Are Mental Health Services Tax Deductible Mental health services that may qualify for tax deductions include therapy sessions psychiatric care medication management inpatient treatment and substance abuse

According to IRS Publication 502 you can only classify services or items as medical expenses if they alleviate or prevent a physical or mental disability or illness Below For the expense to be deductible it must directly relate to your therapy practice or mental health services Components of a Business Expense 1 Ordinary The expense should be typical

Are Mental Health Services Tax Deductible

Are Mental Health Services Tax Deductible

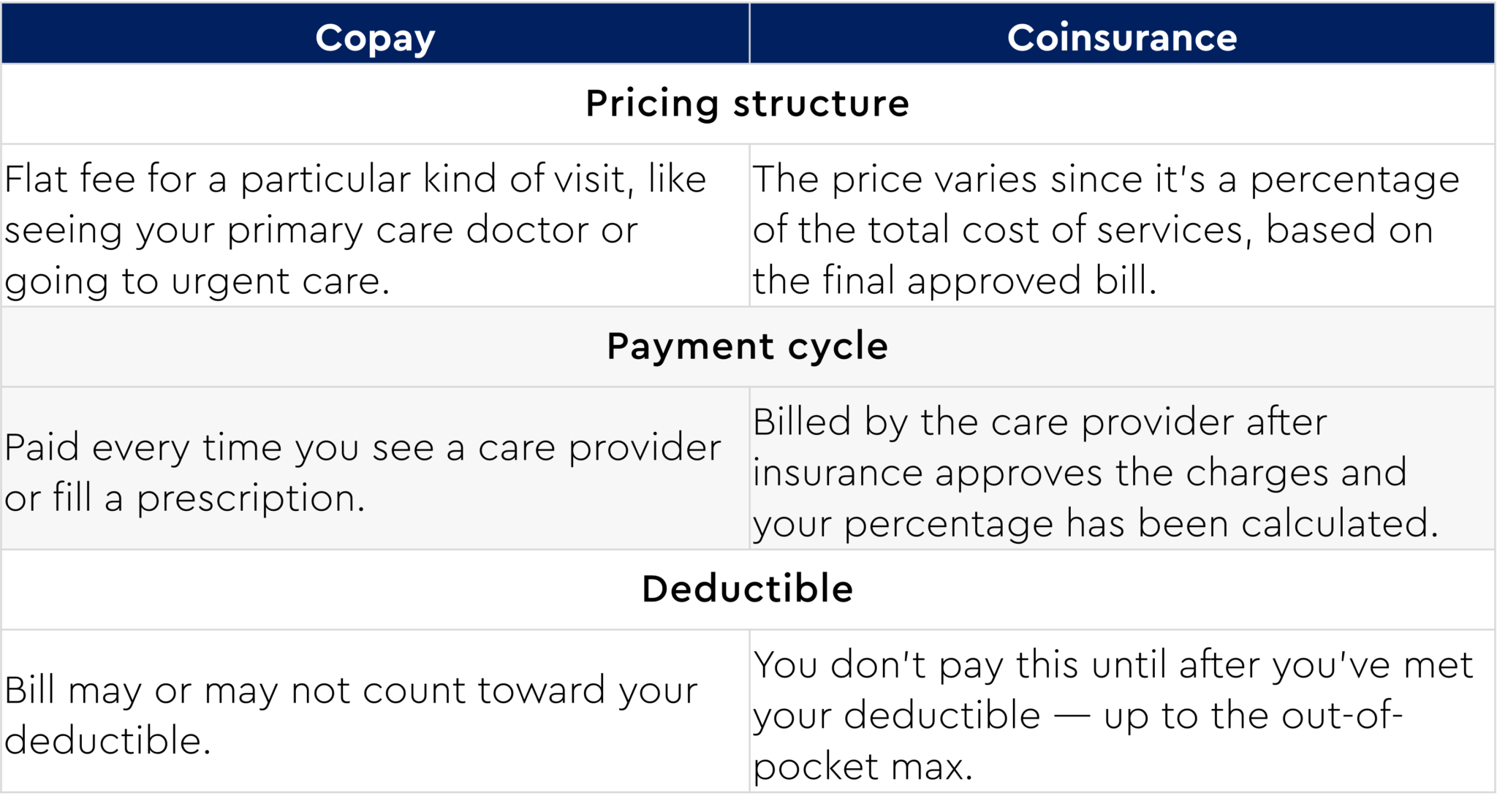

https://cdn.axiawh.com/wp-content/uploads/2022/10/20192901/glossary-table2-2048x1111.png

Is Health Insurance Tax Deductible For Self Employed International

https://www.internationaltrisomyalliance.com/wp-content/uploads/2023/01/is-health-insurance-tax-deductible-for-self-employed.png

Are Medical Expenses Tax Deductible Capital One

https://ecm.capitalone.com/WCM/learn-grow/card/lgc988_hero_are-medical-expenses-tax-deductible_v1.jpg

The cost of going to therapy may be tax deductible for both clients and for therapists attending therapy sessions themselves If you re a client there are particular requirements you need to Generally speaking the IRS views medical expenses including mental health care as potentially deductible But before you start planning that yacht purchase with your imagined

Mental health services are tax deductible if they are deemed necessary for the treatment of a diagnosed mental illness The tax deduction can provide financial relief and improve access to Yes premiums for health insurance plans that cover mental health services are tax deductible if your total medical expenses including these premiums exceed 7 5 of your AGI

More picture related to Are Mental Health Services Tax Deductible

Tax Preparation Review

https://fitischools.com/wp-content/uploads/2021/06/professional-tax-preparer.jpg

Are Health Insurance Premiums Ever Tax Deductible My HST

https://myhst.com/wp-content/uploads/2022/11/Are_Health_Insurance_Premiums_Ever_Tax_Deductible__1077198.jpg

Are Health Insurance Premiums Tax Deductible

https://www.agilerates.com/wp-content/uploads/2023/04/are-health-insurance-premiums-tax-deductible.png

For tax returns filed in 2022 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2021 adjusted gross income So if your In conclusion mental health care costs are tax deductible if they meet certain requirements To qualify the expenses must be necessary to treat a diagnosed mental health condition While

[desc-10] [desc-11]

Mental Health Care Cost In The Philippines Lumina Homes

https://www.lumina.com.ph/assets/news-and-blogs-photos/Mental-Health-Care-Cost-in-the-Philippines/Mental-Health-Care-Cost-in-the-Philippines.webp

What Medical Expenses Are Tax Deductible Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2023/05/23-optima-medical-tax-deductible.png

https://motivatecounseling.com

Mental health services that may qualify for tax deductions include therapy sessions psychiatric care medication management inpatient treatment and substance abuse

https://www.goodrx.com › insurance › taxes › deductible...

According to IRS Publication 502 you can only classify services or items as medical expenses if they alleviate or prevent a physical or mental disability or illness Below

Lift Your Voice In Support Of Mental Health By Making A Tax Deductible

Mental Health Care Cost In The Philippines Lumina Homes

Billing For Mental Health Services Free Photo On Pixabay Pixabay

Florida To Ban Transgender Health Care Treatments For Minors AP News

System Is Broken Mental Health Royal Commission Will Save Lives On

Why You Should Celebrate Your Mental Health Milestones

Why You Should Celebrate Your Mental Health Milestones

Gauging Employees Mental Health

Mental Health Services Hunterdon County NJ

Are Mental Health Labels Acting As The Boundaries We Are Too Afraid To

Are Mental Health Services Tax Deductible - The cost of going to therapy may be tax deductible for both clients and for therapists attending therapy sessions themselves If you re a client there are particular requirements you need to