Employee Tax Table 2024 Personal Income Tax PIT Brackets for Individuals in Papua New Guinea for 2024 A resident individual who earns a salary or wage in Papua New Guinea must pay tax on that income at fortnightly rates according to the Income Tax Salary or Wages Tax Rates 2024 Budget Amendment Act

Tables A B and C show the Salary or Wages Tax to be deducted by the employers from the total salary or wages paid to their employees on a fortnightly basis from 1 January 2023 The government has increased the Tax free threshold from K17 500 to K20 000 In the 2024 Budget the Government decided to maintain the tax free threshold at K20 000 per annum or tax free fortnightly income up to K769 permanently from 1 January 2024 onwards The only new measure in the budget was repealing the dependent rebate

Employee Tax Table 2024

Employee Tax Table 2024

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?resize=1250%2C837&ssl=1

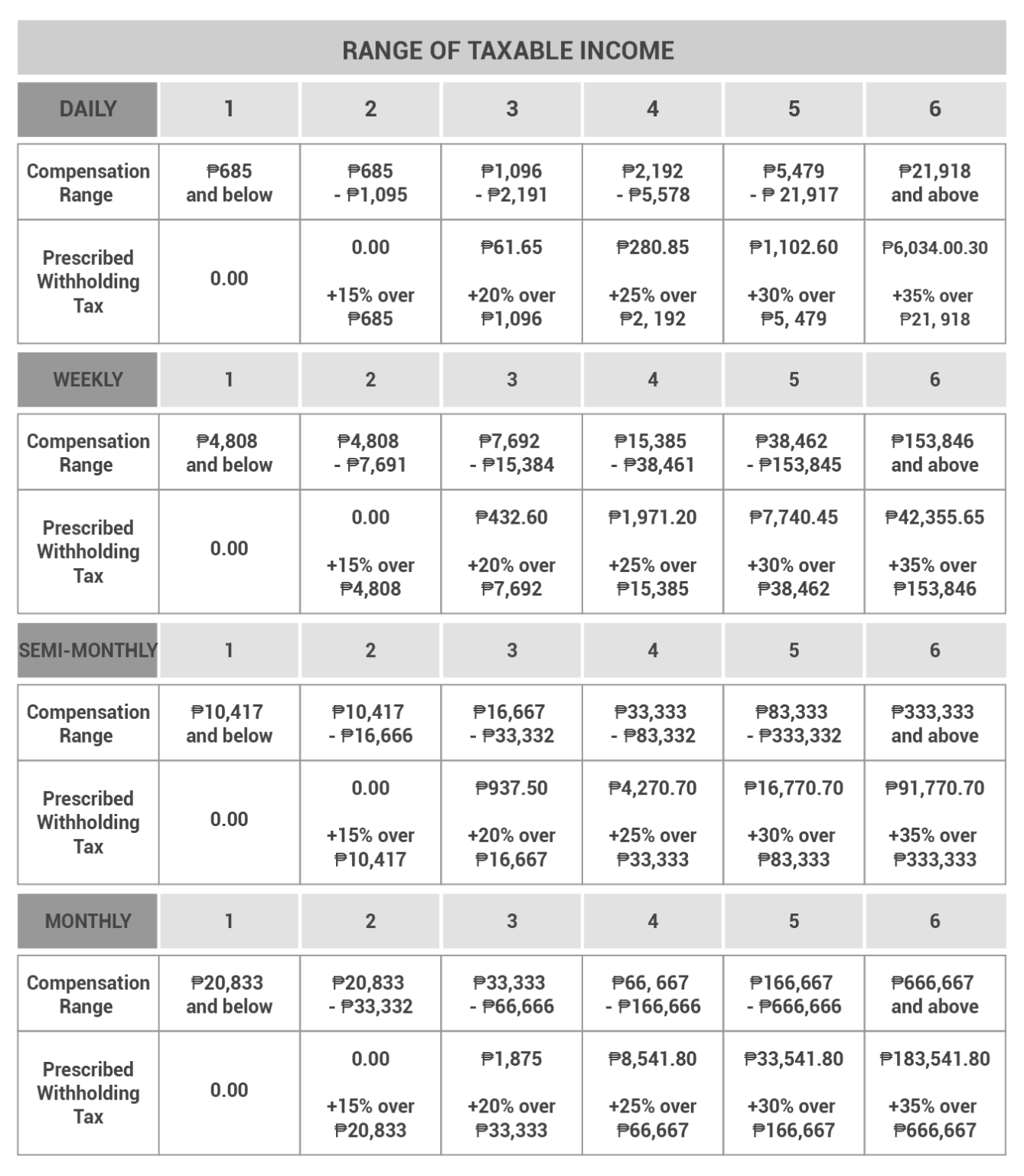

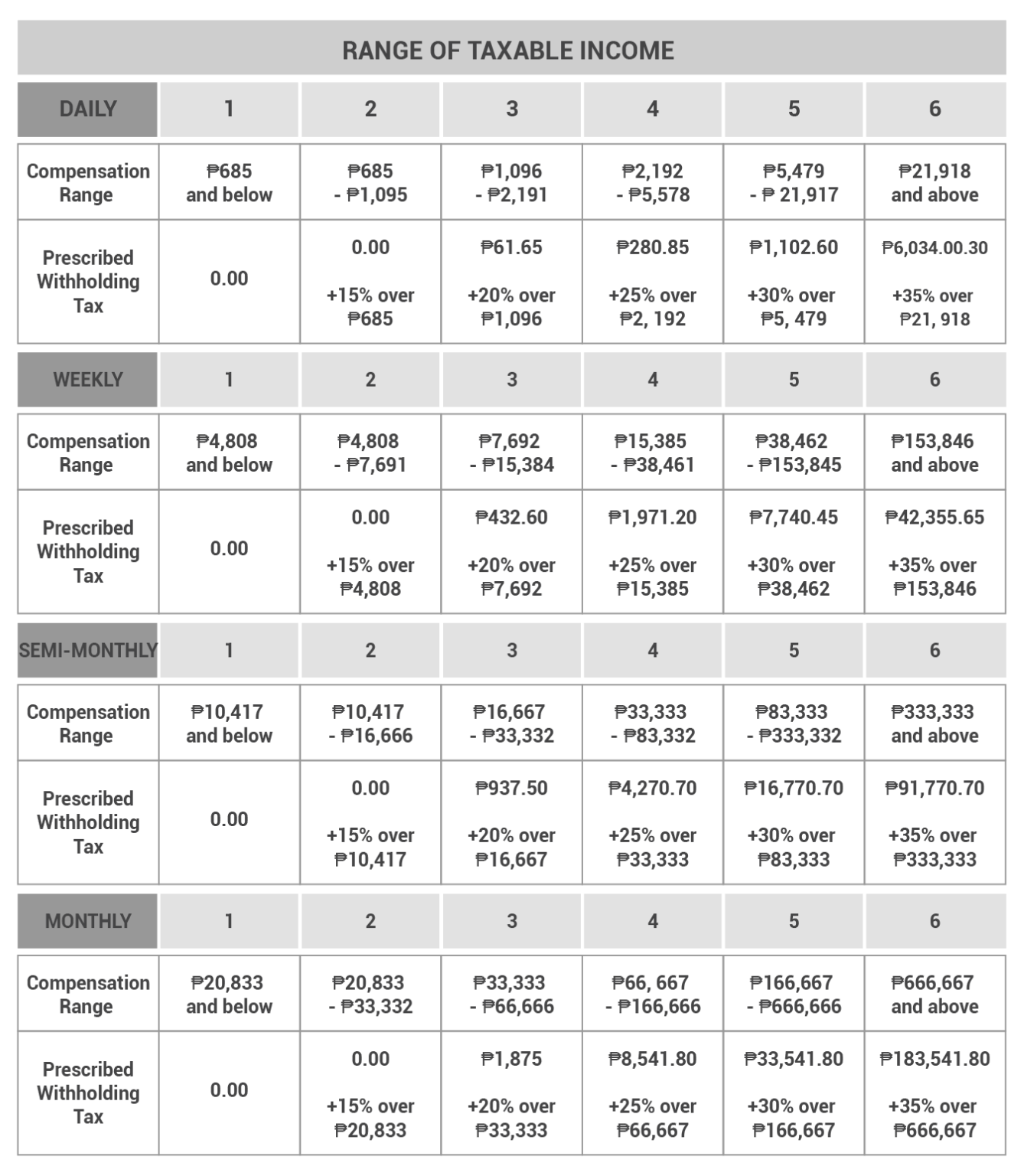

Tax SSS And PHIC Updates For 2023 InCorp Philippines

https://kittelsoncarpo.com/wp-content/uploads/2023/02/TAX-SSS-PHIC-UPDATES_TABLES-02-min-1338x1536.png

New Year 2024 Greeting Card Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/560000/velka/nieuwjaar-jaar-2024-wenskaart-17039349077oJ.jpg

Review the latest income tax rates thresholds and personal allowances in Papua New Guinea which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Papua New Guinea The Papua New Guinea Tax Calculator below is for the 2024 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in Papua New Guinea This includes calculations for Employees in Papua New Guinea to calculate their annual salary after tax

PNG fiscal year begins on 1 January and ends on 31 December For salary or wage earners who are not required to submit income tax returns the tax period is a fortnight and tax is assessed by reference to the salary or wage income derived in that fortnight See the 2024 for money you earned in 2024 Find the 2025 for money you earn in 2025 See current federal tax brackets and rates based on your income and filing status

More picture related to Employee Tax Table 2024

Philippines Tax Tables 2024 Tax Rates And Thresholds In Philippines

https://ph.icalculator.com/img/og/PH/92.png

New Year 2024 Greeting Card Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/560000/velka/nieuwjaar-jaar-2024-wenskaart-17032727948GO.jpg

New Year 2024 Greeting Card Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/560000/velka/nieuwjaar-2024-wenskaart-1701763531fR7.jpg

The table below details the monthly income tax bands and rates generally applicable to the chargeable income of resident individuals Year 2024 Chargeable Income GH MONTHLY TAX DEDUCTION TABLES 2024 TAX YEAR PAYE GEN 01 G01 A03 Revision 0 Page 1 of 15 Under 65 65 74 Over 75 Under 65 65 74 Over 75 R 0 R 4 979 R 59 748 R 0 R 0 R 0 R 9 929 R 10 029 R 119 748 R 360 R 0 R 0 R 4 980 R 5 080 R 60 360 R 0 R 0 R 0 R 10 030 R 10 130 R 120 960 R 378 R 0 R 0

[desc-10] [desc-11]

Buy Planner 2024 2025 Jan 2024 Dec 2024 2024 Planner Planner 2024

https://m.media-amazon.com/images/I/911hAyukpYL.jpg

Buy 2024 Family 2024 From January 2024 To December 2024 2024 UK

https://m.media-amazon.com/images/I/91Zgt7J3ikL.jpg

https://quickbooks.intuit.com › global › tax-tables › ...

Personal Income Tax PIT Brackets for Individuals in Papua New Guinea for 2024 A resident individual who earns a salary or wage in Papua New Guinea must pay tax on that income at fortnightly rates according to the Income Tax Salary or Wages Tax Rates 2024 Budget Amendment Act

https://static.irc.gov.pg › December

Tables A B and C show the Salary or Wages Tax to be deducted by the employers from the total salary or wages paid to their employees on a fortnightly basis from 1 January 2023 The government has increased the Tax free threshold from K17 500 to K20 000

United Arab Emirates Tax Tables 2024 Tax Rates And Thresholds In

Buy Planner 2024 2025 Jan 2024 Dec 2024 2024 Planner Planner 2024

Puerto Rico Tax Tables 2023 Tax Rates And Thresholds In Puerto Rico

2024 Png Public Domain Pictures

New Year 2024 Free Stock Photo Public Domain Pictures

Philippines Tax Tables 2020 Tax Rates And Thresholds In Philippines

Philippines Tax Tables 2020 Tax Rates And Thresholds In Philippines

New Year 2024 Greeting Card Free Stock Photo Public Domain Pictures

New Year 2024 Greeting Card Free Stock Photo Public Domain Pictures

New Year 2024 Greeting Card Free Stock Photo Public Domain Pictures

Employee Tax Table 2024 - The Papua New Guinea Tax Calculator below is for the 2024 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in Papua New Guinea This includes calculations for Employees in Papua New Guinea to calculate their annual salary after tax