Income Tax Calculated On Which Income Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by Review all types of income you need to report on your income tax and benefit return

Income Tax Calculated On Which Income

Income Tax Calculated On Which Income

https://i.ytimg.com/vi/YHq0mPLzdGc/maxresdefault.jpg

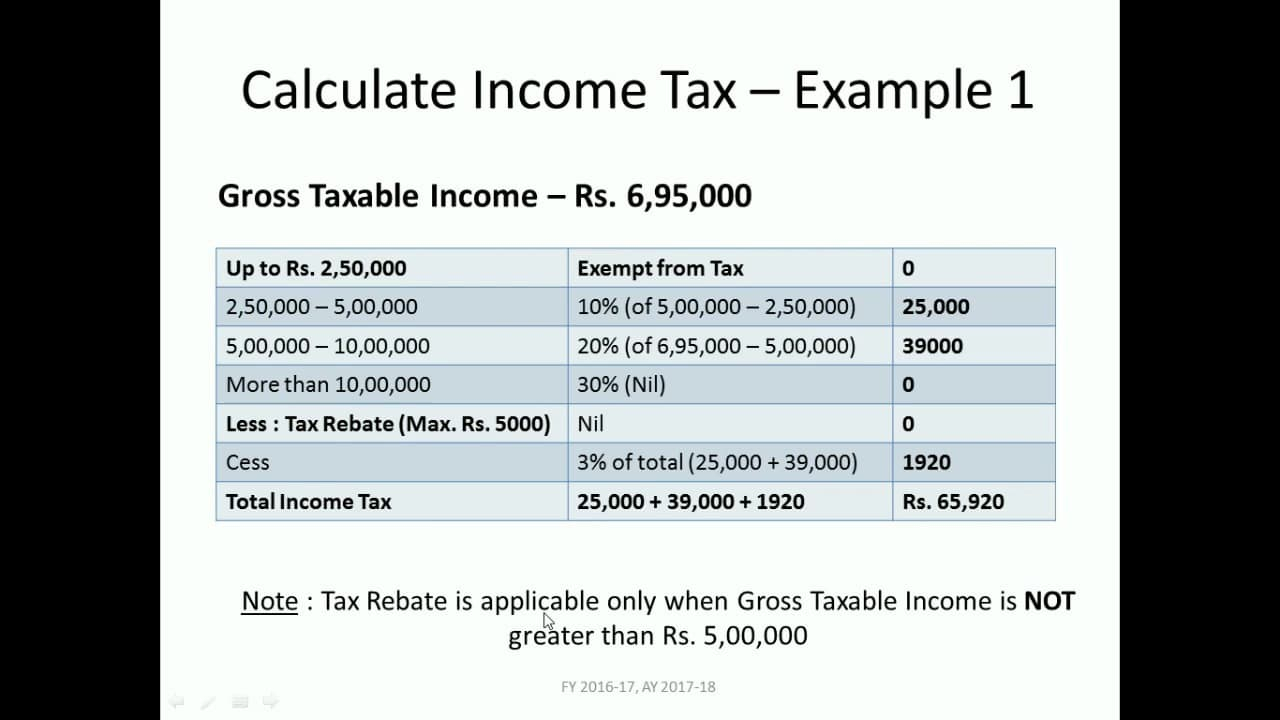

How To Calculate Income Tax FY 2020 21 EXAMPLES New Income Tax

https://i.ytimg.com/vi/oAXCPUn3sfk/maxresdefault.jpg

How Income Tax Calculated On Unrealized Realized Profit Loss YouTube

https://i.ytimg.com/vi/UqYlfyOwhfk/maxresdefault.jpg

Canada Disability Benefit The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income As an employee you complete this form if you have a new employer or payer and will receive salary wages or any other remuneration or if you wish to increase the amount of

More picture related to Income Tax Calculated On Which Income

How To Calculate Income Tax On Salary EXAMPLE NEW Income Tax

https://i.ytimg.com/vi/AN0z7TiH0ec/maxresdefault.jpg

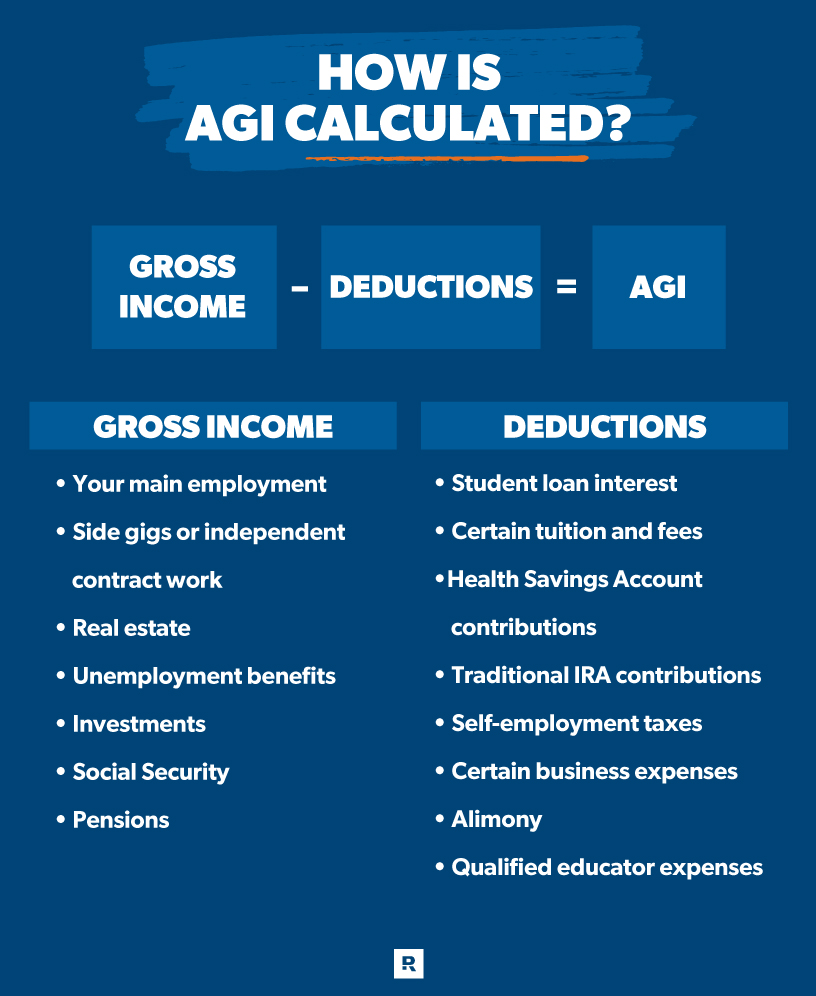

What Is Adjusted Gross Income AGI Does My Snapshot On Tax Act Have The

https://cdn.ramseysolutions.net/media/blog/taxes/personal-taxes/how-is-agi-calculated.jpg

Calculate Your Tax Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/how-to-calculate-income-tax-formula.jpg

You can get an income tax package online or by mail Certain tax situations may require a specific return or form For tax filing information go to Get ready to do your taxes If Find options to make a payment for your personal income taxes business taxes or some government programs

[desc-10] [desc-11]

Tax Rates 2025 Matthew T Jones

https://workingholidayincanada.com/wp-content/uploads/2020/02/Federal-rates-min.jpg

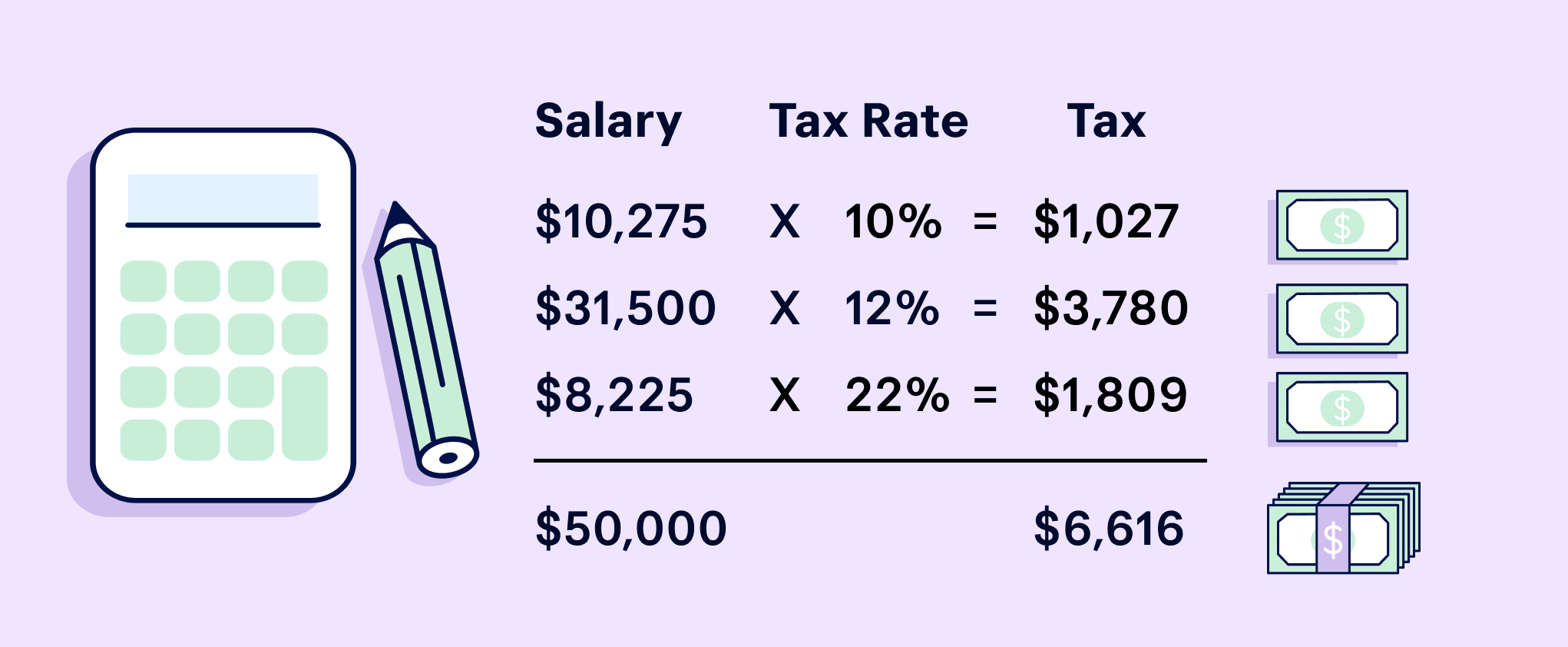

How To Calculate Tax On Income Hotsell Cityofclovis

https://media.geeksforgeeks.org/wp-content/uploads/20221216182245/Income-Tax-on-Salary-3.png

https://www.canada.ca › en › department-finance › news › delivering-a-…

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

https://www.canada.ca › en › revenue-agency › news › tax-season-start…

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by

2025 Income Tax Calculator Abby F Jenkins

Tax Rates 2025 Matthew T Jones

:max_bytes(150000):strip_icc()/effectivetaxrate_final-cf3facabd80c4116bbf5923934956c34.png)

Income Tax Rates 2021 22 Calculator Infoupdate

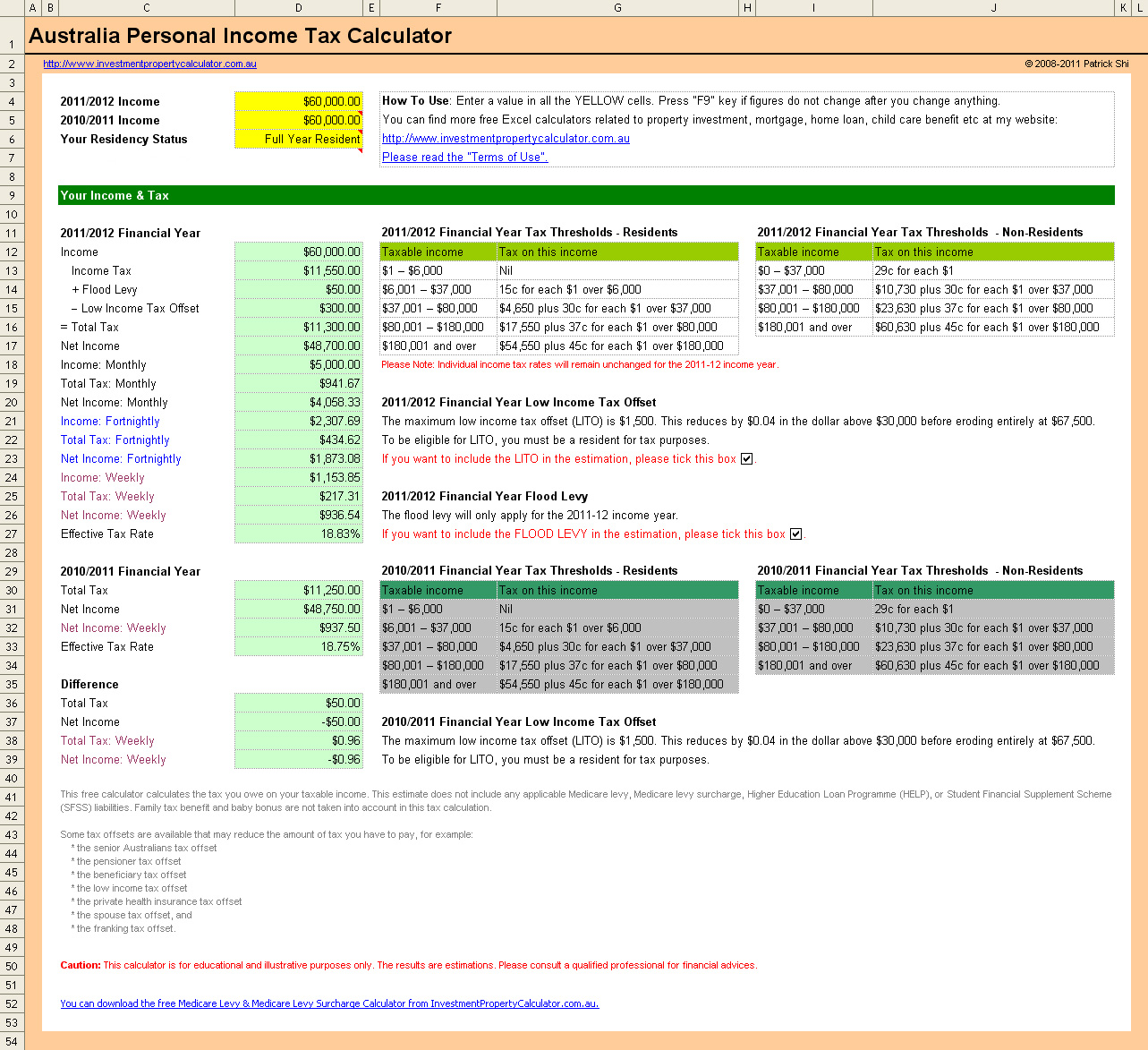

Tax Calculator Australia 2025 25 Nansen R Frandsen

Tax Refund Chart 2025 Usa Trine M Knudsen

Tax Brackets 2025 Uk Dylan Parrott

Tax Brackets 2025 Uk Dylan Parrott

Estimate My Tax Return 2025 In Oliver S Madsen

Tax Brackets 2025 Canada Cra Bent A Juhl

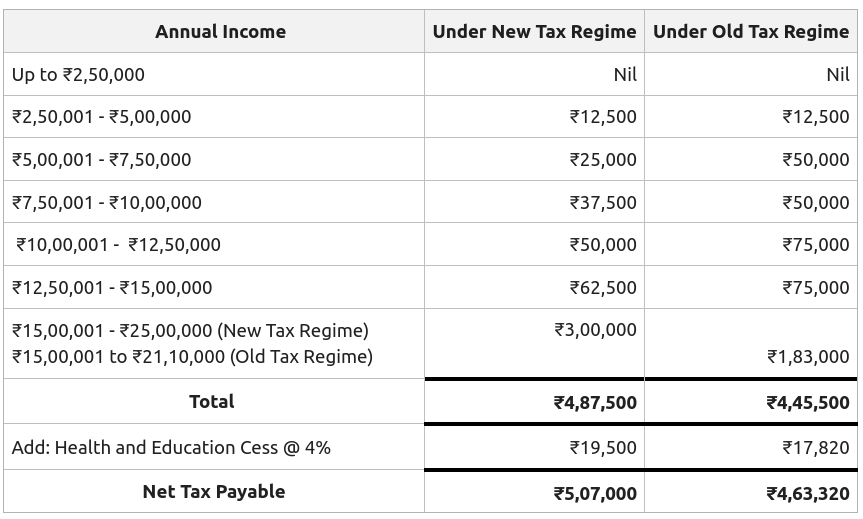

Tax Calculator 2025 25 New Regime India Caleb V Zepps

Income Tax Calculated On Which Income - Canada Disability Benefit The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is