Payroll Tax Tables 2025 Ground Floor Finance House Building Government Office Complex Kingsway Road Maseru 266 22 313796 Toll Free 8002 2009 info rsl ls

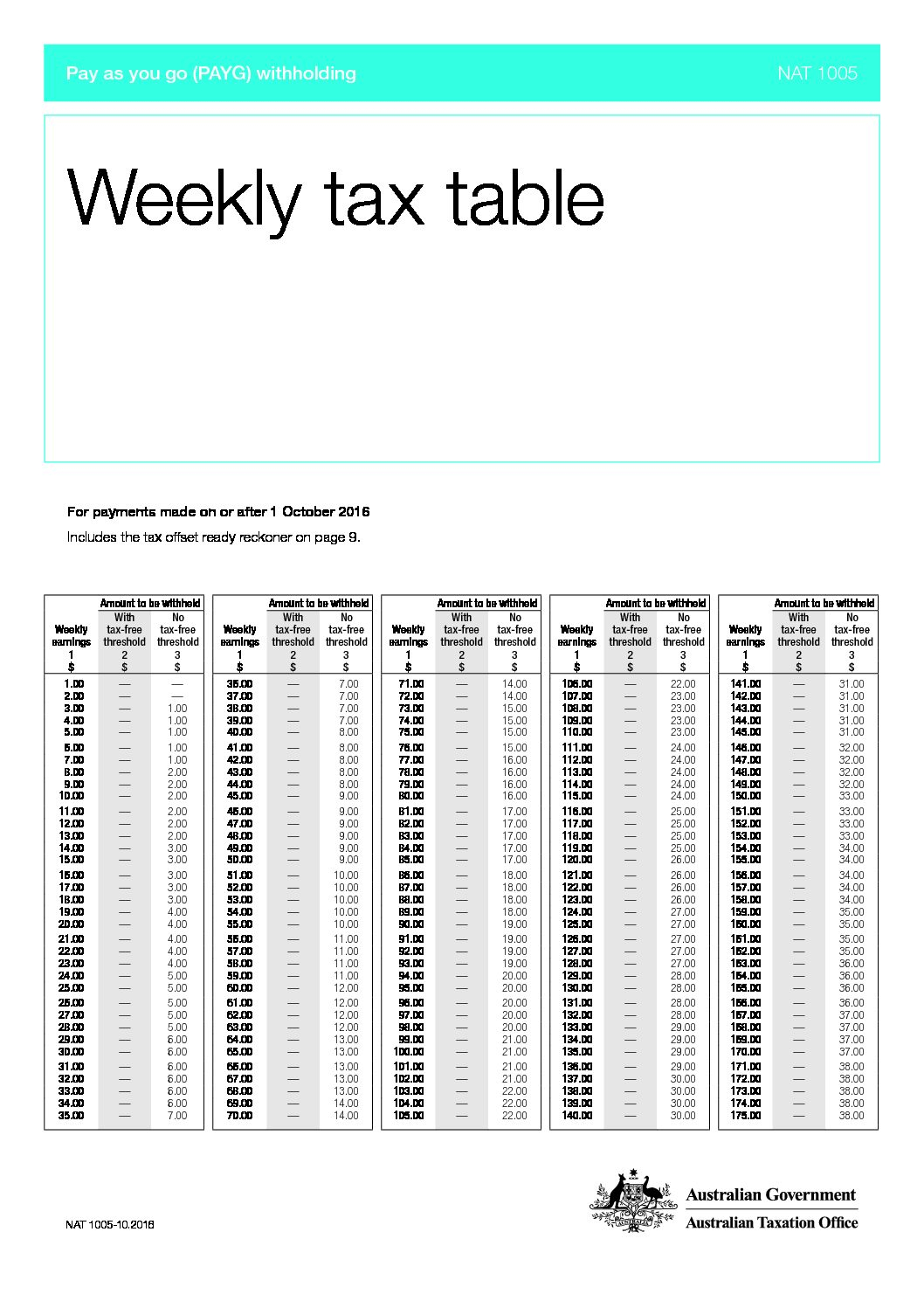

Lesotho Personal Income Tax Tables in 2025 The Income tax rates and personal allowances in Lesotho are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Lesotho Tax Calculator 2025 1 Percentage Method Tables for Automated Payroll Systems and Withholding on Periodic Payments of Pensions and Annuities 2 Wage Bracket Method Tables for Manual Payroll Systems With Forms W 4 From 2020 or Later 3 Wage Bracket Method Tables for Manual Payroll Systems With Forms W 4 From 2019 or Earlier 4

Payroll Tax Tables 2025

Payroll Tax Tables 2025

https://www.pherrus.com.au/wp-content/uploads/2022/02/Payroll-Tax-vs-Income-Tax.png

Payroll Tax Rates And Contribution Limits For 2023

https://www.payrollpartners.com/wp-content/uploads/2023/02/February-20-2023-1536x1152.jpg

Annual Bonus Tax Calculator KE Tax 2024

https://ke.icalculator.com/img/og/KE/65.png

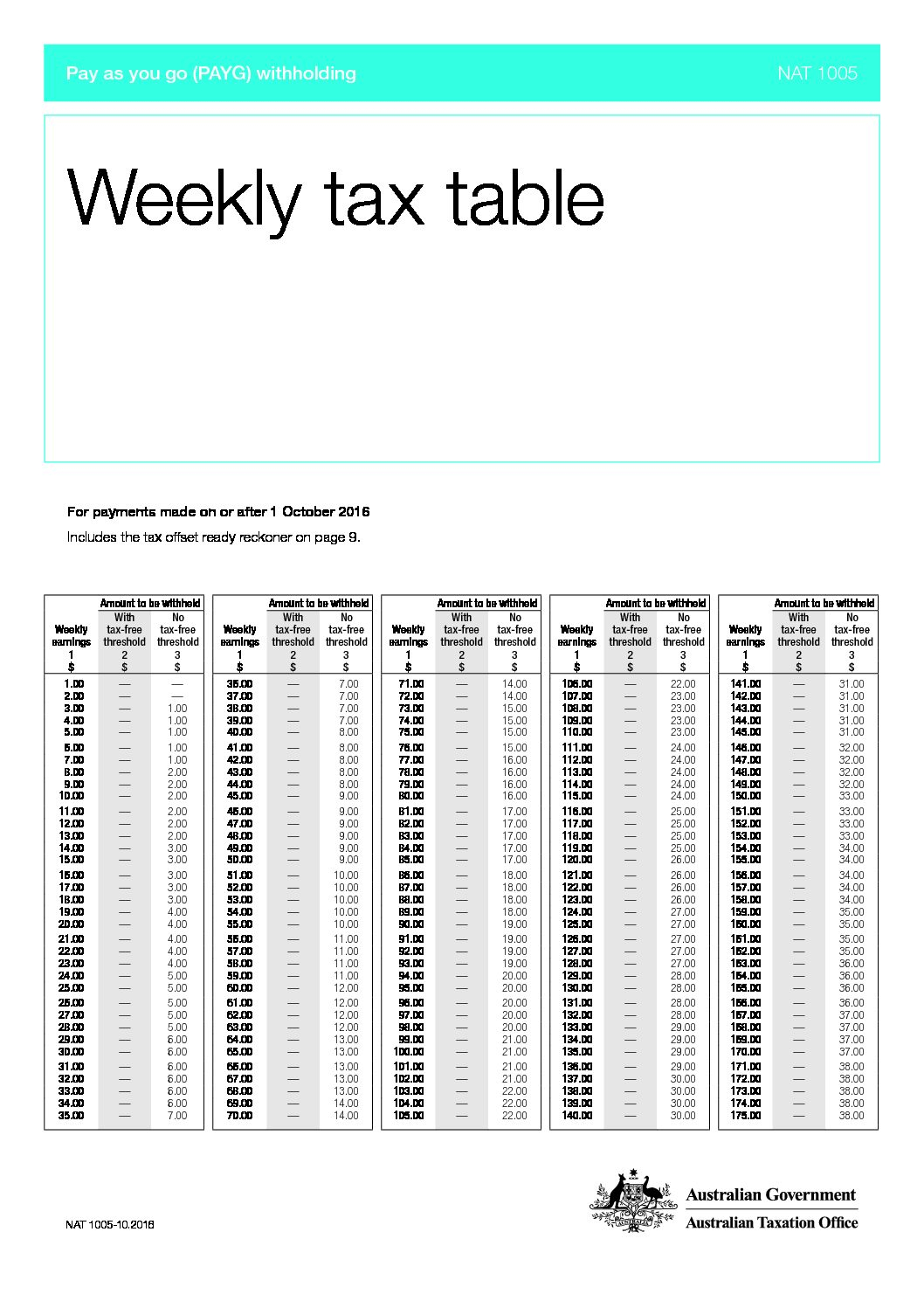

If you re an employer with an automated payroll system use Worksheet 1A and the Percentage Method tables in this section to figure federal income tax withholding This method works for Forms W 4 for all prior current and future years The updates may include information regarding recent legislative changes affecting federal payroll reporting IRS news releases and special announcements pertaining to the payroll industry new employment tax procedures and other information specifically affecting federal payroll tax returns

The official IRS Publication 15 T for 2025 includes both Percentage Method Tables for Automated Payroll Systems which is the calculation method used by Payroll Mate and the Wage Bracket Method Tables for manual calculation of federal income tax The IRS has released the 2025 tax brackets along with updated federal income tax withholding tables for employers Use these updated tax tables to calculate federal income tax on employee wages in 2025

More picture related to Payroll Tax Tables 2025

Philippines Payroll Calculator 2024 ICalculator PH

https://ph.icalculator.com/img/og/PH/9.png

Singapore Tax Tables 2020 Tax Rates And Thresholds In Singapore

https://sg.icalculator.com/img/og/SG/88.png

Pay Rise Calculator BZ Tax 2022

https://bz.icalculator.com/img/og/BZ/65.png

MONTHLY TAX DEDUCTION TABLES 2025 TAX YEAR PAYE GEN 01 G01 A03 Revision 0 Page 1 of 15 Under 65 65 74 Over 75 Under 65 65 74 Over 75 R 0 R 4 979 R 59 748 R 0 R 0 R 0 R 9 929 R 10 029 R 119 748 R 360 R 0 R 0 R 4 980 R 5 080 R 60 360 R 0 R 0 R 0 R 10 030 R 10 130 R 120 960 R 378 R 0 R 0 Following is a summary of the federal 2025 payroll tax changes including Social Security Medicare Unemployment Tax Minimum Wage 401 k limits and more The wage base remains at 7 000 The effective tax rate for 2025 is 0 6 The federal minimum wage rate per hour for 2025 is 7 25 effective 7 24 09

[desc-10] [desc-11]

Weekly Federal Tax Chart Federal Withholding Tables 2021

https://federalwithholdingtables.net/wp-content/uploads/2021/07/tax-tables-weekly-2019-review-home-decor.jpg

1120k Salary After Tax In Philippines PH Tax 2024

https://ph.icalculator.com/img/og/PH/39.png

https://www.rsl.org.ls › node

Ground Floor Finance House Building Government Office Complex Kingsway Road Maseru 266 22 313796 Toll Free 8002 2009 info rsl ls

https://ls.icalculator.com › income-tax-rates

Lesotho Personal Income Tax Tables in 2025 The Income tax rates and personal allowances in Lesotho are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Lesotho Tax Calculator 2025

Pay Rise Calculator BF Tax 2021

Weekly Federal Tax Chart Federal Withholding Tables 2021

20595k Salary After Tax Example JP Tax 2024

Income Tax Calculator CC Tax 2018

1313 876k Salary After Tax In Washington US Tax 2024

793130k Salary After Tax In Japan JP Tax 2024

793130k Salary After Tax In Japan JP Tax 2024

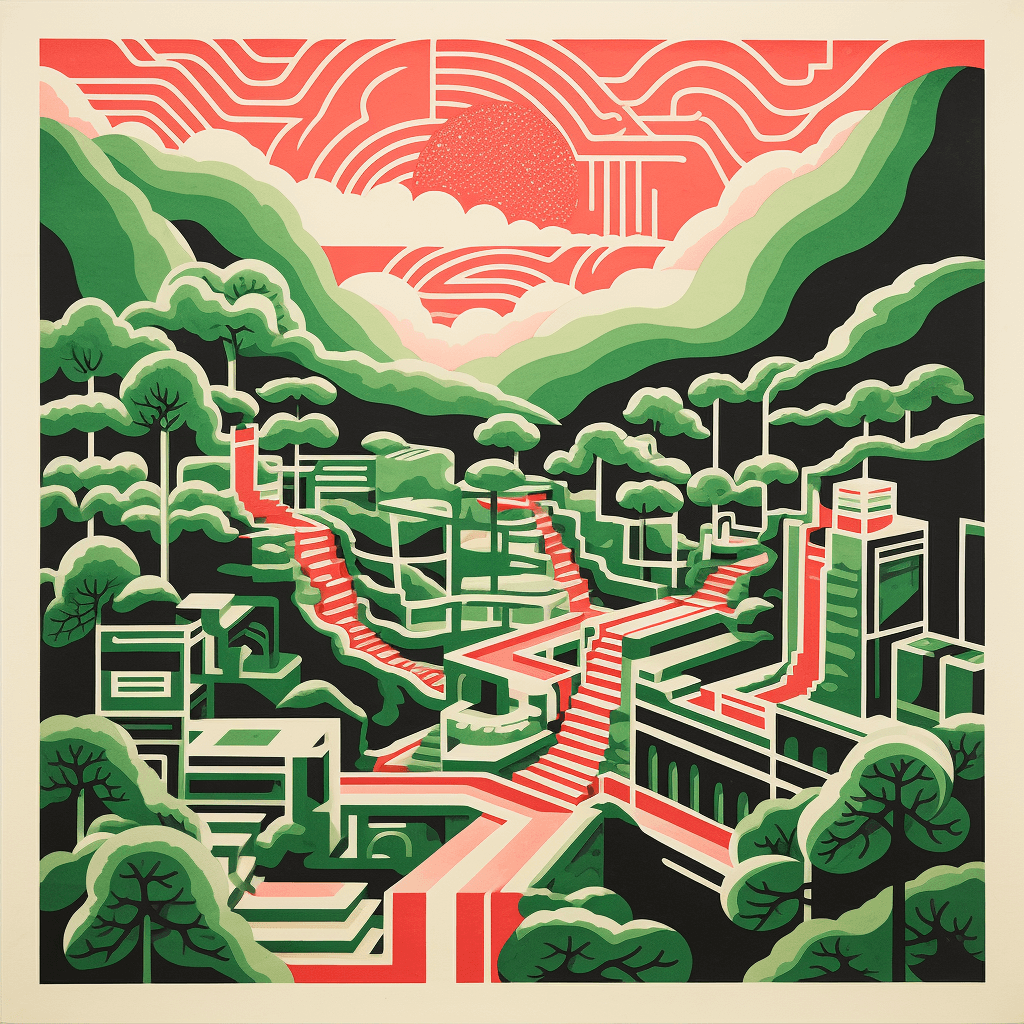

Budget 2023 Your Tax Tables And Tax Calculator Millennium Belasting

352k Salary After Tax In Japan JP Tax 2024

Weekly Deduction Tables 2021 Federal Withholding Tables 2021

Payroll Tax Tables 2025 - If you re an employer with an automated payroll system use Worksheet 1A and the Percentage Method tables in this section to figure federal income tax withholding This method works for Forms W 4 for all prior current and future years