Hmrc Online Gift Sales Tax Rules From HMRC s point of view cracking down on those who are generating incredibly small amounts of profit or even making losses via eBay will lead to the completion of

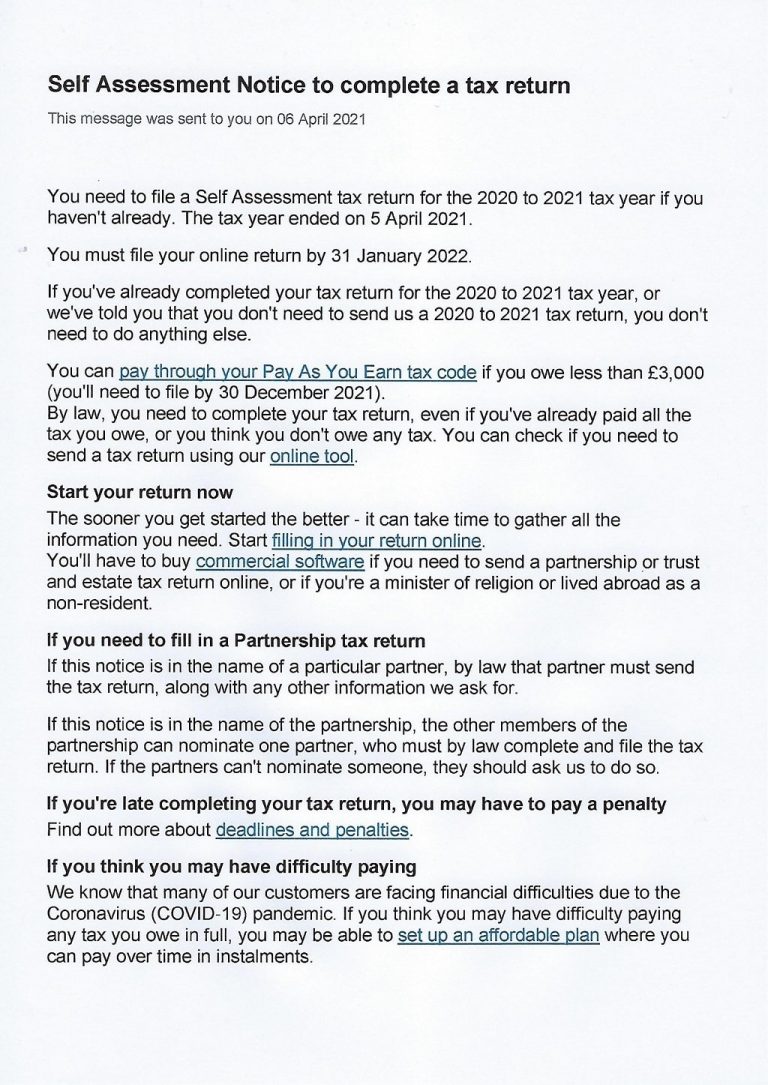

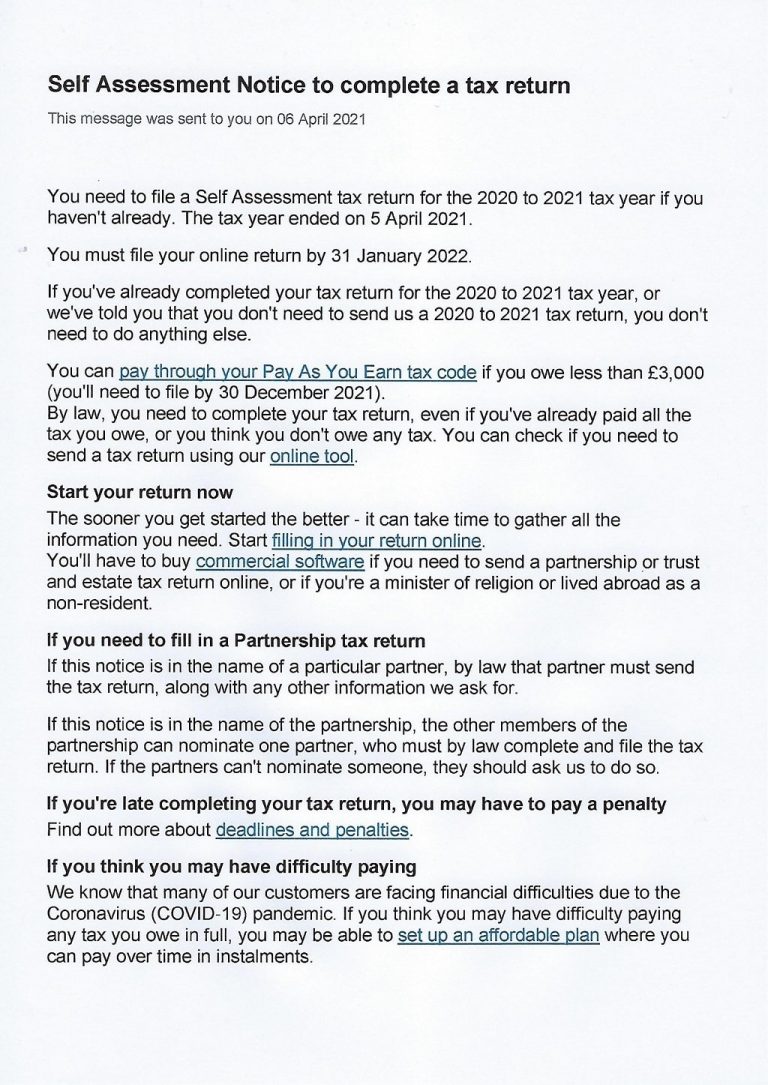

Hi I am going self employed and need to register for a UTR number I have a gateway account but is there a section or form that s connected for self employment to access 7 Oct UPDATE HMRC has confirmed that this email is NOT a scam It is a genuine communication from HMRC AccountingWEB moderators Dear customer We re

Hmrc Online Gift Sales Tax Rules

Hmrc Online Gift Sales Tax Rules

https://i.ytimg.com/vi/2IrcuYVXl6k/maxresdefault.jpg

How To Change Address In Hmrc Online YouTube

https://i.ytimg.com/vi/C9-_YGLgpO4/maxresdefault.jpg

Dullard Picture Illinois State Veterinary Medical Association

https://www.isvma.org/wp-content/uploads/2020/09/Dullard-Picture-scaled.jpg

From HMRC s tax calculation guidance notes page TCSN35 Class 2 NICs You pay Class 2 contributions if you re self employed Class 2 contributions are 3 45 a week or HMRC I want to be very clear I am aware that contacting a source of income is a potential reason as to why the tax refund has not been made What I m actually asking is to

Hi Bruce Maginnis In your letter include proof from your pension provider of payments made for each tax year you re claiming for and whether the payment amounts are Hello there I would like to inquire about the employee electric car salary sacrifice If the company wants to offer the electric car to the employee through the salary sacrifice

More picture related to Hmrc Online Gift Sales Tax Rules

Lamky 2020 2 Illinois State Veterinary Medical Association

https://www.isvma.org/wp-content/uploads/2020/09/Lamky-2020-2-scaled.jpg

Latest VAT News And Updates

https://assets.ycodeapp.com/assets/app49987/images/published/ijvya_detroit.png

VTNEStudySeries2023 Illinois State Veterinary Medical Association

https://www.isvma.org/wp-content/uploads/2023/01/VTNEStudySeries2023.png

HMRC has issued a significant clarification that could benefit companies who believed they were ineligible to claim R D tax relief due to a missed pre notification requirement However with HMRC s many rules and updates understanding how this process operates can be confusing for both you and your employees This blog aims to offer a

[desc-10] [desc-11]

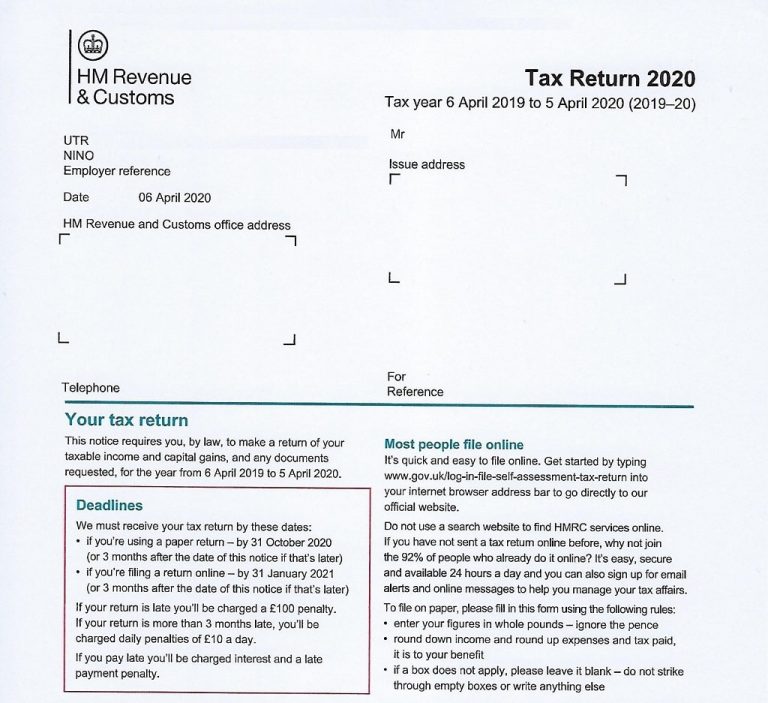

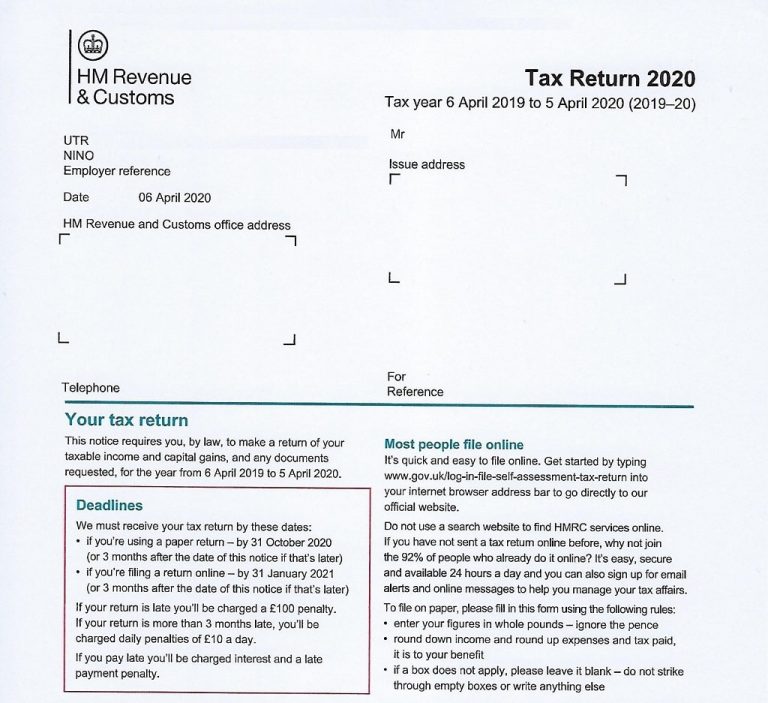

Hmrc Tax Return

https://taxhelp.uk.com/wp-content/uploads/SA316-2021-HMRC-Notice-to-File-a-2021-Tax-Return-m-768x1085.jpg

Hmrc Tax Return

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/60031/VAT407_example.jpg

https://www.accountingweb.co.uk › community › blogs › philip-fisher › h…

From HMRC s point of view cracking down on those who are generating incredibly small amounts of profit or even making losses via eBay will lead to the completion of

https://community.hmrc.gov.uk › customerforums › sa

Hi I am going self employed and need to register for a UTR number I have a gateway account but is there a section or form that s connected for self employment to access

HMRC Self Assessment

Hmrc Tax Return

Hmrc Pay Scales 2023 Image To U

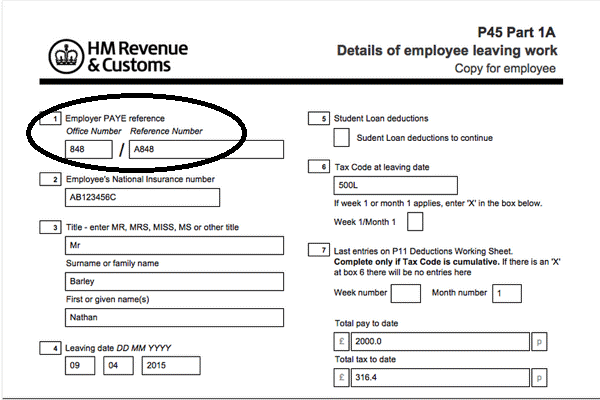

Employer s PAYE Ref Number Claim My Tax Back

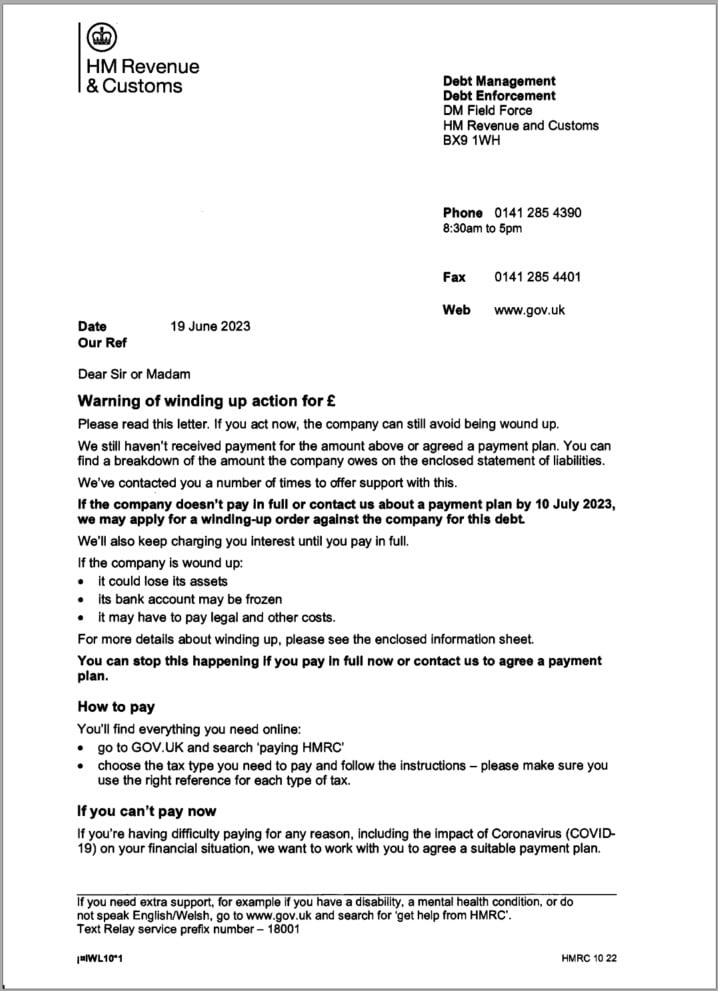

Winding Up Notice Format Vrogue co

Personal Tax Form 2025 Lori J Clifford

Personal Tax Form 2025 Lori J Clifford

Hmrc Lifetime Allowance 2023 24 Image To U

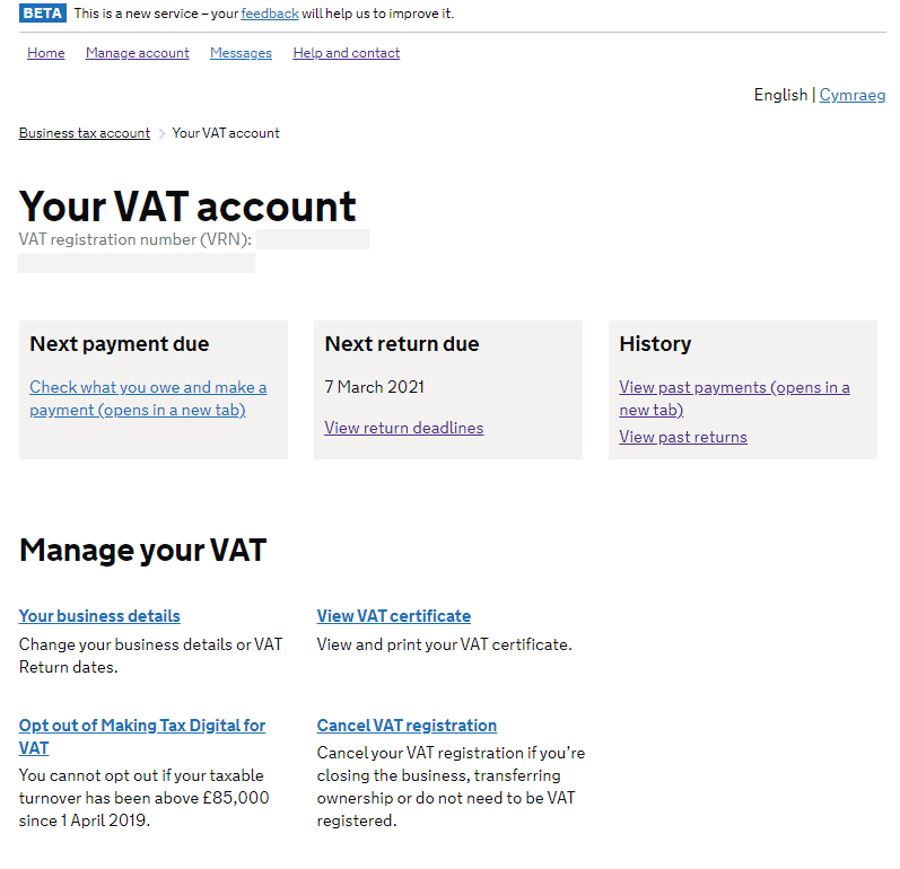

How To Check Your Business HMRC Position MaxCap

How To Check Your Business HMRC Position Fleximize

Hmrc Online Gift Sales Tax Rules - Hi Bruce Maginnis In your letter include proof from your pension provider of payments made for each tax year you re claiming for and whether the payment amounts are