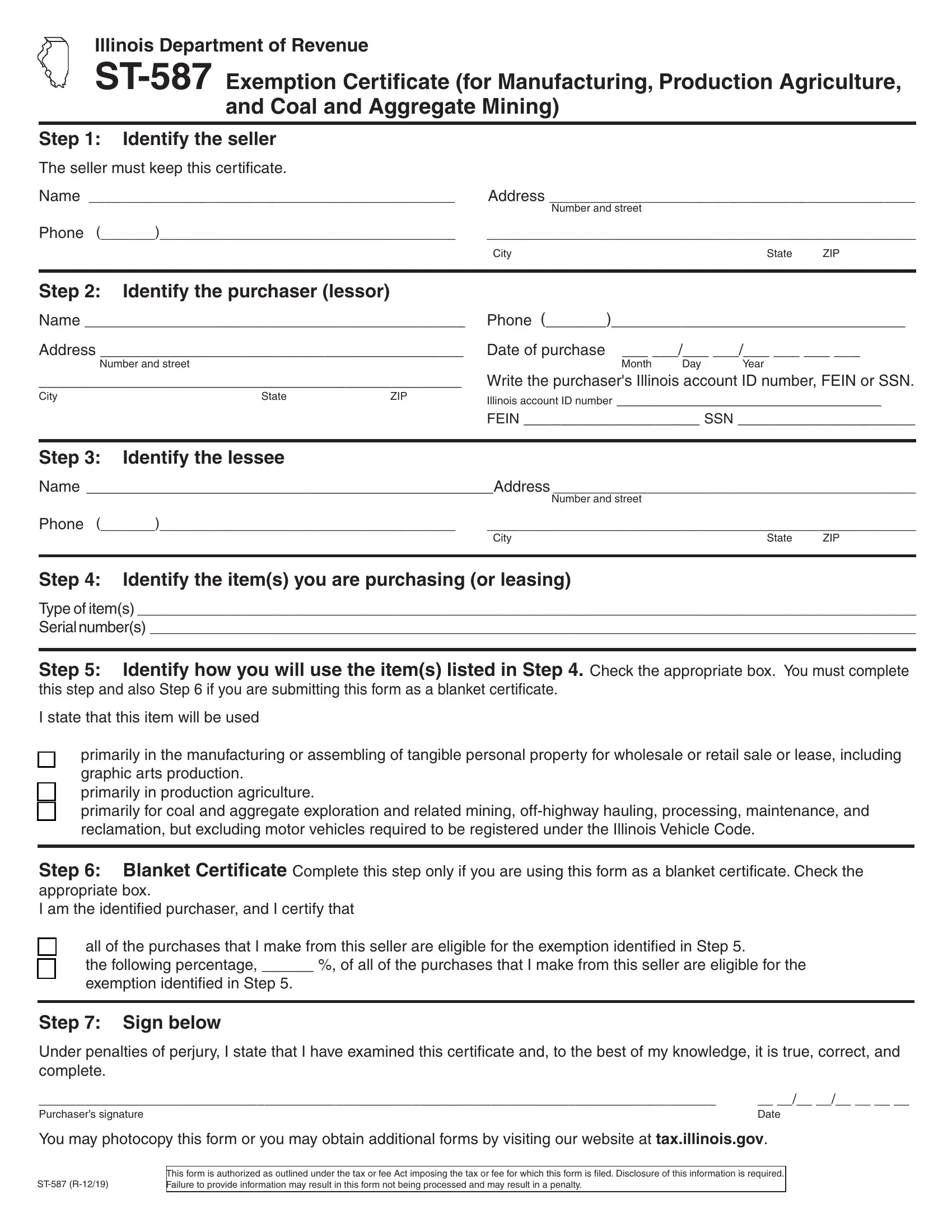

St 587 Form Fill Out Printable PDF Forms Online

https://formspal.com/pdf-forms/other/st-587-form/st-587-form-preview.webp

In order to qualify as a tax exempt 501 c 3 organization a nonprofit must exist for one or more exclusively charitable purposes Religious The organization truly holds religious beliefs and What is a 501 c 3 nonprofit organization A 501 c 3 nonprofit organization is generally a business entity that adds to the public good The name comes from section 501 c 3 of the

501c3 is a section of IRS tax code that deals with tax exempt organizations and status of some nonprofits Discover how to qualify for a 501c3 status There are specific rules and regulations for starting a 501 c 3 and maintaining one Avoid these 6 mistakes to maintain tax exempt status

More picture related to Are 501c3 Exempt From Sales Tax In Washington State

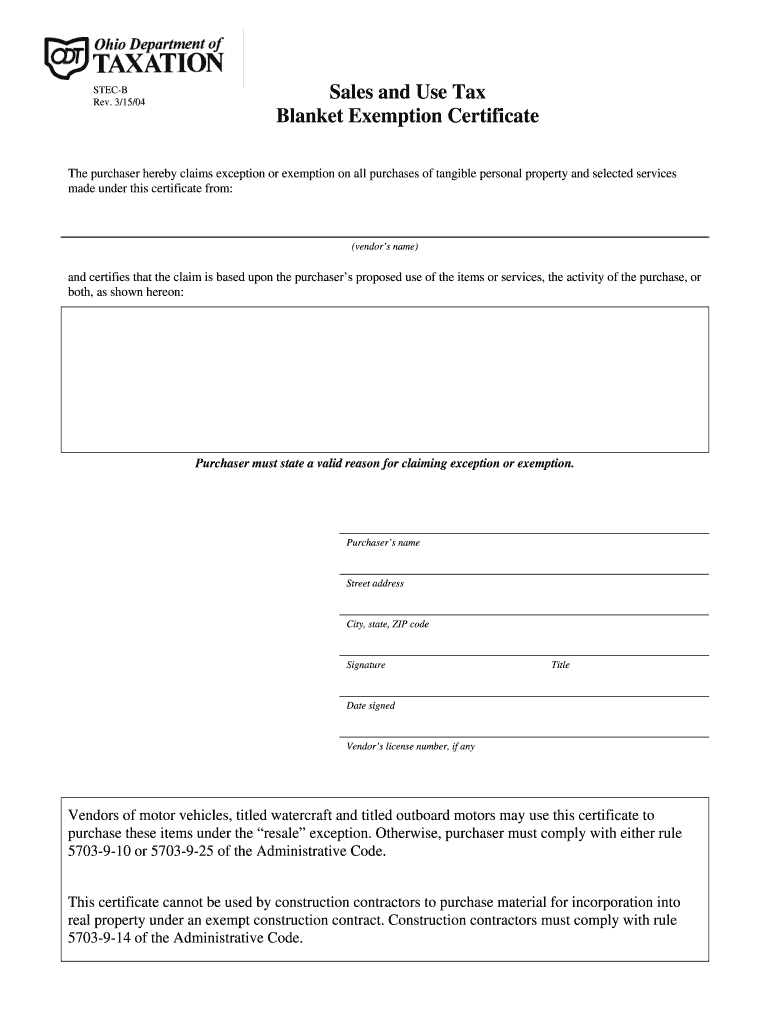

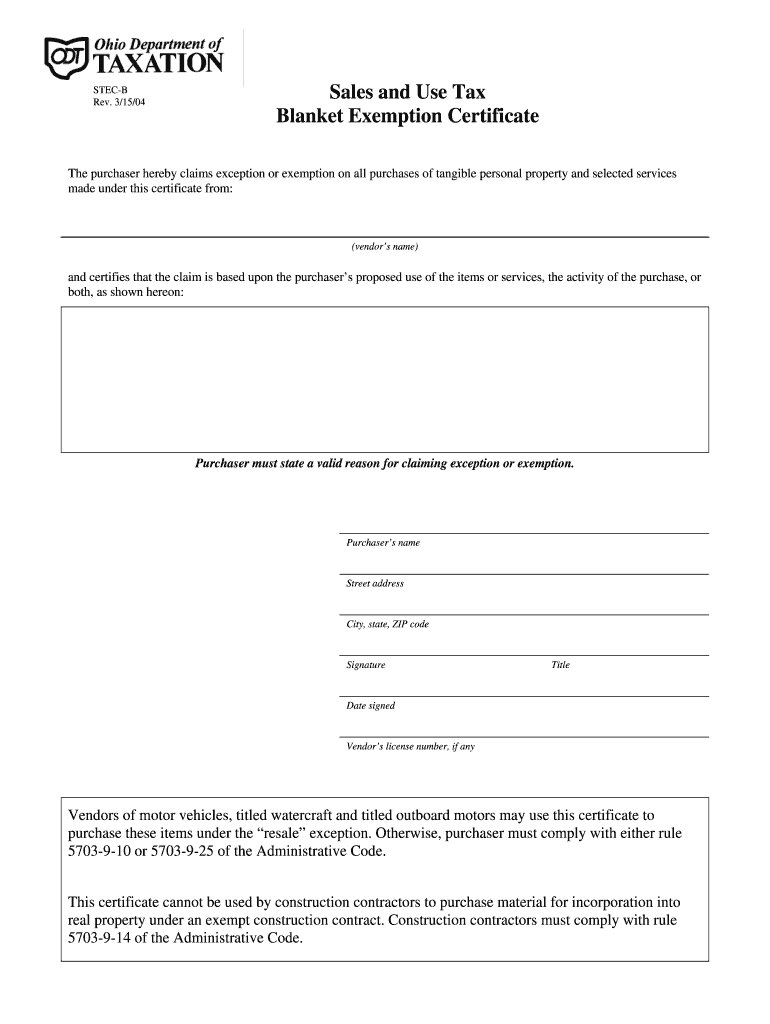

Ohio Resale Certificate 2020 Fill And Sign Printable Template Online

https://www.pdffiller.com/preview/100/91/100091925/large.png

Donation Receipt Letter Templates PDF Word EForms

https://i.pinimg.com/originals/04/3c/11/043c1177581d5d6766f93bfa9bab67f9.jpg

.png)

Az Sales Tax Rates 2025 Rami Belle

https://files.taxfoundation.org/legacy/docs/State-and-Local-Rates-LOST-(Large).png

Wikipedia defines a 501c3 organization as A 501 c organization or simply a 501 c is a tax exempt nonprofit organization in the United States Section 501 c of the To apply for recognition by the IRS of exempt status under IRC Section 501 c 3 you must use either Form 1023 or Form 1023 EZ All organizations seeking exemption under

[desc-10] [desc-11]

Aia G706 Form Sample Form Resume Examples My3aw5a1wp

https://i2.wp.com/childforallseasons.com/wp-content/uploads/2018/10/501c3-form-sample.jpg

Ohio Tax Exempt Form Fill And Sign Printable Template Online US

https://www.pdffiller.com/preview/13/287/13287539/large.png

https://en.wikipedia.org › wiki

A 501 c 3 organization is a United States corporation trust unincorporated association or other type of organization exempt from federal income tax under section 501 c 3 of Title 26 of the

https://www.investopedia.com › terms

A 501 c 3 organization is a tax exempt nonprofit organization subject to many IRS rules Learn the requirements and costs of setting up a 501 c 3

501c Complete With Ease AirSlate SignNow

Aia G706 Form Sample Form Resume Examples My3aw5a1wp

Ohio State Sales Tax 2025 Form James Ball

501c3 Tax Deductible Donation Letter Sample With Examples

Tax Exempt Form 2024 For Business Lona Livvyy

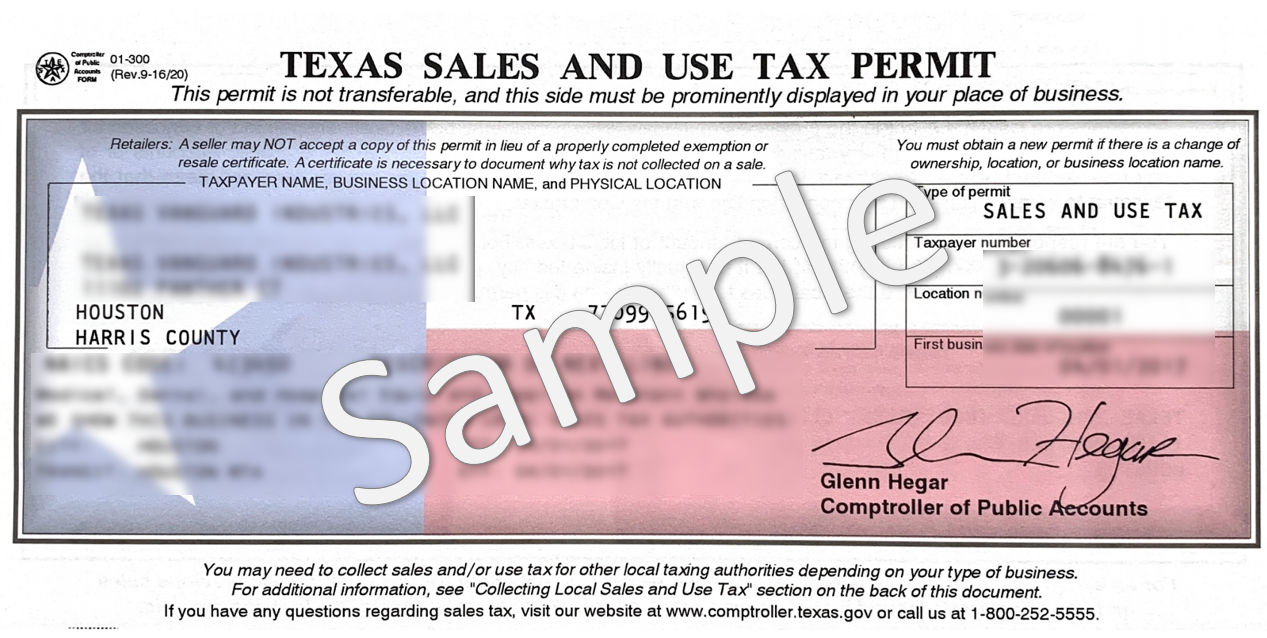

Are Texas Schools Exempt From Sales Tax

Are Texas Schools Exempt From Sales Tax

Ejemplo De Carta Para Solicitar Fondos 501c3

Tax Exemption Form 2025 Philippines Jennifer Grants

Ultimate Washington Sales Tax Guide Zamp

Are 501c3 Exempt From Sales Tax In Washington State - [desc-12]