Company Tax Rate 2022 23 Ato Company Corporation Incorporation Enterprise Firm Company company

Hi Since company is a collective noun what kind of verb should I use with it in the following example Dictionaries say it s either singular or plural but I think it depends on Hi son nie I have seen this when the company name includes the names of the owners partners in the business for example M S Smith Jones and Brown Publishing

Company Tax Rate 2022 23 Ato

Company Tax Rate 2022 23 Ato

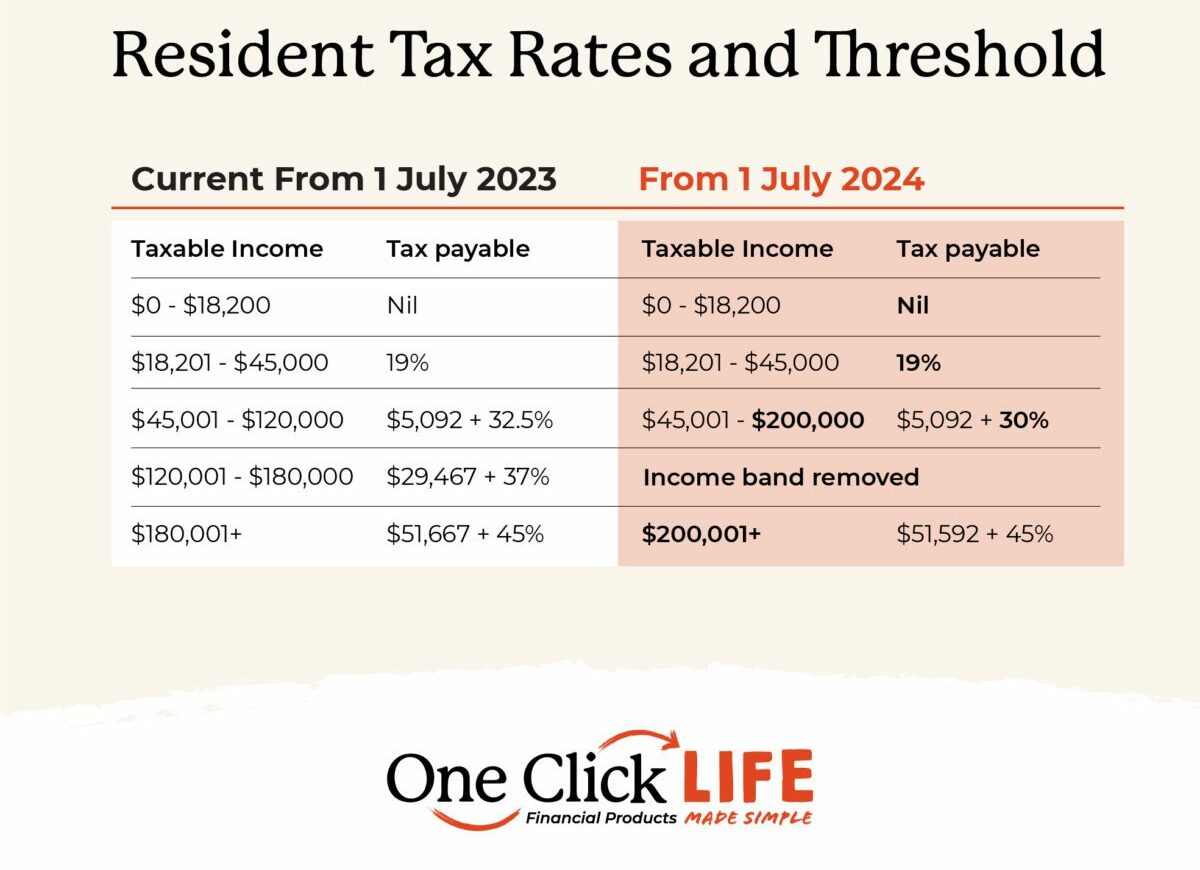

https://oneclicklife.com.au/wp-content/uploads/2023/04/Budget-Tax-Rates-Threshold-01-scaled-e1681366579595.jpg

Tax Slab Rate Ay 2023 24 Individual Image To U

https://eadvisors.in/wp-content/uploads/2022/12/Income-tax-Slab-Rates-for-AY-2023-24.jpg

![]()

Design De S mbolo De Sinal De cone De Imposto 10146533 PNG

https://static.vecteezy.com/system/resources/previews/010/146/533/original/tax-icon-sign-symbol-design-free-png.png

In my opinion I work for a company is the correct option if the company employs me directly i e I work there all year round and they pay me a salary I work with a company Company Corporation Inc Incorporated Co Ltd Company Limited

Which is the correct preposition in this case in or at The text is part of a presentation of a company In At Fresh Foods we understand what our clients want from a Is an abbreviation for Company In either country a company might or might not be Limited or Incorporated Therefore Co sometimes occurs with Ltd and sometimes it

More picture related to Company Tax Rate 2022 23 Ato

2025 Tax Calculator Lachlan E Marriott

https://atotaxrates.info/wp-content/uploads/2020/06/2025-tax-calculator1-1024x547.jpg

2025 Tax Rates Australia Alexander B Stump

https://www.pitcher.com.au/wp-content/uploads/2023/05/FedBudget_FullReport_230510_table.jpg

2025 Tax Rates Jamie K Therry

https://images.prismic.io/payfit/4a90d271-43c6-4dcf-834a-53fa79bb3a33_UK+tax+rates.png?auto=compress,format&rect=0,0,642,406&w=2429&h=1536

Chairman president CEO 1 chairman president ceo Chief Executive Officer 9 The company is a supplier of offset and rotogravure printing machines 10 Supplier scare japanese bid brisk but shipper quoting 20c levels

[desc-10] [desc-11]

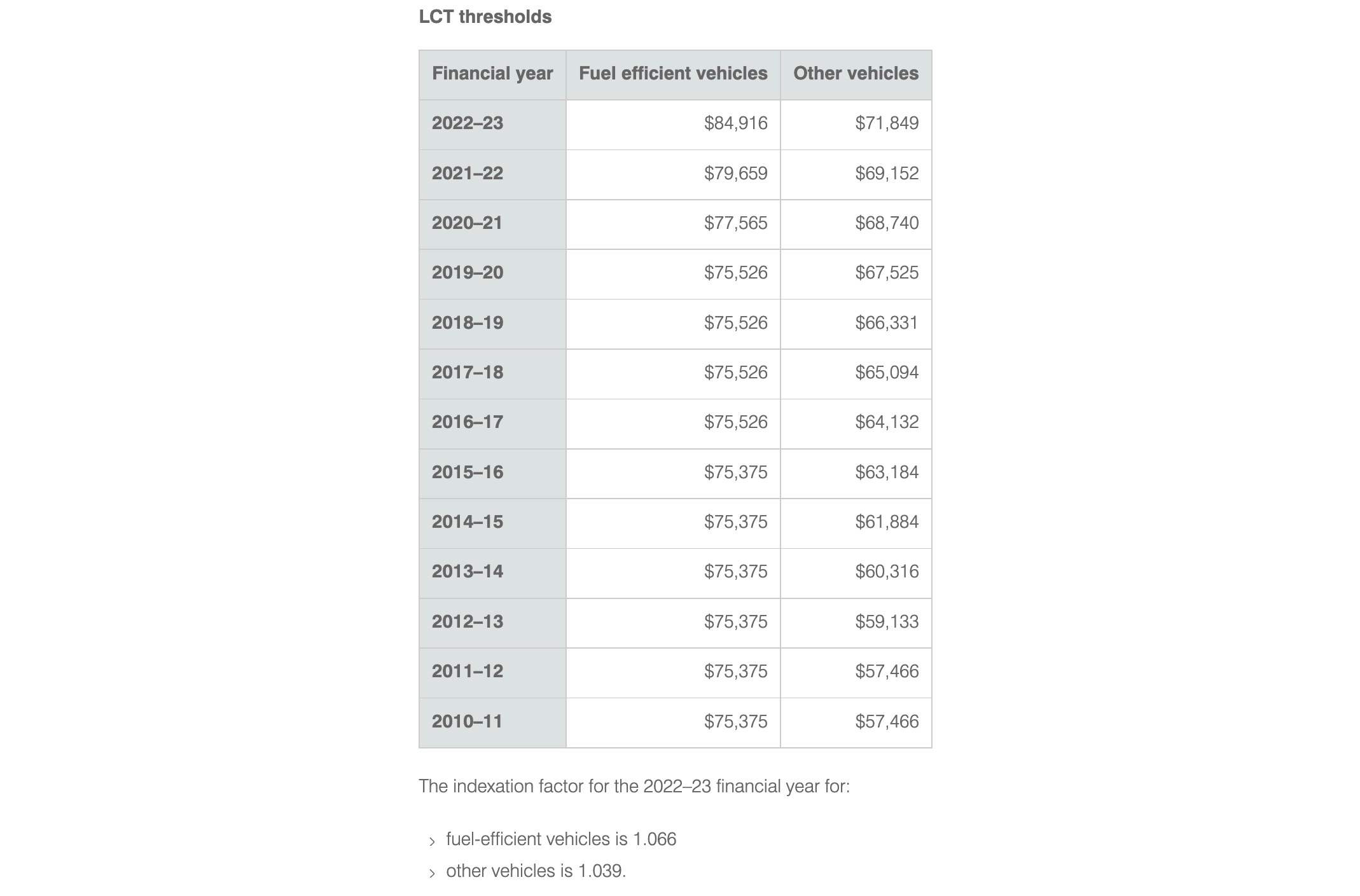

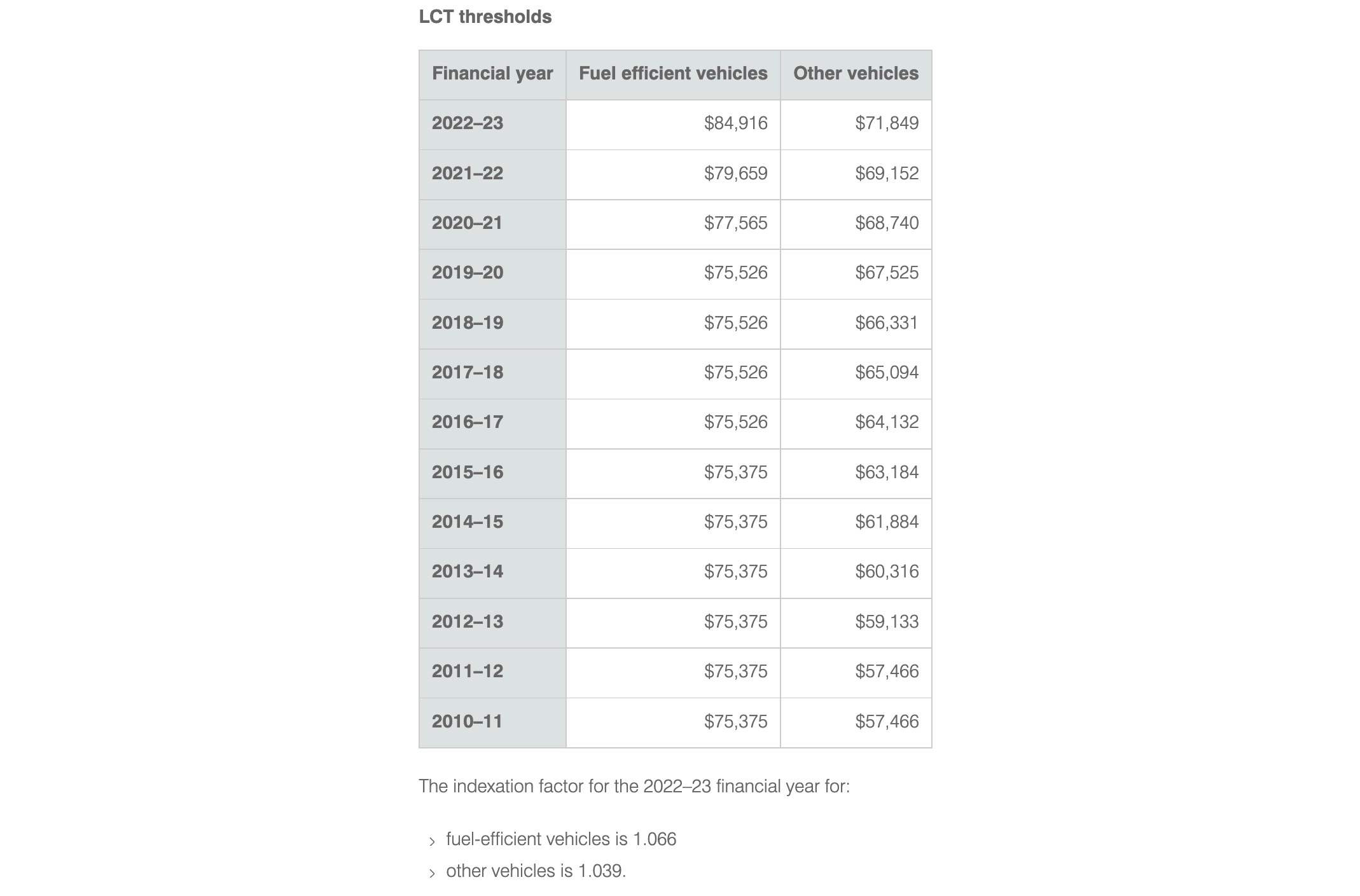

Tax Rates 2024 Australia Ato Bekki Carolin

https://performancedrive.com.au/wp-content/uploads/2022/06/2022-2023-Luxury-Car-Tax-threshold-ATO-Australia.jpg

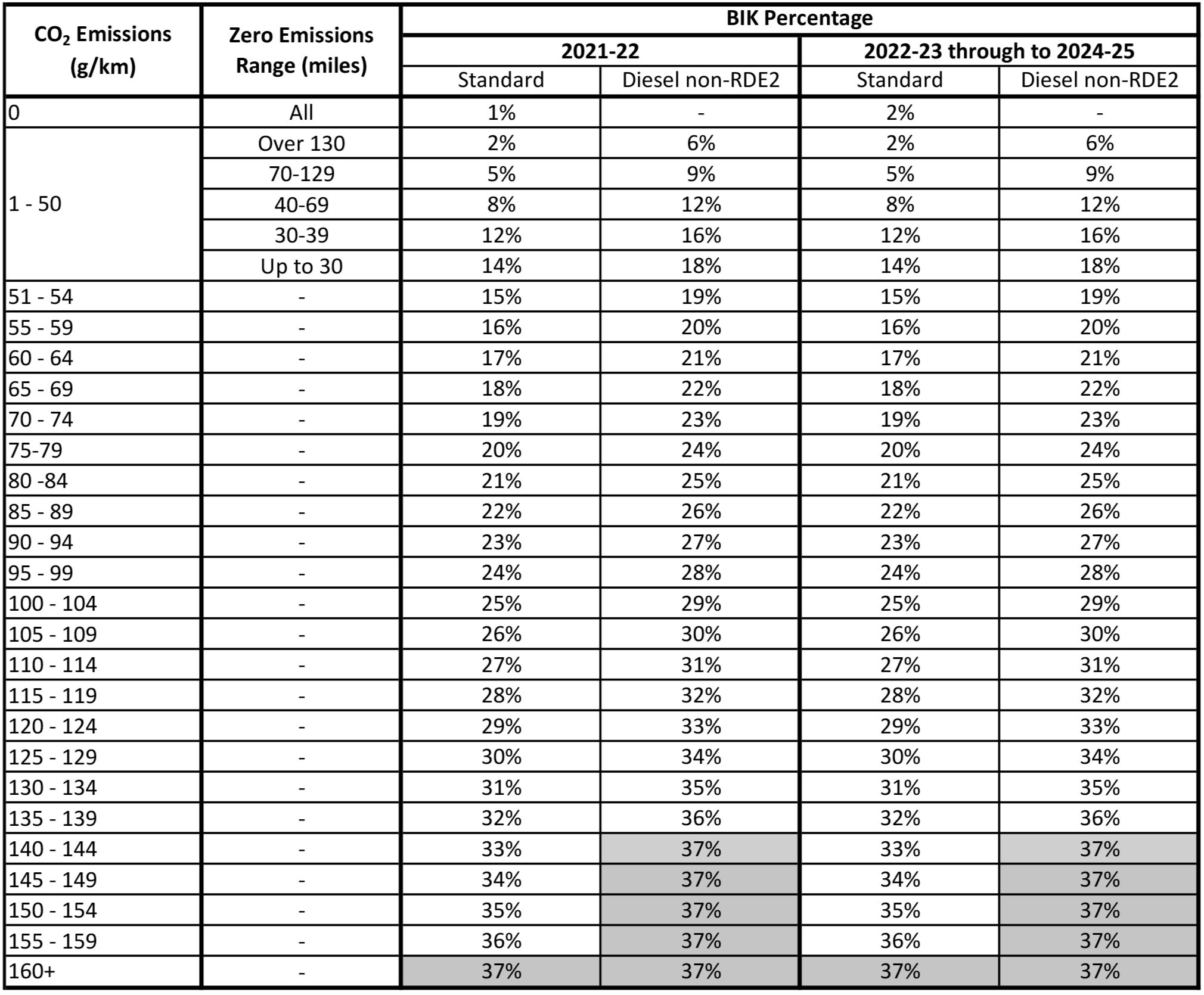

Minnesota 2025 Tax Tables Hudson V Dalley

https://images.squarespace-cdn.com/content/v1/52ebb01ae4b05068ce86fa9b/f9922abb-9e7c-4cf9-88f0-9d255f6a4288/Company-car-tax-BIK-table-2021-to-2025.jpg

https://www.zhihu.com › question

Company Corporation Incorporation Enterprise Firm Company company

https://forum.wordreference.com › threads

Hi Since company is a collective noun what kind of verb should I use with it in the following example Dictionaries say it s either singular or plural but I think it depends on

Tax Act 2024 Prices Adena Carrissa

Tax Rates 2024 Australia Ato Bekki Carolin

Income Tax 2022 2023 Image To U

Income Tax Brackets Australia 2025 John L Ramey

Corporation Tax Rates 2024 Trinidad Ora Nonnah

Irs Tax Brackets 2025 Over 65 Caleb G Secombe

Irs Tax Brackets 2025 Over 65 Caleb G Secombe

Ato Tax Brackets 2024 25 Ardath Charmine

2022 Eic Tax Table Chart

Capital Gains Tax 2025 25 Alexander A Kater

Company Tax Rate 2022 23 Ato - Company Corporation Inc Incorporated Co Ltd Company Limited