How To Calculate Income Tax Expense Guide to what is Income Tax Expense We explain it with formula how to calculate differences with income tax payable example

Learn how to calculate income tax expense by understanding taxable income adjustments and deferred tax components for accurate financial reporting Understanding how Calculate the income tax expense and the business s net income earnings Income tax expense can be calculated as Earnings before taxes times an effective tax rate Income tax expense

How To Calculate Income Tax Expense

How To Calculate Income Tax Expense

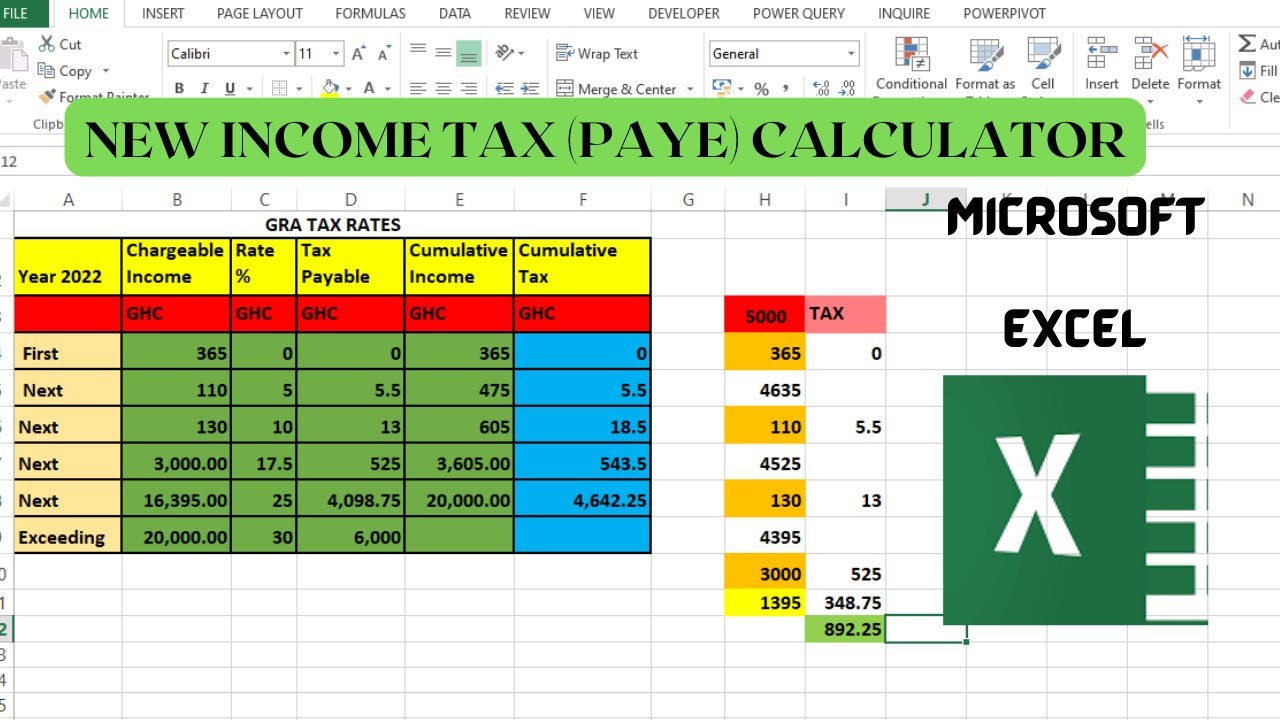

https://i.ytimg.com/vi/GLkVUljDNDU/maxresdefault.jpg

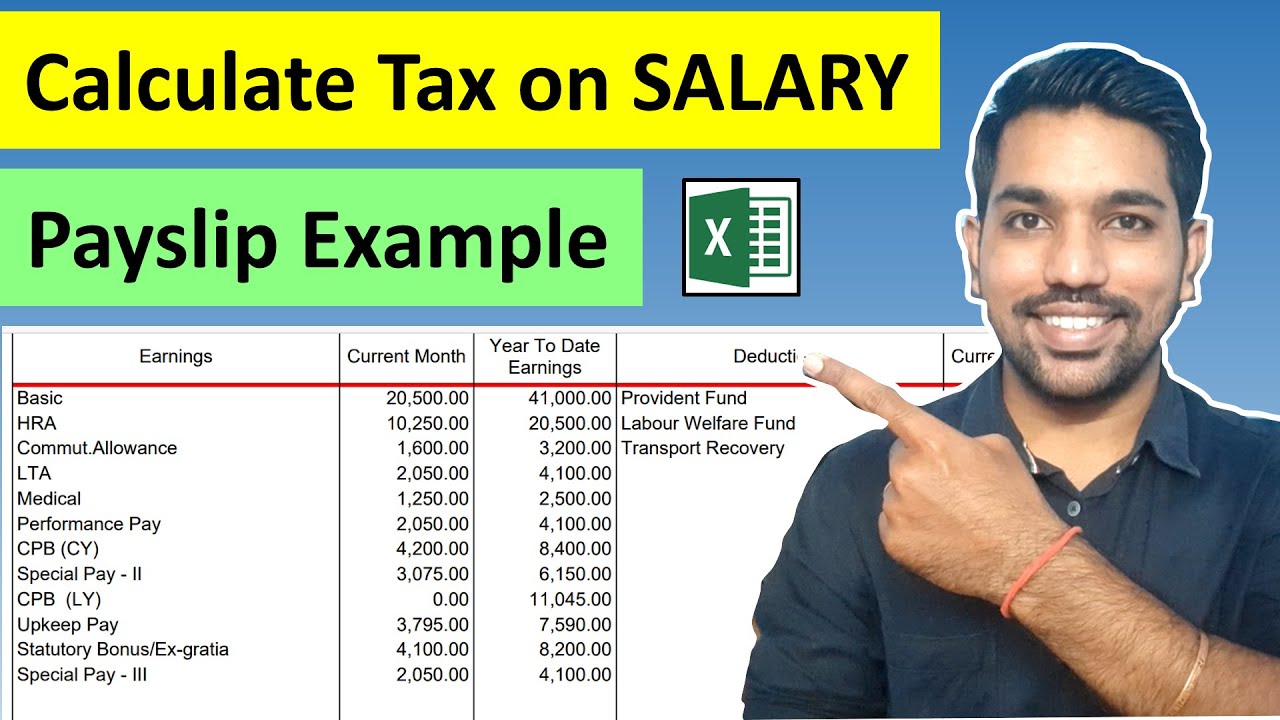

How To Calculate Income Tax On Salary With Payslip Example Income Tax

https://i.ytimg.com/vi/USW68EaURfg/maxresdefault.jpg

Taxable Income Formula Calculator Examples With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-Formula.jpg

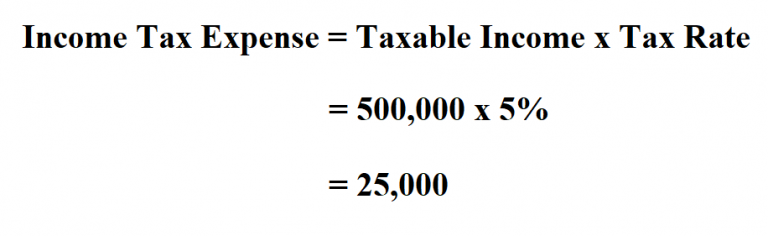

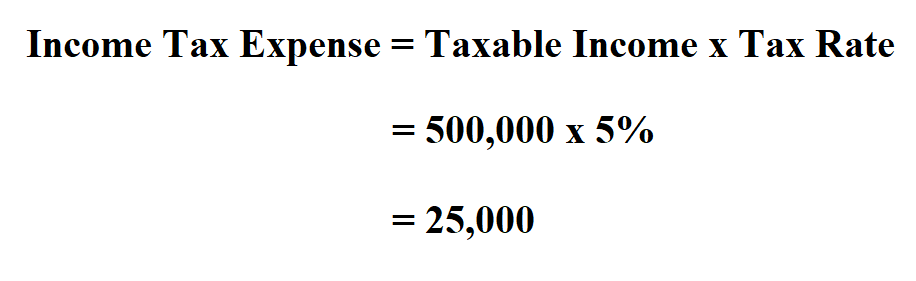

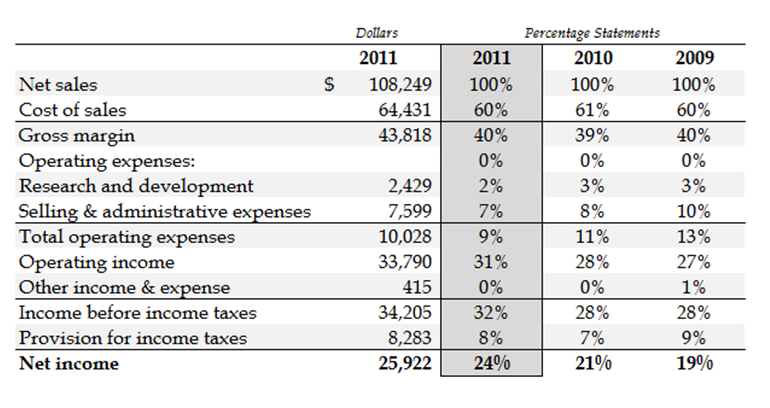

Tax expenses are the total amount of taxes owed by an individual corporation or other entity to a taxing authority Income tax expense is calculated by multiplying taxable By understanding the basics of income tax expense accounting including taxable income tax rates and the calculation process businesses and individuals can accurately

The formula for calculating tax expense typically involves determining the taxable income and applying the appropriate tax rate Here s the basic formula Tax Expense Taxable Income How to Calculate Income Tax Expense It is calculated based on the applicable corporate tax rate and taxable income which may differ from accounting profit due to

More picture related to How To Calculate Income Tax Expense

How To Calculate Income Tax Expense

https://www.learntocalculate.com/wp-content/uploads/2020/08/income-tax-expense-2-768x236.png

How To Calculate Income Tax Expense

https://www.learntocalculate.com/wp-content/uploads/2020/08/income-tax-expense-2.png

INCOME TAX CALCULATOR 2023 24

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh8ZbDvdbYnppQ86RNtZEC3FjH-jfVCSV3XpPZNo258wYVsTiE4tiC33pZEWnzFTDp4-83CDswTYg8p8iy8-me4xkU0dMDv-NuD8pnWQKBgZElap9Gy4TzlAktNxUUvC8tNjQ41CGJ9SdOi1tTS1aWyW3V8z7LAHZ87nlU8lTrczRsCPnk_URdyGEhHSD4P/s1488/Calculate-Income-Tax-in-Excel-1.png

Understanding how to calculate income tax expenses can help you manage your finances In this article we explain what income tax expenses are discuss how to calculate Steps to Calculate Income Tax Expense Start with pretax financial income from the income statement Adjust for permanent differences nontaxable nondeductible items and temporary

[desc-10] [desc-11]

Income Tax Calculator 2024 25 Excel Gayel Florella

https://cdn.educba.com/academy/wp-content/uploads/2019/08/Calculate-Income-Tax-in-Excel-1-1024x640.png

Income Tax Calculator 2025 India Zachary Flynn

https://i.ytimg.com/vi/_bM1Y6-JXl4/maxresdefault.jpg

https://www.wallstreetmojo.com › income-tax-expense

Guide to what is Income Tax Expense We explain it with formula how to calculate differences with income tax payable example

https://accountinginsights.org › what-is-the-formula...

Learn how to calculate income tax expense by understanding taxable income adjustments and deferred tax components for accurate financial reporting Understanding how

Average Tax Rate Calculator AsmaManalyaa

Income Tax Calculator 2024 25 Excel Gayel Florella

Excel Tax Calculator Australia 2025 Martha C Martin

Understanding And Interpreting Percentage Statements

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Marge Brute B n fice D exploitation Et Revenu Net

Deferred Income Tax Liabilities Explained with Real Life Example In A

Deferred Income Tax Liabilities Explained with Real Life Example In A

Voxt

How Effective Tax Rate Is Calculated From Income Statements

[img_title-16]

How To Calculate Income Tax Expense - How to Calculate Income Tax Expense It is calculated based on the applicable corporate tax rate and taxable income which may differ from accounting profit due to