How Is Income Tax Calculated For Foreigners In Singapore Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of Some expenses deducted on your income statement are not allowable for income tax purposes and are not identified on Schedule 1 In this case use columns 605 and 295 and line 296

How Is Income Tax Calculated For Foreigners In Singapore

How Is Income Tax Calculated For Foreigners In Singapore

https://i.ytimg.com/vi/oAXCPUn3sfk/maxresdefault.jpg

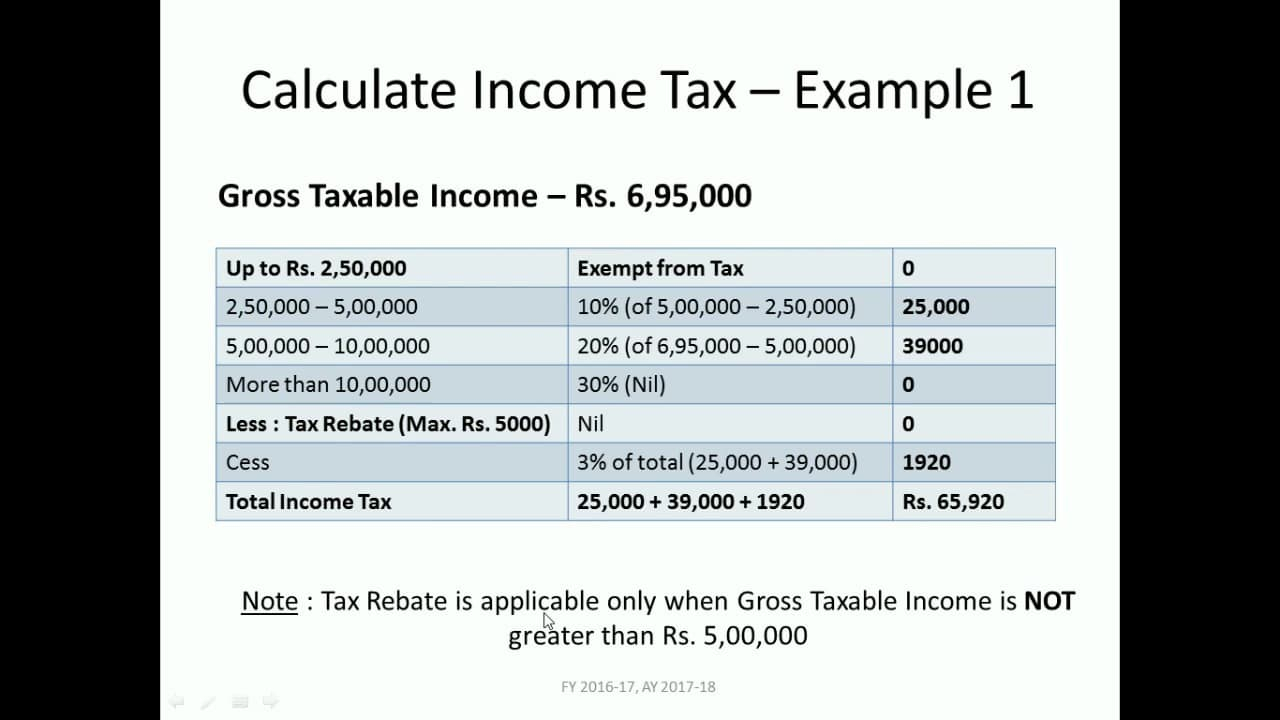

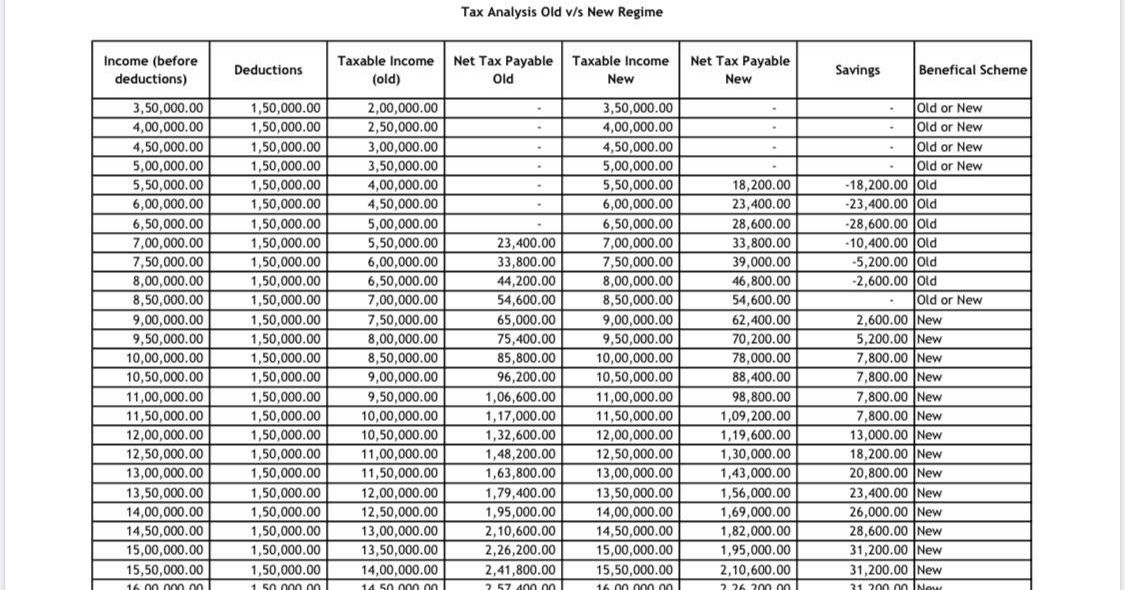

How To Save Income Tax On Salary Above 7 Lakh Old Vs New Tax Regime

https://i.ytimg.com/vi/rYXXnjdYFu0/maxresdefault.jpg

Chinese Id Number

https://osintonchina.com/images/chinese-resident-identity-card-example.png

You or your spouse or common law partner received Employment and Income Assistance or Manitoba Supports for Persons with Disabilities payments in 2024 You can only claim part of 2025 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are

When you fill out your Old Age Security Return of Income form be sure to enter the amounts that are indicated on your NR4 OAS slip Also be sure to enter the OAS repayment amount on line This income can be distributed to its shareholders as an eligible dividend This means that unlike a CCPC a non CCPC must maintain an LRIP account to track its income that has benefited

More picture related to How Is Income Tax Calculated For Foreigners In Singapore

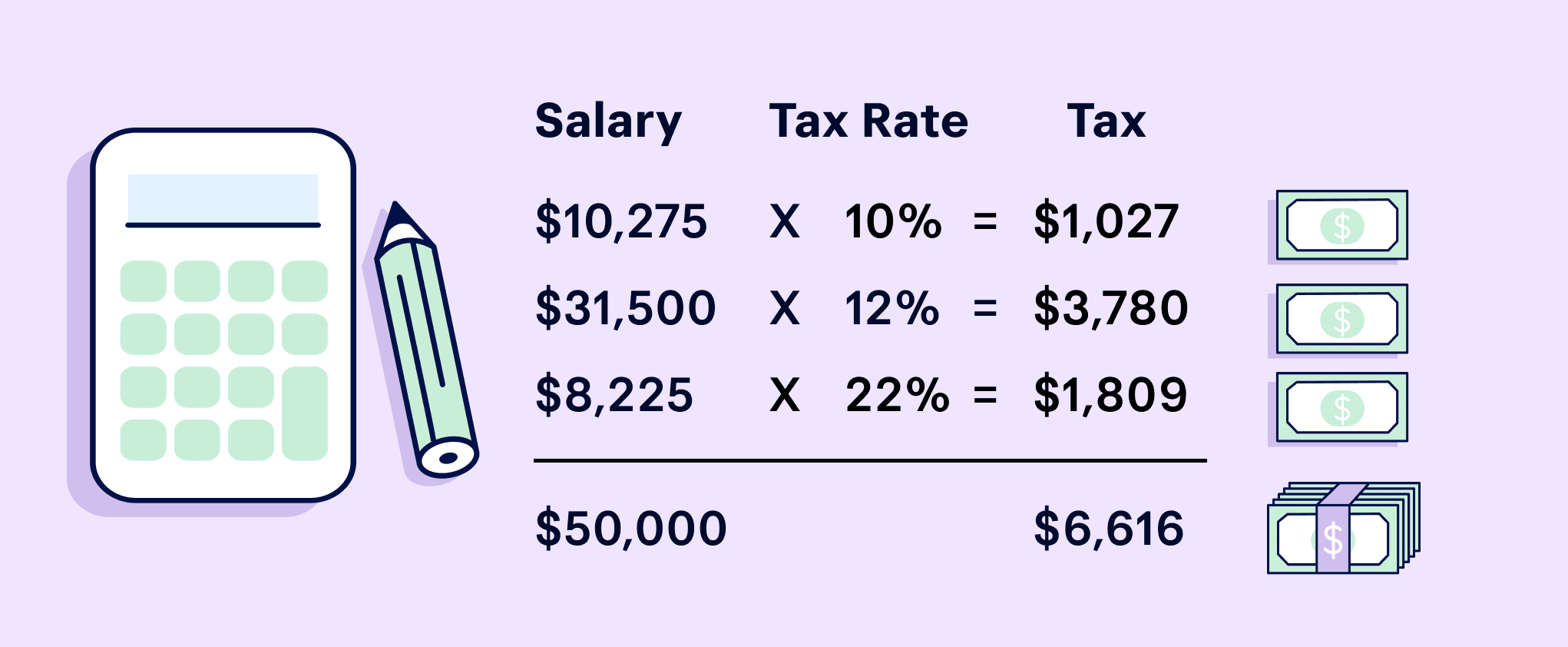

How To Calculate Your Federal Taxes By Hand PaycheckCity Worksheets

https://worksheets.clipart-library.com/images2/estimated-tax-worksheet-calculator/estimated-tax-worksheet-calculator-19.png

US Federal Corporate Income Taxes Figure1 1 News From The Johns

https://releases.jhu.edu/wp-content/uploads/2015/05/US-Federal-Corporate-Income-Taxes_Figure111-774x1024.jpg

Income Tax For Ay 2024 25 Calculator Image To U

https://i.ytimg.com/vi/4MNnk4NFRuw/maxresdefault.jpg

How to fill out the Other information section The Other information area at the bottom of the T4 slip has boxes for you to enter codes and amounts that relate to employment Formerly known as Climate action incentive payment Basic amount and rural supplement for residents of Alberta Manitoba New Brunswick Newfoundland and Labrador Nova Scotia

[desc-10] [desc-11]

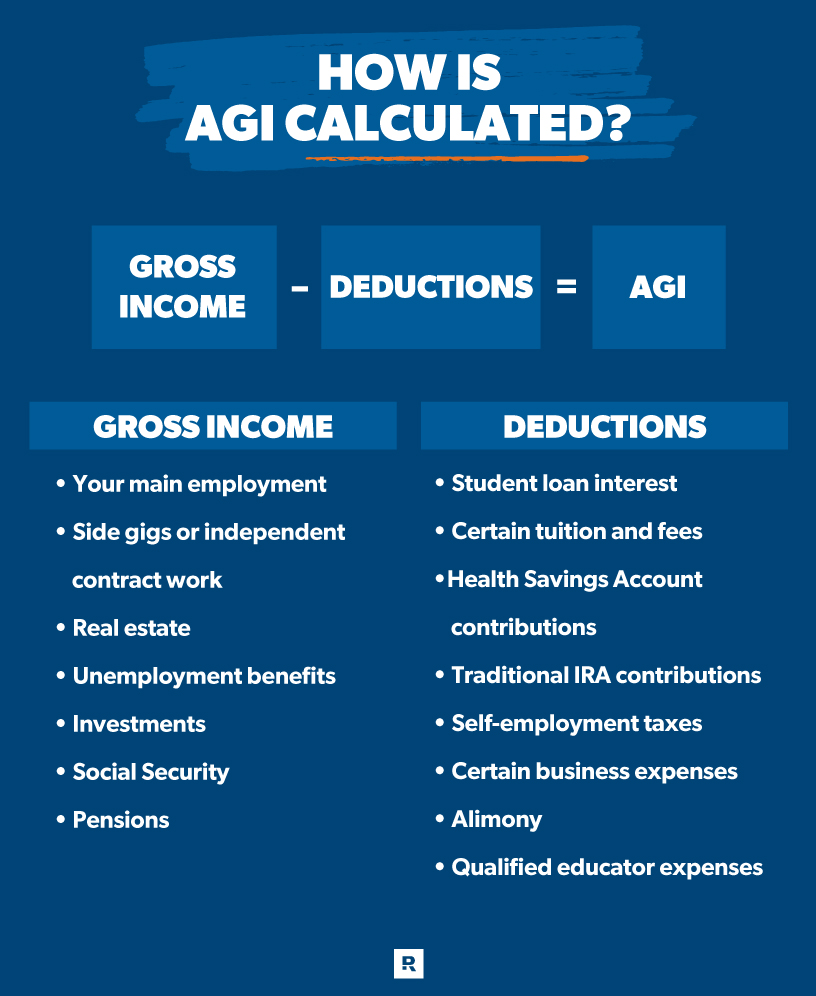

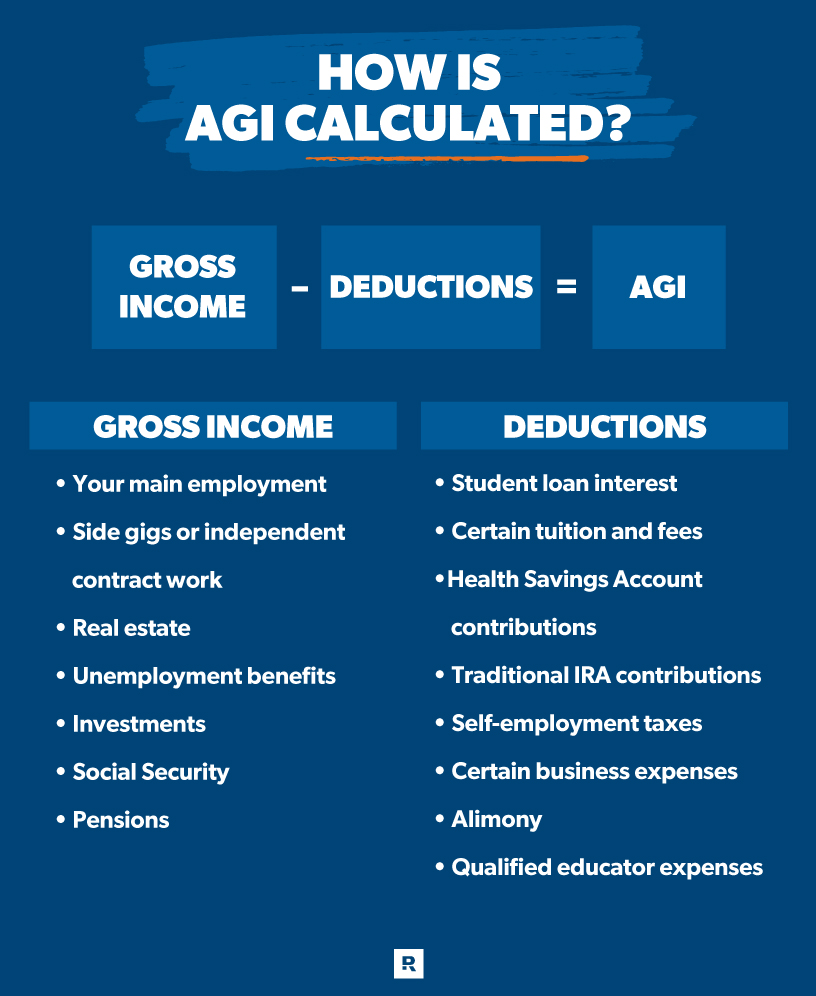

What Is Adjusted Gross Income AGI Does My Snapshot On Tax Act Have The

https://cdn.ramseysolutions.net/media/blog/taxes/personal-taxes/how-is-agi-calculated.jpg

Calculate Your Tax Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/how-to-calculate-income-tax-formula.jpg

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

https://www.canada.ca › en › services › taxes › income-tax

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

Tax Return 2025 South Africa Kiara Macintosh

What Is Adjusted Gross Income AGI Does My Snapshot On Tax Act Have The

Net Income Calculation

Fed Tax Rates 2025 Calculator Hayden Cohn C

Tax Calculator 2025 2025 Estimator Stine D Olesen

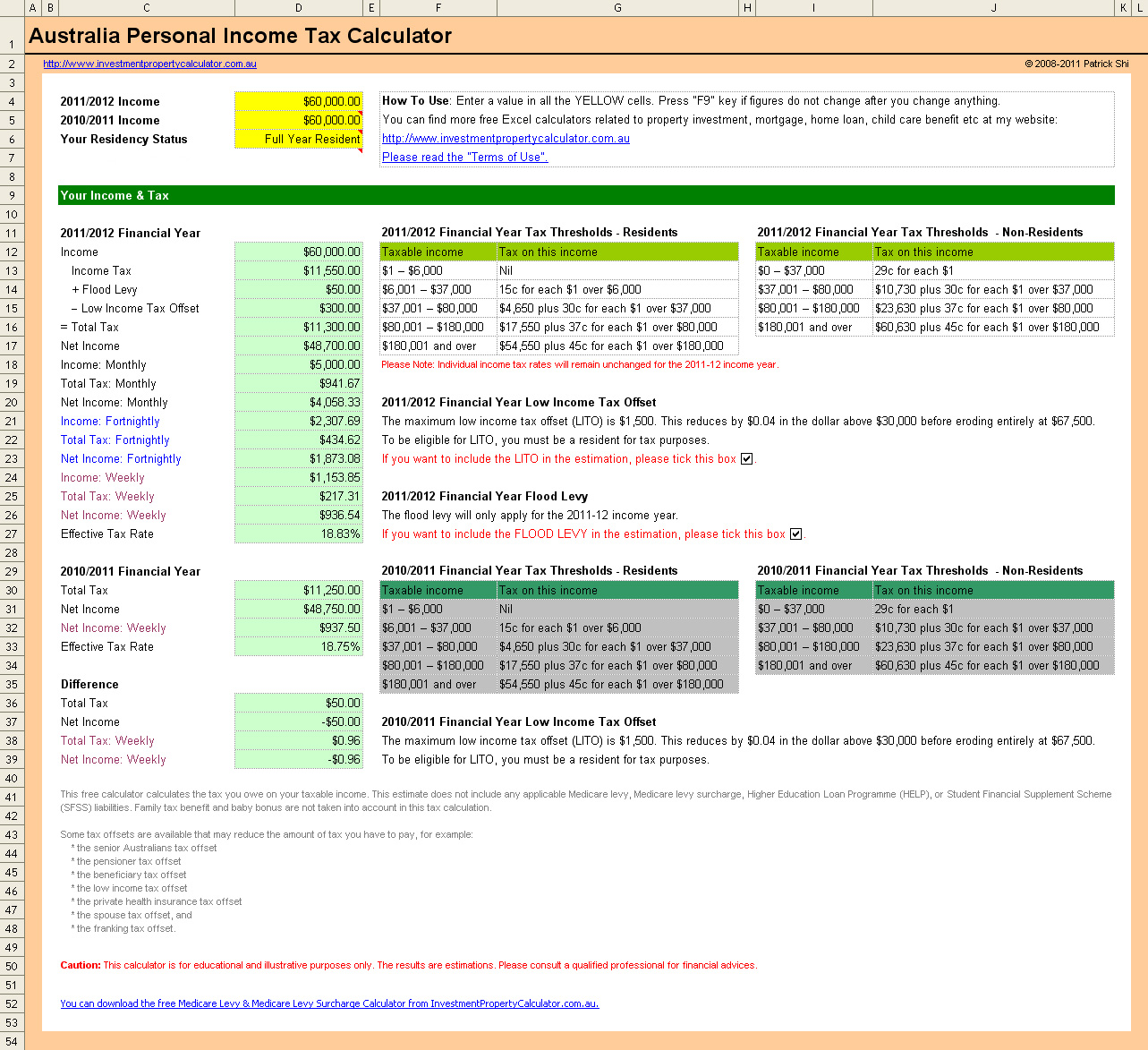

Individual Income Tax Rates 2025 Australia Selma G Bach

Individual Income Tax Rates 2025 Australia Selma G Bach

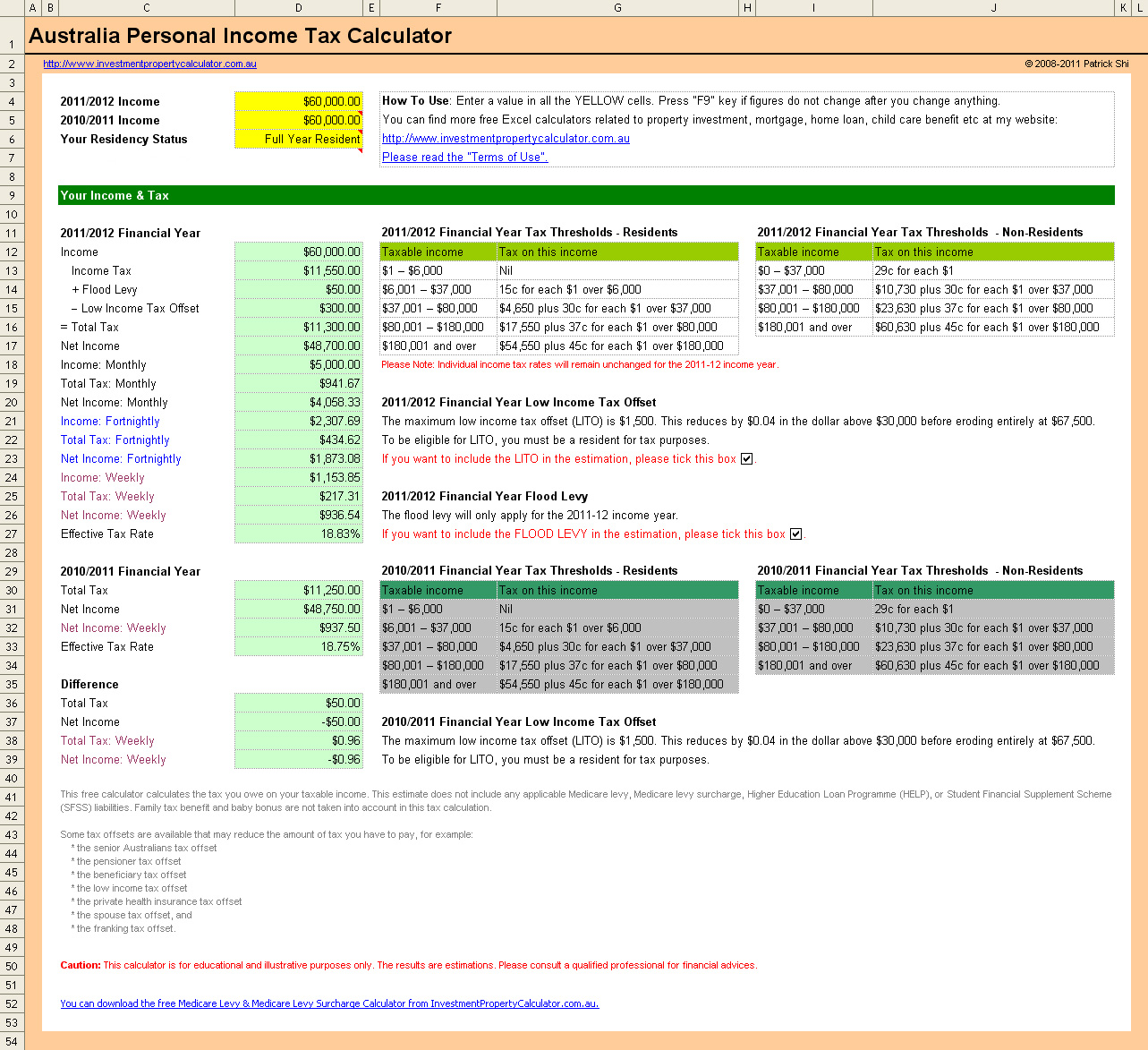

Paying Tax In China Teach English In China Graduate Teaching Jobs

India Tax Brackets 2024 Keri Selena

Tax Brackets 2025 Federal Rebecca Wrixon W

How Is Income Tax Calculated For Foreigners In Singapore - 2025 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are