Income Tax Rates For Assessment Year 2022 23 INCOME definition 1 money that is earned from doing work or received from investments 2 a company s profit in a Learn more

Learn about what income means for individuals businesses the different types of income and some examples of how income is earned Click for more Income is an increase in the net assets of the entity except for increases caused by contributions from owners Two main types of income are sales revenue and gains Examples of income

Income Tax Rates For Assessment Year 2022 23

Income Tax Rates For Assessment Year 2022 23

https://taxguru.in/wp-content/uploads/2022/02/Income-tax-rates-for-assessment-year-2022-23-Financial-Year-2021-22.jpg

TDS Rate Chart AY 2023 2024 FY 2022 2023 Sensys Blog

http://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210.jpg

Malaysia Personal Income Tax Rates 2023

https://1.bp.blogspot.com/-wSxCF2gX3kI/XihB5-5YvBI/AAAAAAAAImk/mZ5YhHutHcEeWTRlDOLa4enoptF5aCCYACLcBGAsYHQ/s1600-rw-e60/Malaysia%2Bincome%2Btax%2Brates.png

What is Income Income can be broadly defined as the amount of money received for providing labor capital or other assets It is typically measured in terms of a specific time Income refers to money cash or cash equivalents coming in either for work done interest or profit from capital invested or rent from a property or land that is let When it comes from

A two income family a family in which both adults have jobs that provide income Every company must keep control of its income and expenditure Financial assets have the advantage of earning income For 2023 expenditure exceeded income by 10 000 He has a

More picture related to Income Tax Rates For Assessment Year 2022 23

Malaysia Personal Income Tax Relief 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjM81nSzJ2QiCATWboDACN2BpfNmw-0Wf5BApuHi91cjON32r6XUxhruNbA8f0o3K_H_4oIf1B4xQE6D0tInpJ7fFjXuaqCtw3-786N9ouUQ8nKcW7kxtIy0bZOmw2wXtBmRb63A-pQjcxK9mCdSvqTGiUvUxaePn9JkzlCVQKv7Gj0EukB_pdXpC10/s1585/Individual_Tax_Relief_2021.jpg

Income Tax Rates For Computation Of Taxable Income AY 2023 24

https://www.taxmann.com/post/wp-content/uploads/2022/11/income-tax-rates.jpg

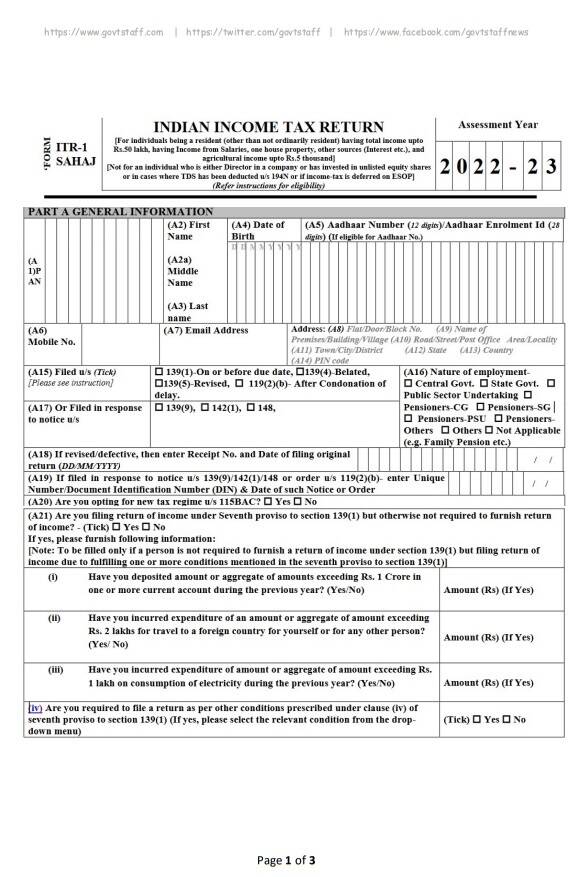

INCOME TAX CALCULATION STATEMENT FORM PDF FINANCIAL YEAR 2022 2023

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhL6Qpqkeow0Y6MNZdAszATYTGyD23ZRZV59OlBU8UiuKGS9rlgKzyVO2H2MqO8xtqExnAZVS_v6cq8_YGKIz9iMaqIhTKnt7wL49GfnLuvFfia0fpAmA3lHjXzt3Z51YYAmwfDouiFuHqMmdX2iDvGlO95vSB5TjhQIGyahDj8LcqUTUKqzDGx0ZoT/w1600/IT FORM.PNG

Discover what income explained is and how it s taxed and see real world examples Learn the different types of income and how taxation affects Income meaning definition what is income the money that you earn from your work o Learn more

[desc-10] [desc-11]

Tax Rates For Fy 2023 24 Image To U

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets.jpg

Income Tax Rate And Slab 2023 What Will Be Tax Rates And Slabs In New

http://cachandanagarwal.com/wp-content/uploads/2022/12/51805DBD-BAC4-4644-8380-1BCEA472764E.png

https://dictionary.cambridge.org › dictionary › english › income

INCOME definition 1 money that is earned from doing work or received from investments 2 a company s profit in a Learn more

https://www.financestrategists.com › tax › income

Learn about what income means for individuals businesses the different types of income and some examples of how income is earned Click for more

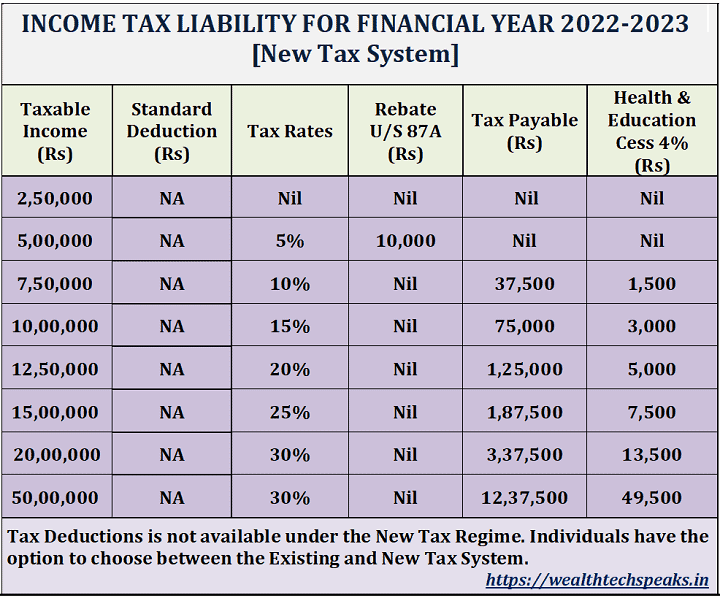

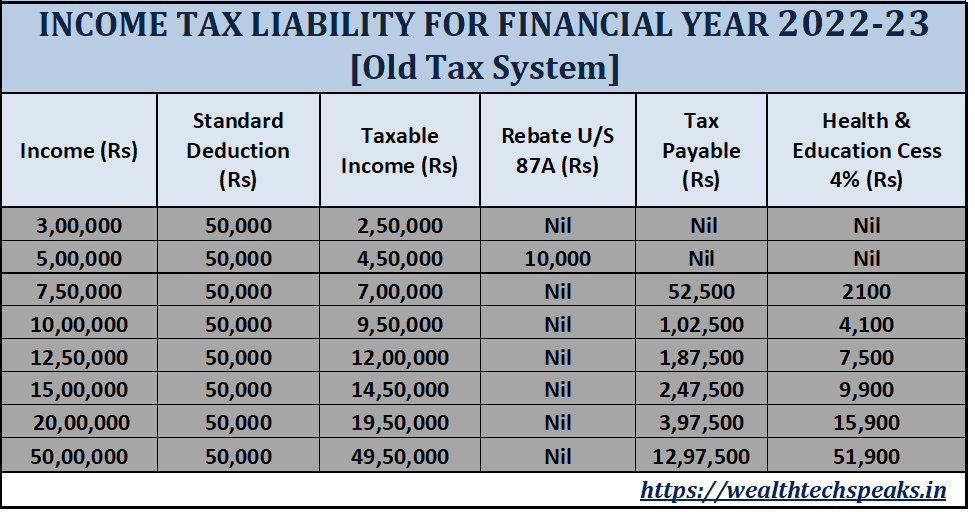

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

Tax Rates For Fy 2023 24 Image To U

Income Tax Rates For Financial Year 2021 22 And 2022 23

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png)

1040 Line 44 2021 At Tanquentinblog Blog

Income Tax Slab Rates For FY 2021 22 Budget 2021 Highlights

Income Tax Slab Rates For FY 2021 22 Budget 2021 Highlights

Income Tax Forms SAHAJ ITR 1 ITR 2 ITR 3 SUGAM ITR 4 ITR 5 ITR 6

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

Income Tax Rates For Assessment Year 2024 25 Image To U

Income Tax Rates For Assessment Year 2022 23 - [desc-12]