Is Employee Health Insurance Tax Deductible Hi I m wondering which preposition is correct here of or from 1a Peter is an employee of Novartis 2a Peter of Novartis told me he was very busy currently 1b Peter is an

La r gle dit que Les noms f minins se terminant par t ou ti ne prennent pas de e Donc on dit une qualit une sant etc Mais pour Bonsoir A propos d un recrutement et concernant une femme cririez vous Statut employ ou Statut employ e Merci

Is Employee Health Insurance Tax Deductible

Is Employee Health Insurance Tax Deductible

https://i.ytimg.com/vi/UCrvMbkduH8/maxresdefault.jpg

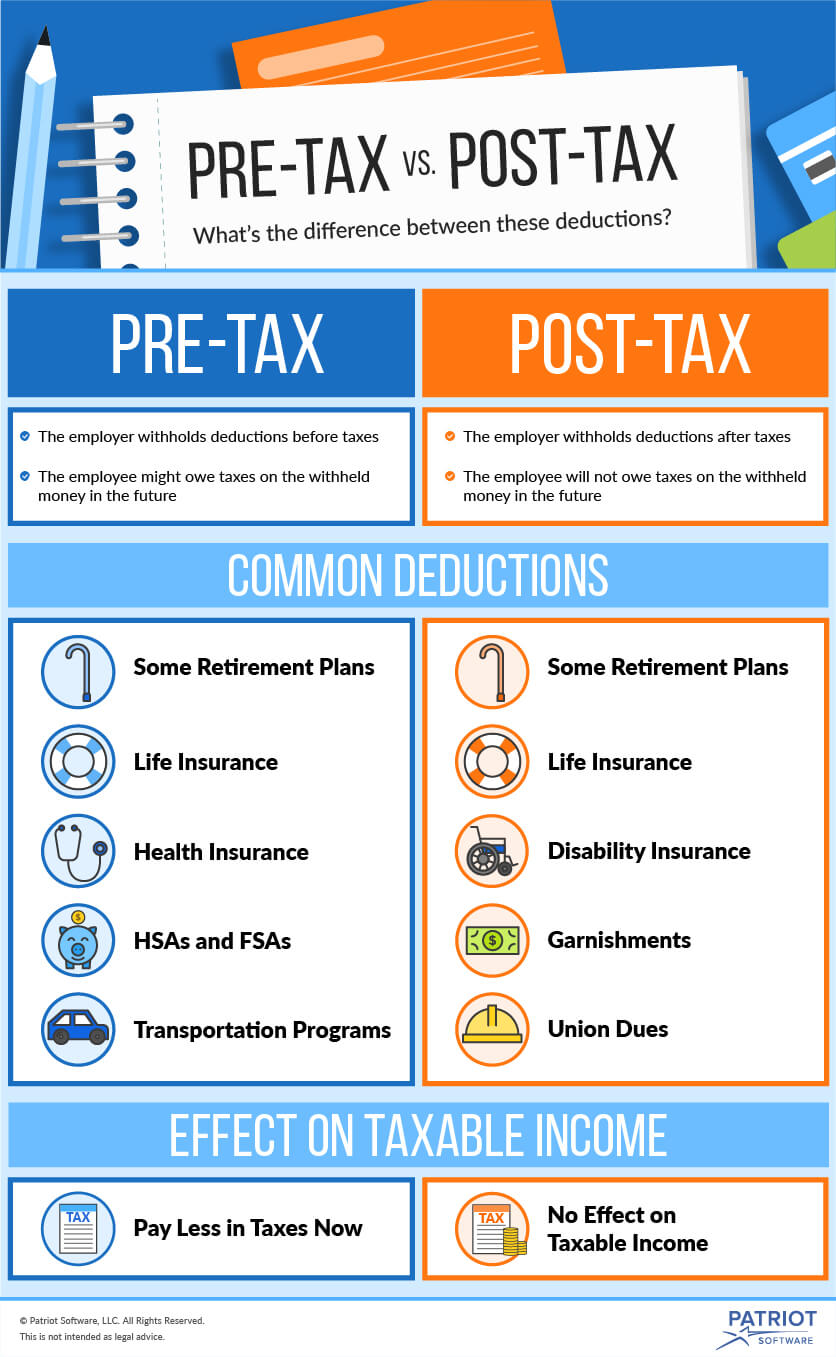

Are Health Insurance Premiums Tax Deductible Insurance Deductible

https://i.pinimg.com/736x/41/18/66/4118660dcdfb923da8f29f18391f22df.jpg

Ghi 2025 Deductible Medical Andrea G Bonner

https://medicarehero.com/wp-content/uploads/2022/09/2023-Medicare-Part-B-Premium-Chart.png

Qual la differenza tra employee e employer Sentiti libero di rispondere con un esempio Il proprietario della domanda ne sar al corrente Solo l utente che ha fatto questa domanda pu Bonjour tous J ai des doutes sur l orthographe administratif ou administrative apr s employ e Les deux sont il possibles Si non lequel des deux

Permanent job a job with no predetermined end date and protections against being fired without warning full time job a job where the employee works at least a minimum number of hours In my opinion I work for a company is the correct option if the company employs me directly i e I work there all year round and they pay me a salary I work with a company

More picture related to Is Employee Health Insurance Tax Deductible

W 2 Doctored Money

https://images.squarespace-cdn.com/content/v1/57a4d128e6f2e1220f6a1d97/1493149012061-4BVJEX5FZG7C1V0ZOGJ1/ke17ZwdGBToddI8pDm48kG4VqDreF-qTqyP-RyQBlzwUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcz9FKOkYZZtCaZTQFz_pq4njr3fQnFjhxZuT9qSS4BtKI42iWDYN3Yj3ILGKtJgbC/image-asset.png

:max_bytes(150000):strip_icc()/deducting-health-insurance-3974024_color3-d4fe1c4e6ba34c979209bc07d53b929e.png)

Are Health Insurance Premiums Tax Deductible

https://www.thebalancemoney.com/thmb/UKXd0IUJg8gSmU1hHw2I6pBBywI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/deducting-health-insurance-3974024_color3-d4fe1c4e6ba34c979209bc07d53b929e.png

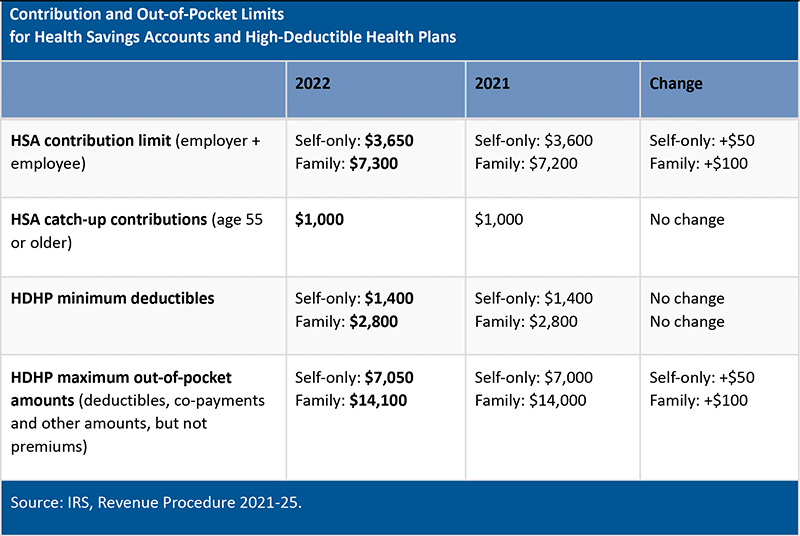

Irs Limits 2024 Miran Minetta

https://wilkecpa.com/wp-content/uploads/2022/03/IRS-table.png

Hi Would you pls comment on which of these seems to be correct and most appropriate 1 A timely exchange of information between company employees is an Hi If I would like to express an idea that an employee is continued to be employed since a date and is still continued to be employed in a foreseeable future is it suitable to use

[desc-10] [desc-11]

Ghi 2024 Deductible Vs Ibbie Laverne

https://www.insurancefortexans.com/hs-fs/hubfs/Health Insruance Deductible Comparison.png?width=3000&name=Health Insruance Deductible Comparison.png

Hsa 2025 Maximum Limit Hsa Annette J Young

https://helpdesksuites.com/wp-content/uploads/2022/05/2023-IRS-HSA-Limits-V8z6Yv.png

https://forum.wordreference.com › threads

Hi I m wondering which preposition is correct here of or from 1a Peter is an employee of Novartis 2a Peter of Novartis told me he was very busy currently 1b Peter is an

https://www.question-orthographe.fr › question › une-employe-ou-une-u…

La r gle dit que Les noms f minins se terminant par t ou ti ne prennent pas de e Donc on dit une qualit une sant etc Mais pour

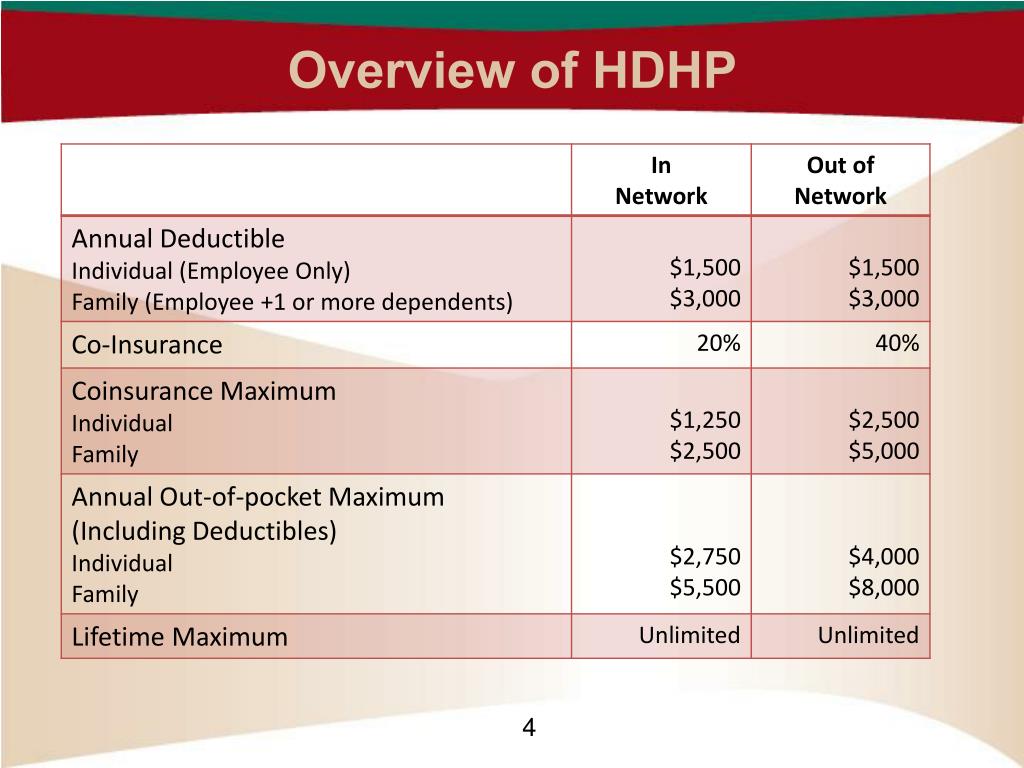

2025 Hdhp Minimum Deductible Jeffrey A Taub

Ghi 2024 Deductible Vs Ibbie Laverne

High Deductible Health Plan Definition 2024 Ilysa Raquel

Part B Cost For 2025 Mary T Lambert

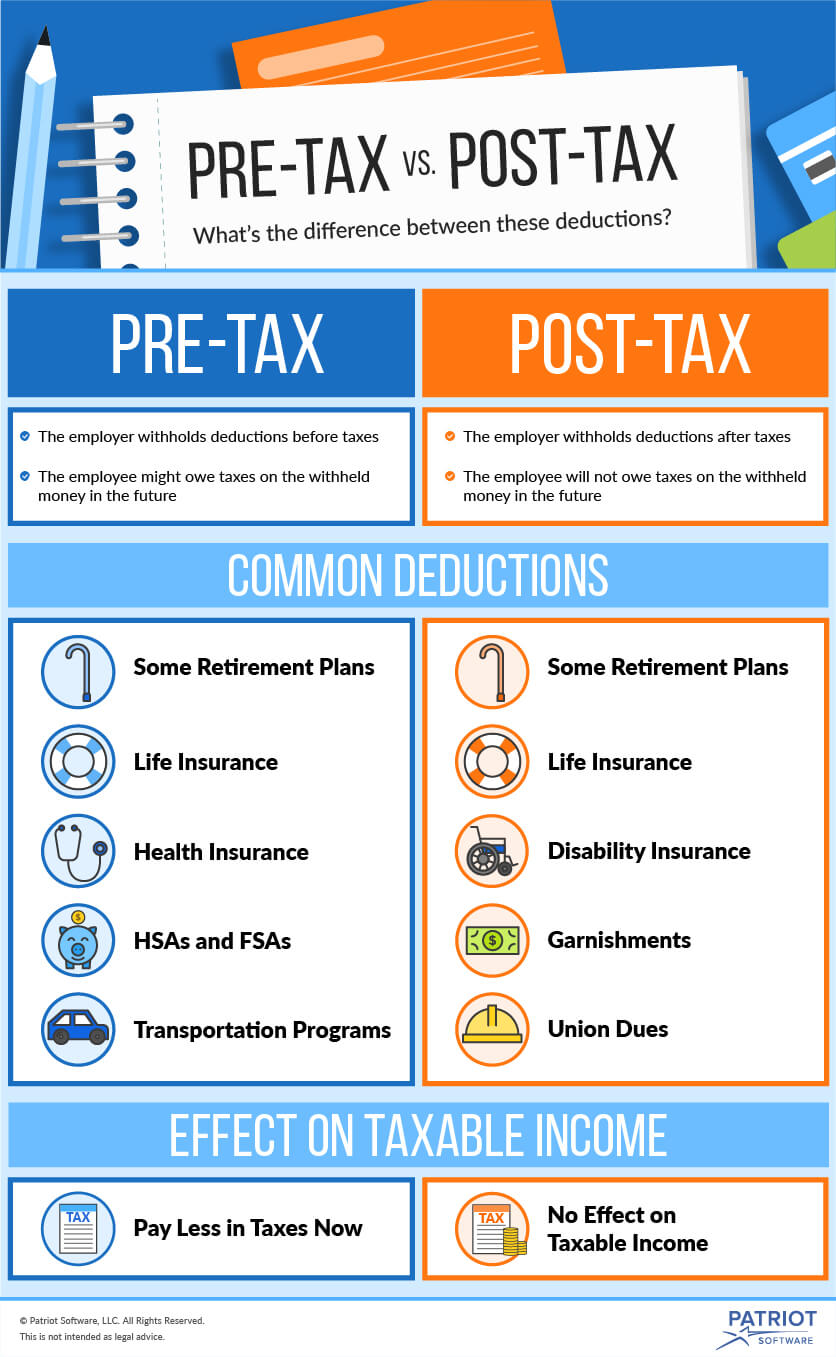

5 Year End Medical Plan Tax Deduction Strategies

Are Employee Contributions To Health Insurance Tax Deductible The

Are Employee Contributions To Health Insurance Tax Deductible The

:max_bytes(150000):strip_icc()/Are-health-insurance-premiums-tax-deductible-4773286_v1-dbe23582da6346498c4596ab0bfa05f2.jpg)

Are Health Insurance Premiums Tax Deductible Employee Health Insurance

High Deductible Health Plan 2024 Sissy Ealasaid

Health Insurance Logo Health Symbol Icon And Two Hands Vector Logo

Is Employee Health Insurance Tax Deductible - [desc-14]