Credit Scoring Systems Credit scoring models are statistical tools that evaluate creditworthiness and determine the likelihood of default on credit obligations These models are used by credit

Credit scoring models are statistical analyses used by credit bureaus that evaluate your worthiness to receive credit The agencies select statistical characteristics found in a Using a numerical score aids lenders in assessing the risk associated with extending credit and facilitating informed lending decisions The system streamlines the credit

Credit Scoring Systems

Credit Scoring Systems

https://www.pymnts.com/wp-content/uploads/2017/04/fico-small-business-sme-loan-origination-approval-score-risk-bank-credit-union.jpg

43 Navy Federal Minimum Credit Score Mortgage RoslynnTheo

https://www.credit.com/wp-content/uploads/2020/10/Credit-Score-Charts-1024x693.png

Premium AI Image AI Driven Credit Scoring Systems Analyzing Financial

https://img.freepik.com/premium-photo/ai-driven-credit-scoring-systems-analyzing-financial-data_665280-11354.jpg

Credit scoring models refer to statistical and algorithm based frameworks that assess the potential default risk involved in extending a loan or debt to a particular individual or firm There are FICO Scores are the industry standard in credit scoring with expertise in developing credit scores for over 30 countries supporting financial inclusion across the credit ecosystem For

A credit score is a number from 300 to 850 that rates a consumer s creditworthiness The higher the score the better a borrower looks to potential lenders Credit scoring is a systematic and statistical method used by financial institutions to assess the creditworthiness of individuals or businesses seeking financial products such as loans or

More picture related to Credit Scoring Systems

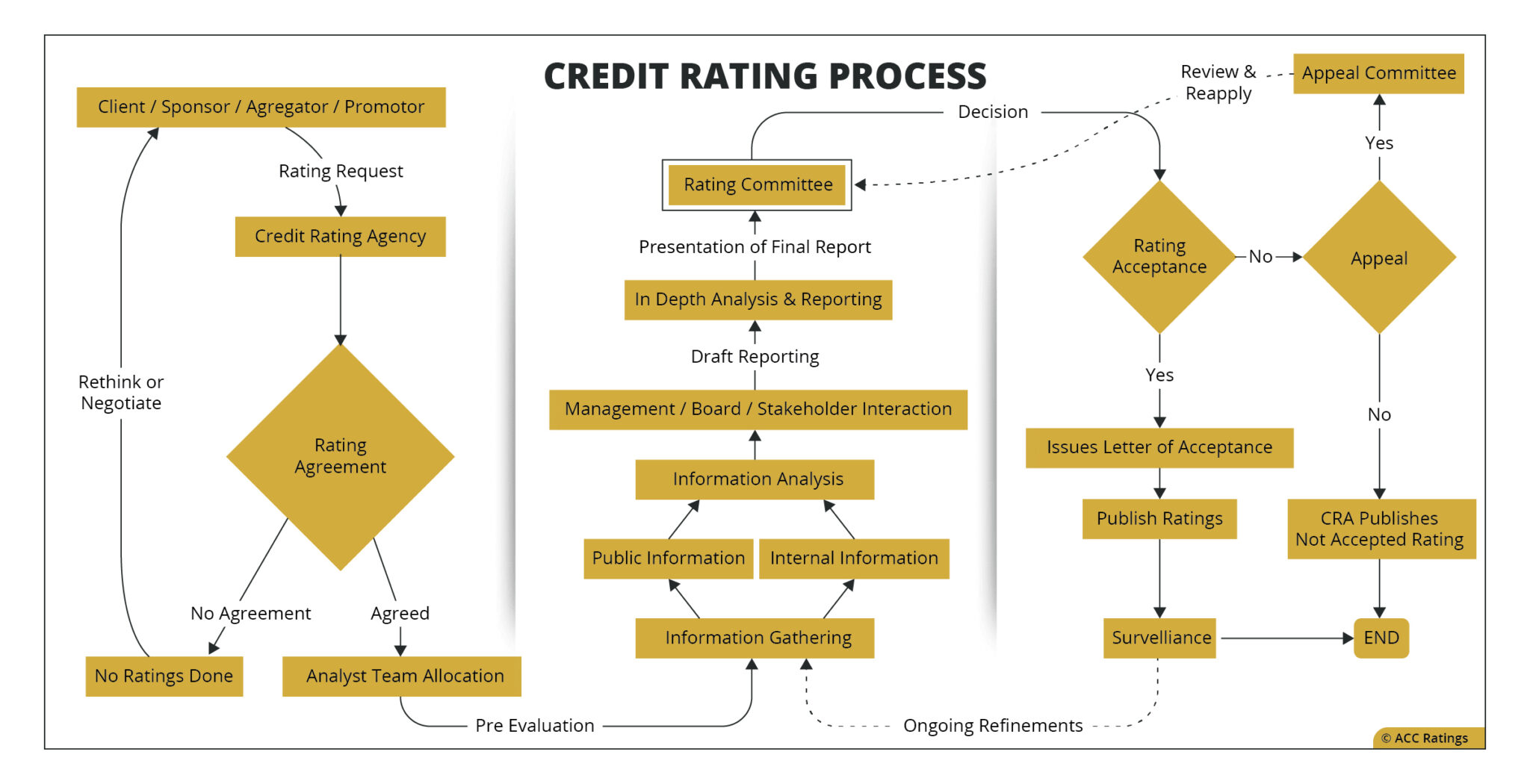

Credit Rating Process ACC Rating Credit Advisors

https://accratings.com/wp-content/uploads/2020/12/acc_dec_28_credit_rating_process-2048x1050.jpg

Premium Photo AI Driven Credit Scoring Systems Analyzing Financial Data

https://img.freepik.com/premium-photo/ai-driven-credit-scoring-systems-analyzing-financial-data_665280-11361.jpg

PT Smartekno Solusi Bisnis

https://www.smartekno.co.id/assets/smartekno/css.jpg

Credit scoring is widely understood to have immense potential to assist in the economic growth of the world economy Additionally it is a valuable tool for improving financial inclusion credit Credit Scoring Systems are pivotal instruments that financial institutions utilize to assess the creditworthiness of borrowers They serve as a standardized metric for gauging

[desc-10] [desc-11]

Credit scoring System QS Study

https://qsstudy.com/wp-content/uploads/2019/02/Credit-scoring-System.jpg

How Racial Bias Informs Why The Current Credit Scoring System Needs A

https://qcashfinancial.com/wp-content/uploads/2021/08/rupixen-com-Q59HmzK38eQ-unsplash.jpg

https://www.highradius.com › resources › Blog › credit...

Credit scoring models are statistical tools that evaluate creditworthiness and determine the likelihood of default on credit obligations These models are used by credit

https://www.debt.org › credit › report › scoring-models

Credit scoring models are statistical analyses used by credit bureaus that evaluate your worthiness to receive credit The agencies select statistical characteristics found in a

Alternative Credit Data And The Future Of Credit Scoring

Credit scoring System QS Study

Credit Scoring estadistical csv At Master Machine Learning in Credit

Transforming B2B With Algo360 s AI Credit Scoring Think360

What s A Good Credit Score It Depends On The Lender And Credit scoring

Alternative Credit Scoring Solutions FinScore

Alternative Credit Scoring Solutions FinScore

How Does Credit Scoring Work Internationally

Leveraging Telco Based Credit Scoring Systems Finscore

Proposed Architecture For Credit Scoring Download Scientific Diagram

Credit Scoring Systems - A credit score is a number from 300 to 850 that rates a consumer s creditworthiness The higher the score the better a borrower looks to potential lenders