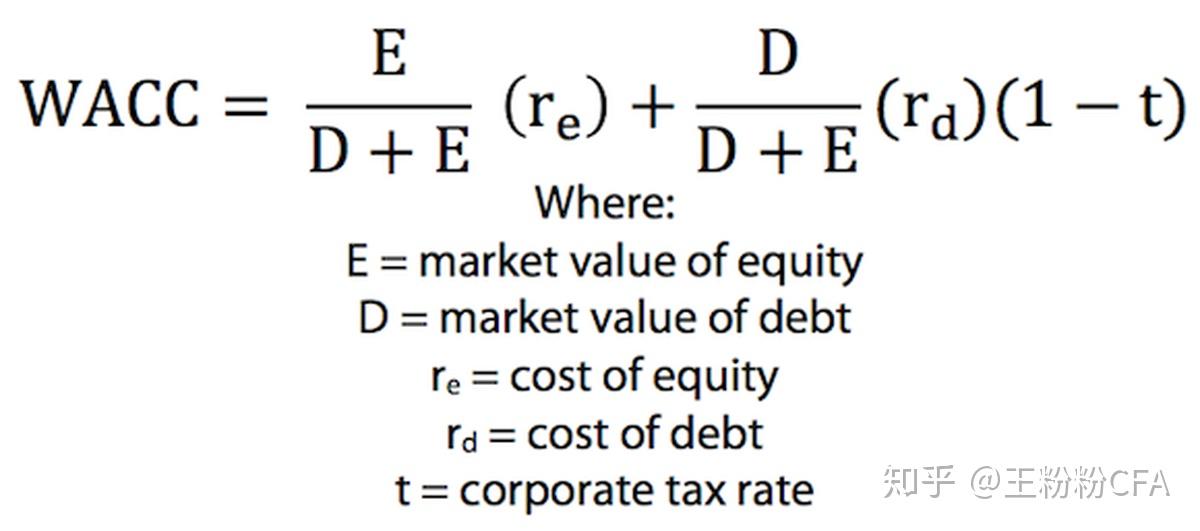

Cost Of Capital And Cost Of Debt Cost of Debt The cost of debt capital is the cost of using a bank s or financial institution s money in the business The banks get their compensation in the form of interest on

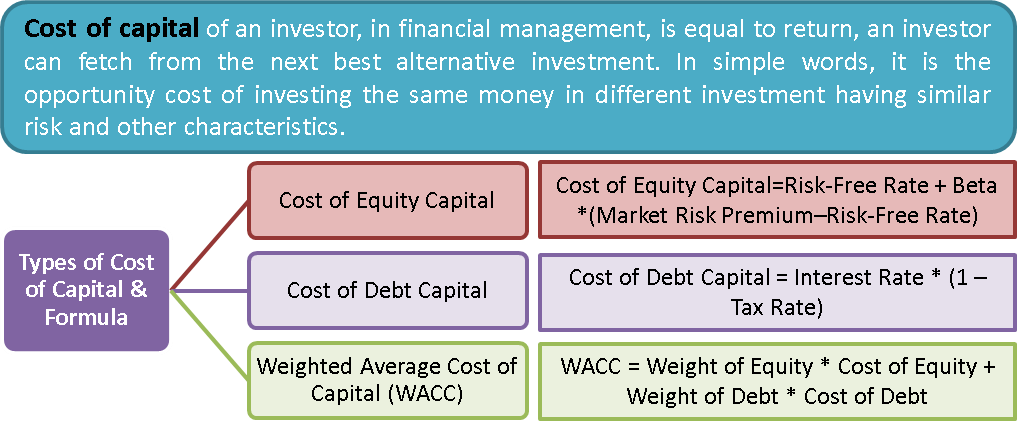

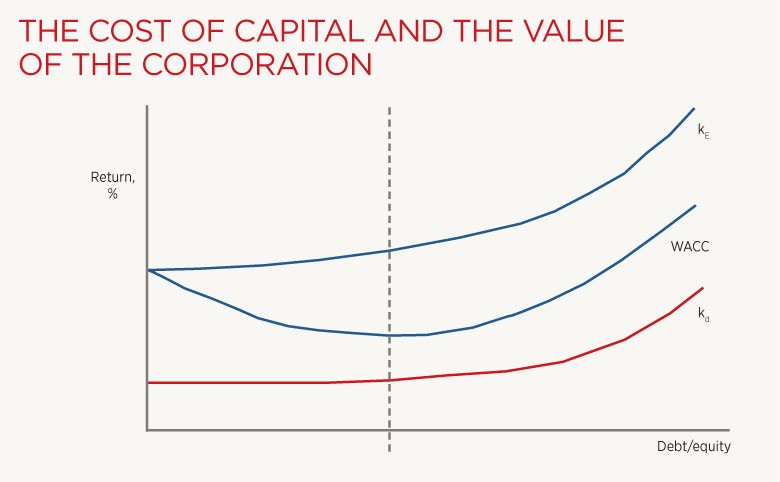

Understanding and accurately estimating the cost of capital including WACC equity cost and debt cost is vital for effective financial management and valuation By The components of cost of capital include debt equity and preference shares which all have their costs Each element is vital for decision making Funds can be raised by the company

Cost Of Capital And Cost Of Debt

Cost Of Capital And Cost Of Debt

https://i.ytimg.com/vi/V7oRE2s3mB4/maxresdefault.jpg

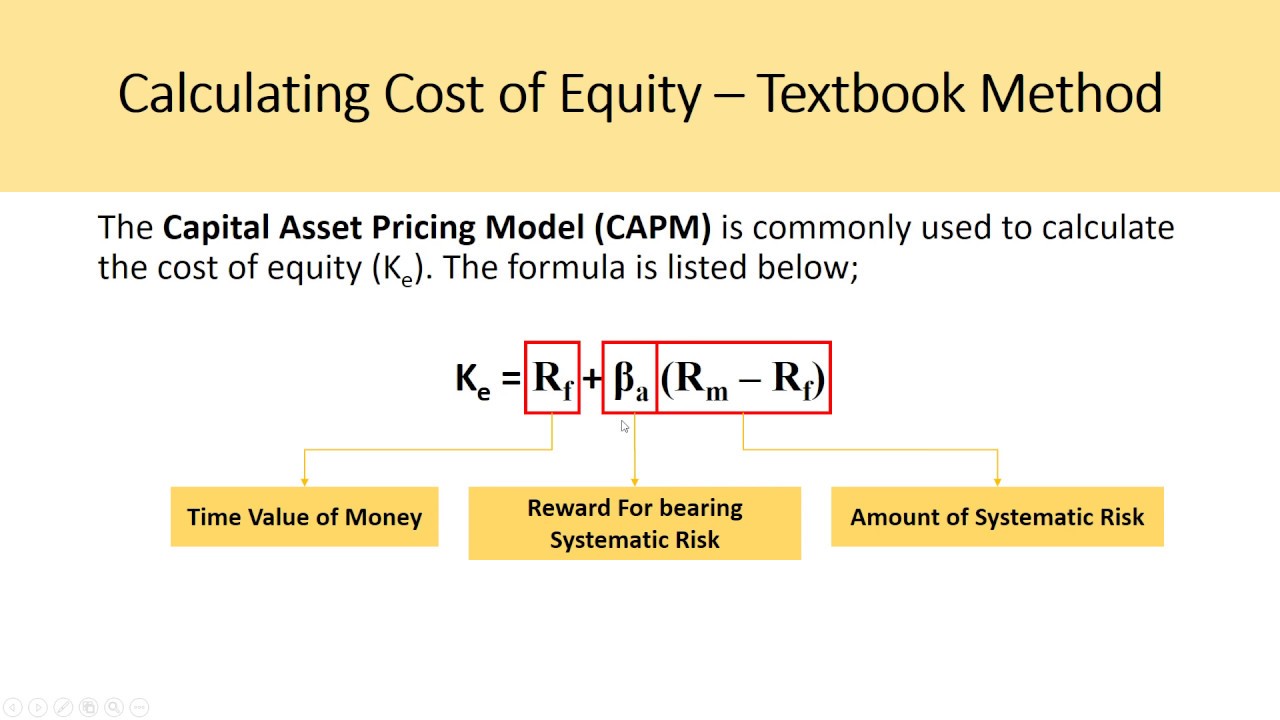

Estimating Cost Of Equity For WACC DCF Model Insights YouTube

https://i.ytimg.com/vi/ZigyWoDAMrE/maxresdefault.jpg

How To Calculate Cost Of Capital Cost Of Equity And Debt

https://i.ytimg.com/vi/3GANmCpuNTg/maxresdefault.jpg

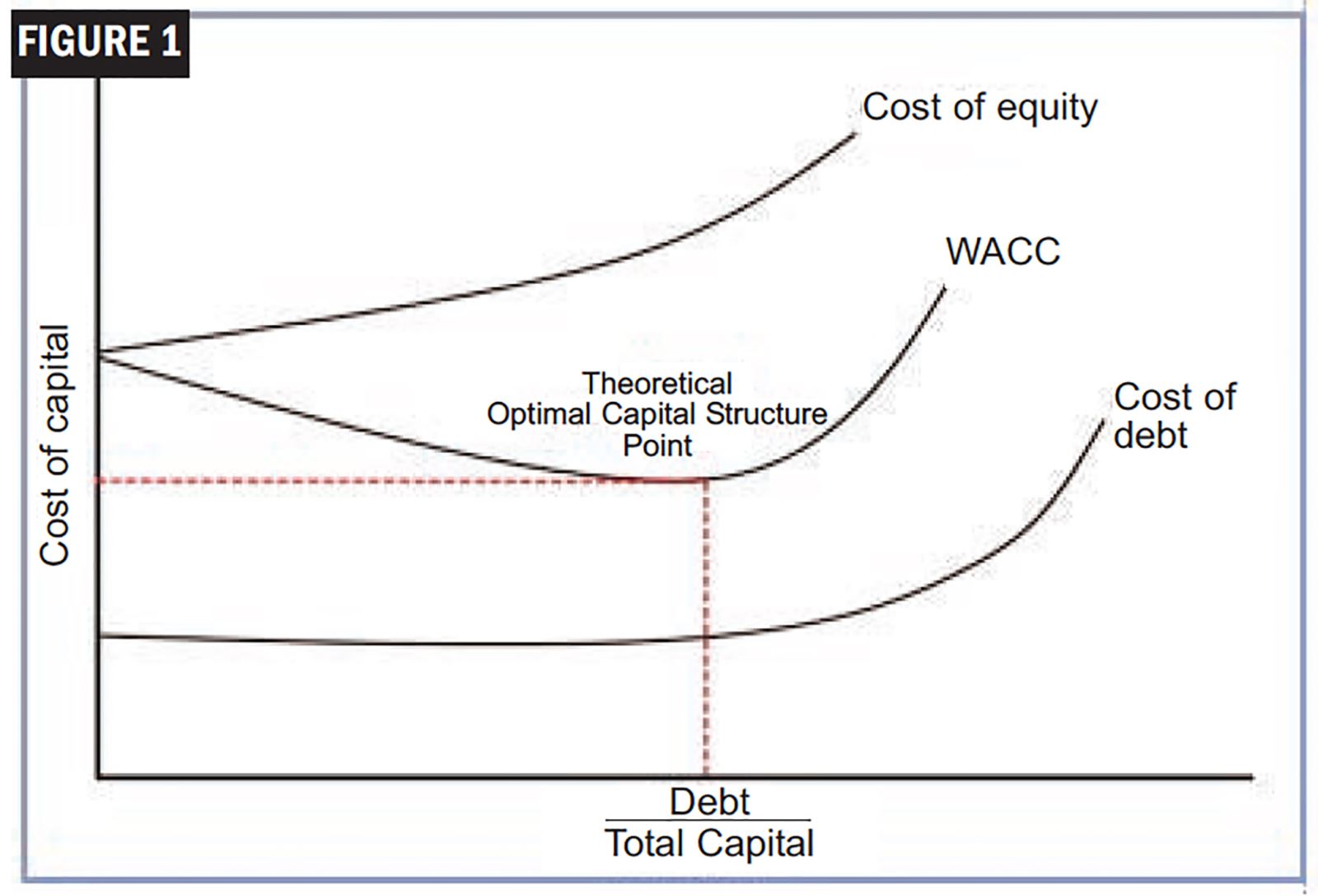

Cost of capital is the minimum rate of return that a business must earn before generating value Before a business can turn a profit it must at least generate sufficient income to cover the cost The cost of debt is the rate at which you can borrow at currently It will reflect not only your default risk but also the level of interest rates in the market The two most widely used

The cost of capital is made up of two components the cost of debt and the cost of equity The cost of debt is the interest rate that a company pays on its borrowed funds while The cost of capital is the minimum rate of return that a company must earn on its investments to maintain its market value and attract funds The cost of capital can be divided

More picture related to Cost Of Capital And Cost Of Debt

Cost Of Capital Part 1 Of 5 Cost Of Debt YouTube

https://i.ytimg.com/vi/661vxstSKfQ/maxresdefault.jpg

Debt Archives Plan Projections

https://www.planprojections.com/wp-content/uploads/wacc-formula.png

AGH AGR

https://www.bvagroup.com/files/images/Figure 1.jpg

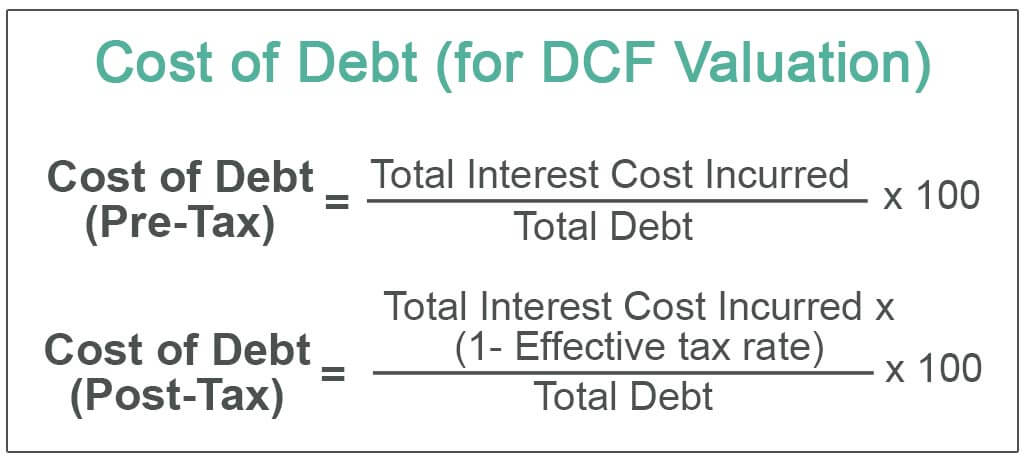

Debt cost also known as the cost of debt is the effective rate a company pays on its borrowed funds This rate can vary depending on the company s creditworthiness the terms of the debt Understand the components of the cost of debt Identify the tax implications of debt Explain how debt plays into the weighted average cost of capital The cost of long term debt rd is the after

[desc-10] [desc-11]

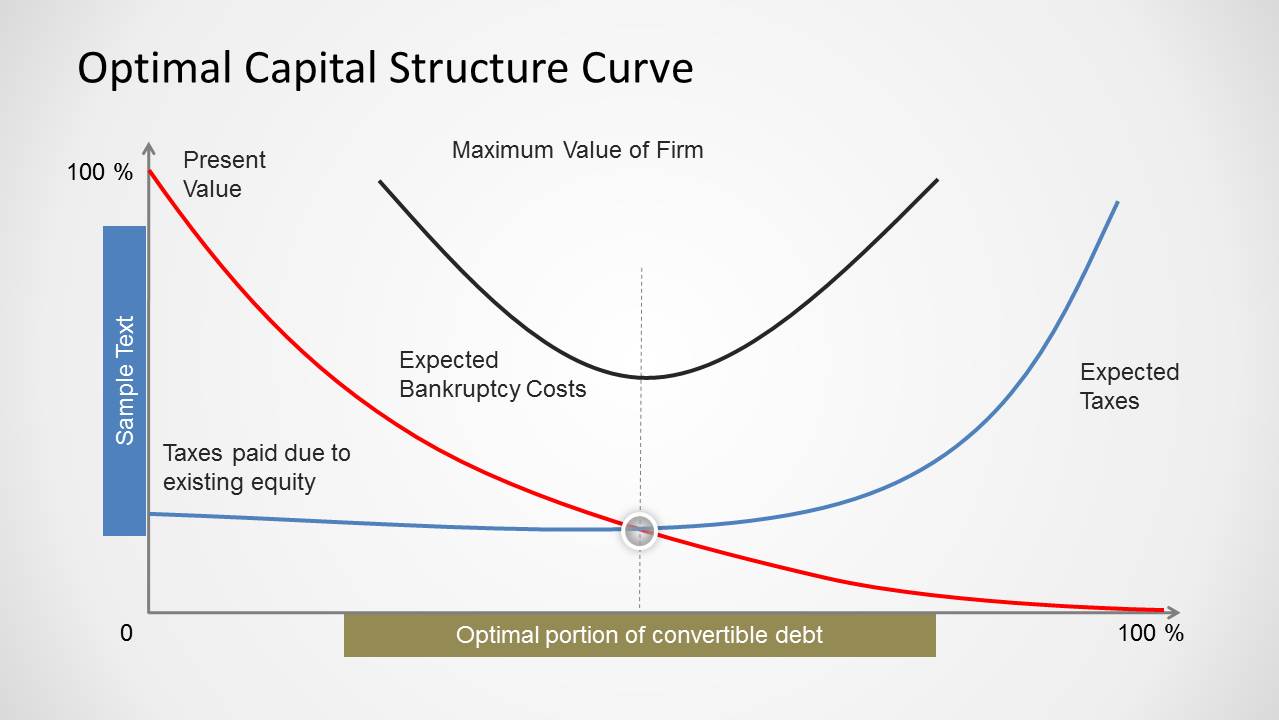

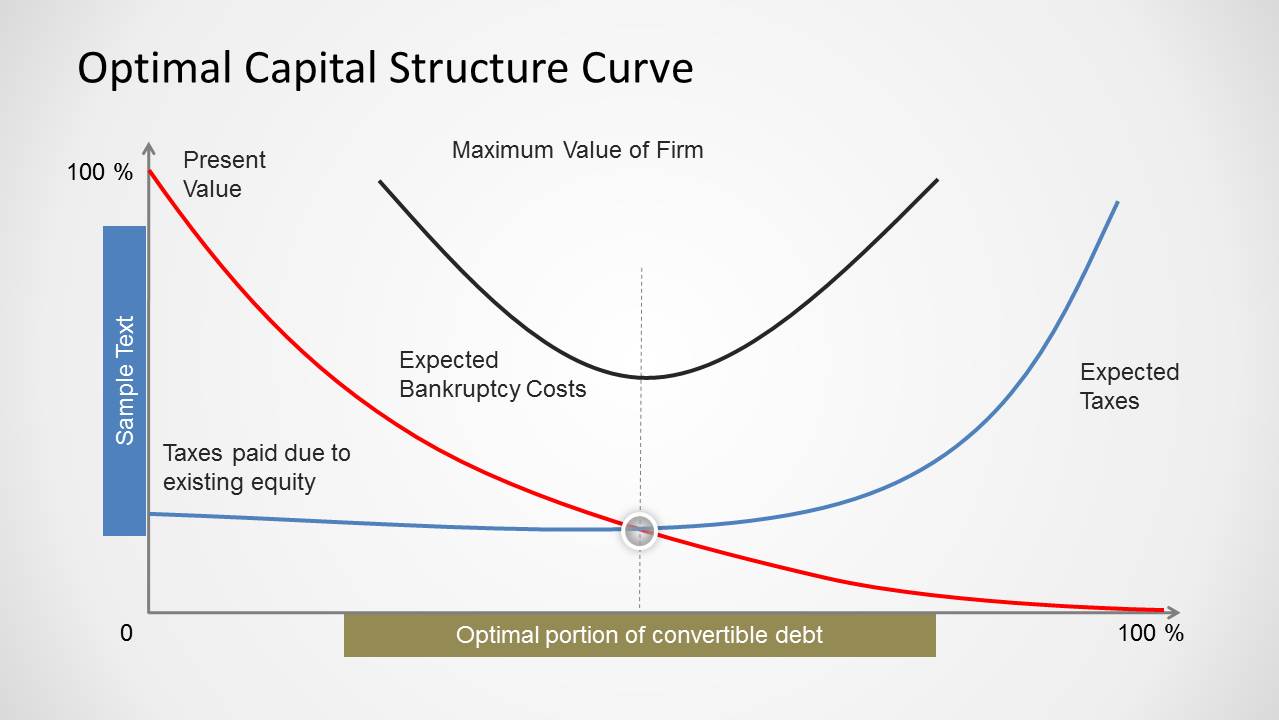

Optimal Capital Structure Curve For PowerPoint SlideModel

https://slidemodel.com/wp-content/uploads/6226-01-optimal-capital-structure-1.jpg

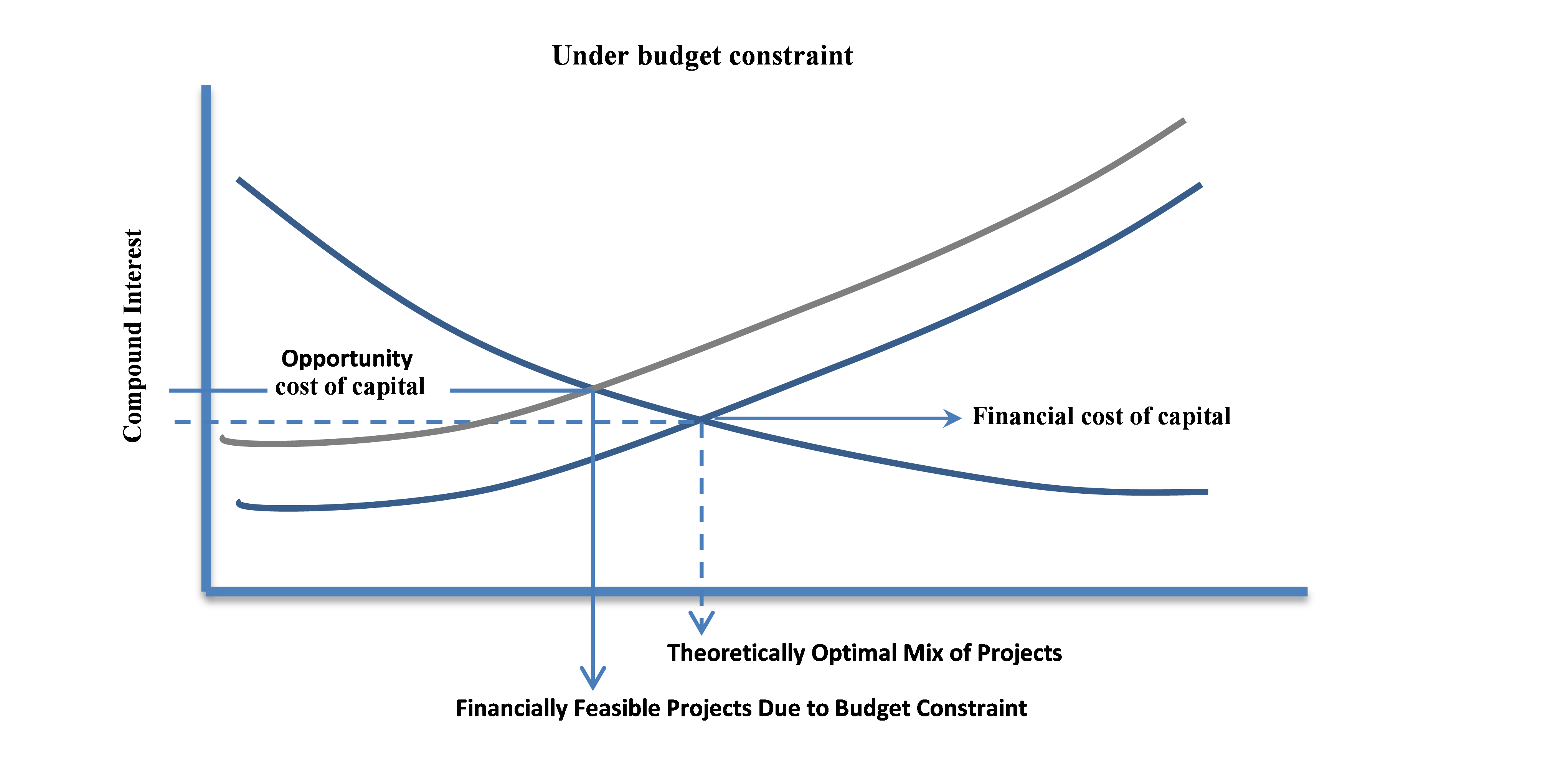

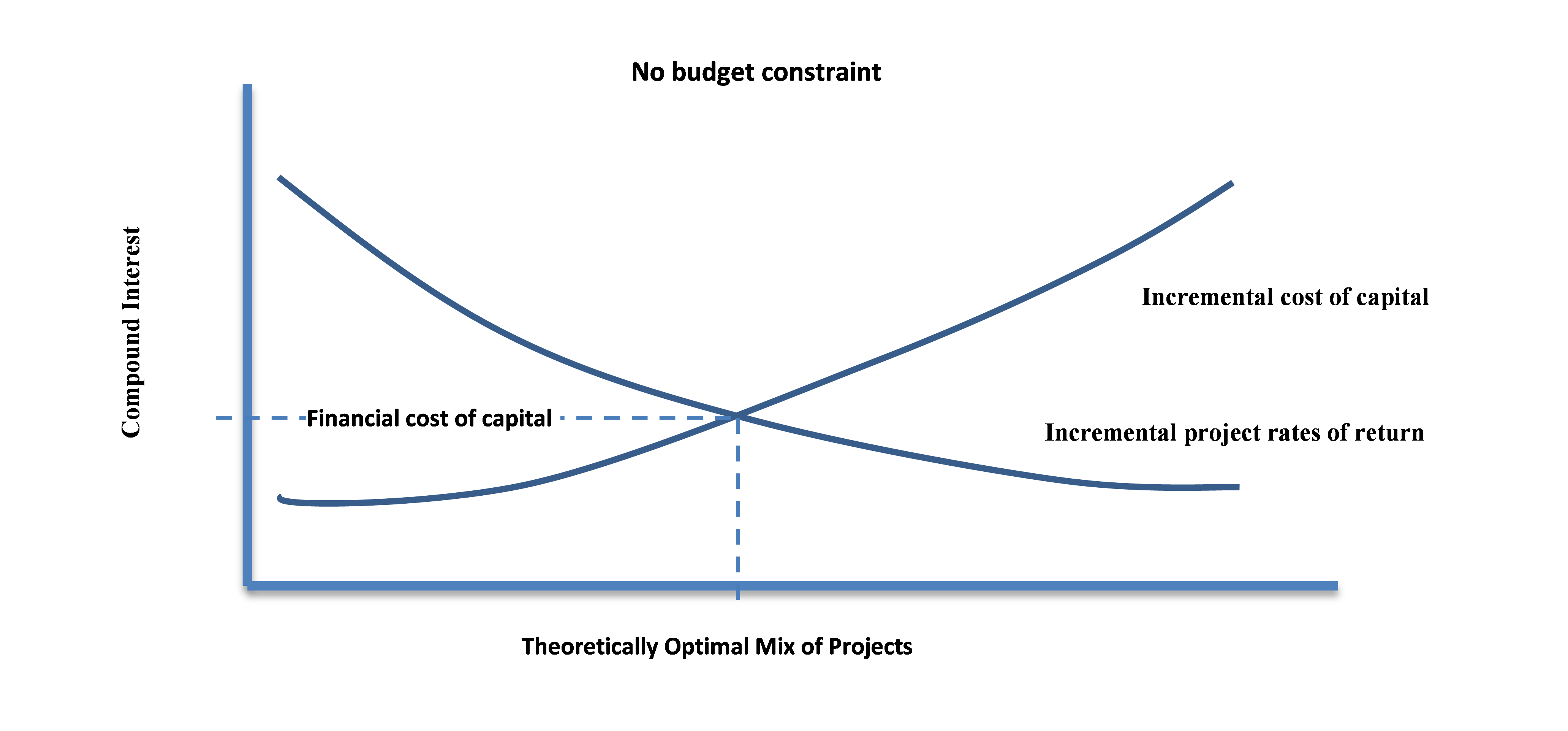

Financial Cost Of Capital And Opportunity Cost Of Capital EME 460

https://www.e-education.psu.edu/eme460/sites/www.e-education.psu.edu.eme460/files/Lesson3/Figure 3-4.png

https://efinancemanagement.com › investment-decisions › cost-of-capital

Cost of Debt The cost of debt capital is the cost of using a bank s or financial institution s money in the business The banks get their compensation in the form of interest on

https://site.financialmodelingprep.com › education › ...

Understanding and accurately estimating the cost of capital including WACC equity cost and debt cost is vital for effective financial management and valuation By

Financial Cost Of Capital And Opportunity Cost Of Capital EME 460

Optimal Capital Structure Curve For PowerPoint SlideModel

1

:max_bytes(150000):strip_icc()/TermDefinitions_wacc_final-626b8af9bfc741d6a9792fe0568242cd.png)

Weighted Average Formula

Cost Of Capital Define Types Debt Equity WACC Uses Factors EFM

How To Lower Wacc Phaseisland17

How To Lower Wacc Phaseisland17

What Is Weighted Average Cost Of Capital WACC Forage

Cost Of Debt Definition Formula Calculate Cost Of Debt For WACC

Weighted Average Cost Of Capital WACC Investing Post

Cost Of Capital And Cost Of Debt - [desc-14]