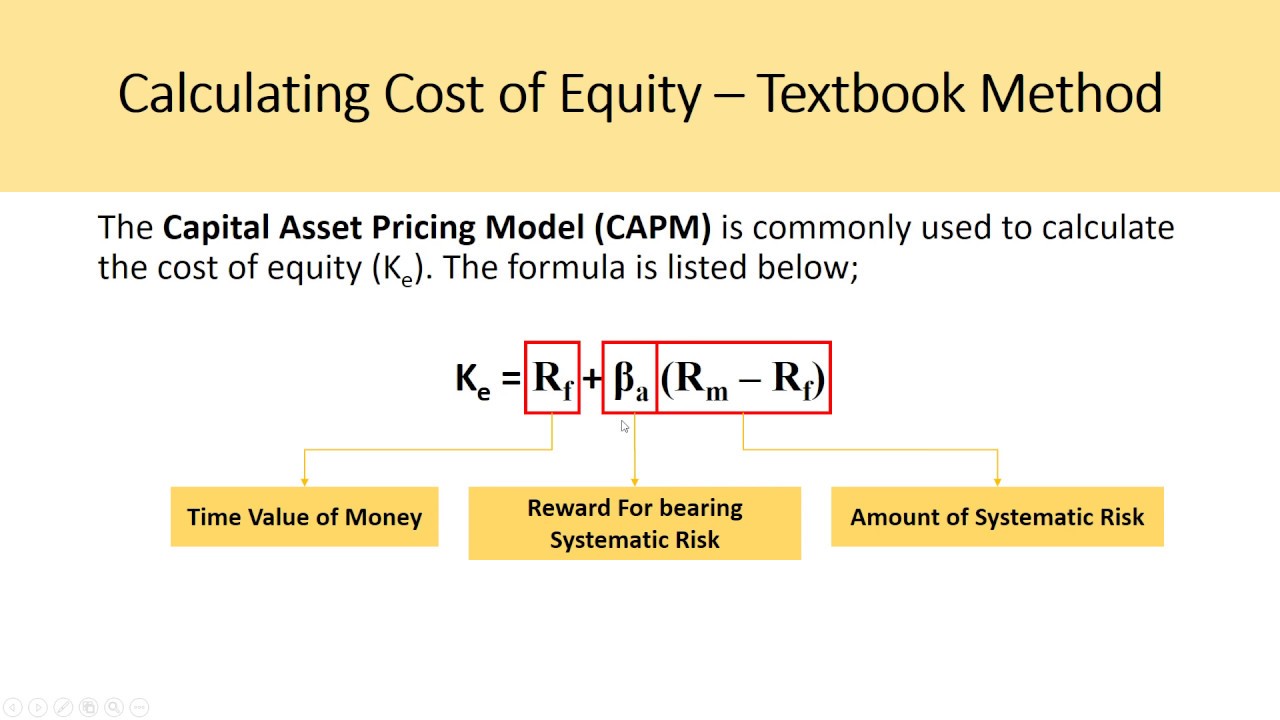

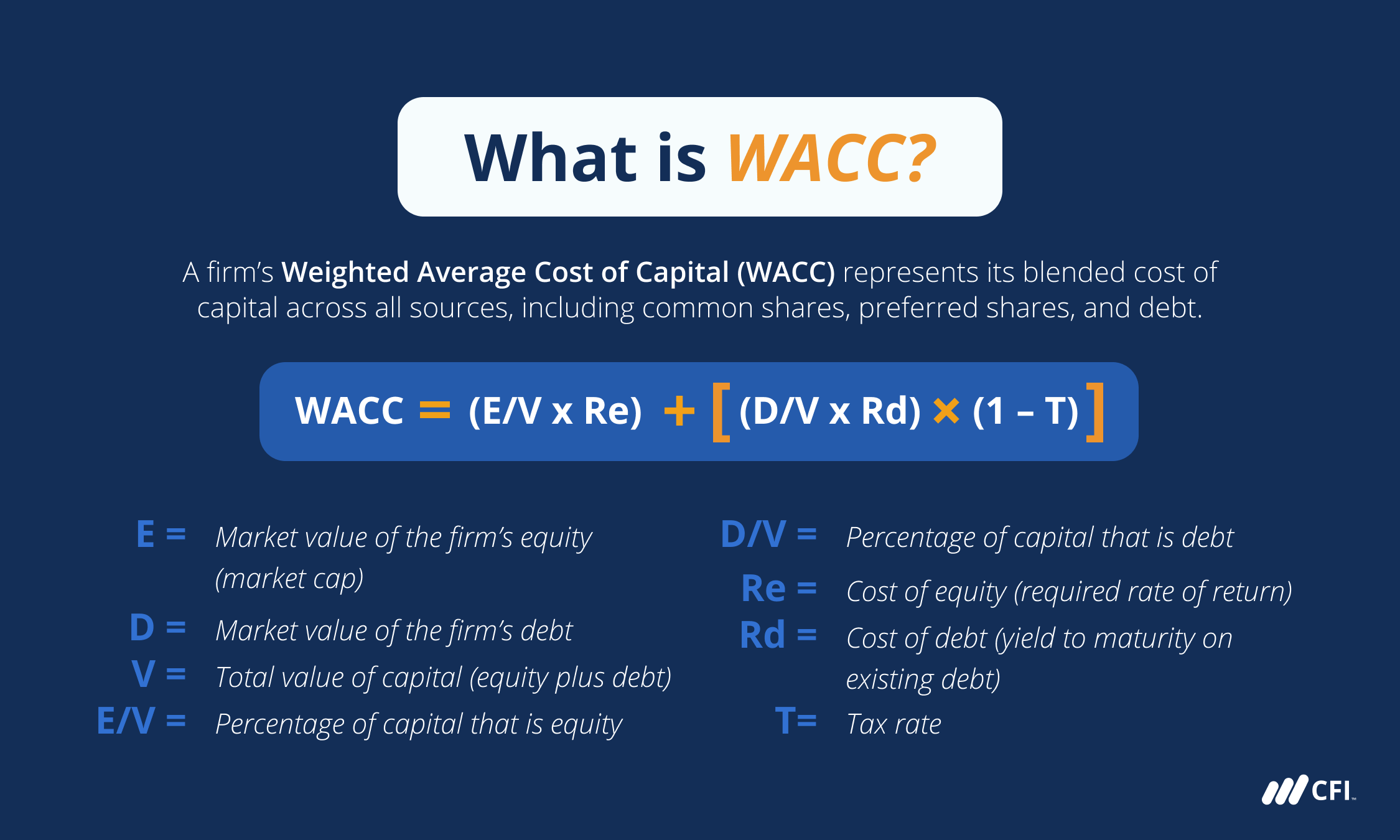

Is Wacc And Cost Of Equity The Same A firm s Weighted Average Cost of Capital WACC represents its blended cost of capital across all sources including common shares preferred shares and debt The cost of each type of

The WACC is the rate at which a company s future cash flows need to be discounted to arrive at a present value PV for the business It reflects the perceived riskiness The weighted average cost of capital WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets The WACC is commonly referred to as

Is Wacc And Cost Of Equity The Same

Is Wacc And Cost Of Equity The Same

https://i.ytimg.com/vi/zirujoiyL28/maxresdefault.jpg

Estimating Cost Of Equity For WACC DCF Model Insights YouTube

https://i.ytimg.com/vi/ZigyWoDAMrE/maxresdefault.jpg

WACC Weighted Average Cost Of Capital WACC Formula And Cost Of

https://i.ytimg.com/vi/MUpCQyKeFgI/maxresdefault.jpg

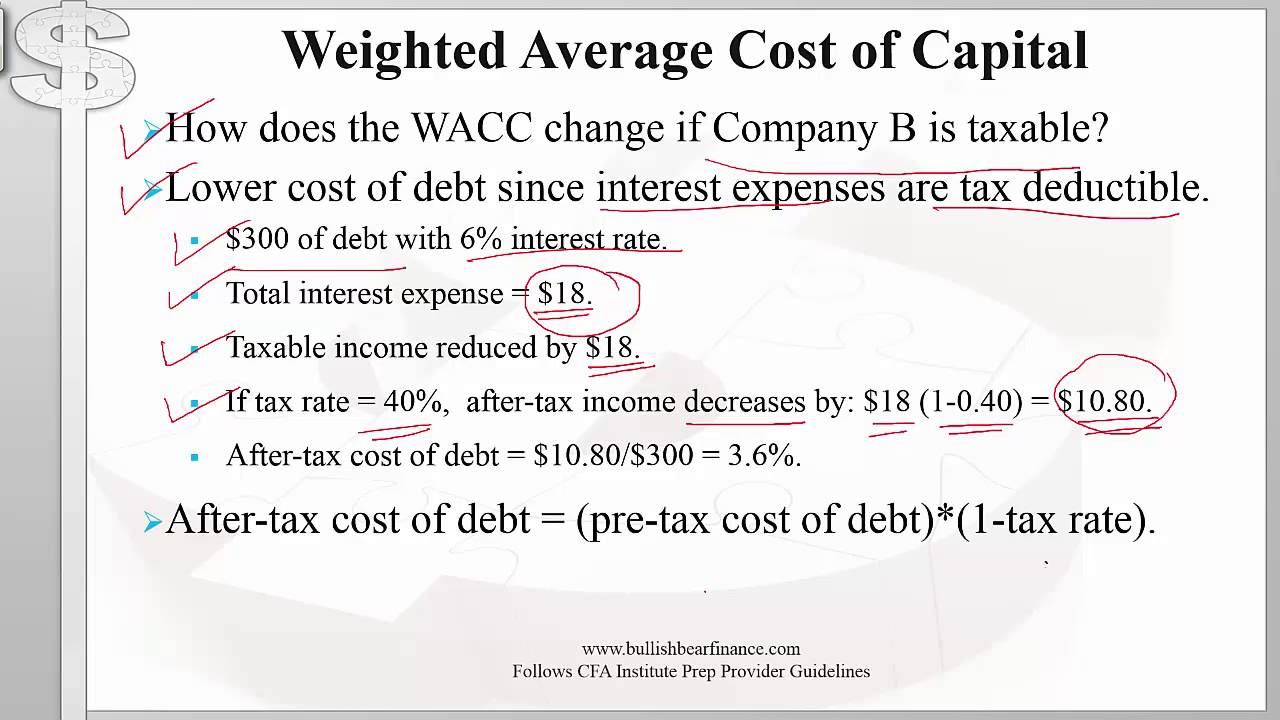

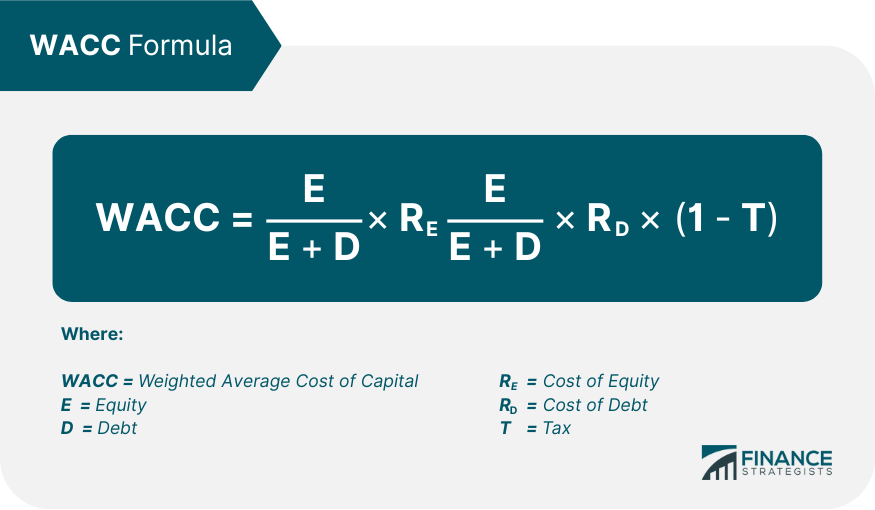

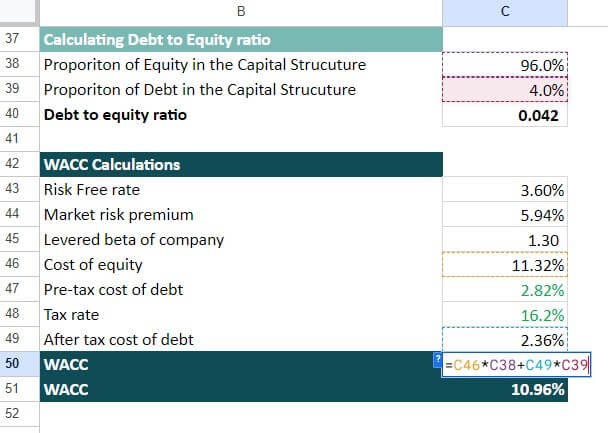

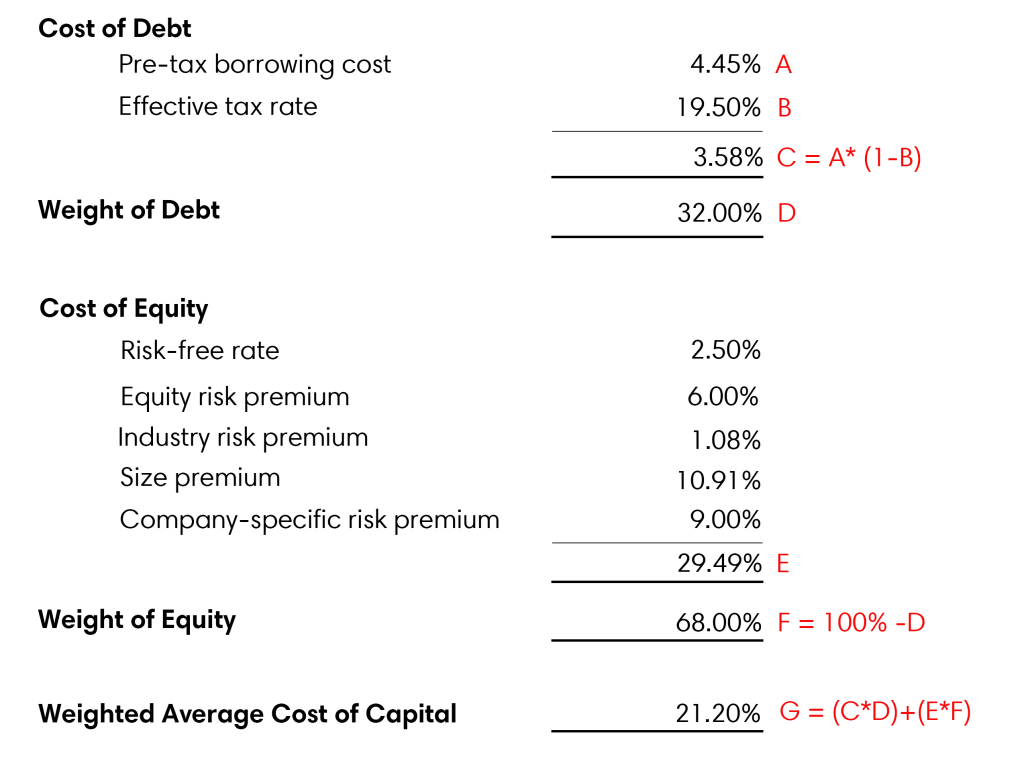

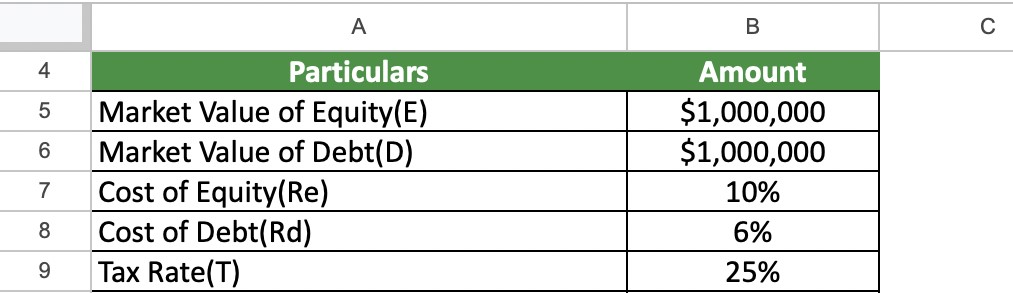

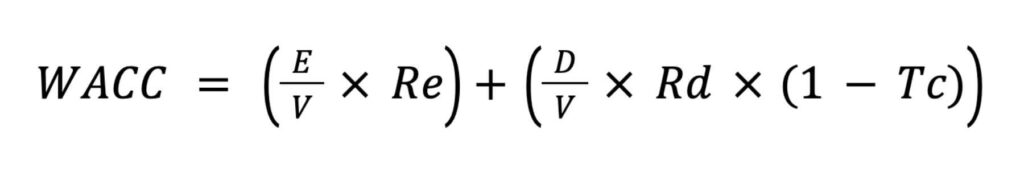

WACC is the weighted average of a company s debt and its equity cost Weighted Average Cost of Capital equation assumes that capital markets both debt and equity in any given industry Learn how to calculate WACC and use it to assess investments set discount rates and improve capital budgeting decisions

Definition The weighted average cost of capital WACC is a financial ratio that calculates a company s cost of financing and acquiring assets by comparing the debt and equity structure The weighted average cost of capital WACC is the implied interest rate of all forms of the company s debt and equity financing which is weighted according to the

More picture related to Is Wacc And Cost Of Equity The Same

ZWCAD India Best 2D 3D CAD Software Hope Technologies 46 OFF

https://www.financestrategists.com/uploads/WACC-Formula.png

WACC Formula Excel Overview Calculation And Example 49 OFF

https://cdn.educba.com/academy/wp-content/uploads/2020/04/Eg2-Step3-3.jpg

WACC Adalah Archives Kledo Blog

https://kledo.com/blog/wp-content/uploads/2022/09/wacc-adalah-01.jpg

The Weighted Average Cost of Capital WACC is a financial metric that represents the average rate of return a company must generate on its existing assets to satisfy all its security holders The Weighted Average Cost of Capital WACC is a financial metric that represents the average cost of the various sources of financing equity debt preferred stock

[desc-10] [desc-11]

4 Innovative Methods To Calculate WACC Resourceful EduCBA

https://cdn.educba.com/academy/wp-content/uploads/2013/12/Weighted-Average-Cost-of-Capital-WACC.jpg

WACC Formula Cost Of Capital Plan Projections

https://www.planprojections.com/wp-content/uploads/wacc-formula.png

https://corporatefinanceinstitute.com › resources...

A firm s Weighted Average Cost of Capital WACC represents its blended cost of capital across all sources including common shares preferred shares and debt The cost of each type of

https://www.wallstreetprep.com › knowledge › wacc

The WACC is the rate at which a company s future cash flows need to be discounted to arrive at a present value PV for the business It reflects the perceived riskiness

Wacc Calculator Cheap Sale Cityofclovis

4 Innovative Methods To Calculate WACC Resourceful EduCBA

Weighted Average Cost Of Capital WACC Calculator

What Is WACC Davis Martindale Blog

What Is WACC How Companies Investors And You Can Use It

WACC Calculation Finance Investing Finance Lessons Accounting And

WACC Calculation Finance Investing Finance Lessons Accounting And

Wacc Excel Template

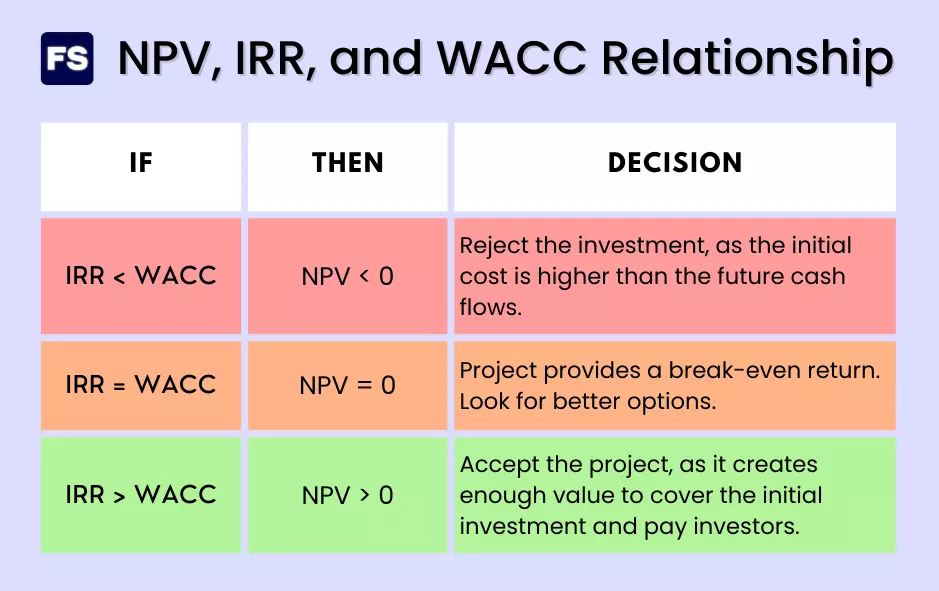

IRR Greater Than WACC Do You Know What It Means

What Is Weighted Average Cost Of Capital WACC Forage

Is Wacc And Cost Of Equity The Same - Learn how to calculate WACC and use it to assess investments set discount rates and improve capital budgeting decisions