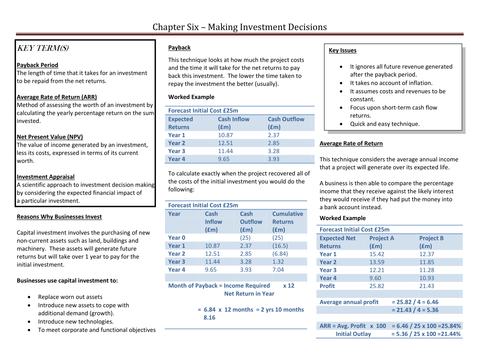

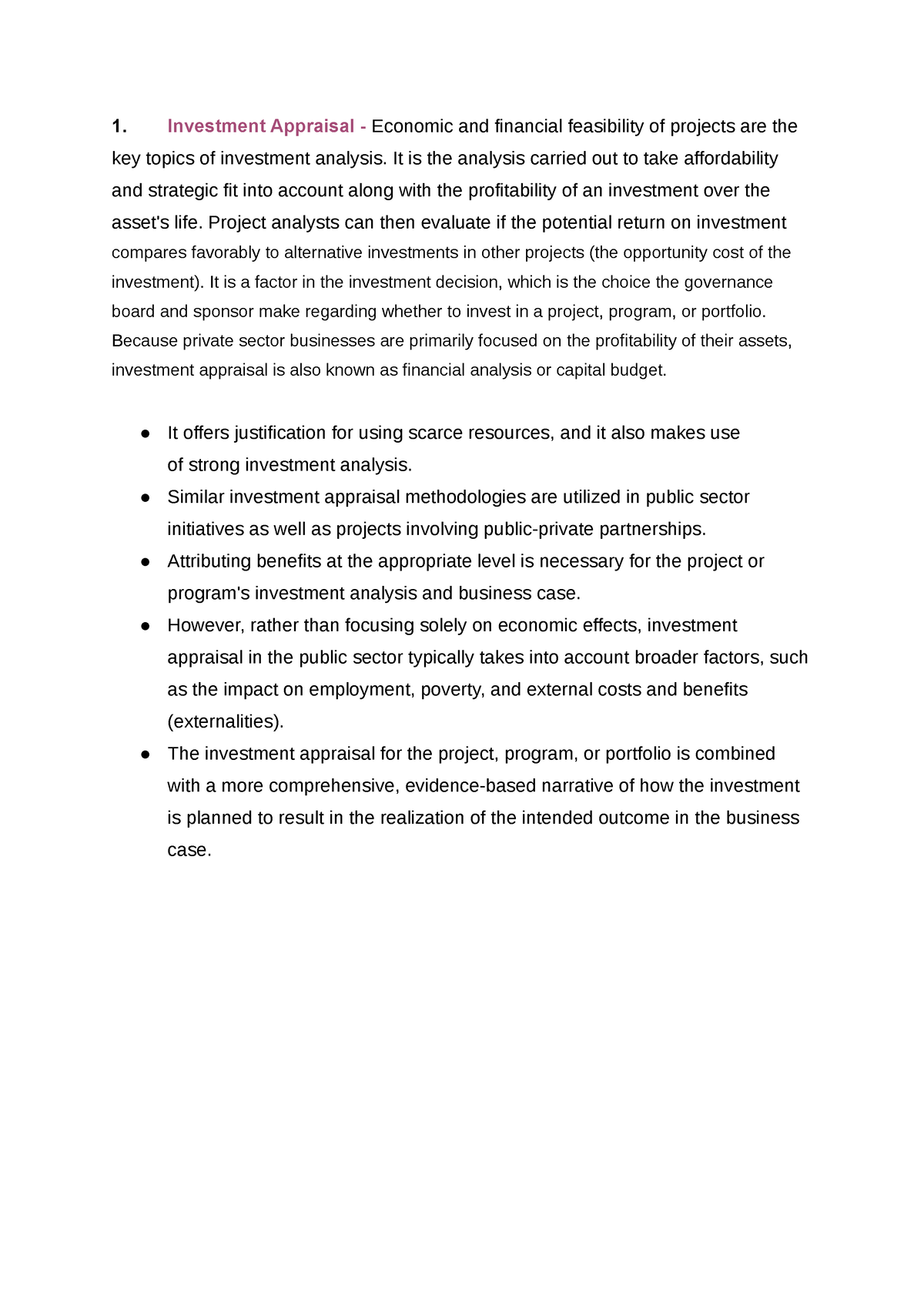

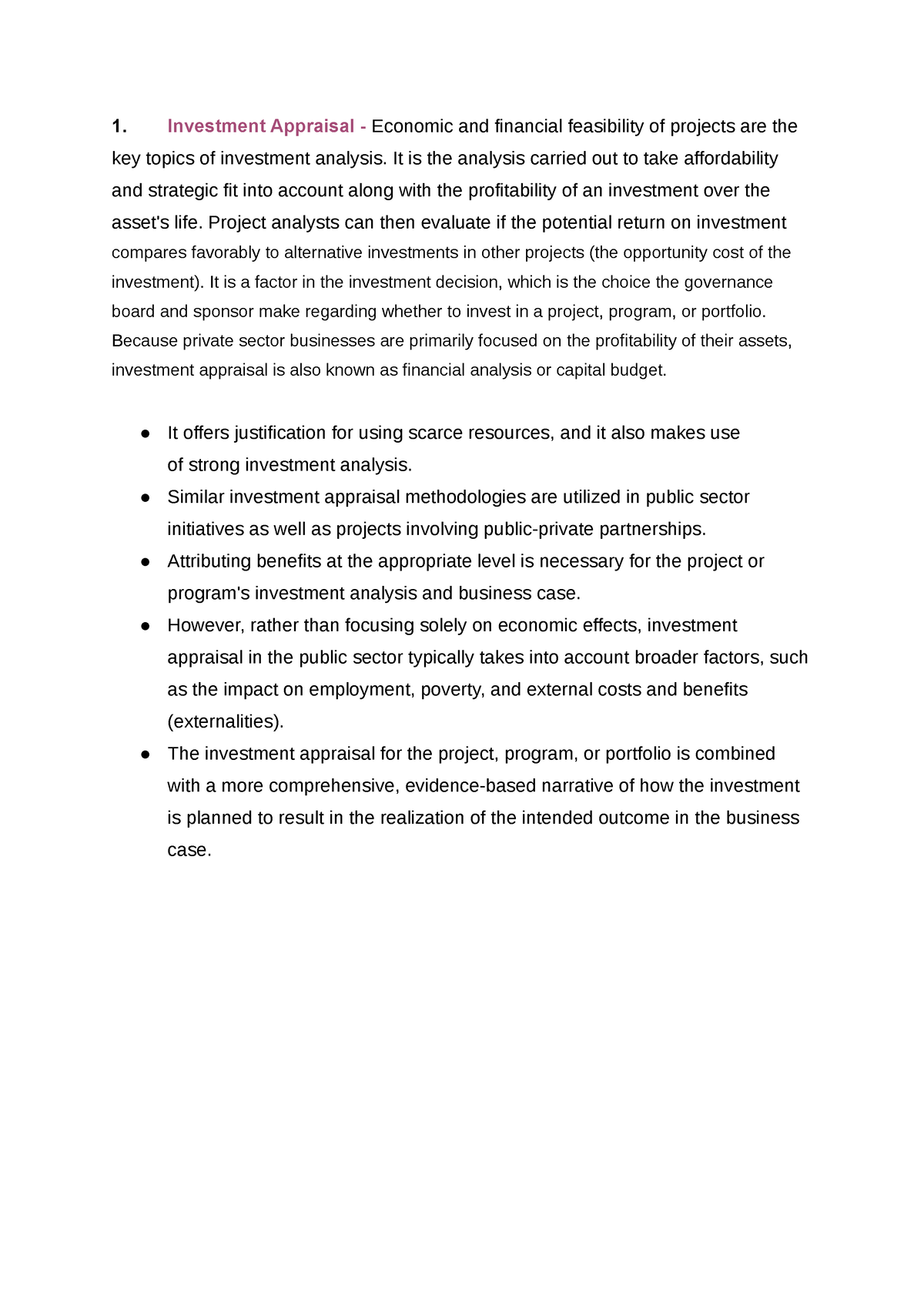

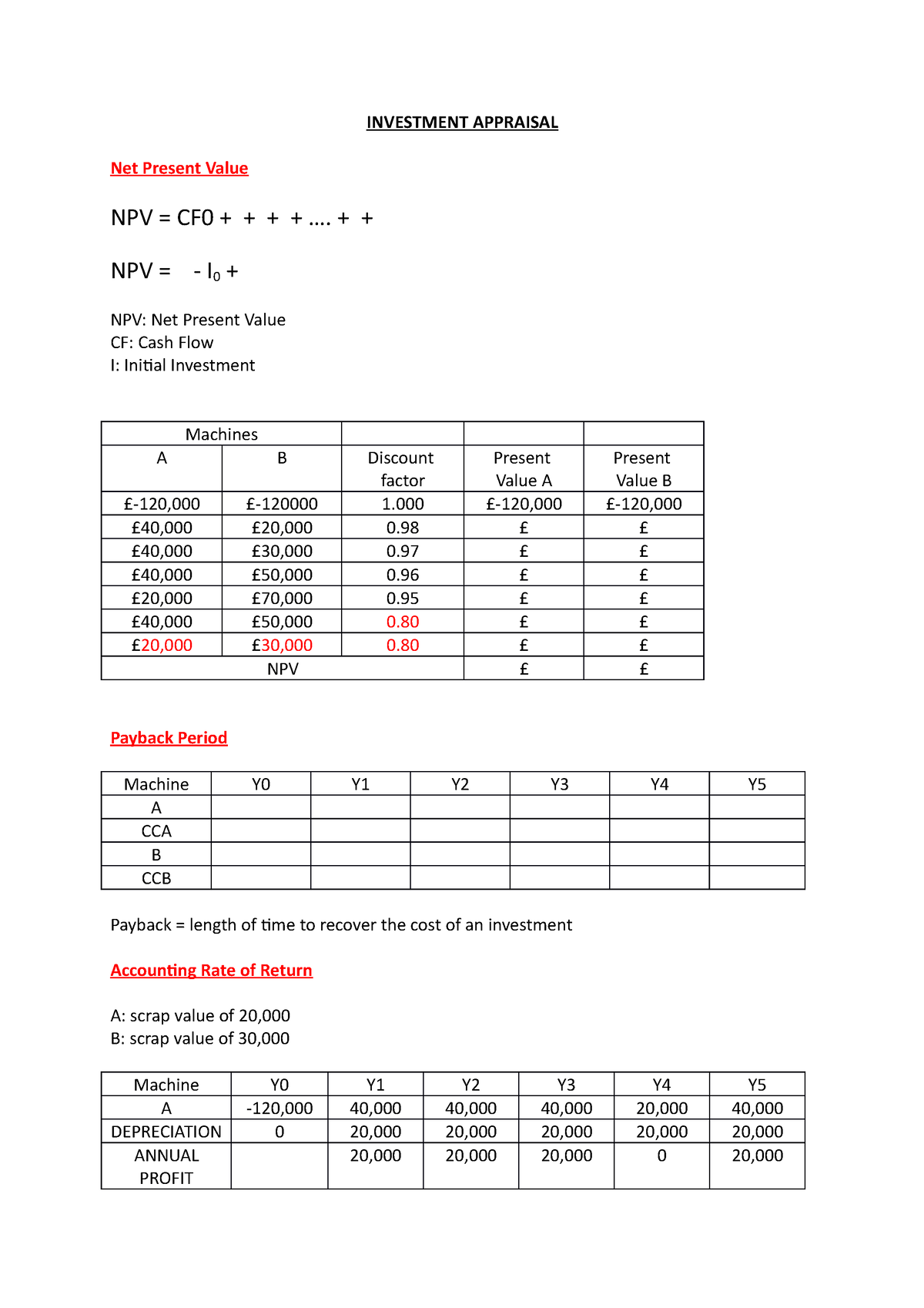

Investment Appraisal Techniques Examples Investment appraisal refers to the techniques used by firms and investors primarily to determine whether an investment is profit making or not The examples include assessing the profitability and affordability of investing in long term projects new products machinery etc

Investment appraisal is a process of analysing whether an investment project is worthwhile or not what is the investment appraisal method The payback period the average rate of return and net present value are the methods that determine a project s value The following points highlight the top seven investment appraisal techniques The techniques are 1 Payback Period Method 2 Accounting Rate of Return Method 3 Net Present Value Method 4 Internal Rate of Return Method 5 Profitability Index Method 6 Discounted Payback Period Method 7 Terminal Value Method Technique 1 Payback Period Method

Investment Appraisal Techniques Examples

Investment Appraisal Techniques Examples

https://dryuc24b85zbr.cloudfront.net/tes/resources/11050908/image?width=500&height=500&version=1518516794331

The Basics Of Investment Appraisal Techniques

https://accountinghubspot.com/wp-content/uploads/2023/09/Investment-appraisal-techniques.jpg

Investment Appraisal And Its Techniques YouTube

https://i.ytimg.com/vi/WQqxis7K5kA/maxresdefault.jpg

Two basic appraisal techniques covered here are Return on Capital Employed ROCE and Payback There are other more sophisticated methods of investment appraisal such as Net Present Value NPV and Internal Rate of Return IRR In this unit we shall describe the various appraisal methods and acquaint you with their relative merits so that you could identify the appropriate method for appraising investment proposals in different situations

Several investment appraisal techniques are available to businesses each with distinct advantages and limitations The most commonly used methods include Net Present Value NPV Internal Rate of Return IRR Payback Period and Accounting Rate of Return ARR To recover the original investment cost but ignores total profits over a project s life Discounted cash flow or DCF for short is an investment appraisal technique which takes into account both the time value of money and also the profitability over a project s life DCF is therefore superior to both ARR and pay back as method of

More picture related to Investment Appraisal Techniques Examples

Investment Appraisal Techniques 3 Nhyira Premium University

https://nhyirapremiumuniversity.com/wp-content/uploads/2019/09/20190919_095722_0000.jpg

Investment Appraisal Techniques YouTube

https://i.ytimg.com/vi/MRpQVn2trL0/maxresdefault.jpg

Investment Appraisal Techniques Teaching Resources

https://dryuc24b85zbr.cloudfront.net/tes/resources/6173742/image?width=500&height=500&version=1389362900000

In this and the following chapters we will be looking at how the Financial Manager should go about making capital investment decisions For example they may have to decide whether or not it is worthwhile investing 1 000 000 in a new factory Alternatively they may have to make the choice between several available investments 2 Our collection of case studies explores how companies utilise various appraisal techniques such as net present value internal rate of return and payback period to assess the viability of investment opportunities These real world examples highlight best practices in evaluating potential returns risks and strategic alignment

[desc-10] [desc-11]

Investment Appraisal In Business Notes Investment Appraisal

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/774ebc46fc51125e911f08208eaad5e0/thumb_1200_1695.png

Investment Appraisal Techniques 2

https://s3.studylib.net/store/data/009418429_1-a823d7e627591b194c08d01bc5d1766b-768x994.png

https://www.wallstreetmojo.com

Investment appraisal refers to the techniques used by firms and investors primarily to determine whether an investment is profit making or not The examples include assessing the profitability and affordability of investing in long term projects new products machinery etc

https://www.studysmarter.co.uk › explanations › ...

Investment appraisal is a process of analysing whether an investment project is worthwhile or not what is the investment appraisal method The payback period the average rate of return and net present value are the methods that determine a project s value

Capital Investment Appraisal Techniques FIN2212 Financial

Investment Appraisal In Business Notes Investment Appraisal

A Level Business Investment Appraisal Lesson Elements Ppt Download

Investment Appraisal INVESTMENT APPRAISAL Net Present Value NPV CF0

Investment Appraisal FundsNet

SOLUTION Lecture 2 Basic Investment Appraisal Techniques With

SOLUTION Lecture 2 Basic Investment Appraisal Techniques With

Lecture 5 Methods Of Investment Appraisal 2 PDF

INVESTMENT APPRAISAL Question 3 ADVANCED INVESTMENT APPRAISAL

Investment Appraisal WORKED ANSWER Part 2 2 YouTube

Investment Appraisal Techniques Examples - Several investment appraisal techniques are available to businesses each with distinct advantages and limitations The most commonly used methods include Net Present Value NPV Internal Rate of Return IRR Payback Period and Accounting Rate of Return ARR