Income Tax Rate In India Hence the maximum rate of surcharge on tax payable on such incomes shall be 15 2 The surcharge rate for AOP with all members as a company shall be capped at 15

Tax Rates DTAA v Income tax Act This is the official website of Central Board of Direct Taxes CBDT Department of Revenue Ministry of Finance Government of India This article summarizes Income Tax Rates Surcharge Health Education Cess Special rates and rebate relief applicable to various categories of Persons viz Individuals Resident Non Resident HUF Firms LLP Companies Co operative Society Local Authority AOP BOI artificial juridical persons for income liable to tax in the Financial

Income Tax Rate In India

Income Tax Rate In India

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3.jpg

Latest Income Tax Slabs In India Indian Economy

https://st.adda247.com/https://gumlet.assettype.com/fortuneindia/2022-01/93ed99bc-dee9-4368-a199-a0601b154091/Tax_Slabs.jpg?auto=format&q=35&w=1200

Income Tax Slab 2023 New Income Tax Slab Rates For Fy 2023 24 Ay 2024

https://img.etimg.com/photo/msid-97520911/tax-slab.jpg

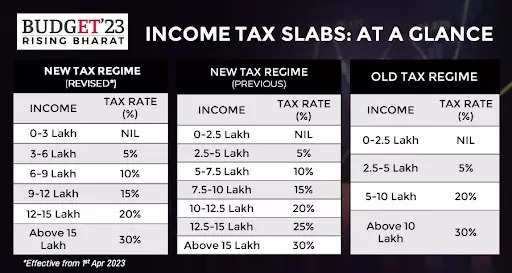

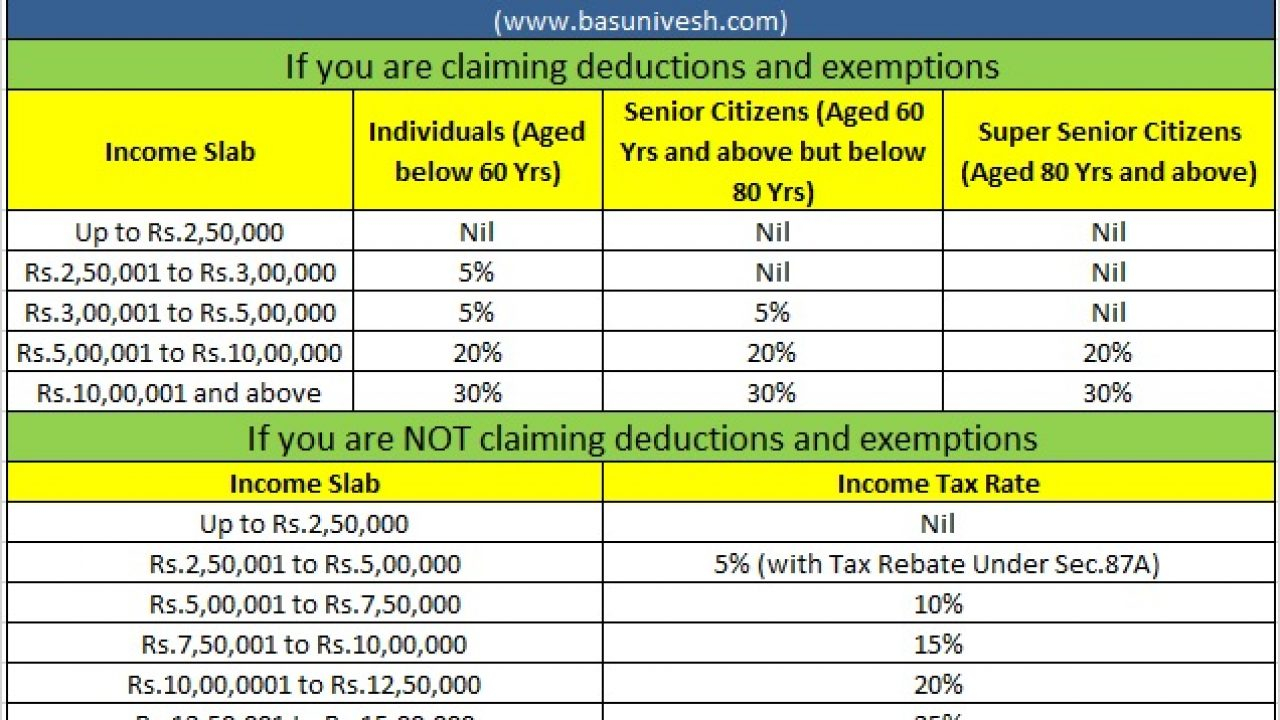

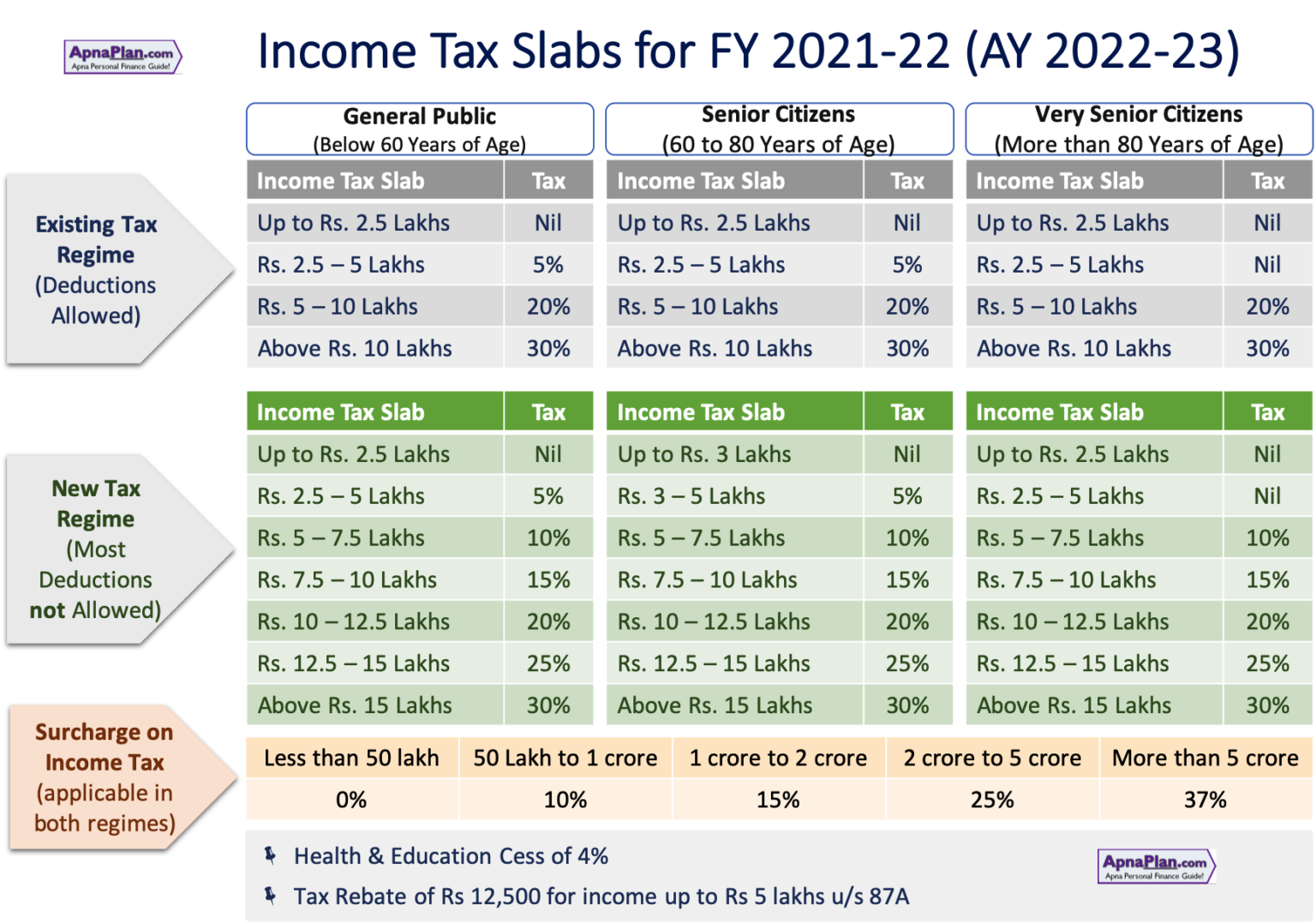

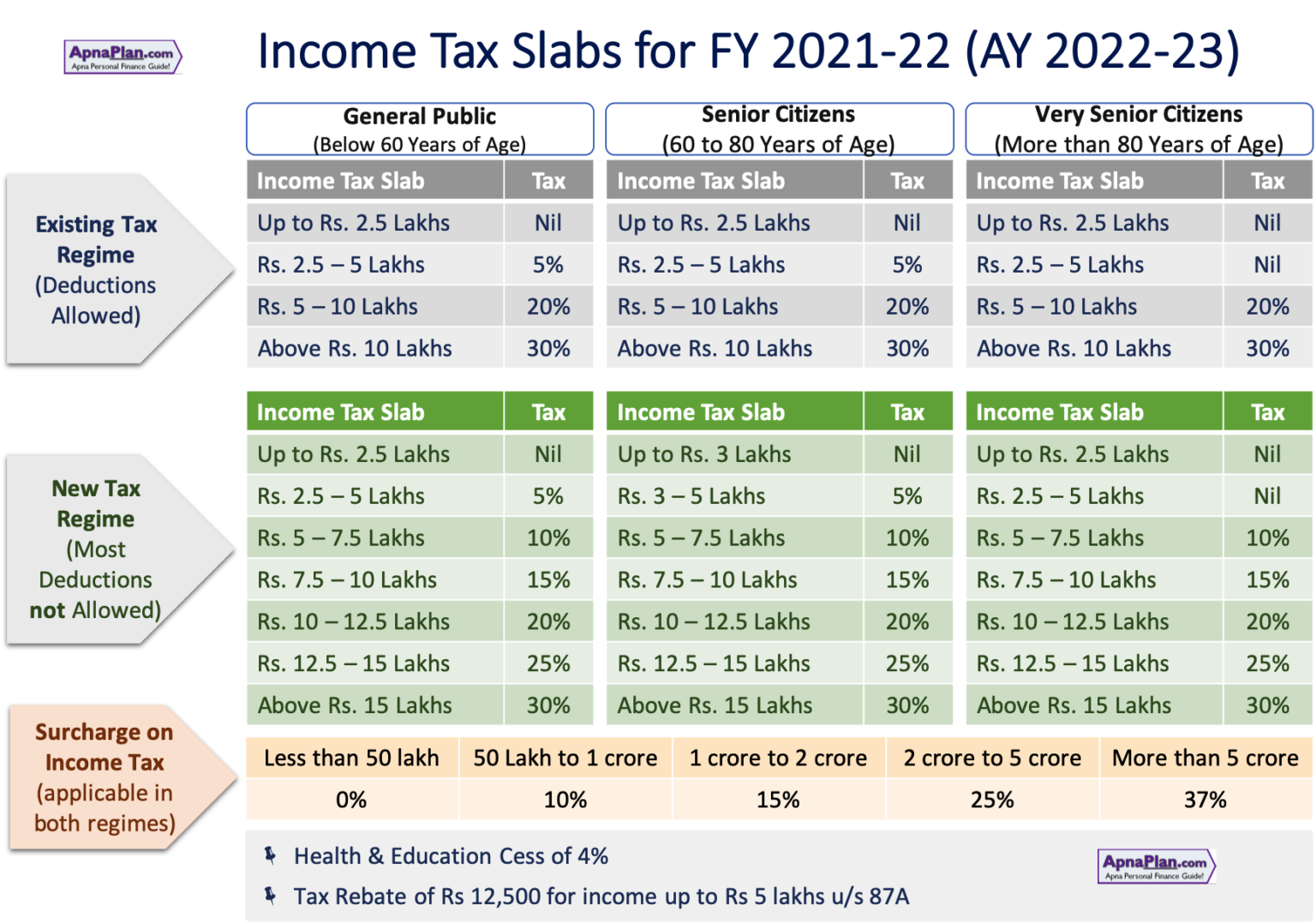

Taxation of individuals in India is primarily based on their residential status in the relevant tax year The residential status of individuals is determined independently for each tax year and is ascertained on the basis of their physical presence in India during the relevant tax year and past years See the Residence section for more information Explore the income tax rates for AY 2024 25 AY 2025 26 under the Old and New Tax Regimes Understand the exemption limits tax slabs surcharges and eligibility for individuals senior citizens firms and companies

In India income tax is calculated using income tax slabs and rates for the applicable financial year FY and assessment year AY For this year the financial year will be 2024 25 and the assessment year will be 2025 26 Understanding income tax rates is essential for financial planning be it for an individual a Hindu Undivided Family HUF a partnership firm or a company This article aims to provide a comprehensive guide on the income tax rates applicable for the Assessment Years 2023 24 and 2024 25

More picture related to Income Tax Rate In India

Custom Essay Amazonia fiocruz br

https://www.fm-magazine.com/content/fmm-home/news/2019/oct/india-shrinks-corporate-income-tax-rates-201922167/_jcr_content/article/articleparsys/image.img.jpg/1571155029521.jpg

2022 Irs Tax Table Chart

https://www.taxpolicycenter.org/sites/default/files/statistics/images/toprate_historical_2.png

Government Of India Personal Income Tax Rates And Slabs Finance

https://www.theteamwork.com/finance/wp-content/uploads/2020/02/india-personal-income-tax-rates.jpeg

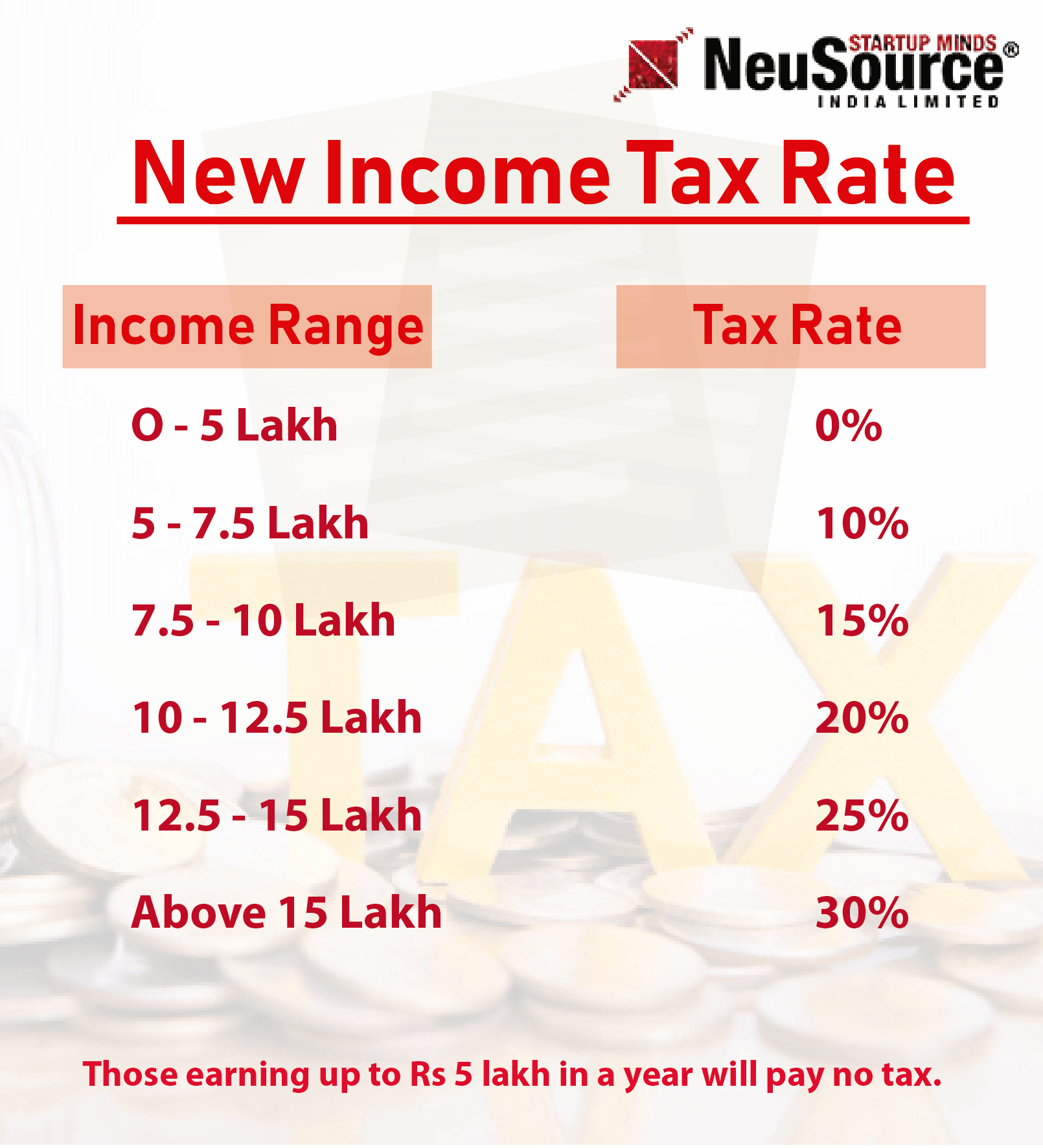

Discover the latest tax slabs rate for 2024 25 and new Tax slabs for salaried individuals and professional by the IT department Old New Income Tax Regime announcments news updates videos and more India s income tax system is progressive meaning tax rates increase with higher income levels The income tax slab in India specify the applicable rates for different income brackets and vary based on residential status age and type of taxpayer

[desc-10] [desc-11]

Income Tax Rates In India For FY 2022 23

https://www.companiesnext.com/uploads/blog/1667303275-Income Tax Rates in India for financial year 2022-23.jpg

New Income Tax Slabs Tax Rate In India For FY AY 2020 21

https://www.neusourcestartup.com/Usefull/ImagePath/36/36.png

https://incometaxindia.gov.in › Charts Tables › Tax rates.htm

Hence the maximum rate of surcharge on tax payable on such incomes shall be 15 2 The surcharge rate for AOP with all members as a company shall be capped at 15

https://incometaxindia.gov.in › Pages › tax-rates.aspx

Tax Rates DTAA v Income tax Act This is the official website of Central Board of Direct Taxes CBDT Department of Revenue Ministry of Finance Government of India

Where Does India Stand In Terms Of Income Tax Rate Know How The Income

Income Tax Rates In India For FY 2022 23

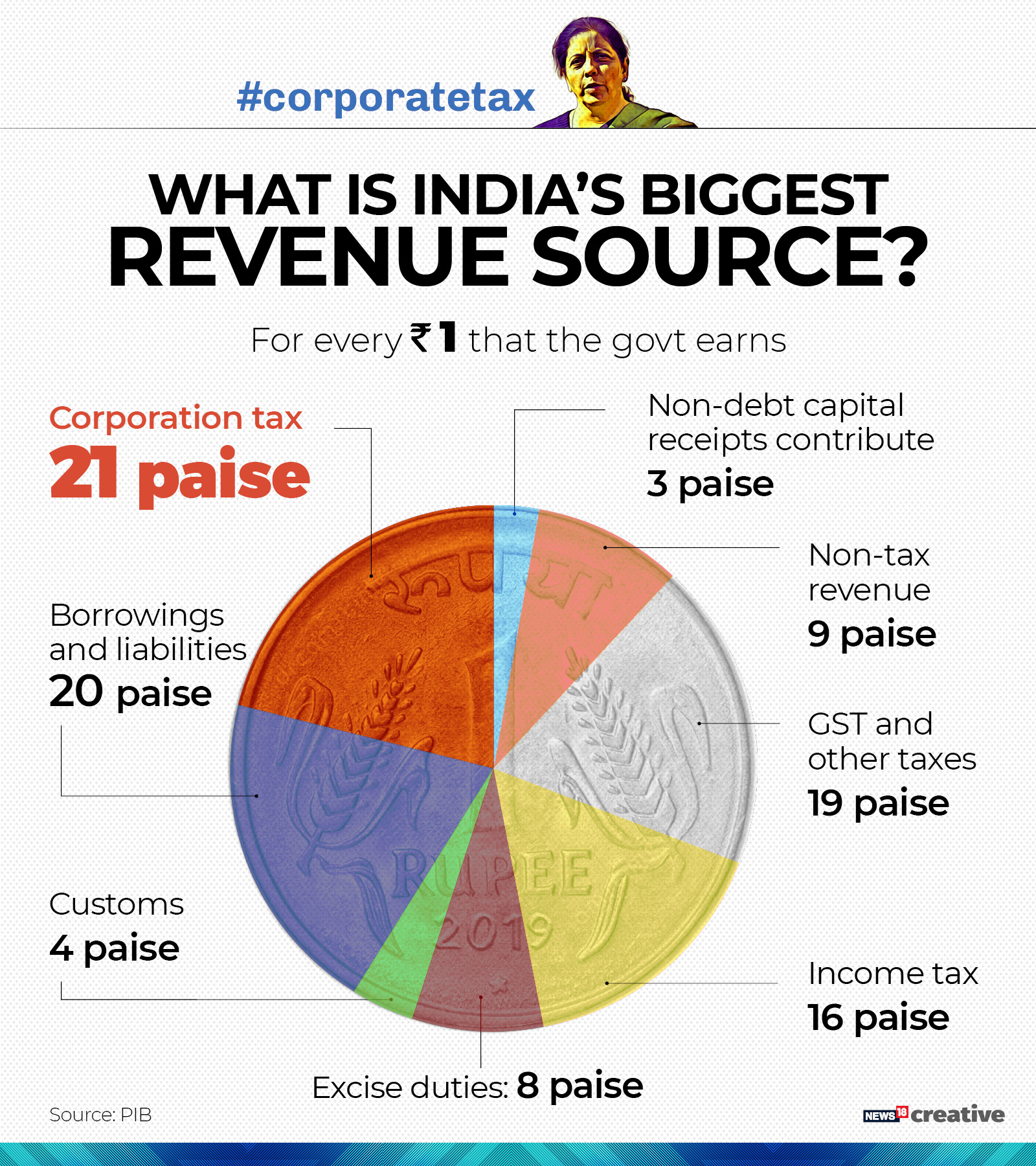

What The Corporate Tax Cuts Mean For India In Four Charts Forbes India

Income Tax Rate In Nepal For 2080 81 FY 2023 24 Top Nepali

Warning Income Tax India Says Your ITR Refund Will Not Be Credited

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Meaning Of Corporate Tax In India And Corporate Tax Rate For Companies

South Carolina s 2021 Agenda Why Income Tax Cuts Matter

Behind The Numbers On Income Tax News Bright Grahame Murray

Income Tax Rate In India - [desc-13]