How Is Land Tax Calculated In Victoria Land tax is calculated by applying the appropriate land tax rate to the total taxable value of your land holdings excluding exempt land such as your home For example at midnight on 31 December 2023 Alice owns Property C her principal place of residence PPR

Land tax is calculated using the site values determined by the Valuer General Victoria of all taxable land you owned as at midnight on 31 December of the year preceding the year of assessment To calculate your land tax estimate use our land tax calculator or How is land tax calculated Land tax is an annual tax that is applied on the total taxable value of all the land you own in Victoria Land tax is calculated on the site value i e unimproved value of all taxable land you own as at midnight on 31 December each year

How Is Land Tax Calculated In Victoria

How Is Land Tax Calculated In Victoria

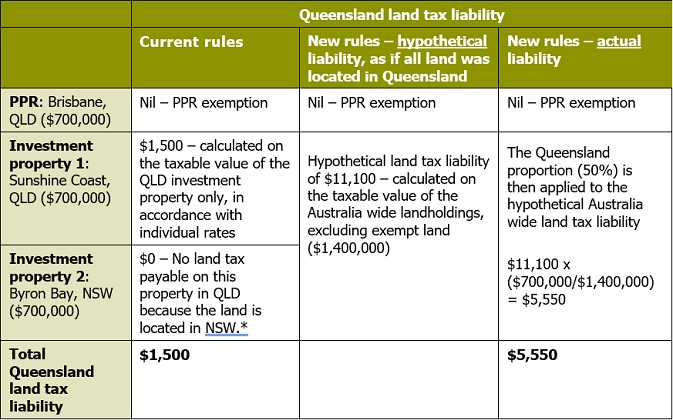

https://www.propertyzest.com.au/wp-content/uploads/2022/09/land-tax-qld.png

Land Tax 101 How To Reduce Land Tax

https://www.mortgagecorp.com.au/wp-content/uploads/2016/09/land-tax.jpg

FY 2023 Budget Property Taxes

https://stories.opengov.com/victoriatx/uploads/65b2280c2134-Calculated_Effective_Tax_Rates.PNG

Once a general valuation is completed the State Revenue Office receives all valuations and uses them to calculate land tax vacant residential land tax and the windfall gains tax The site value SV of your land is used to calculate land tax Find out more from the State Revenue Office at sro vic gov au land tax How is the VIC land tax calculated The VIC land tax is calculated using the appropriate VIC land tax rate and applying this to the total taxable value of your land holdings excluding exempt land such as your home

Land tax is calculated by applying the appropriate land tax rate to the total taxable value of all taxable land of which the taxpayer was the owner at midnight on 31 December immediately preceding that tax year 3 The general land tax rates are as follows over the page Victoria s land tax is calculated on a progressive scale with different rates applied depending on the total value of taxable land owned Victoria s land tax rates from the 2024 land tax year are as follows If the total taxable value of land holdings is less than 50 000 the land tax payable is zero

More picture related to How Is Land Tax Calculated In Victoria

What Is Land Tax YouTube

https://i.ytimg.com/vi/04Iq75yZf-s/maxresdefault.jpg

What Is Land Tax And How Is It Calculated Liston Newton

https://assets-global.website-files.com/5ac46dd2c3ce7d464cd0c44e/61bc19ed2869c6092ad09c36_land-tax-980-580-p-800.jpeg

Land Tax Clearance Certificate InfoTrack

https://www.infotrack.com.au/wp-content/uploads/Land-Tax.jpg

How To Calculate Land Tax Calculating land tax in Victoria is based on the total taxable value of all your landholdings You ll need to apply the rate that corresponds to your property value bracket in the table of your applicable Land Tax Rates Example If you own property worth 500 000 you fall into the 300 000 to 600 000 bracket Valuations for council rates fire services property levy and land tax are made annually in accordance with the Valuation of Land Act 1960 They are undertaken or overseen by the Valuer General Rating valuations are used to fairly distribute council rates to ratepayers

[desc-10] [desc-11]

How Is Tax Calculated On Fixed Deposits LiveWell

https://livewell.com/wp-content/uploads/2023/11/how-is-tax-calculated-on-fixed-deposits-1700195310.jpg

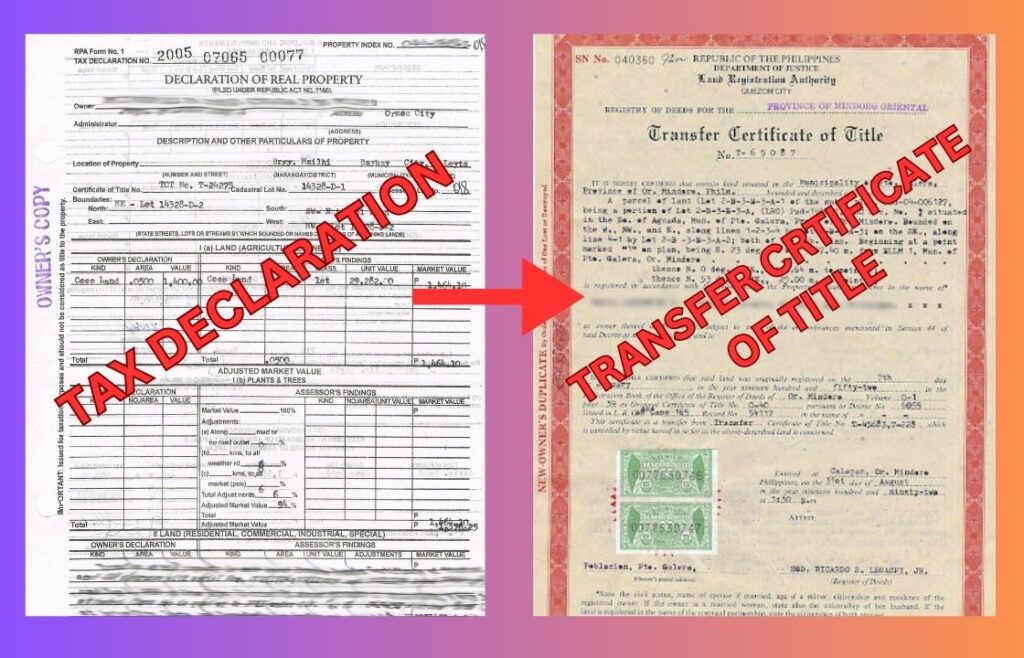

Process For Obtaining A Land Title From A Tax Declaration PHILREP

https://philrep.com.ph/wp-content/uploads/2023/12/PHILREP-Blog-1-1024x658.jpg

https://www.sro.vic.gov.au/land-tax/land-tax-assessment-example

Land tax is calculated by applying the appropriate land tax rate to the total taxable value of your land holdings excluding exempt land such as your home For example at midnight on 31 December 2023 Alice owns Property C her principal place of residence PPR

https://sro.vic.gov.au/rates-taxes-duties-and-levies/land-tax-current-rates

Land tax is calculated using the site values determined by the Valuer General Victoria of all taxable land you owned as at midnight on 31 December of the year preceding the year of assessment To calculate your land tax estimate use our land tax calculator or

Queensland Land Tax Laws Are Changing In 2023 What You Need To Know

How Is Tax Calculated On Fixed Deposits LiveWell

Understand How The Federal Income Tax Is Calculated

Controversial Land Tax Scrapped For Queensland Property Owners

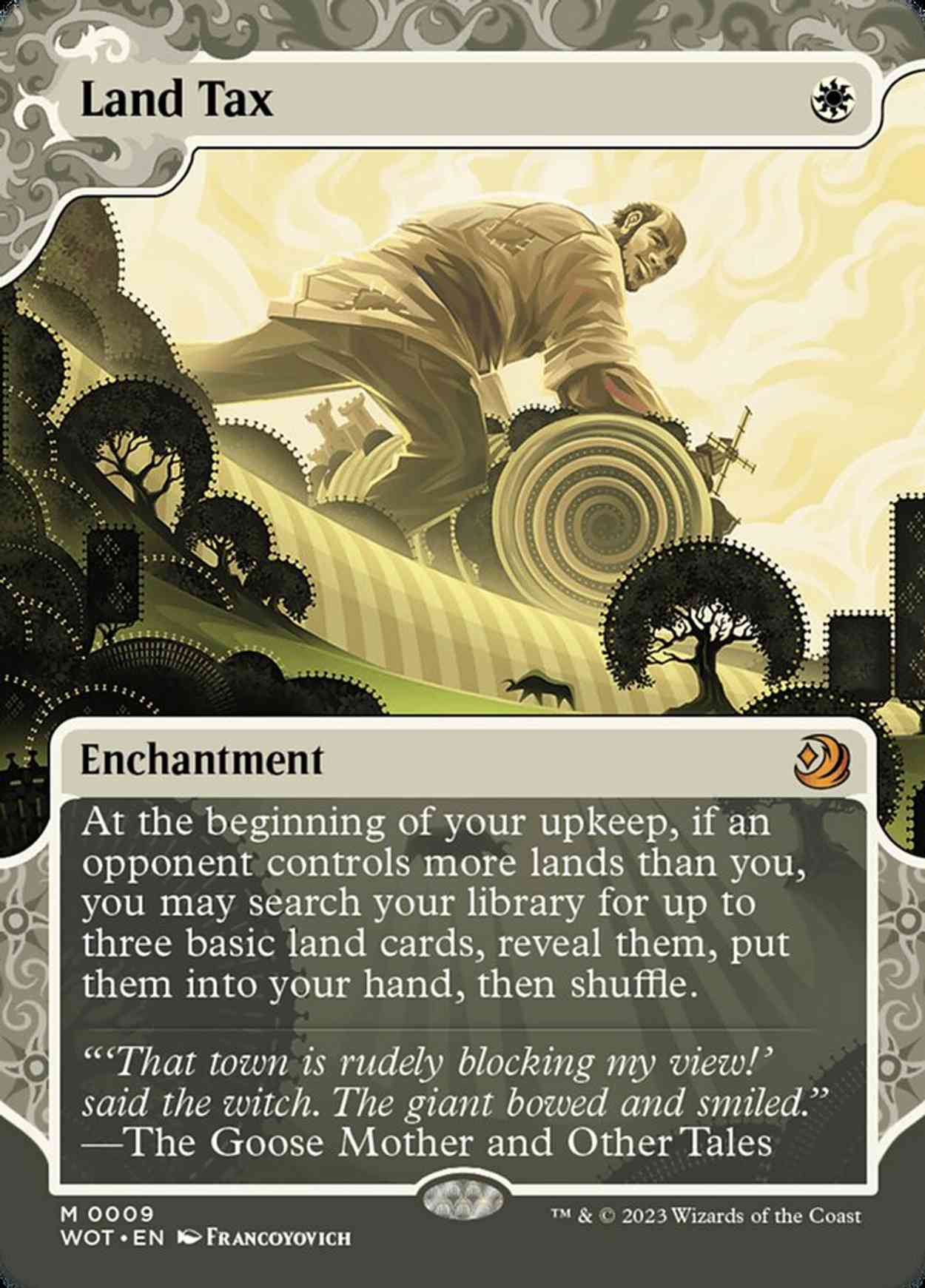

Land Tax Price From Mtg Wilds Of Eldraine Enchanting Tales

How Is Land Tax Calculated 2023 24 YouTube

How Is Land Tax Calculated 2023 24 YouTube

New Queensland Land Tax Rules Queensland Land Tax Rates To Be Based On

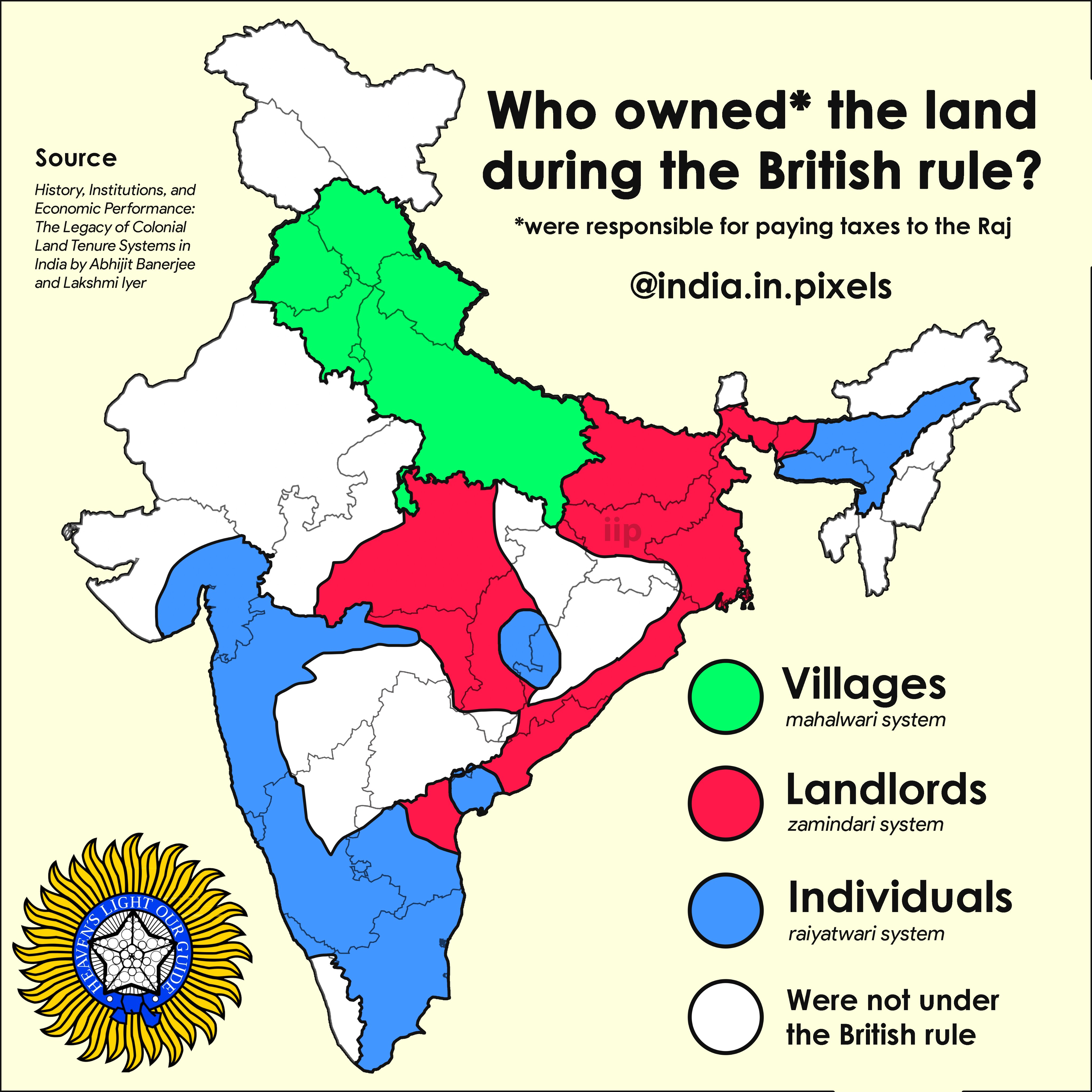

India In Pixels On Twitter Who Owned The Land During British Rule

Queensland New Property Land Tax Shelved

How Is Land Tax Calculated In Victoria - [desc-13]