Income Tax Exemption For Salaried Employees The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full year tax rate for 2025 will be 14 5 per cent and the full Filing through a tax preparer If you don t do your taxes on your own an EFILE certified tax preparer like an accountant can file your income tax and benefit return for you Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper

Income Tax Exemption For Salaried Employees

Income Tax Exemption For Salaried Employees

https://i.ytimg.com/vi/SLd0vB7YtTA/maxresdefault.jpg

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

https://i.ytimg.com/vi/dP3caU0XDlc/maxresdefault.jpg

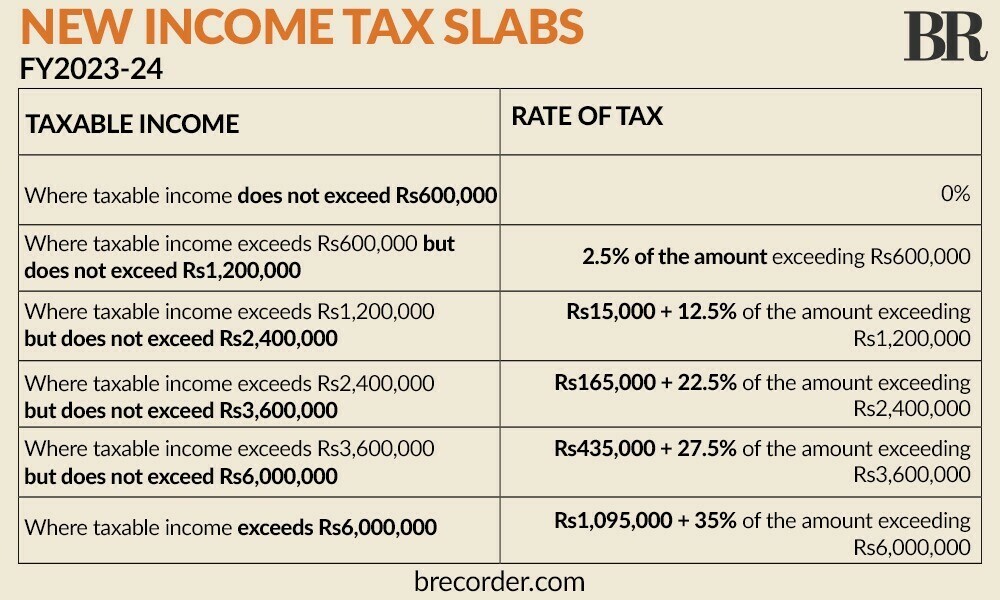

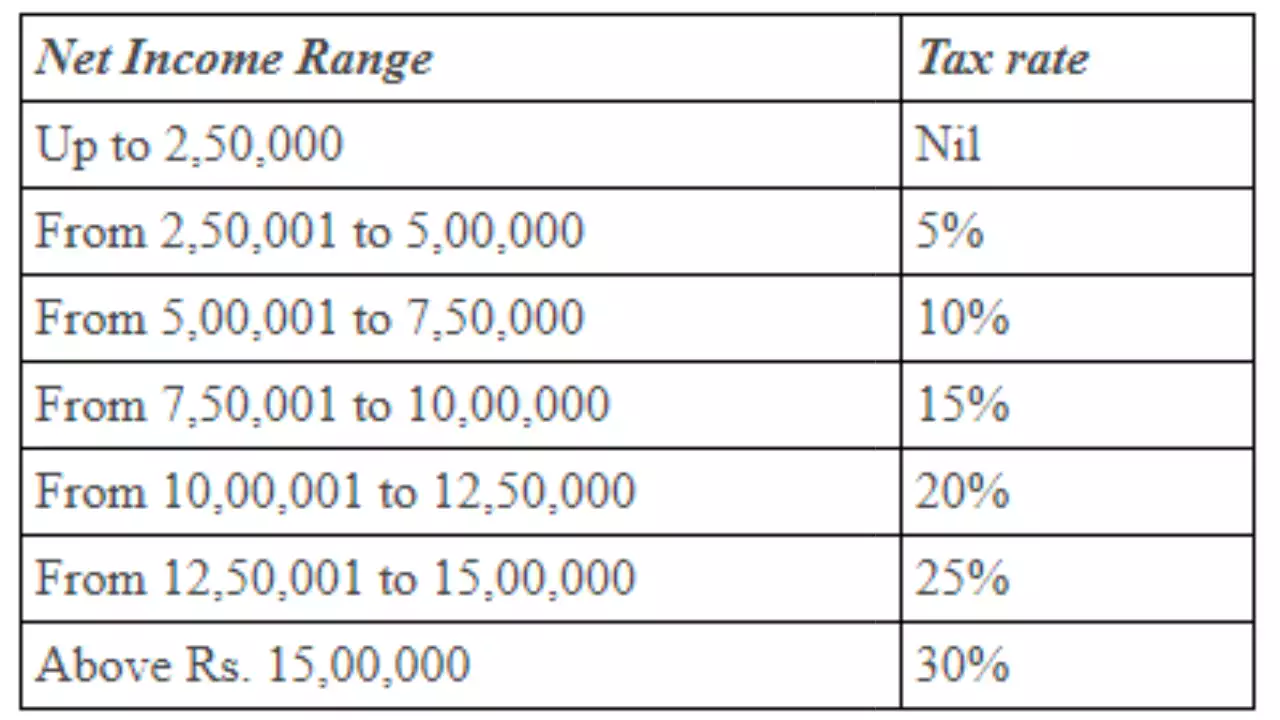

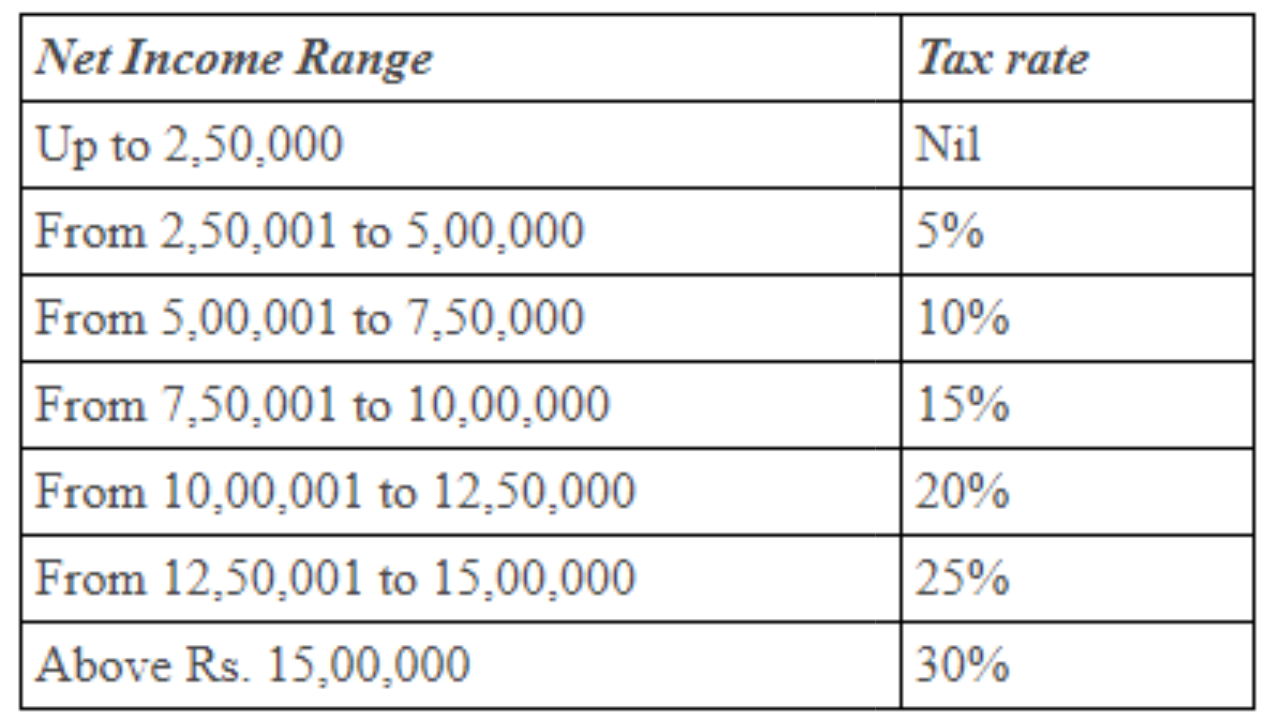

Income Tax Slab 2023 24 Income Tax Calculation In Paksitan Tax Slab

https://i.ytimg.com/vi/MlFOZ1aCtrc/maxresdefault.jpg

Income tax Personal business corporation trust international and non resident income tax NETFILE service in tax software that allows most people to submit a personal income tax return electronically to the Canada Revenue Agency

Your income It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year 90 997 for 2024 Increased Old Age Security pension at age 75 In July 2022 the Old Age Security pension was permanently increased by 10 for seniors aged 75 and over Change in individual income tax rate The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government tables a Motion to bring down costs for Canadians The Payroll Deduction Online Calculator PDOC has been revised to reflect this change

More picture related to Income Tax Exemption For Salaried Employees

Understanding Income Tax Exemption

http://www.luxswissrw.co.uk/wp-content/uploads/2024/11/1725683660726.jpg

Budget 2023 24 high Earners To Pay A Higher Income Tax As Govt

https://i.brecorder.com/primary/2023/06/261441140911e3a.jpg

Farm Tax Deductions 2025 Steve A Johnson

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

How to make a full or partial payment to the CRA online by mail or in person Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services

[desc-10] [desc-11]

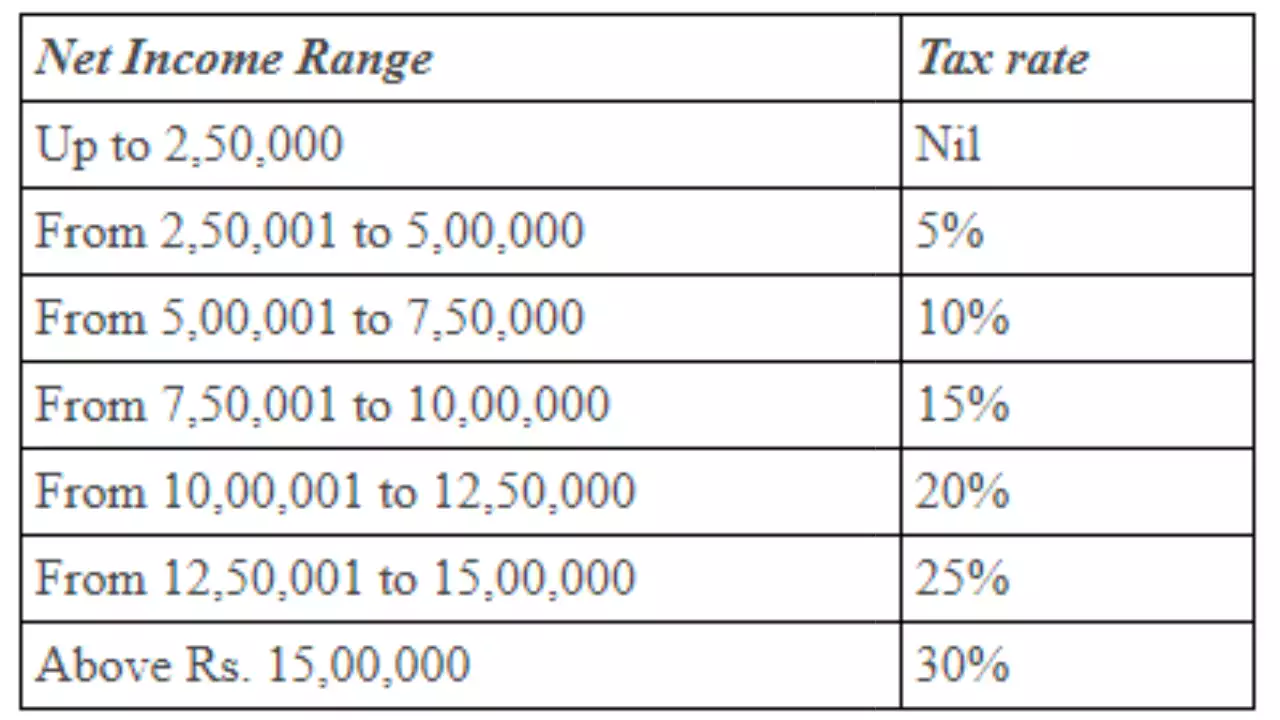

2024 Tax Slab India Gelya Juliann

https://static.tnn.in/photo/msid-107317246/107317246.jpg

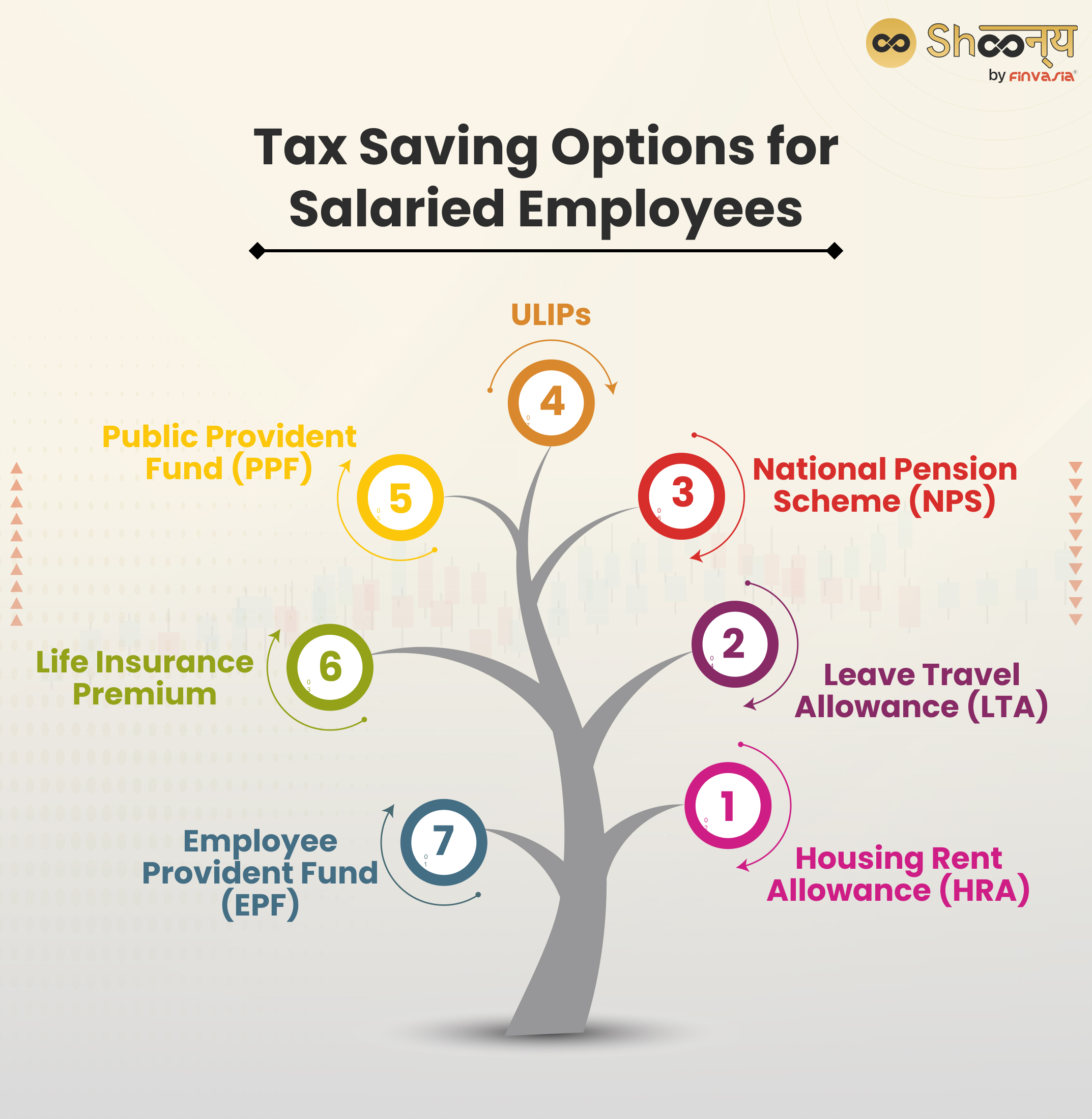

Hra Exemption For Salaried Employees Factzone

https://blog.shoonya.com/wp-content/uploads/2024/03/Tax-Saving-Options-for-Salaried-Employees.jpg

https://www.canada.ca › en › services › benefits › disability › canada-dis…

The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income

https://www.canada.ca › en › department-finance › news › delivering-a-…

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full year tax rate for 2025 will be 14 5 per cent and the full

Hra Exemption For Salaried Employees Factzone

2024 Tax Slab India Gelya Juliann

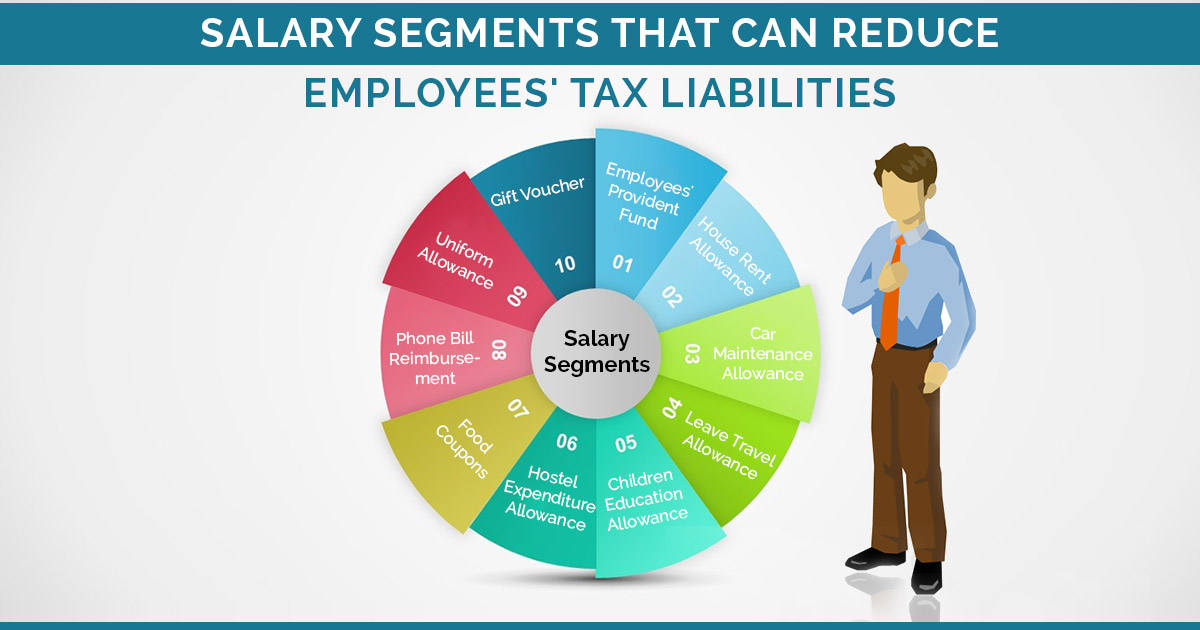

Salary Segments That Can Reduce Employees Tax Liabilities

Budget 2024 Tax Slabs India Elena Heather

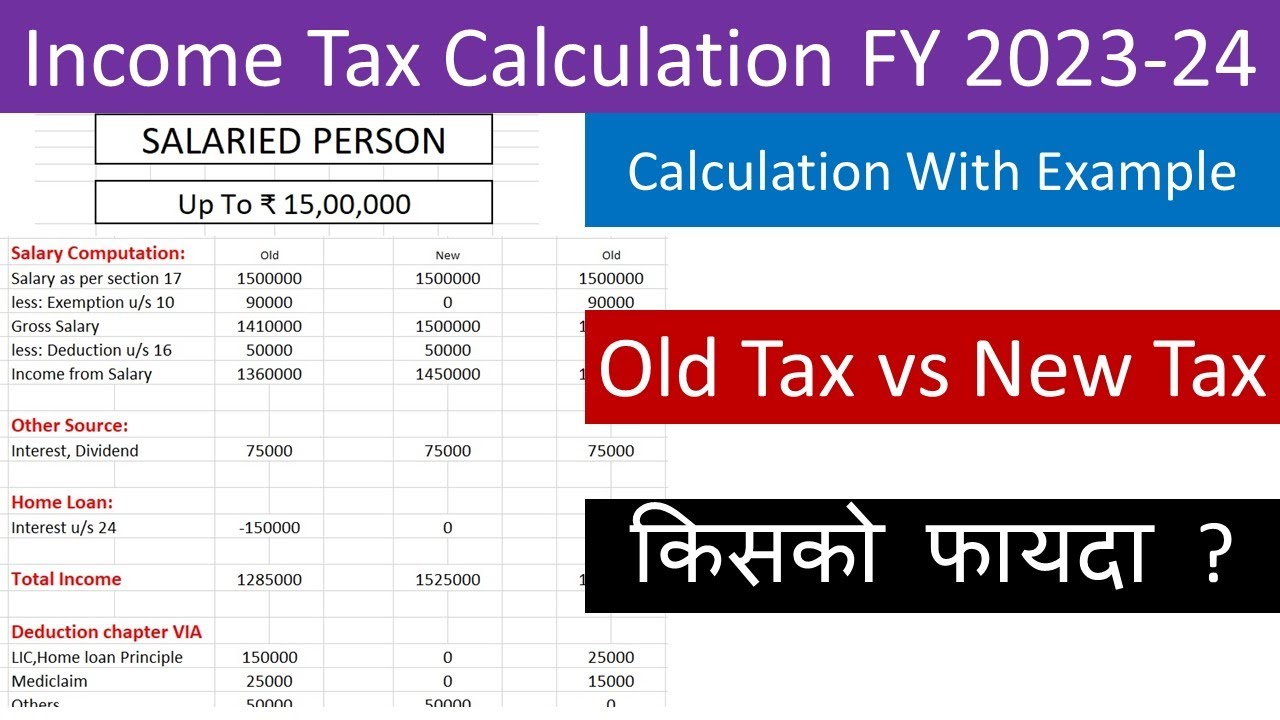

How To Calculate Income Tax 2023

7 Useful Income Tax Exemptions For The Salaried

7 Useful Income Tax Exemptions For The Salaried

Income Tax Challan For Salaried Employees

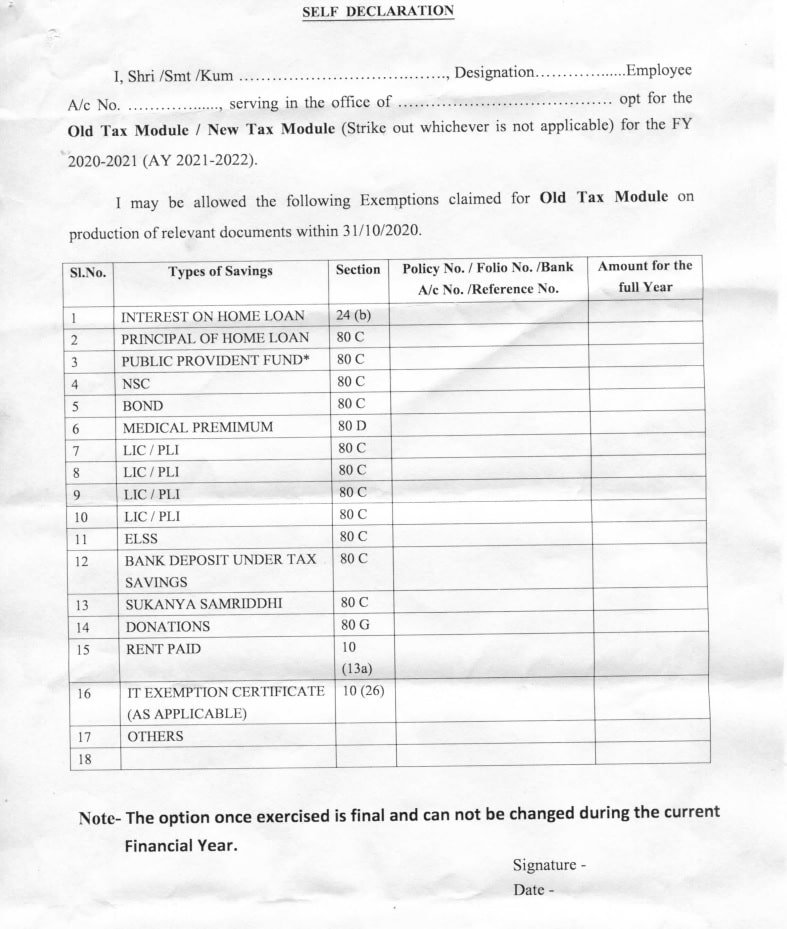

New Income Tax Regime Declaration Form 2020 21 PDF Download For

Income Tax Exemption 10

Income Tax Exemption For Salaried Employees - Income tax Personal business corporation trust international and non resident income tax