How To Calculate Income Tax On Salary With Example In Excel Fy 2020 21 This article shows step by step procedures to calculate income tax in excel using IF function Learn them download workbook and practice

In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example We will also see when your salary increases due to annual increments bonuses or job switch how you can easily calculate your TDS on Learn how to calculate income tax in Excel using formulas Step by step guide covers tax slabs calculations and simplifying tax computation with examples

How To Calculate Income Tax On Salary With Example In Excel Fy 2020 21

How To Calculate Income Tax On Salary With Example In Excel Fy 2020 21

https://fincalc-blog.in/wp-content/uploads/2022/01/calculate-tax-on-salary-payslip-example-video.webp

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-15-1-1024x538.png

How To Calculate Income Tax On Salary A Guide

https://www.wintwealth.com/blog/wp-content/uploads/2022/11/How-to-Calculate-Income-Tax-on-Salary-With-Example.jpg

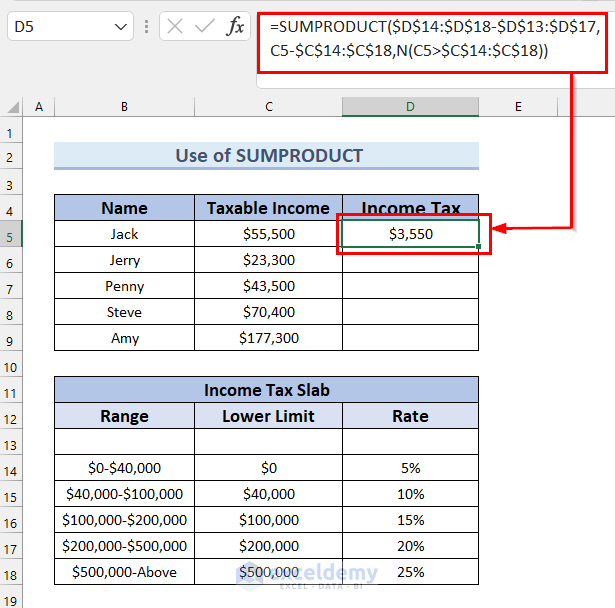

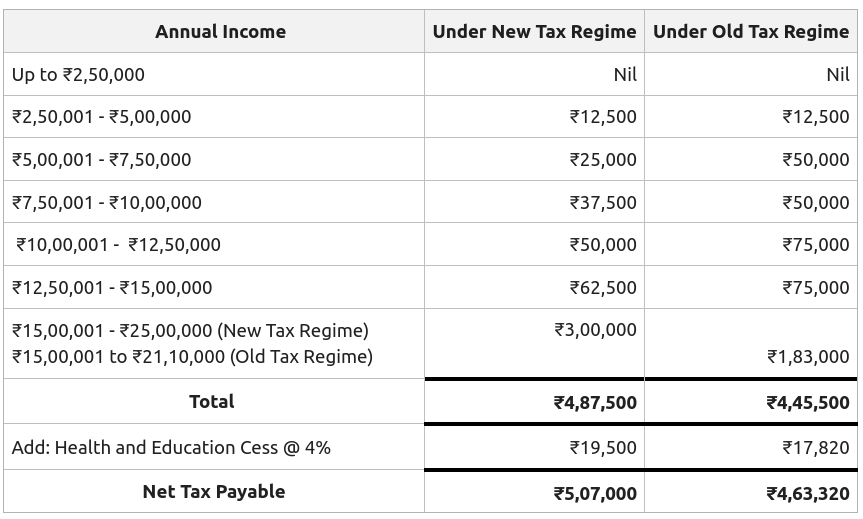

When it comes to calculating income tax in Excel IF formulas can be a powerful tool They allow you to set conditions and perform calculations based on those conditions making it easy to determine the amount of tax owed based on income deductions and exemptions Download Income Tax Calculator FY 2020 21 AY 2021 22 in Excel Format This calculator is designed to work with both old and new tax slab rates released in the budget 2020 You can calculate your tax liabilities as per old and new tax slab

Write the formula B2 B3 B4 inside the formula bar and press the Enter key Step 4 Taxable income is now extracted from gross income which is 2 19 000 Taxable income is on which we apply the tax Tax is 5 on income below 2 50 000 As the taxable value is between 1 5 to 2 5 lakhs so that 5 will apply to income Simple Income Tax Calculator for the Financial Year 2020 21 in Excel for Salaried Individuals Tax Planning in the beginning of the Financial Year is always better instead of doing that at the end of the year in hurry

More picture related to How To Calculate Income Tax On Salary With Example In Excel Fy 2020 21

How To Calculate Income Tax On Salary With Example In Excel FinCalC Blog

https://i.ytimg.com/vi/USW68EaURfg/maxresdefault.jpg

How To Calculate Income Tax On Salary With Example In Excel

https://www.exceldemy.com/wp-content/uploads/2022/06/29.-How-to-Calculate-Income-Tax-on-Salary-With-Example-in-Excel.png

Income Tax Calculator Fy 2023 24 Excel Sheet Free Download 2023

https://fincalc-blog.in/wp-content/uploads/2023/02/how-to-calculate-income-tax-2023-24-excel-income-tax-calculation-examples-video-1024x576.webp

Download Auto Income Tax Calculator with Form 16 and salary Statement 3in 1 for A Y 2020 21 in Excel format The following formula is used to calculate income taxes Gross Salary Deductions Taxable Income Income Tax Taxable Income x Applicable Tax Rate Tax Rebate What is the maximum non taxable income limit

Taxpayers fall into specific income categories and the tax rates applied to their income vary accordingly Excel can be a powerful tool for simplifying these calculations allowing individuals to determine their tax liabilities accurately Use IF function to calculate tax in Excel Input tax rate and income amount Write IF formula to apply tax rate Test formula with different income amounts Save time and reduce errors with IF function

How To Calculate Income Tax On Salary With Example

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

Income Tax Calculator 2024 25 Excel Free Download Jaimie Aridatha

https://cdn.educba.com/academy/wp-content/uploads/2019/08/Calculate-Income-Tax-in-Excel-1-1024x640.png

https://www.exceldemy.com › calculate-income-tax-in...

This article shows step by step procedures to calculate income tax in excel using IF function Learn them download workbook and practice

https://fincalc-blog.in › tds-on-salary-calculation...

In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example We will also see when your salary increases due to annual increments bonuses or job switch how you can easily calculate your TDS on

How To Calculate Tax On Salary Sale Online Www pennygilley

How To Calculate Income Tax On Salary With Example

How To Calculate Income Tax On Salary with Example GeeksforGeeks

Income Tax Calculator FY 2023 24 Excel DOWNLOAD FinCalC Blog

Tax Calculator 2024 25 Excel Sheet Melba Simonne

Calculating Tax Basis For Partnership

Calculating Tax Basis For Partnership

How To Calculate Income Tax On Salary with Example GeeksforGeeks

Income Tax Calculator 2024 25 Excel Silva Dulcinea

How To Calculate Income Tax On Salary with Example Cyberdime io

How To Calculate Income Tax On Salary With Example In Excel Fy 2020 21 - Write the formula B2 B3 B4 inside the formula bar and press the Enter key Step 4 Taxable income is now extracted from gross income which is 2 19 000 Taxable income is on which we apply the tax Tax is 5 on income below 2 50 000 As the taxable value is between 1 5 to 2 5 lakhs so that 5 will apply to income