Income Tax On 30 Lakhs Salary In India Quora Change in individual income tax rate The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government

Your net income is used to calculate your federal and provincial or territorial non refundable tax credits The CRA also uses your net income and your spouse s or common law partner s net The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government tables a Motion to bring down costs

Income Tax On 30 Lakhs Salary In India Quora

Income Tax On 30 Lakhs Salary In India Quora

https://i.ytimg.com/vi/CcMfZw6JQh8/maxresdefault.jpg

12 LPA In Hand Salary Reality Of 12 LPA Tax Calculation For 12

https://i.ytimg.com/vi/ZpinqaunE28/maxresdefault.jpg

30 LPA In Hand Salary Reality Of 30 LPA Tax Calculation For 30

https://i.ytimg.com/vi/EbEOXcrNFwc/maxresdefault.jpg

As an employee you complete this form if you have a new employer or payer and will receive salary wages or any other remuneration or if you wish to increase the amount of If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery

Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1 Add the taxable items and the non allowable expenses listed on lines 101 to 199 The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

More picture related to Income Tax On 30 Lakhs Salary In India Quora

No Tax Upto 12 Lakhs Salary AY 24 25 How To Save Tax On 12 Lakhs

https://i.ytimg.com/vi/c5D9qr4JeFg/maxresdefault.jpg

How To Save Tax For Salary Above 15 Lakhs Or 20 Lakhs Income Tax

https://i.ytimg.com/vi/LSq278XeT4w/maxresdefault.jpg

How To Save Tax For Salary Above 15 Lakhs Or 20 Lakhs Income Complete

https://i.ytimg.com/vi/o9rGHxiDfH4/maxresdefault.jpg

The type of Canadian income that you receive during the tax year determines which income tax package you should use If you receive only income from employment or business use the Income tax Information on taxes including filing taxes and get tax information for individuals

[desc-10] [desc-11]

How To Save Income Tax On Salary Above 7 Lakh Old Vs New Tax Regime

https://i.ytimg.com/vi/rYXXnjdYFu0/maxresdefault.jpg

New Income Tax Slab Rate 2023 Tamil Budget 2023 Upto 7 Lakhs No Tax

https://i.ytimg.com/vi/pse7oxoILCY/maxresdefault.jpg

https://www.canada.ca › en › revenue-agency › services › e-services › di…

Change in individual income tax rate The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government

https://www.canada.ca › ... › deductions-credits-expenses

Your net income is used to calculate your federal and provincial or territorial non refundable tax credits The CRA also uses your net income and your spouse s or common law partner s net

ReillyViola

How To Save Income Tax On Salary Above 7 Lakh Old Vs New Tax Regime

Tax Calculator For Wages Sale Online Www pennygilley

How To Calculate Tax On Salary Sale Online Www pennygilley

LPA Means Lakhs Per Annum In Indian Rupees Which Translates 46 OFF

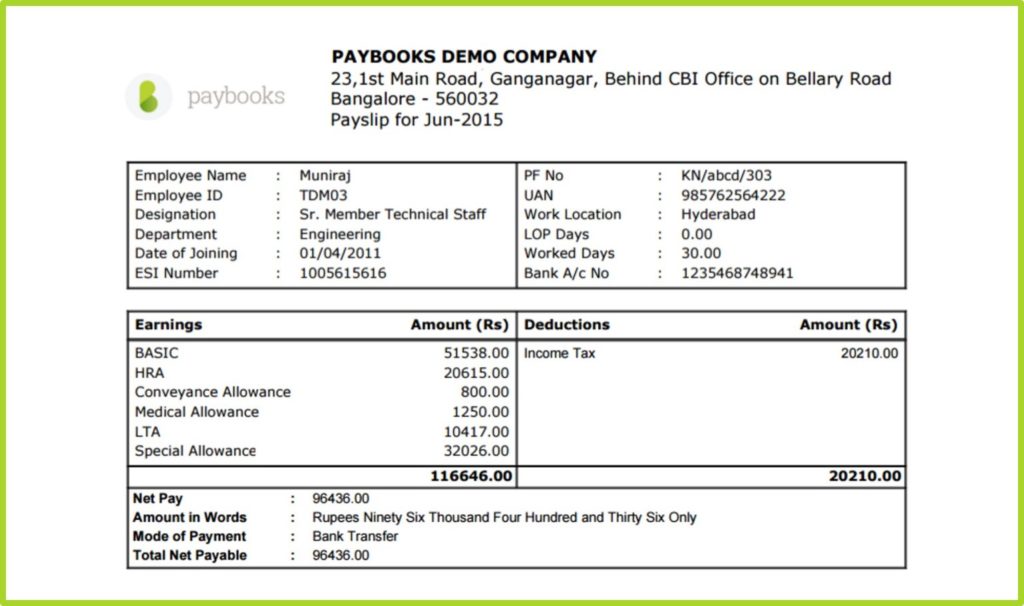

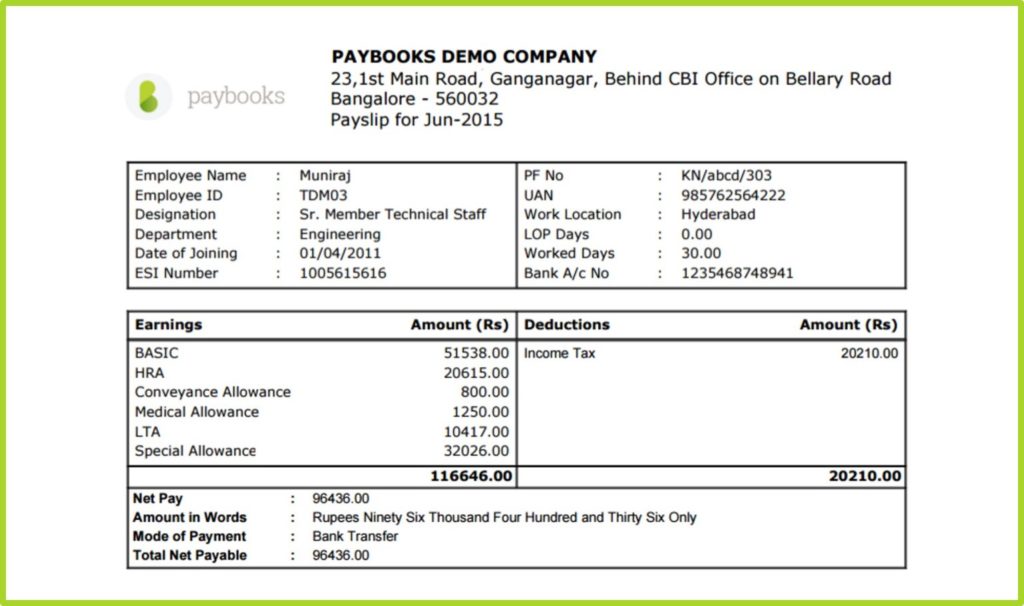

Salary Slip Format India Kidsop

Salary Slip Format India Kidsop

Tax Rates 2025 Atonement Oscar Blake

Tax Brackets 2025 25 Richard D Hart

Tax Rate 2025 Pakistan Randy M Myers

Income Tax On 30 Lakhs Salary In India Quora - If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery