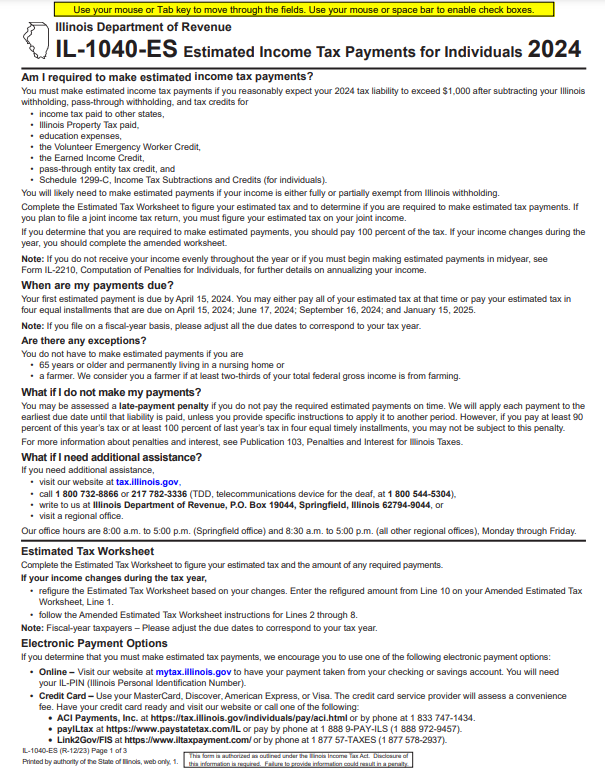

Are Property Taxes Deductible Property taxes are deductible in the year they are paid not assessed Timing payments strategically can help manage cash flow and tax liability Prepaying property taxes might offer benefits but it s important to consider potential changes in tax laws or

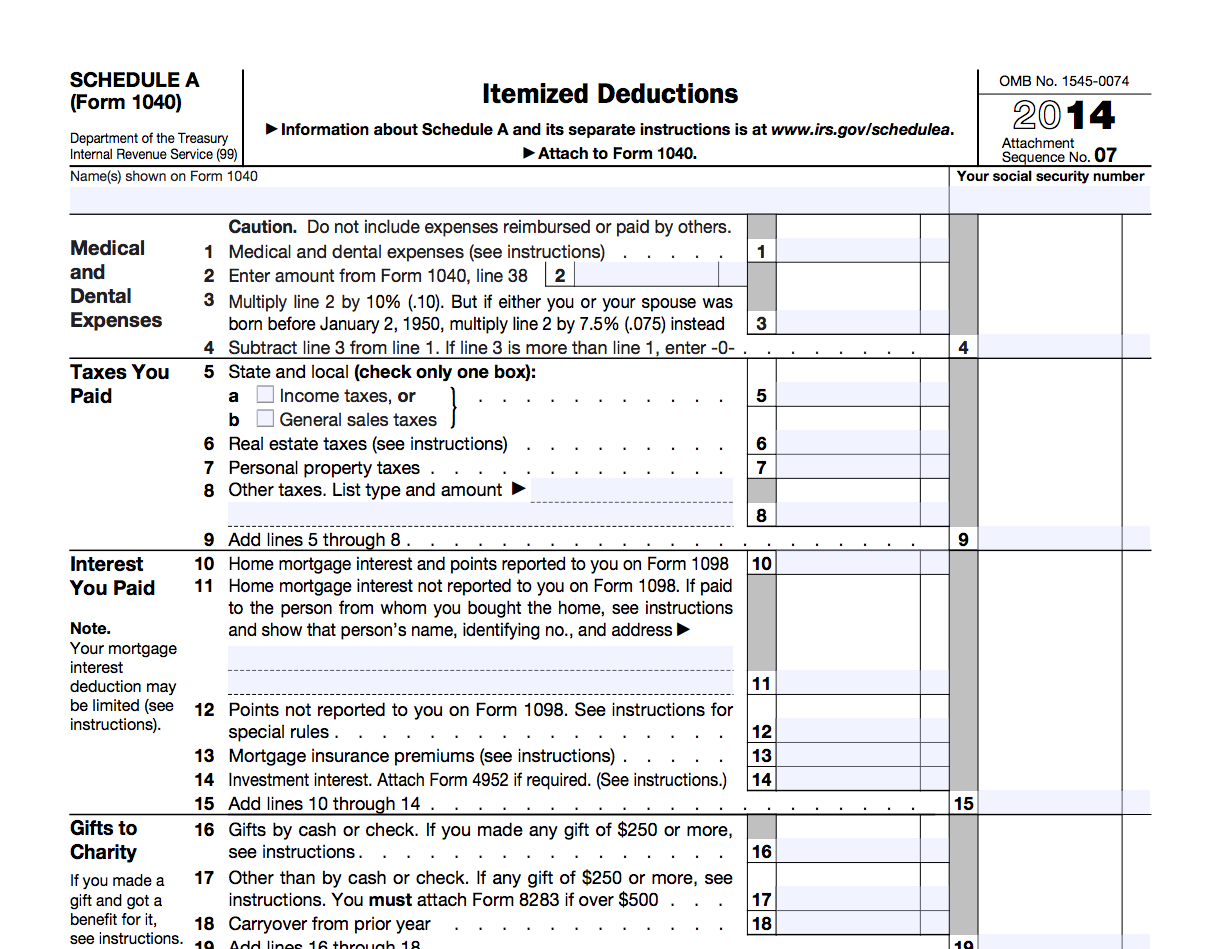

Are property taxes deductible Find out how to deduct personal property and real estate taxes by itemizing on Schedule A of Form 1040 Tax deadline is April 15 Real estate taxes property taxes paid on your primary residence are deductible as an itemized deduction on Schedule A of your federal return If a real estate taxes paid amount was reported to you usually in Box 10 on your Form 1098 this represents the amount of real estate taxes you paid on your residence during the tax year

Are Property Taxes Deductible

Are Property Taxes Deductible

https://educounting.com/wp-content/uploads/2024/07/are-property-taxes-deductible-3.webp

Are Property Taxes Deductible Only Under These Conditions

https://media.marketrealist.com/brand-img/YY28LMIjB/1600x837/are-property-taxes-deductible-1674791772955.jpg?position=top

Are Property Taxes Deductible A Guide For Real Estate Investors

https://bpimg.biggerpockets.com/https://www.biggerpockets.com/blog/wp-content/uploads/2023/08/schedule-e-page-2.jpg?twic=v1/cover=611:791/max=1000

Property taxes are generally deductible but your deduction depends on the property type personal rental or business There s a 10 000 cap on state and local taxes including property taxes but rental and business property taxes are generally fully deductible The Internal Revenue Service lets you deduct the cost of property taxes in certain circumstances However it may not always be advantageous for homeowners

Property taxes are tax deductible The Internal Revenue Service considers them a state and local tax SALT and they are deductible under the IRS s SALT deduction You can deduct property To deduct property taxes you must use a Schedule A of Form 1040 to itemize deductions Many property owners take the standard deduction on their federal income taxes which theoretically covers a range of expenses allowed by the IRS that could legitimately be subtracted from your income

More picture related to Are Property Taxes Deductible

Are Property Taxes Deductible BiggerPockets Blog

https://bpimg.biggerpockets.com/https://www.biggerpockets.com/blog/wp-content/uploads/2023/08/schedule-A.jpg?twic=v1/cover=612:792/max=1000

Why Do Property Taxes Go Up Where Do Property Taxes Go Are Property

https://img2.marketshost.com/news/2023/08/why-do-property-taxes-go-up-where-do-property-taxes-go-are-property-ta-64f04268a1dca58479147-900.webp

Are Property Taxes Deductible In 2019 YouTube

https://i.ytimg.com/vi/uhuKlNV4bvk/maxresdefault.jpg

Deductible real estate taxes include any state local or foreign taxes that are levied for the general public welfare They do not include taxes charged for home renovations or for Each property s taxes can be deductible but remember the combined deduction limit under the SALT cap For rental properties property taxes are deductible as a business expense They are claimed on a Schedule E along with rental income This helps offset rental income reducing taxable income Understanding tax implications across all

[desc-10] [desc-11]

Real Estate Tax Vs Property Tax What Is Deductible YouTube

https://i.ytimg.com/vi/Y8Kr4n-ndvo/maxresdefault.jpg

IRS Lays Out Property Tax Deduction Rules YouTube

https://i.ytimg.com/vi/TeZlLtw8OGM/maxresdefault.jpg

https://accountinginsights.org › can-you-deduct...

Property taxes are deductible in the year they are paid not assessed Timing payments strategically can help manage cash flow and tax liability Prepaying property taxes might offer benefits but it s important to consider potential changes in tax laws or

https://turbotax.intuit.com › tax-tips › home...

Are property taxes deductible Find out how to deduct personal property and real estate taxes by itemizing on Schedule A of Form 1040 Tax deadline is April 15

Deductible Maryland Health Connection

Real Estate Tax Vs Property Tax What Is Deductible YouTube

Itemized Tax Deductions McKinley Hutchings CPA PLLC

List Of Itemized Ded Elmer K McConnell

Are Property Taxes Deductible 10 Stars Property Management

How To Find Annual Property Taxes Printable Online

How To Find Annual Property Taxes Printable Online

Donation Letter For Taxes Sample And Examples Word

Illinois Property Tax Return USRebate

/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

Property Tax

Are Property Taxes Deductible - [desc-13]