Income Limit For Medicare Part B Premium Contact information for the Canada Revenue Agency CRA phone numbers mailing addresses

Canada Revenue Agency forms listed by number You may be looking for T1 income tax package forms and schedules If you receive federal benefits including some provincial territorial benefits you will receive payment on these dates If you set up direct deposit payments will be deposited in your

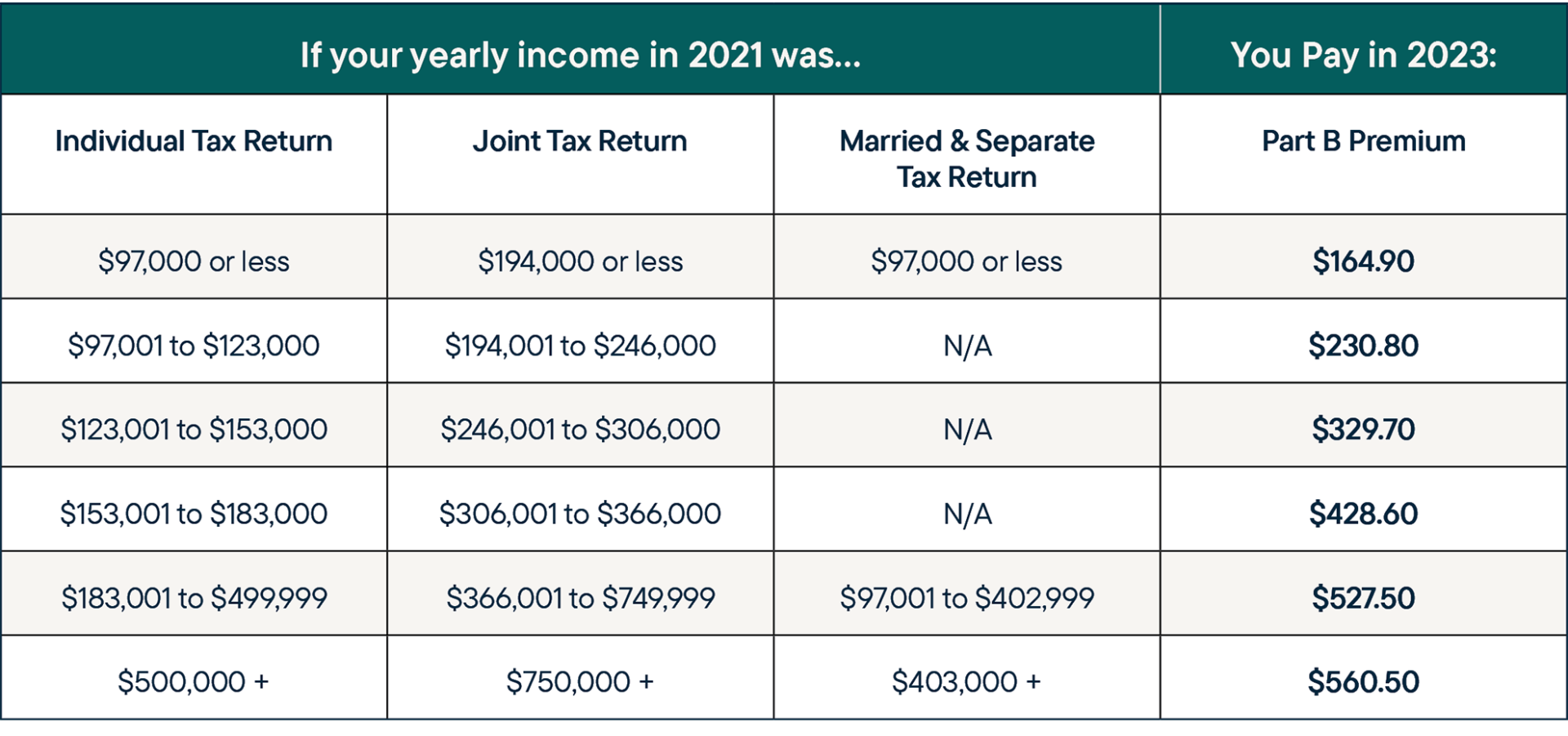

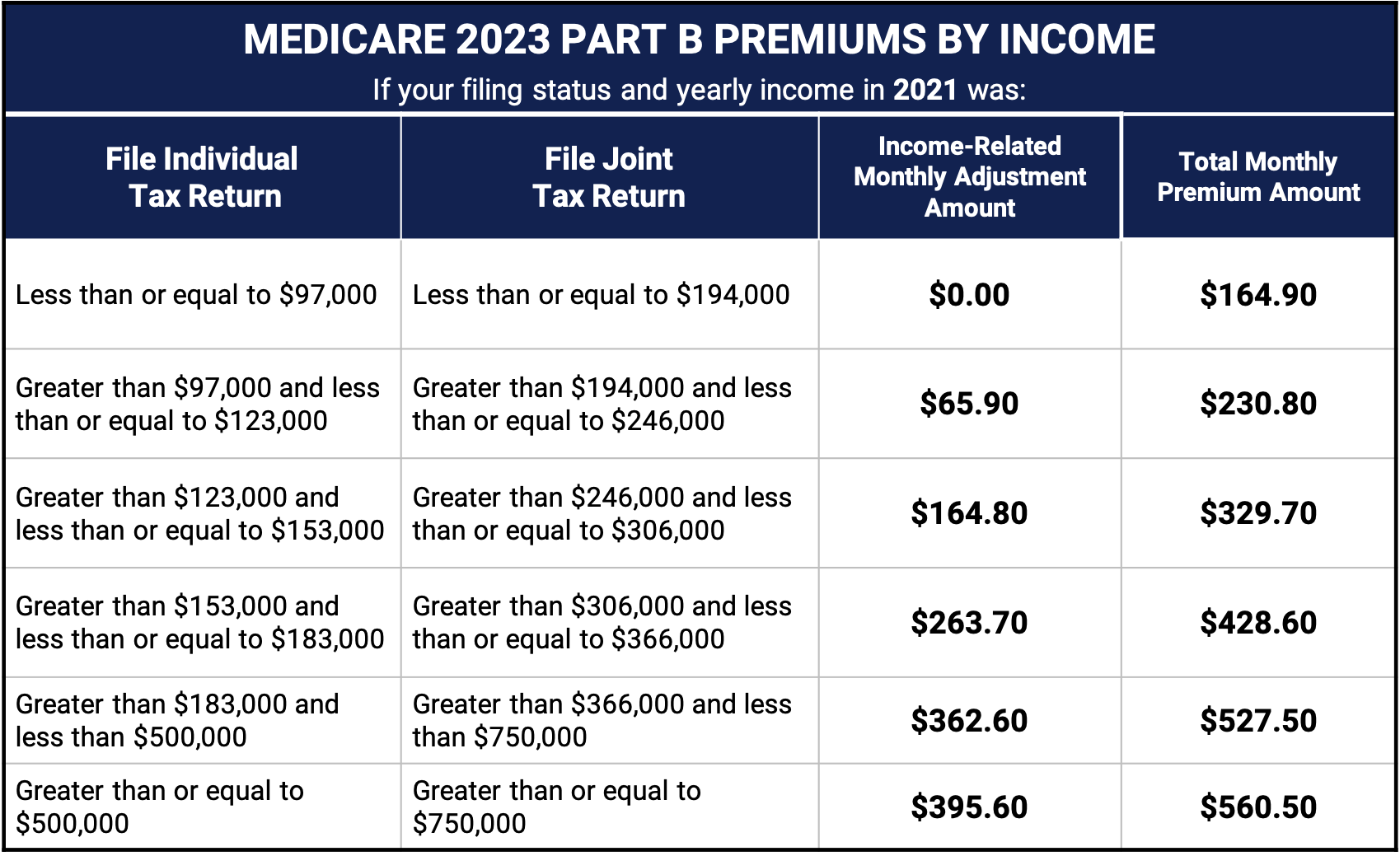

Income Limit For Medicare Part B Premium

Income Limit For Medicare Part B Premium

https://www.retiremed.com/sites/default/files/2022-12/Part B IRMAA Chart_Cerkl.png

Medicare Income Limits 2024 California Emma Norina

https://medicarehero.com/wp-content/uploads/2022/09/2023-Medicare-Part-B-Premium-Chart.png

2024 Irmaa Brackets Part D Manon Angeline

https://meg-bee-page.s3.amazonaws.com/images/RADIUS_LIVE_3370/2022 Part D IRMAA Chart jpg.jpg

Scroll down to read the publication T4130 Employers Guide Taxable Benefits and Allowances Unless otherwise stated all legislative references are to the Income Tax Act or where What are your responsibilities As the Canadian payer or withholding agent you are responsible for withholding and remitting Part XIII tax and for reporting the income and withholding tax on

General information for corporations on how to complete page 3 of the T2 Corporation Income Tax Return Any income in respect of a property net of applicable expenses must be reported for tax purposes While your election is in effect you can designate the property as your principal

More picture related to Income Limit For Medicare Part B Premium

Medicare Premiums Based On Income 2024 Irmaa Taxable Gipsy Kaitlin

https://gmedicareteam.com/wp-content/uploads/2020/12/2021-Part-B-IRMAA-Chart.png

[img_title-5]

[img-5]

[img_title-6]

[img-6]

However certain types of income such as pension income are not subject to CPP contributions and EI premiums As a result you will have to adjust the amount of federal and Note The Guaranteed Income Supplement and Allowance amounts don t increase when you delay receiving Old Age Security pension payments You cannot receive the Guaranteed

[desc-10] [desc-11]

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://www.canada.ca › en › revenue-agency › corporate › contact-infor…

Contact information for the Canada Revenue Agency CRA phone numbers mailing addresses

https://www.canada.ca › en › revenue-agency › services › forms-publicat…

Canada Revenue Agency forms listed by number You may be looking for T1 income tax package forms and schedules

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Income Limit For Medicare Part B Premium - General information for corporations on how to complete page 3 of the T2 Corporation Income Tax Return