Is Tax Deducted Every Month Income tax Personal business corporation trust international and non resident income tax

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income tax Information on taxes including filing taxes and get tax information for individuals businesses charities and trusts Income tax

Is Tax Deducted Every Month

Is Tax Deducted Every Month

https://i.ytimg.com/vi/q9D4nTuByxI/maxresdefault.jpg

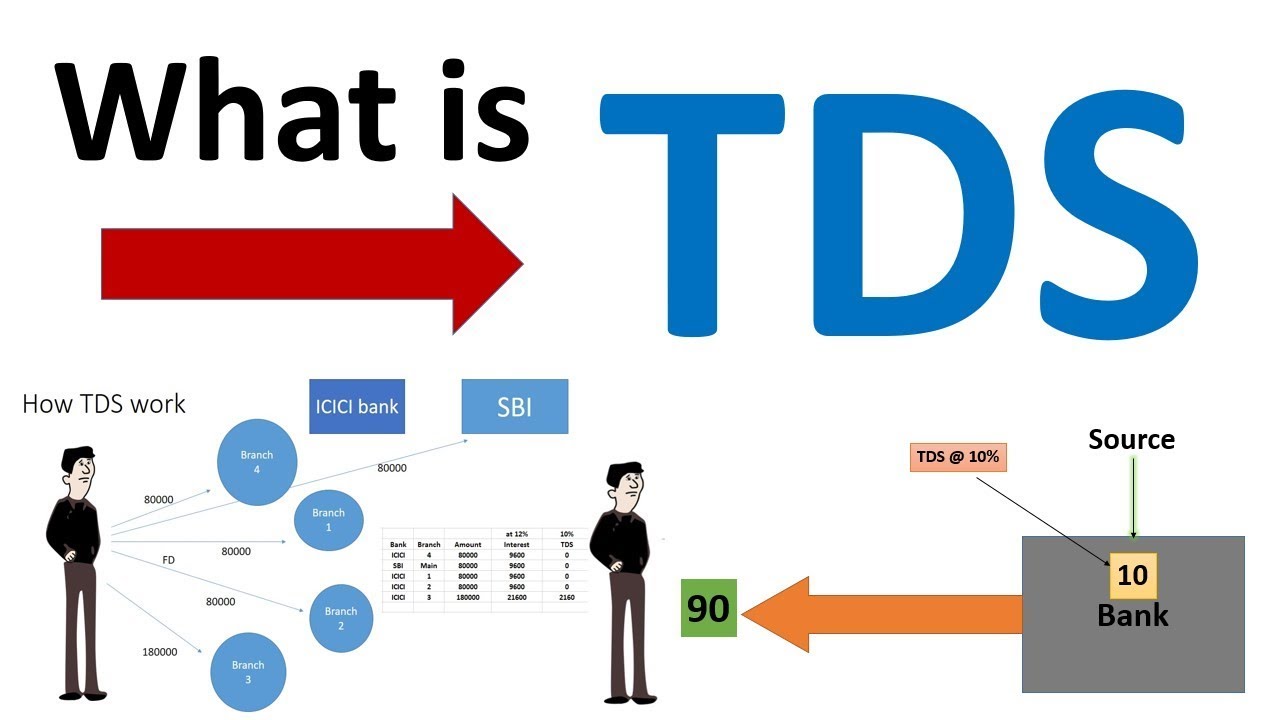

1 What Is Tax Deducted At Source TDS YouTube

https://i.ytimg.com/vi/ehDvKY4dYvo/maxresdefault.jpg

What Is Tax Deducted At Source And Tax Collected At Source YouTube

https://i.ytimg.com/vi/5MMOv9vN6qs/maxresdefault.jpg

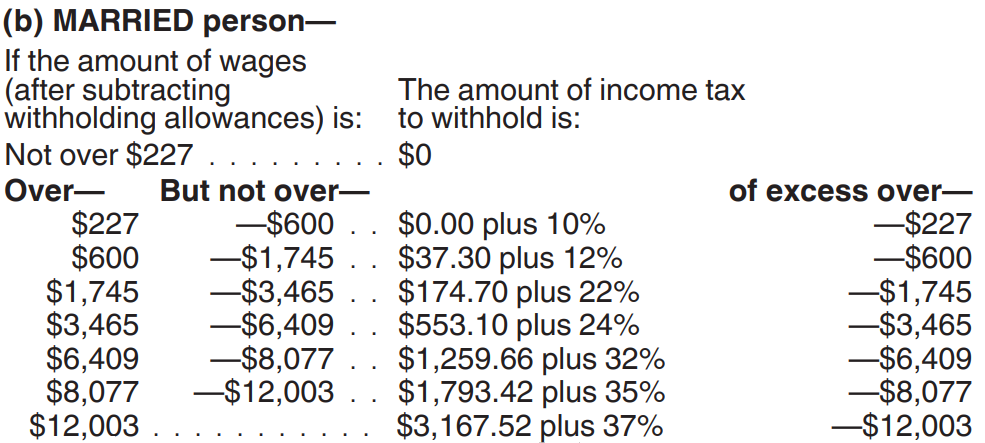

The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown below the This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a

Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund or

More picture related to Is Tax Deducted Every Month

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

https://i.ytimg.com/vi/lBO3PaW69Mc/maxresdefault.jpg

Request Letter To Stop Deduction From Salary Request Letter For Stop

https://i.ytimg.com/vi/T2IaPwOvIX4/maxresdefault.jpg

What Is TDS Tax Deduction At Source How To Calculate TDS Tax

https://i.ytimg.com/vi/3f8bcJMUGpQ/maxresdefault.jpg

When using certified tax software the Auto fill my return service automatically fills in parts of your income tax and benefit return with information that the CRA has available at the time Canada child benefit The CCB is a non taxable amount paid monthly to help eligible families with the cost of raising children under 18 years of age The CCB may include an additional amount for the

[desc-10] [desc-11]

What Is Tax Deducted At Source TDS Top Points To Note YouTube

https://i.ytimg.com/vi/RFQAywgMD-g/maxresdefault.jpg

What Is TDS TDS Tax Deducted At Source Income Tax Concepts

https://i.ytimg.com/vi/6qDlSOaJKNg/maxresdefault.jpg

https://www.canada.ca › en › services › taxes › income-tax

Income tax Personal business corporation trust international and non resident income tax

https://www.canada.ca › en › revenue-agency › services › tax › individuals …

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income tax

38 Tax Deducted At Source TDS Section 51 Of CGST Act IDT Hindi

What Is Tax Deducted At Source TDS Top Points To Note YouTube

Ouida Minor

WHAT IS TDS Tax Deducted At Source Source Of Income Tax

Tax Dejamor

Pin On Tax Deducted At Source TDS

Pin On Tax Deducted At Source TDS

Pin On Income Tax Blogs

TDS Tax Deducted At Source Is A System Under Which A Specified

Tax Bachao

Is Tax Deducted Every Month - Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services