How Much Is Mba In Unilag Many of the activities carried out by charities are considered to be outside the scope of Value Added Tax VAT Charities engaged exclusively in such activities are neither obliged nor

Not for Profit NFP organisations may have VAT obligations albeit that they may be considered tax exempt from a direct tax perspective As a result it is essential to manage Learn about the new VAT guidance for event admissions in Ireland including place of supply rules for physical virtual and hybrid events effective January 2025

How Much Is Mba In Unilag

How Much Is Mba In Unilag

https://i.ytimg.com/vi/hm2uAP0wC4w/maxresdefault.jpg

10 Very Good Reasons To Do An MBA YouTube

https://i.ytimg.com/vi/LJrPZL0LcWk/maxresdefault.jpg

What Is An MBA Why MBA MBA Degree YouTube

https://i.ytimg.com/vi/VBFUdy8PFfk/maxresdefault.jpg

On 27 June 2025 the Irish Revenue updated its guidance on the VAT treatment of admission to events distinguishing between physical virtual and hybrid formats Physical events are Charges for admission to such an event in Ireland will be liable to Irish VAT regardless of whether the person paying the admission is a taxable person or a non taxable person

An admission is the granting of a right of entry including granting access to an online event in return for a fee This fee may be payable in advance at the time of the event This VAT Compensation Scheme helps any charity to recover a portion of VAT that has been incurred on goods and goods and services acquired the preceding year The

More picture related to How Much Is Mba In Unilag

How To Do An MBA Project Work Very Easily MBA Final Year Project

https://i.ytimg.com/vi/wBvDAFTETVY/maxresdefault.jpg

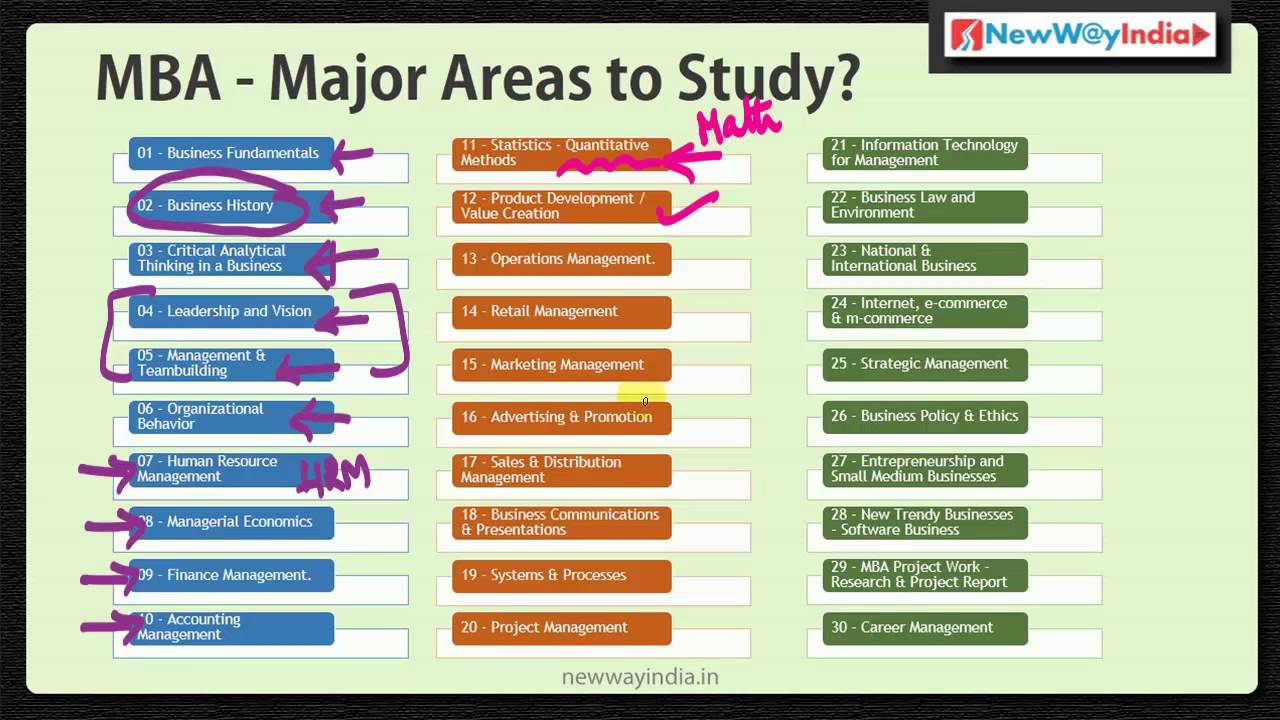

MBA Fundamentals 30 MBA Courses To Study Best MBA Beginner Lectures

https://i.ytimg.com/vi/CuDTPakkhKY/maxresdefault.jpg

UNILAG MBA 2018 2019 Part Time full Time executive

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=6711931218895978

This means that a charity is usually not able to reclaim the VAT it is charged which in turn reduces the funds available to it to carry out its charitable activities A common burden for charities in Ireland is the VAT they incur in the day to day running and managing of their charitable activities The VAT Compensation Scheme for

[desc-10] [desc-11]

Mba Essay

https://imgv2-1-f.scribdassets.com/img/document/113870395/original/bb90b5790b/1628658537?v=1

MBA In IT Emphasis Overseas Education Consultant Study Abroad

https://static.collegedekho.com/media/uploads/2020/10/22/top-10-mba-specializations-in-india.png

https://www.wheel.ie › sites › default › files › media › file...

Many of the activities carried out by charities are considered to be outside the scope of Value Added Tax VAT Charities engaged exclusively in such activities are neither obliged nor

https://www.grantthornton.ie › insights › factsheets › ...

Not for Profit NFP organisations may have VAT obligations albeit that they may be considered tax exempt from a direct tax perspective As a result it is essential to manage

MBA

Mba Essay

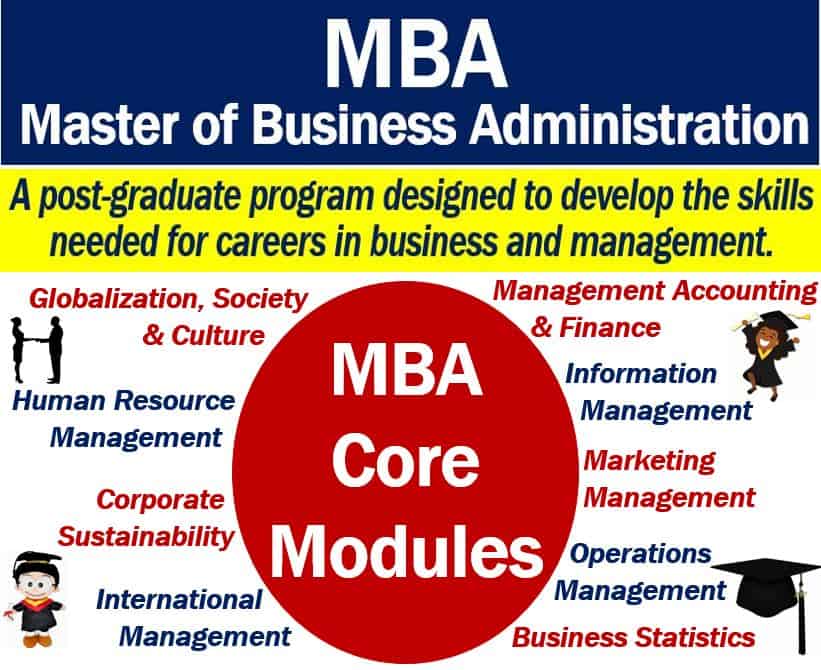

MBA Definition And Meaning Market Business News

Best Answer For Why MBA Why MBA Answer For Freshers Leverage Edu

UNILAG CITS IAF Professional Career Development In Digital Forensics

The Importance Of Studying An MBA

The Importance Of Studying An MBA

MPA Vs MBA What s The Difference

UNILAG Postpones Post UTME Test The Nation Newspaper

Kylian Mbappe Net Worth 2023 How Much Is The Soccer Star Worth

How Much Is Mba In Unilag - This VAT Compensation Scheme helps any charity to recover a portion of VAT that has been incurred on goods and goods and services acquired the preceding year The