How To Get Form 16b Without Tan I m a chartered accountant practising in the field of taxation and financial consultancy i am also a corporate financial advisor corporate speaker corpo

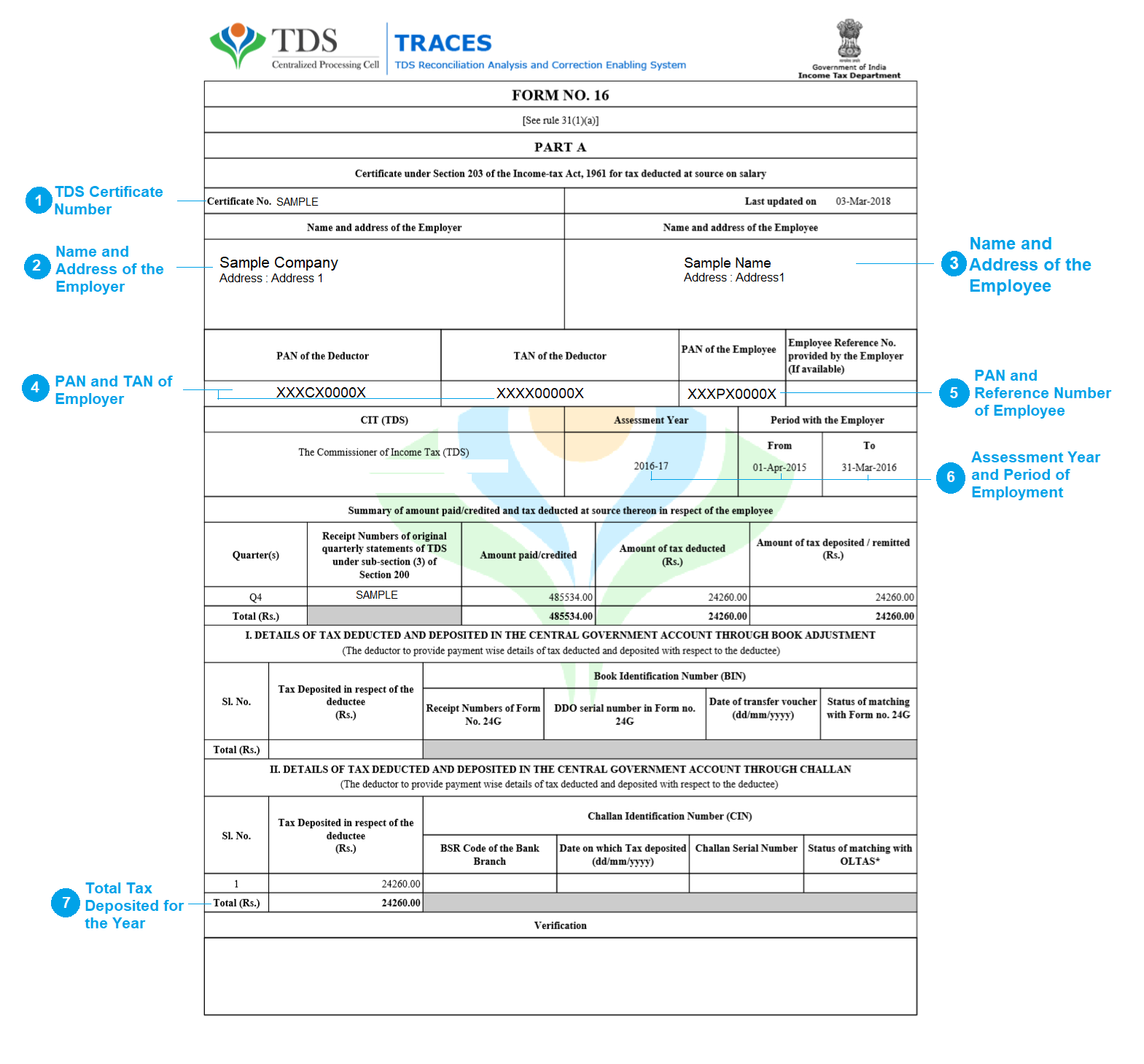

Form 16B Traces facilitates the buyer of immovable property to download Form 16B after registering on TRACES as taxpayer The buyer of the property would be required to issue How to Generate and Download Form 16B The steps to generate and download Form 16B are as follows Open the Traces online portal and register If already registered log

How To Get Form 16b Without Tan

How To Get Form 16b Without Tan

https://www.dialabank.com/wp-content/uploads/2021/03/employertooltip.jpg

How To Download TDS Certificate From Traces How To Download Form 16B

https://i.ytimg.com/vi/Z08ulqmIHuI/maxresdefault.jpg

How To Download Form 16B From Trace Site Form 26QB Download Online

https://i.ytimg.com/vi/bUuC6uCRJUo/maxresdefault.jpg

However as an exception due to genuine hardship faced by the taxpayers deductors under section 194 IA can file their TDS returns without a TAN the deductor needs to file a return cum challan Form 26QB Answer is deductor can download such certificate from Traces website and issue to the seller Buyer of immovable property can download Form 16B after registering on

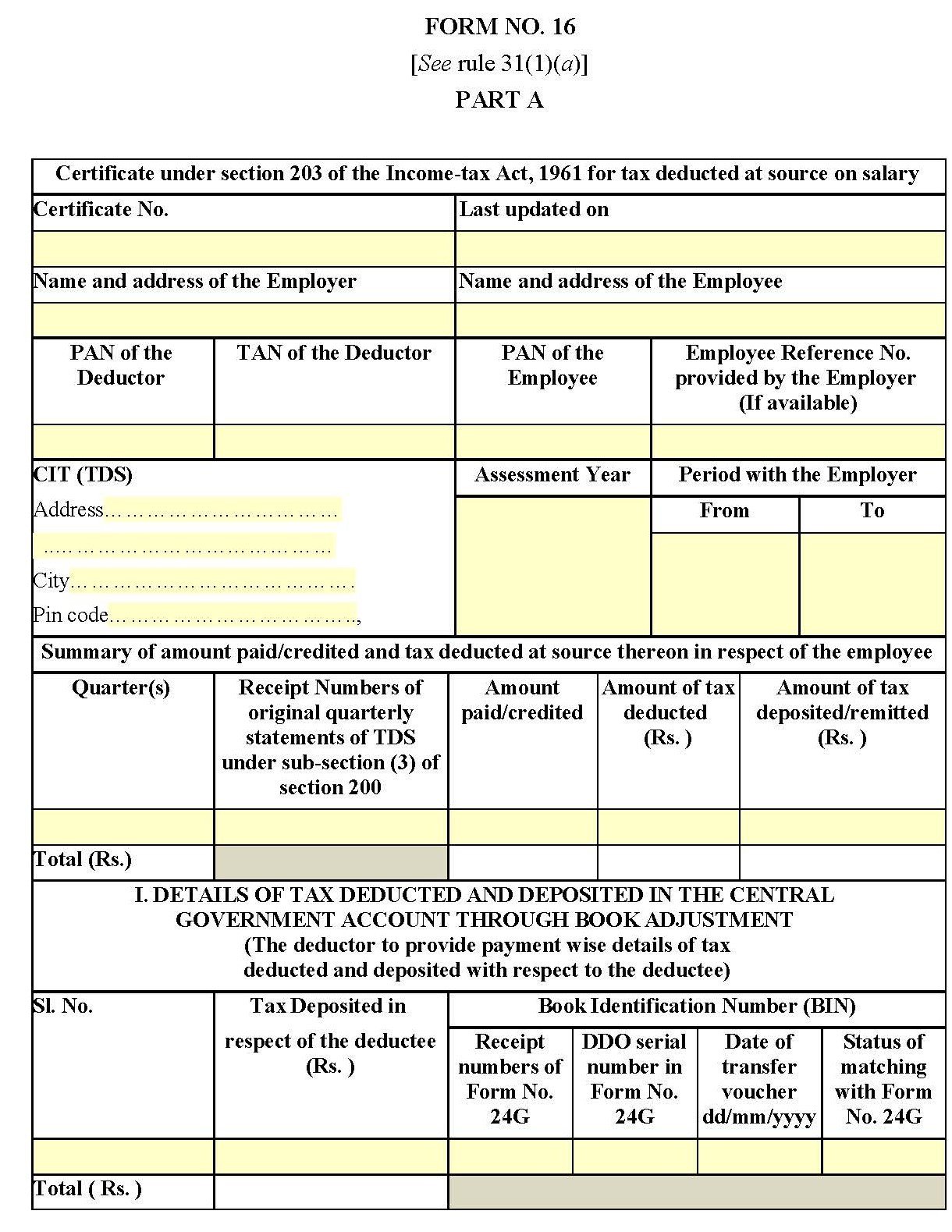

Form 16B is a TDS Certificate issued by a Buyer Taxpayer to Seller Deductee on purchase of property under Sec 194IA which taxpayers can download from the TRACES portal It contains details of payment on the sale Steps to Download Form 16B Register login on TRACES portal www tdscpc gov in as taxpayer using your PAN Select Form 16B For Buyer under Downloads menu

More picture related to How To Get Form 16b Without Tan

How To Download Form 16B TDS On Property TDS On Sale Of Property

https://i.ytimg.com/vi/uCwmGGi8mb0/maxresdefault.jpg

Form 16B TDS Certificate For Sale Of Property I Download Form 16B For

https://i.ytimg.com/vi/UWAXMVPxQCc/maxresdefault.jpg

Download Form 16B TDS On Sale Of Property YouTube

https://i.ytimg.com/vi/wtL5dFEkt0g/maxresdefault.jpg

Form 16B is the certificate issued for TDS deducted on the sale of a property excluding agricultural property Form 16B TDS can be easily downloaded from the TRACES TDS Reconciliation and Analysis and Article explains How to Download Form 16B from TRACES Website Form 16B is a TDS Certificate which reflects that the amount deducted as TDS on Property by the Buyer has been deposited with the Income Tax

Get all information about form 16B with an easy guide to download the TDS certificate on the TRACES Also get to know due dates instalments transactions etc Powerd In this blog we will guide you through the process of downloading Form 16B from the TRACES TDS Reconciliation Analysis and Correction Enabling System portal ensuring a

How Can I Download Form 16B For TDS Form 16B TDS Certificate For

https://i.ytimg.com/vi/PUnX561u-f0/maxresdefault.jpg

How To Download Tds Certificate FORM 16 16A 16B 16C How To Check

https://i.ytimg.com/vi/vVlz-cMAQEQ/maxresdefault.jpg

https://www.youtube.com › watch

I m a chartered accountant practising in the field of taxation and financial consultancy i am also a corporate financial advisor corporate speaker corpo

https://incometaxindia.gov.in › Pages › tax-services

Form 16B Traces facilitates the buyer of immovable property to download Form 16B after registering on TRACES as taxpayer The buyer of the property would be required to issue

Pimple Above Lip Swollen Infoupdate

How Can I Download Form 16B For TDS Form 16B TDS Certificate For

Form 16B TDS Certificate For Sale Of Property II How Can I Download

How To Download TDS Certificate Form 16B In Case Of TDS On Purchase Of

:max_bytes(150000):strip_icc()/woman-forehead-acne-82cc24484a3045fba804bced493aba73.png)

Why Do I Have Pimples Around My Hairline Infoupdate

Affidavit DriverLayer Search Engine

Affidavit DriverLayer Search Engine

Understanding Your Form 16A

Difference Between Form 16 And Form 16A Free Tax Filer Blog

Ctc For Taxes Filed In 2024 Nessy Adelaida

How To Get Form 16b Without Tan - However as an exception due to genuine hardship faced by the taxpayers deductors under section 194 IA can file their TDS returns without a TAN the deductor needs to file a return cum challan Form 26QB