Income Tax Slab For Ay 2022 23 Company The Canada Disability Benefit will provide direct financial support to people with disabilities who are between 18 and 64 years old The program is administered by Service

The income level cut offs do not include the OAS pension the first 5 000 of employment or self employment income and 50 of employment or self employment income How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must

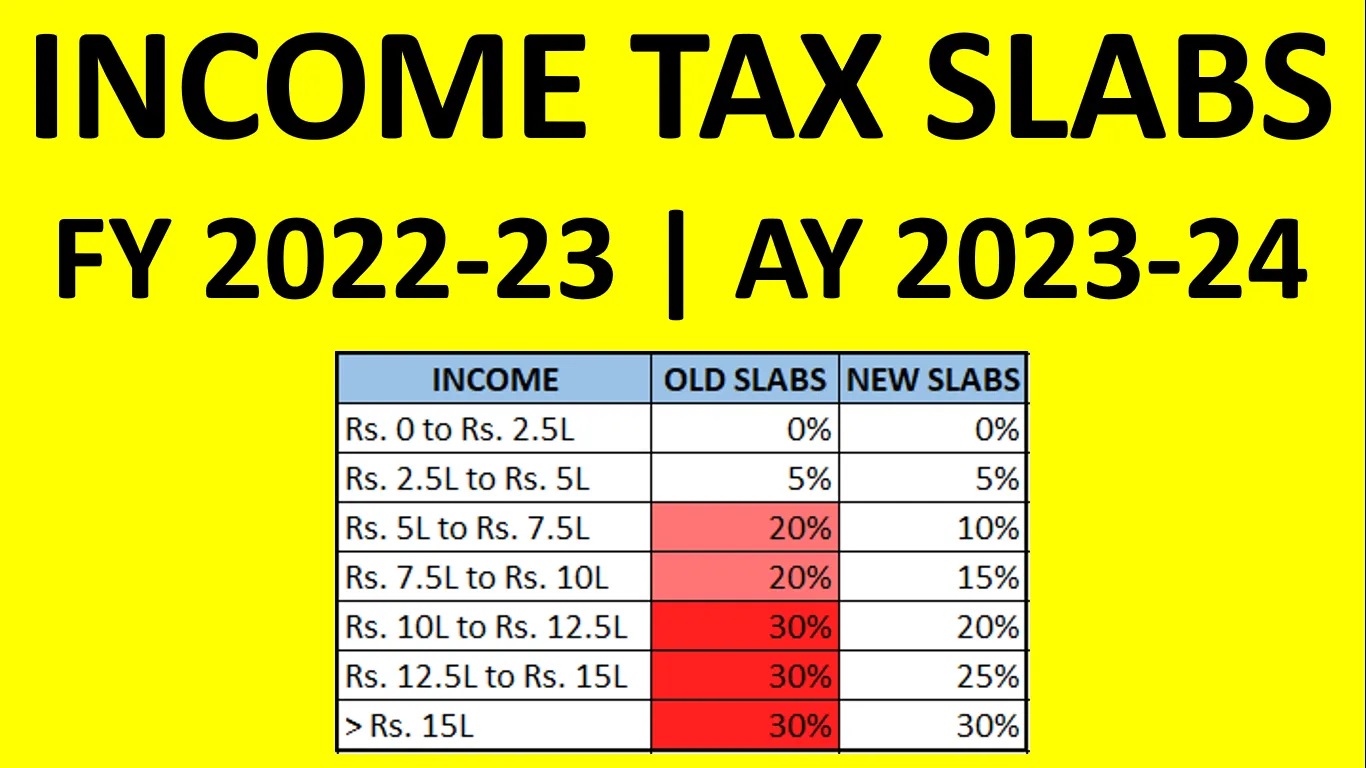

Income Tax Slab For Ay 2022 23 Company

Income Tax Slab For Ay 2022 23 Company

https://eadvisors.in/wp-content/uploads/2022/12/Income-tax-Slab-Rates-for-AY-2023-24.jpg

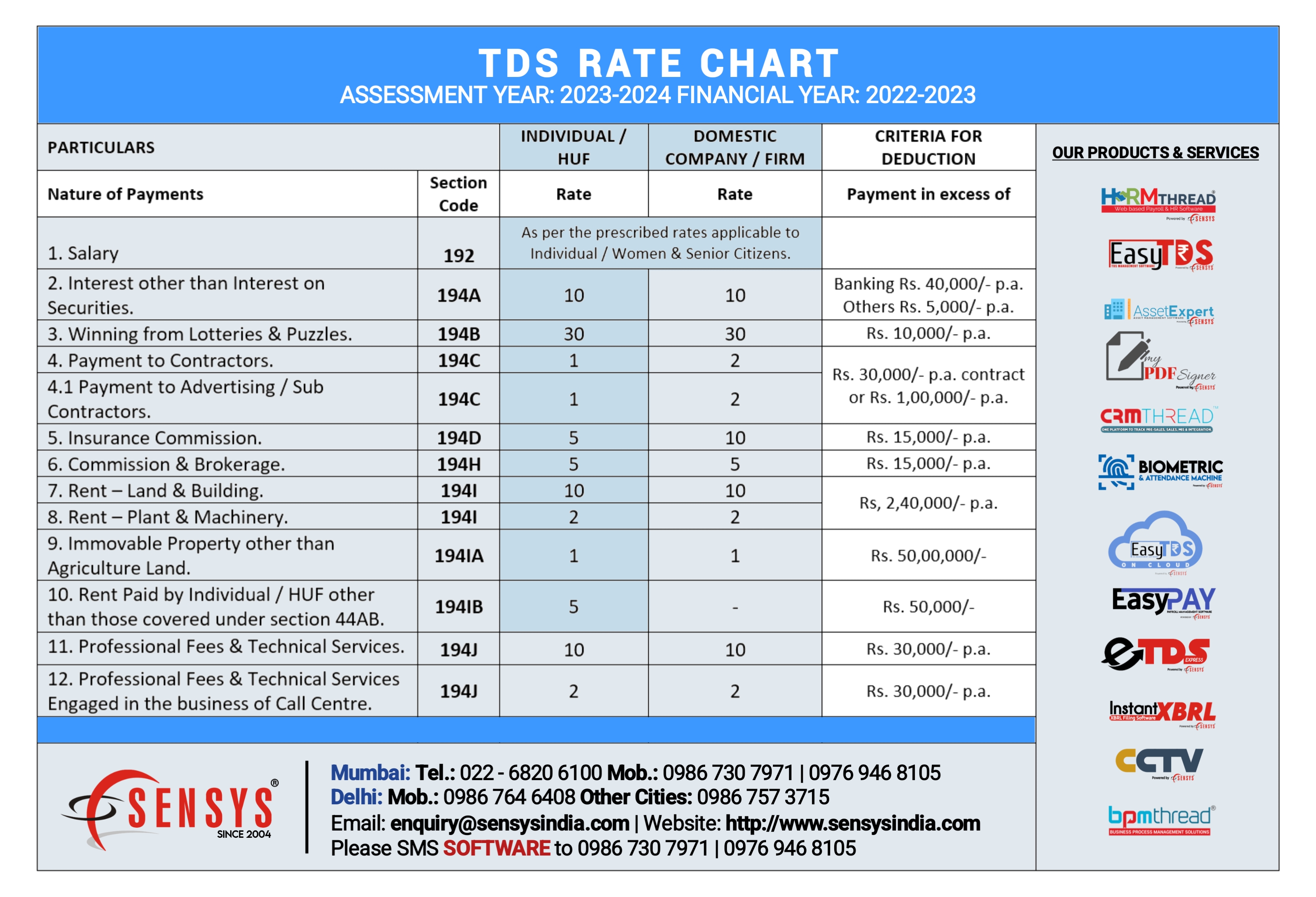

TDS Rate Chart AY 2023 2024 FY 2022 2023 Sensys Blog

http://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210.jpg

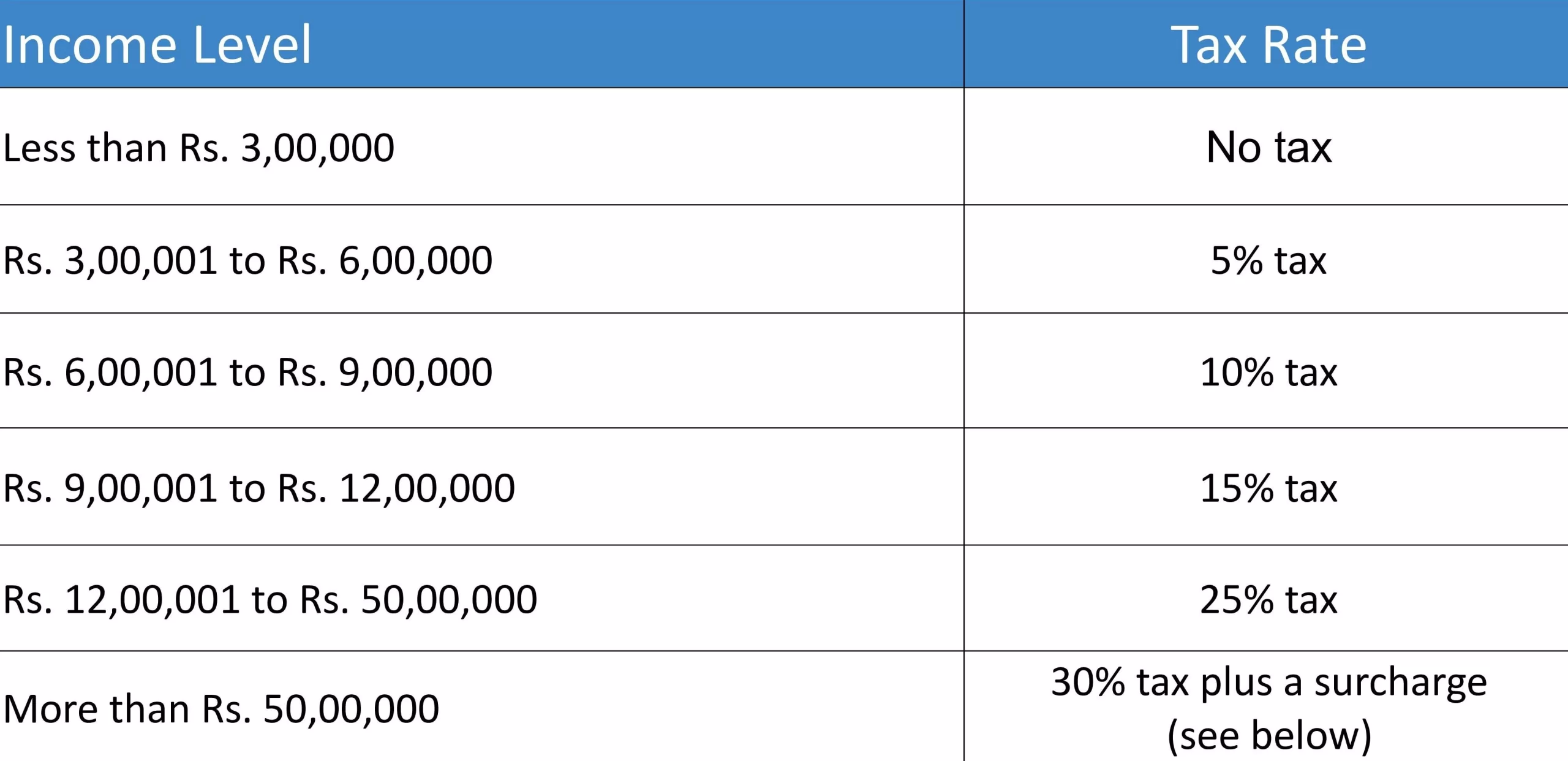

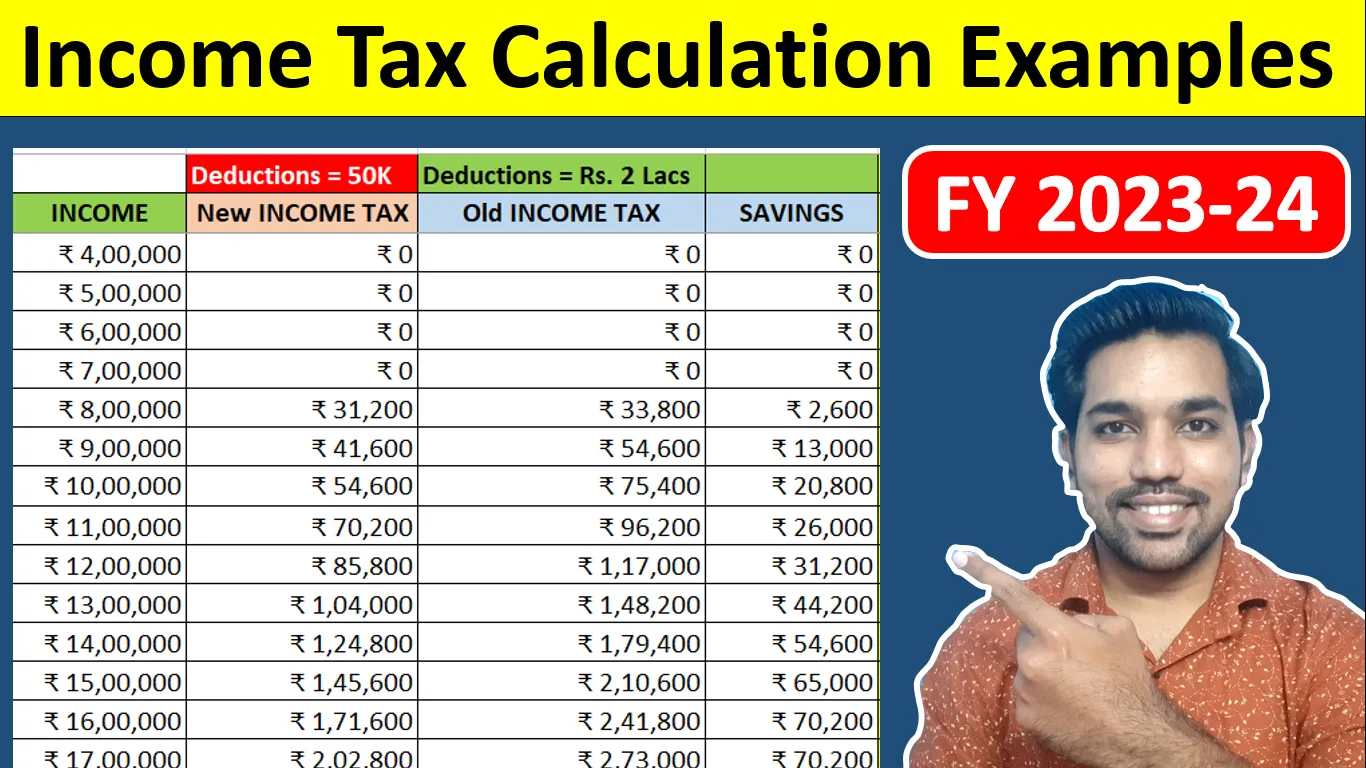

Company Slab Rate For Ay 2024 25 Image To U

https://bestinvestindia.com/wp-content/uploads/2023/02/Screenshot-2023-02-01-at-6.13.22-PM.png

The personal income levels used to calculate your Manitoba tax have changed The basic personal amount has changed The maximum annual amount of eligible expenses for fertility If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery

Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1 Add the taxable items and the non allowable expenses listed on lines 101 to 199 If you are reporting only Canadian source income from taxable scholarships fellowships bursaries research grants capital gains from disposing of taxable Canadian property or from

More picture related to Income Tax Slab For Ay 2022 23 Company

Car Tax Calculator 2024 Maharashtra Angil Tabbie

https://fskindia.com/wp-content/uploads/2024/01/Income-TAX-Calculator-ay-2023-2024-scaled.webp

2025 Standard Tax Deduction In India Harper Lewis

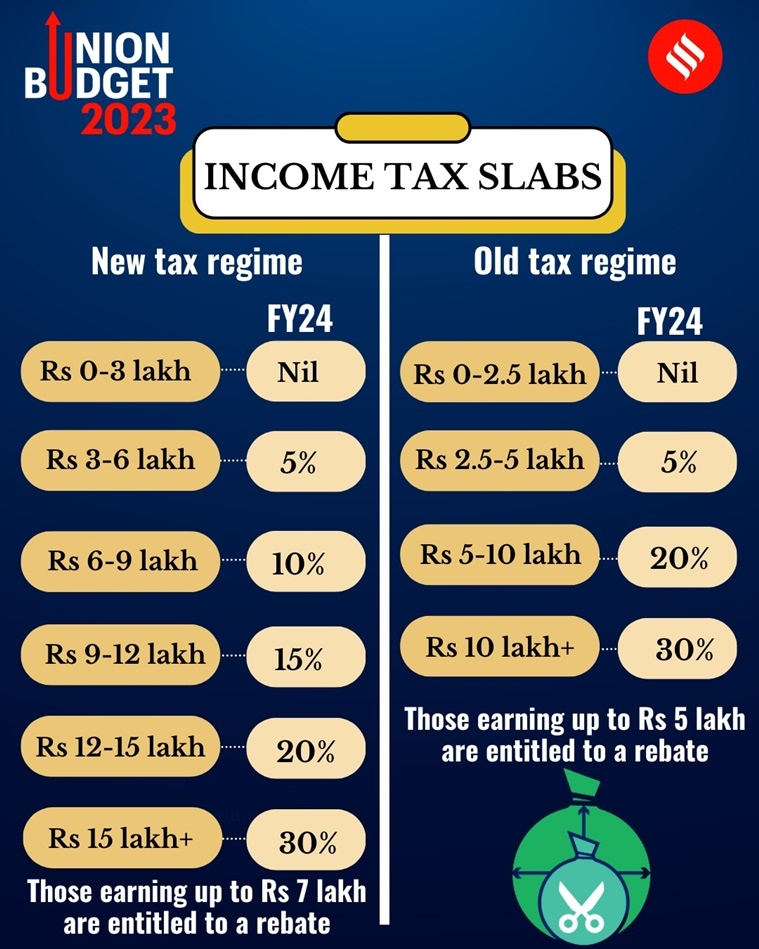

https://images.indianexpress.com/2023/02/tax-slabs-759.jpg

Income Tax Ay 2025 25 Slab Olathe Moon

https://academy.tax4wealth.com/storage/uploads/1684828745-know-the-new-income-tax-slab-rates-for-fy-2023-24-ay-2024-25.jpeg

Filing an income tax and benefit return can help you access benefit and credit payments like the GST HST credit up to 533 for an eligible individual the Canada child If you have a modest income and a simple tax situation the Community Volunteer Income Tax Program CVITP or Income Tax Assistance Volunteer Program for residents of Quebec can

[desc-10] [desc-11]

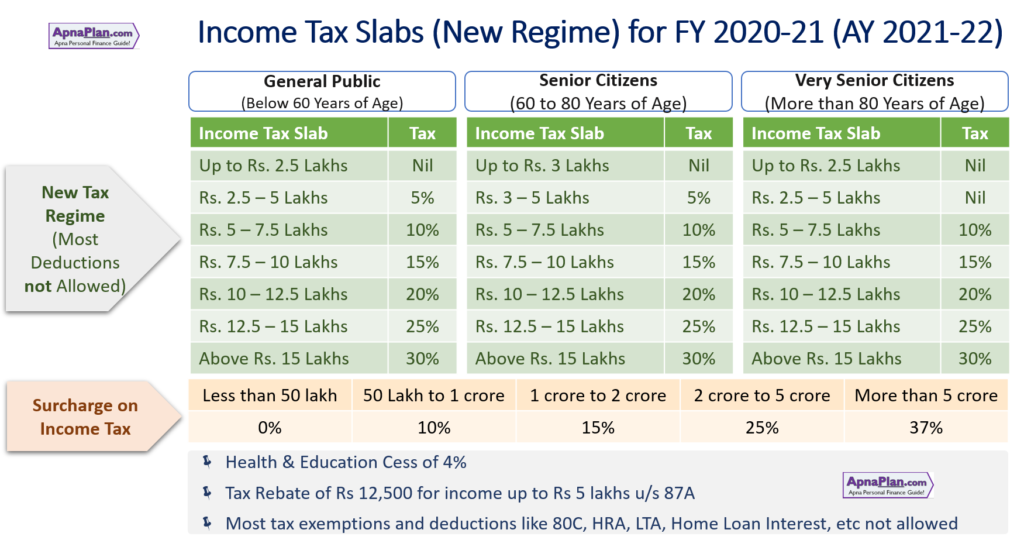

Tax Rates For Ay 2025 25 New Tax Regime Zara B McKivat

https://www.apnaplan.com/wp-content/uploads/2020/02/New-Regime-Income-Tax-Slabs-for-FY-2020-21-AY-2021-22-1024x547.png

Tax Slabs For Ay 2025 24 Old Regime Austin Carr

https://moneyexcel.com/wp-content/uploads/2023/02/incometax-slab-2023-24.jpg

https://www.canada.ca › en › services › benefits › disability › canada-dis…

The Canada Disability Benefit will provide direct financial support to people with disabilities who are between 18 and 64 years old The program is administered by Service

https://www.canada.ca › en › employment-social-development › program…

The income level cut offs do not include the OAS pension the first 5 000 of employment or self employment income and 50 of employment or self employment income

Income Tax Slab For Ay 2024 24 Old Regime Buffy Wrennie

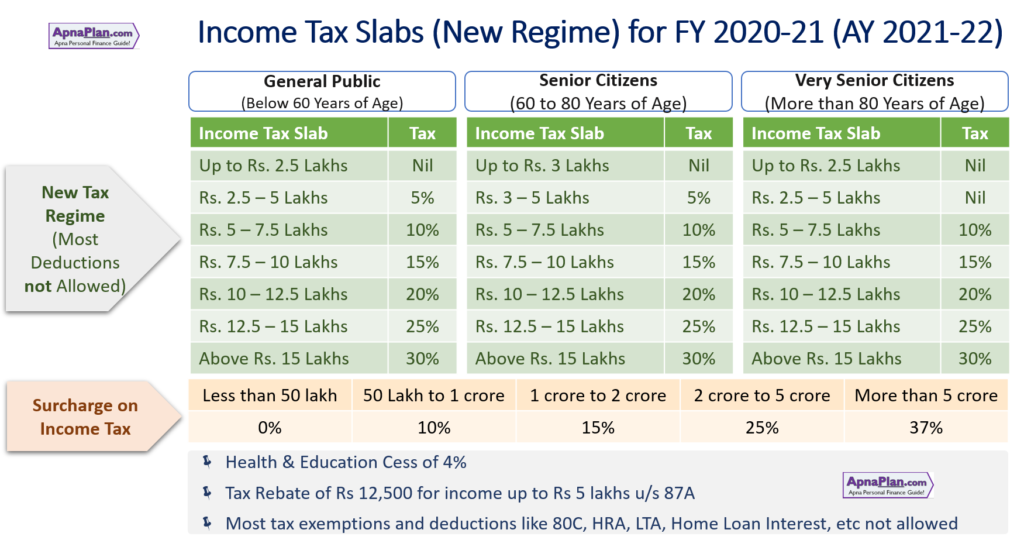

Tax Rates For Ay 2025 25 New Tax Regime Zara B McKivat

Income Tax Calculator Ay 2025 26 New Regime Bambi Christy

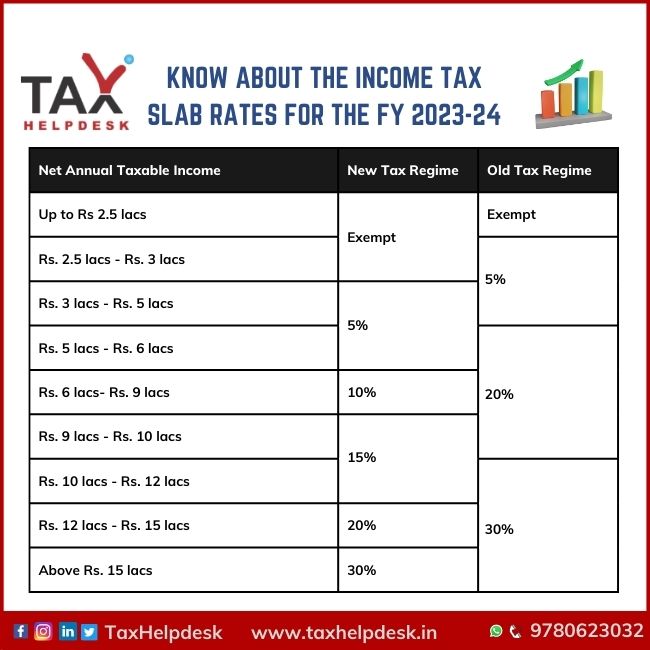

Know About The Income Tax Slab Rates For FY 2023 24

Know The New Income Tax Slab Rates For FY 2023 24 AY 2024 25 By

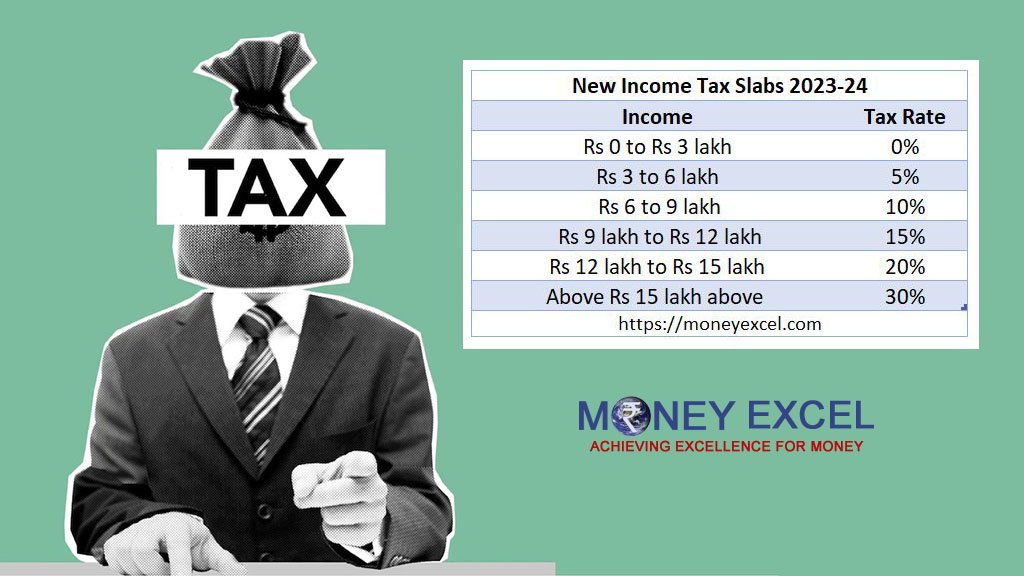

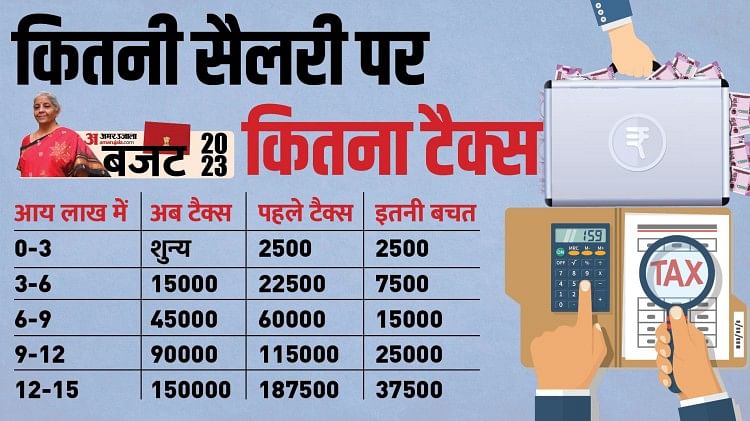

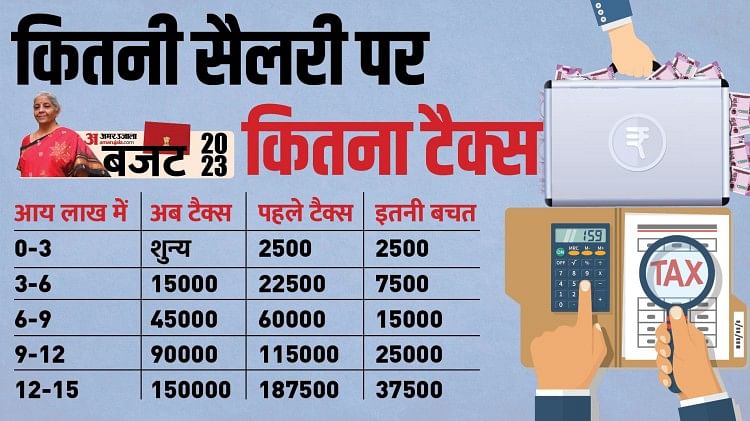

Income Tax Slab Budget 2023 24 Will Income Tax Slab Change In Union

Income Tax Slab Budget 2023 24 Will Income Tax Slab Change In Union

Know The New Income Tax Slab Rates For Fy 2023 24 Ay 2024 25 Eroppa

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 Budget 2021

New Income Tax Slab Rate Announced In Budget 2024 Fy 2024 25 Ay 2025 26

Income Tax Slab For Ay 2022 23 Company - If you are reporting only Canadian source income from taxable scholarships fellowships bursaries research grants capital gains from disposing of taxable Canadian property or from