Payout Ratio Definition Not surprisingly XYZ cuts its dividend in half soon thereafter At the current payout the dividend could bleed the company dry unless earnings improved dramatically And even if it did saving money on future dividends allows it to rebuild its cash hoard Now for a more pleasant example let s look at company ABC

Thus the ratio is one way to identify growth companies Dividend payout ratios and thus plowback ratios are significantly influenced by a company s choices of accounting methods For example different depreciation methods affect a company s earnings per share which affects the dividend payout ratio It is important to understand that capital needs and investor expectations vary from industry to industry which is why comparison of dividends and dividend payout ratio ratios is generally most meaningful among companies within the same industry and the definition of a high or low ratio should be made within this context

Payout Ratio Definition

Payout Ratio Definition

https://i.ytimg.com/vi/B9066sRaZWs/maxresdefault.jpg

Dividend Payout Ratio Definition Formula Importance Pros

https://www.financestrategists.com/uploads/featured/Dividend_Payout_Ratio-scaled.jpg

Dividend Payout Ratio Explained With Examples YouTube

https://i.ytimg.com/vi/L2J1tDOfz64/maxresdefault.jpg

Using this information and the formula above we can calculate that Company XYZ s accounts payable turnover ratio is Payables Turnover Ratio 8 000 000 400 000 20 By dividing 365 days by the ratio we find that Company XYZ takes about 18 days to turn over its accounts payable Why Does the Accounts Payable Turnover Ratio Matter 16 Dividend Payout Ratio The dividend payout ratio measures the total amount of dividends a company pays to its shareholders relative to its net income Expressed as a percentage it indicates the proportion of earnings that get distributed as dividends making it an important financial ratio for investors

SGR is calculated by subtracting the company s dividend payout ratio ie the portion of net income distributed to stockholders in the form of dividends from 1 Next multiply that number by the company s ROE Sustainable Growth Rate Example Say that Company DEF and Company GHI have the same ROE but offer a different dividend payout ratio How Does the Price to Free Cash Flow Ratio P FCF Work The formula for the price to free cash flow ratio is Price to Free Cash Flow Market Capitalization Free Cash Flow For example let s assume that Company XYZ has 10 000 000 shares outstanding which are trading at 3 per share The company also recorded 15 000 000 of free cash flow

More picture related to Payout Ratio Definition

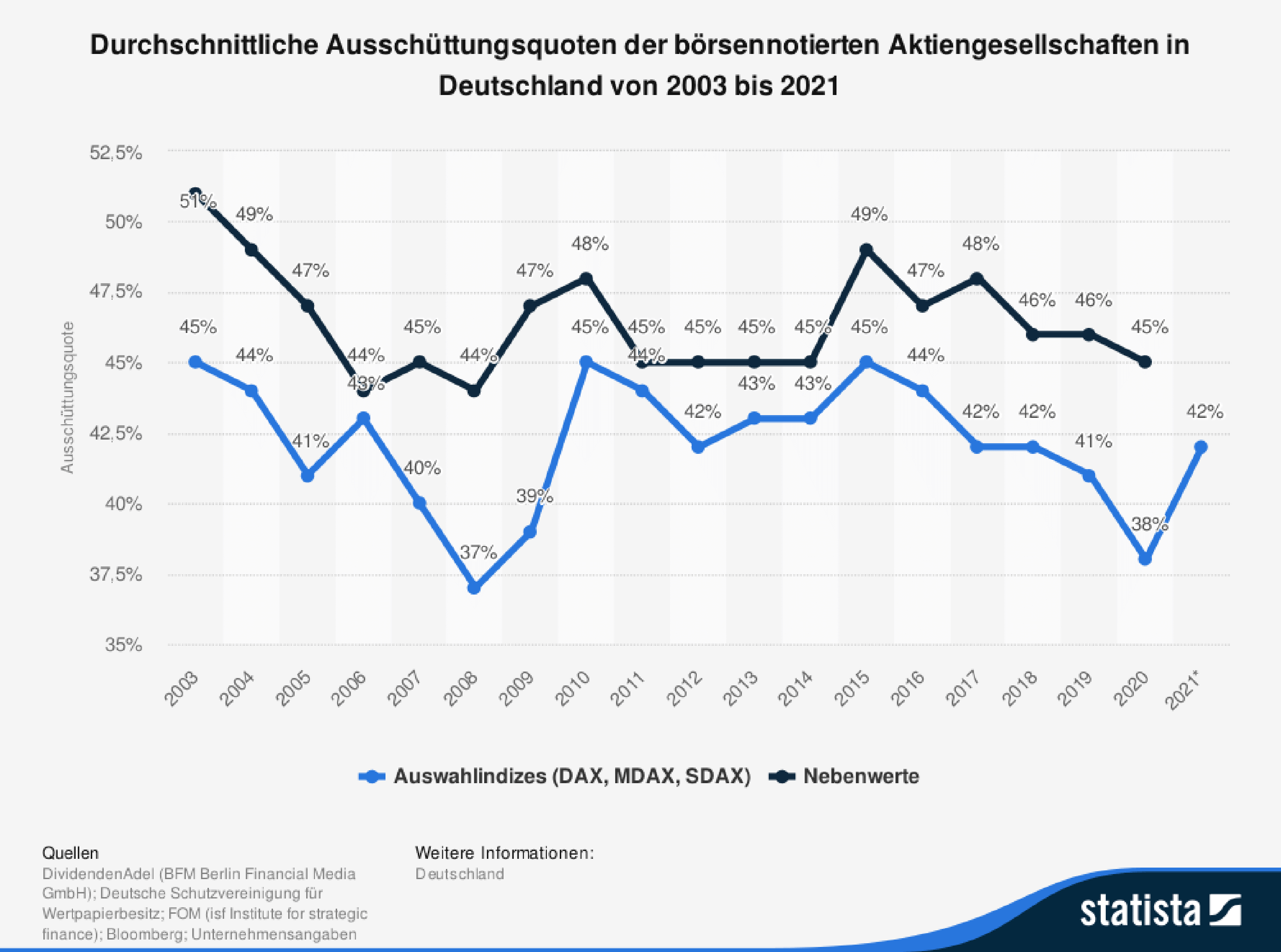

Payout Ratio Definition Erkl rung Beispiele bungsfragen

https://www.bwl-lexikon.de/app/uploads/ausschuettungsquote.png

Dividend Payout Ratio Definition Formula And Calculation

https://fincareplan.com/wp-content/uploads/2023/02/dividend-payout-ratio-1024x580.webp

Dividend Payout Ratio Formula Calculation with Examples YouTube

https://i.ytimg.com/vi/2swHb1ixeNI/maxresdefault.jpg

The price to tangible book value ratio excludes the book value of a company s intellectual property and other intangible assets such as patents and goodwill As such it represents what debtholders or investors would receive if the company liquidated its physical assets assuming that it could get book value for all of those assets As with all financial metrics the debt to equity ratio is only part of the whole picture By itself a low debt to equity ratio may not mean that a company is a good potential investment For example if a company took on debt for expansion purposes their debt to equity ratio may be high this year but it may be a positive sign of growth

[desc-10] [desc-11]

Dividend Payout Ratio Definition Formula Calculation

https://media.freshbooks.com/wp-content/uploads/2021/12/Dividend-payout-ratio.jpg

:max_bytes(150000):strip_icc()/dividend-payout-ratio-467a402bdfc64645b0b476ee17e59074.jpg)

Dividend Payout Ratio Definition Formula And Calculation 56 OFF

https://www.investopedia.com/thmb/EqKy9hRHKnP1stJuAcDU0J6oRNI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/dividend-payout-ratio-467a402bdfc64645b0b476ee17e59074.jpg

https://investinganswers.com › articles › dividend-coverages-payout-rati…

Not surprisingly XYZ cuts its dividend in half soon thereafter At the current payout the dividend could bleed the company dry unless earnings improved dramatically And even if it did saving money on future dividends allows it to rebuild its cash hoard Now for a more pleasant example let s look at company ABC

https://investinganswers.com › dictionary › plowback-ratio

Thus the ratio is one way to identify growth companies Dividend payout ratios and thus plowback ratios are significantly influenced by a company s choices of accounting methods For example different depreciation methods affect a company s earnings per share which affects the dividend payout ratio

Dividend Payout Ratio Definition YouTube

Dividend Payout Ratio Definition Formula Calculation

Payout Ratio Definition Und Berechnung MyDividends24

Dividend Payout Ratio Definition And Formula

What Is A Dividend Payout Ratio Definition Calculation Importance

/Calculating-the-Interest-Coverage-Ratio-583b85933df78c6f6a385242.jpg)

Payout Ratio Definition

/Calculating-the-Interest-Coverage-Ratio-583b85933df78c6f6a385242.jpg)

Payout Ratio Definition

Dividend Payout Ratio Definition Formula And Analysis FinTok

:max_bytes(150000):strip_icc()/PlowbackRatio_Final_4191233-9ed4810e17e14c93972fec8f1eb7f21c.png)

Target Payout Ratio Definition And Example 42 OFF

Payout Ratio Definition Berechnung DeltaValue

Payout Ratio Definition - Using this information and the formula above we can calculate that Company XYZ s accounts payable turnover ratio is Payables Turnover Ratio 8 000 000 400 000 20 By dividing 365 days by the ratio we find that Company XYZ takes about 18 days to turn over its accounts payable Why Does the Accounts Payable Turnover Ratio Matter