Income Tax Expense Formula Cfa My Income app Manage your insurance needs within a single app View existing policy information get information of our products and services and more on the go View app features

Net income equals the total company revenues minus total company expenses As you can see the net income definition is much different than the revenue definition of income The generic By providing and submitting the information I give my consent and agree to Income Insurance Limited its representative agents collectively Income and its third party service provider s

Income Tax Expense Formula Cfa

Income Tax Expense Formula Cfa

https://i.ytimg.com/vi/zirujoiyL28/maxresdefault.jpg

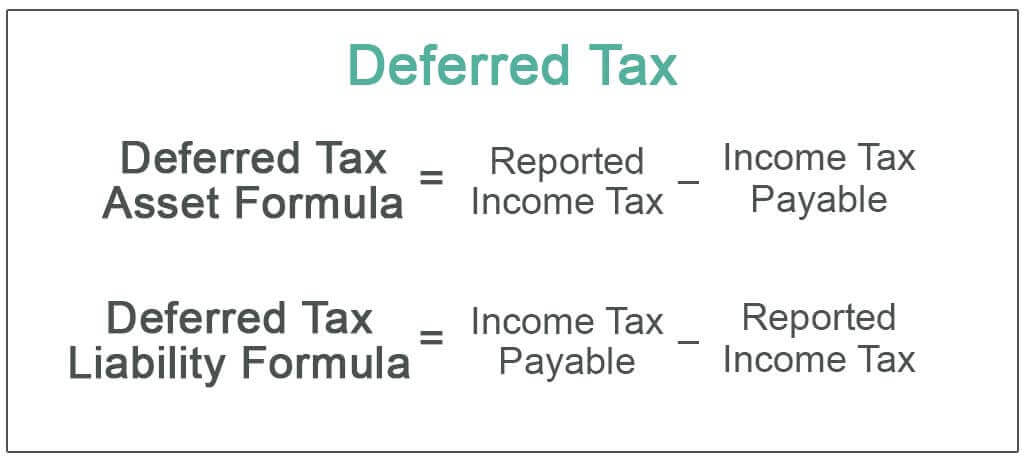

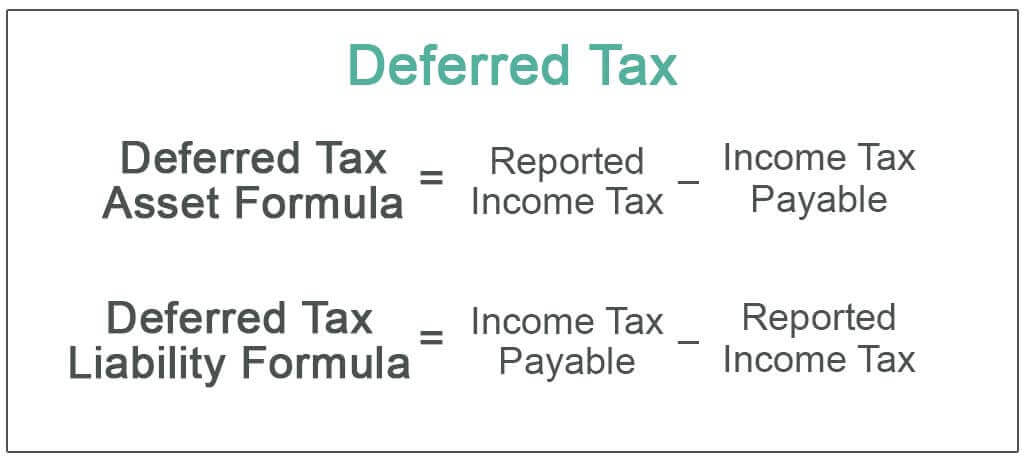

CFA Level I FRA Tax Base Deferred Tax Assets Deferred Tax

https://i.ytimg.com/vi/iNOnmzX54x4/maxresdefault.jpg

CFA Level I Income Taxes Video Lecture By Mr Arif Irfanullah Part 1

https://i.ytimg.com/vi/SKARZp8h5TA/maxresdefault.jpg

Income Example For example qualified dividends and long term capital gains made on investments are taxed at a lower rate than ordinary income Income from social Income tax rates vary based on how much money you make in one calendar year Individuals with lower salaries typically have lower rates than higher income taxpayers and tax

My Income Customer Portal Take control of your account and policy matters Log in Key features at a glance Account management Update your personal particulars and password securely Income Insurance offers Life Health Travel Motor Savings and Investment and other financial planning solutions for your savings protection and retirement needs

More picture related to Income Tax Expense Formula Cfa

Home Goods Salary

https://images.contentful.com/ifu905unnj2g/66K2AdsLlvARouig6tdw8D/9fb05a7c0c4b54eca5f4d7bb8c04ce1c/Net_income_formula.jpg

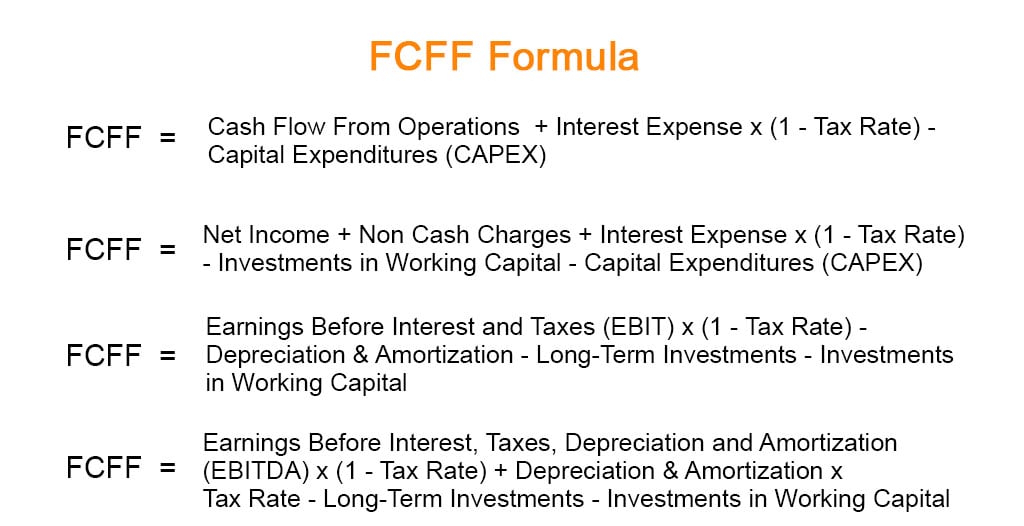

FCFF Formula Examples Of FCFF With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/08/FCFF-Formula-Done.jpg

Arktiklo Blog

https://www.wallstreetmojo.com/wp-content/uploads/2019/01/Operating-Cash-Flow-Formula-1.jpg

Individual income tax can be complex and everyone s situation is different If you want to get professional advice consider choosing an accountant to help manage your tax and lodge your Employment income after salary sacrifice before tax Employment income frequency Other taxable income Other taxable income frequency Annually Monthly Fortnightly Weekly

[desc-10] [desc-11]

Deferred Tax Meaning Expense Examples Calculation

https://wallstreetmojocms.recurpro.in/uploads/Deferred_Tax_2894cd29dc.jpg

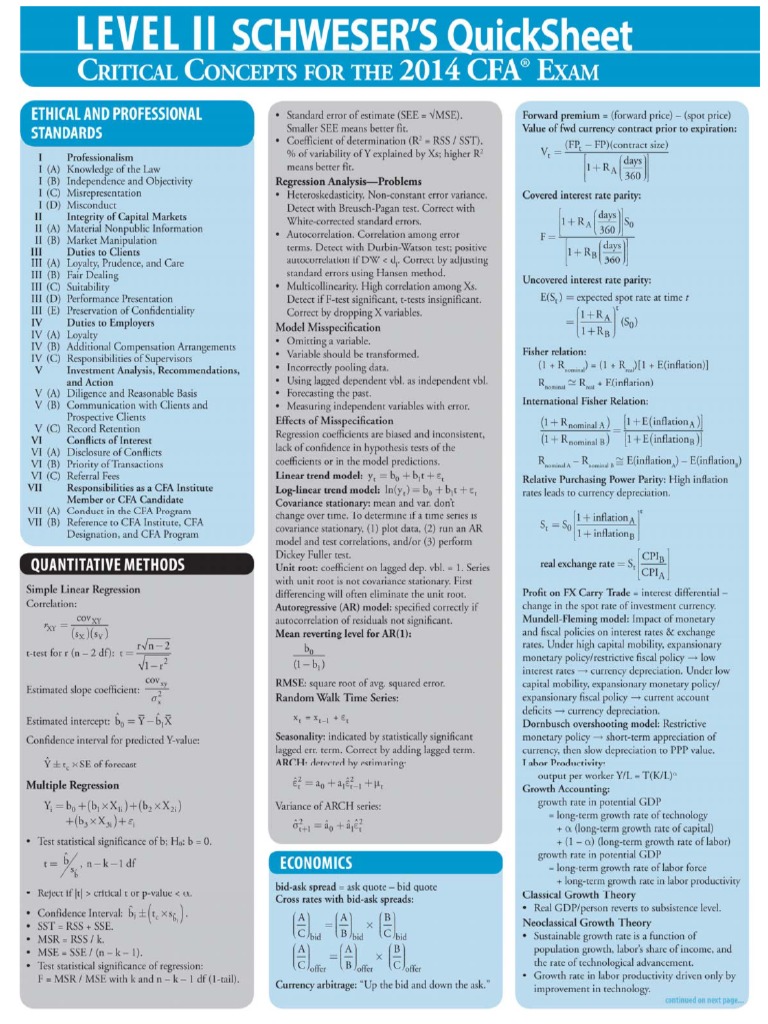

Cfa Level 2 Formula Sheet

https://imgv2-1-f.scribdassets.com/img/document/342994428/original/25abca36d3/1496722037

https://www.income.com.sg › Online-Self-services

My Income app Manage your insurance needs within a single app View existing policy information get information of our products and services and more on the go View app features

https://www.myaccountingcourse.com › accounting-dictionary › income

Net income equals the total company revenues minus total company expenses As you can see the net income definition is much different than the revenue definition of income The generic

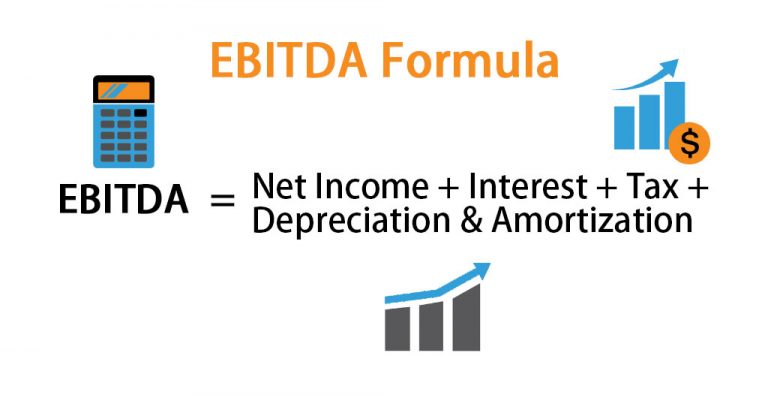

EBITDA Formula Calculator Examples With Excel Template

Deferred Tax Meaning Expense Examples Calculation

Taxable Income Formula Calculator Examples With Excel Template

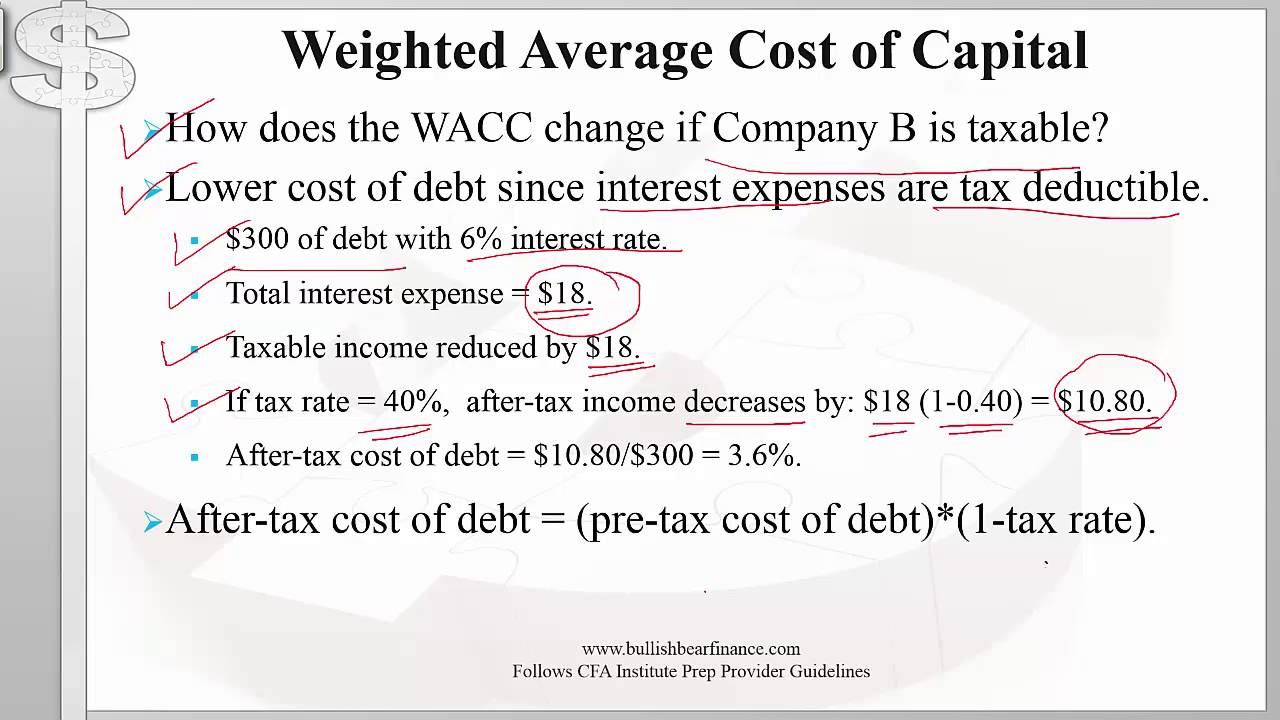

Tax Shield Formula How To Calculate Tax Shield With Example

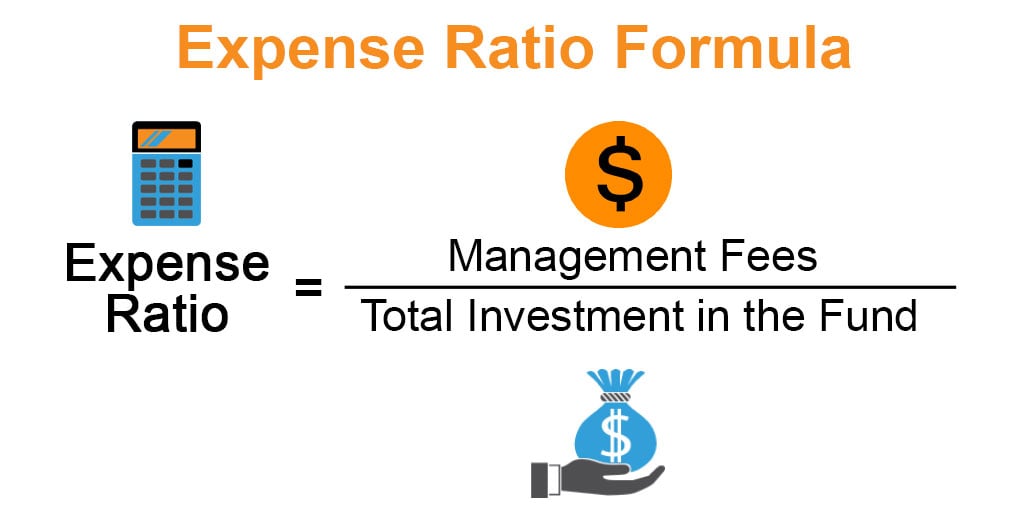

Expense Ratio Formula Calculator Example With Excel Template

Depreciation Expenses Formula Examples With Excel Template

Depreciation Expenses Formula Examples With Excel Template

Interest Expense What Is It Formula Journal Entry

Residual Income Formula

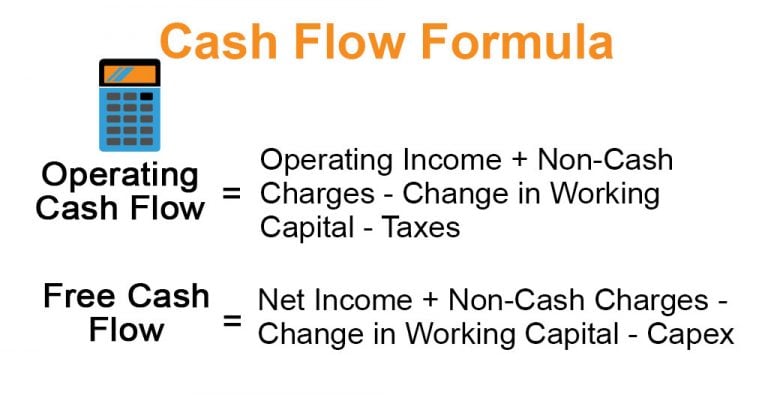

Cash Flow Formula How To Calculate Cash Flow With Examples

Income Tax Expense Formula Cfa - [desc-12]