Recovery Rate Formula Recovery Rate Total Amount Repaid Total Balance of the Loan Suppose a bank makes a loan to a business for 200 000 The 200 000 is the total amount owed including interest

The recovery rate is calculated by dividing the amount recovered by the lender after the default by the total amount owed by the borrower For example if a borrower defaults on a loan of 10 000 and the lender recovers 6 000 after selling the collateral the recovery rate would be 60 What is the formula for recovery rate To calculate the recovery rate the formula you ll need is a straightforward beacon Recovery Rate Total Recovered Value Original Loan Amount 100

Recovery Rate Formula

:max_bytes(150000):strip_icc()/recovery-rate.asp_Final-a8fac2c32d704c628b7408edd9604684.png)

Recovery Rate Formula

https://www.investopedia.com/thmb/hdk7q5Q0BVKGGI8abOHOPc21mmY=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/recovery-rate.asp_Final-a8fac2c32d704c628b7408edd9604684.png

Required Recovery Rate Excel Formula Exceljet

https://exceljet.net/sites/default/files/styles/original_with_watermark/public/images/formulas/required_recovery_rate.png

Overhead Recovery Rate Calculator Double Entry Bookkeeping

http://www.double-entry-bookkeeping.com/wp-content/uploads/overhead-recovery-rate-calculator.jpg

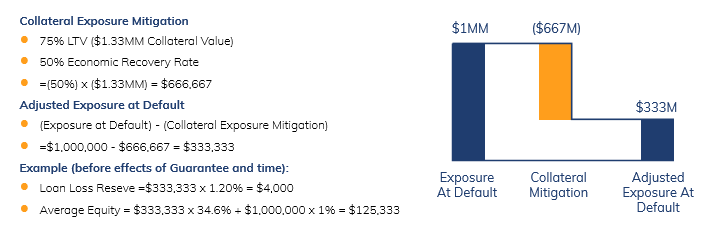

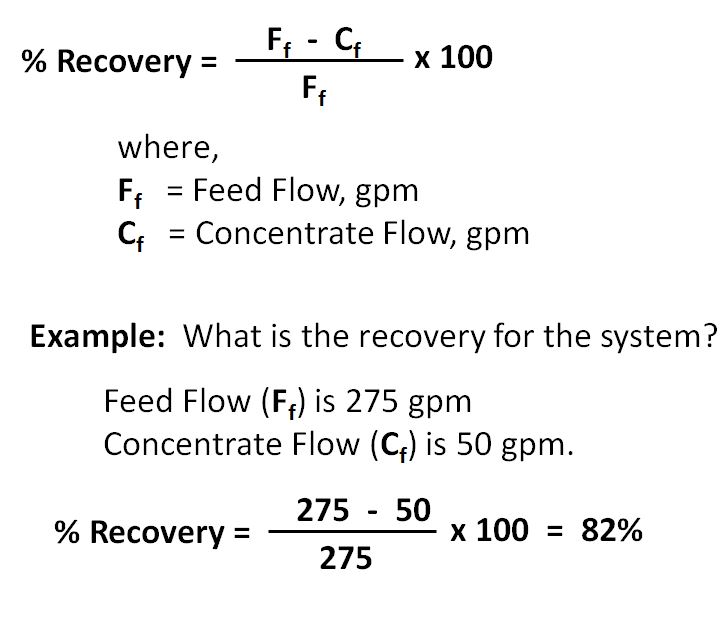

Calculating recovery rate involves a simple formula Recovery Rate Recovered Amount Outstanding Debt 100 Let s break it down step by step Determine the amount that has been recovered from the defaulting borrower This can include the proceeds from collateral liquidation or any debt restructuring measures Recovery rates can be calculated using either the final recovery amount or the average market price post default Key factors influencing recovery rate include the macroeconomic environment industry conditions and characteristics of the bond issuer and the bond itself

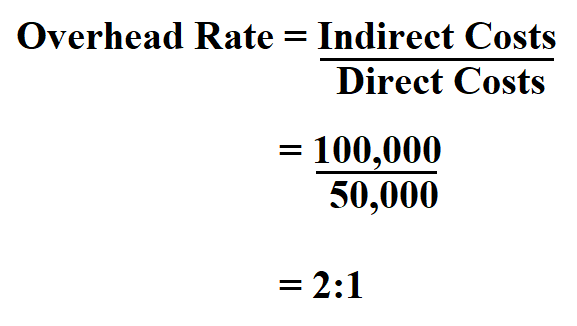

The recovery rate is an important Key Performance Indicator KPI that measures how effectively a business can recover unpaid receivables It is typically represented as a percentage and calculated using the formula Recovery Rate Amount of Receivables Recovered Total Amount of Receivables 100 To calculate the required recovery rate or breakeven rate for an investment loss you can use a simple formula and format the result as a percentage In the worksheet shown the formula in cell F5 is 1 1 C5 1 Where C5 is the loss in column C is expressed as a negative percentage

More picture related to Recovery Rate Formula

Steps In The Calculation Of The Expected Present Value Of A Recovery

https://www.researchgate.net/profile/Stuart-Turnbull/publication/228872070/figure/fig2/AS:650533383712768@1532110653363/Steps-in-the-calculation-of-the-expected-present-value-of-a-recovery-rate-which-is-paid.png

How Are Credit Losses Calculated Leia Aqui How Do You Calculate Net

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/15000722/Loss-Given-Default-LGD-Formula.jpg

How To Calculate Percent Recovery

https://www.learntocalculate.com/wp-content/uploads/2020/07/percent-recovery-1-1024x110.png

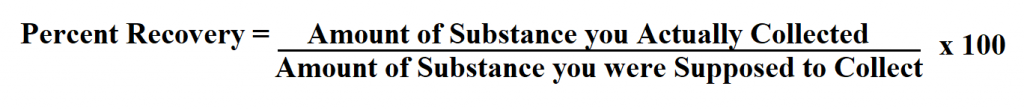

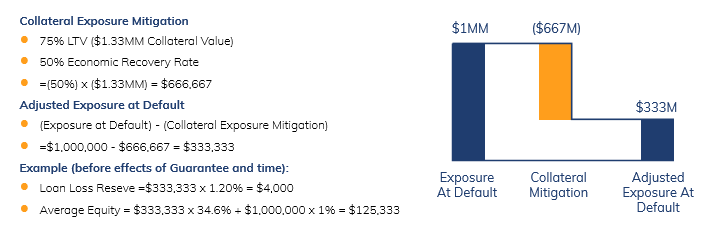

The recovery rate represents the percentage of an exposure such as a loan or bond that creditors or investors can expect to recover after a borrower defaults It quantifies the residual value of the asset or collateral backing the exposure For example if the total amount to be recovered at the beginning of the month is 1 123 000 313 000 late and 810 000 due during the month and the 15th of the month still to be recovered 581 000 the collection efficiency rate is 48 3 Calculation 1 123 000 581 000 1 123 000

[desc-10] [desc-11]

How Do Recovery Rates Affect The Economics Of A Loan Support Center

https://support.precisionlender.com/hc/article_attachments/360052116953/recovery_rates.png

https://abanshimipalayesh.com/wp-content/uploads/2023/04/Recovery_Formula_Image-1.jpg

:max_bytes(150000):strip_icc()/recovery-rate.asp_Final-a8fac2c32d704c628b7408edd9604684.png?w=186)

https://www.investopedia.com › terms › recovery-rate.asp

Recovery Rate Total Amount Repaid Total Balance of the Loan Suppose a bank makes a loan to a business for 200 000 The 200 000 is the total amount owed including interest

https://fastercapital.com › topics › calculation-of-recovery-rate.html

The recovery rate is calculated by dividing the amount recovered by the lender after the default by the total amount owed by the borrower For example if a borrower defaults on a loan of 10 000 and the lender recovers 6 000 after selling the collateral the recovery rate would be 60

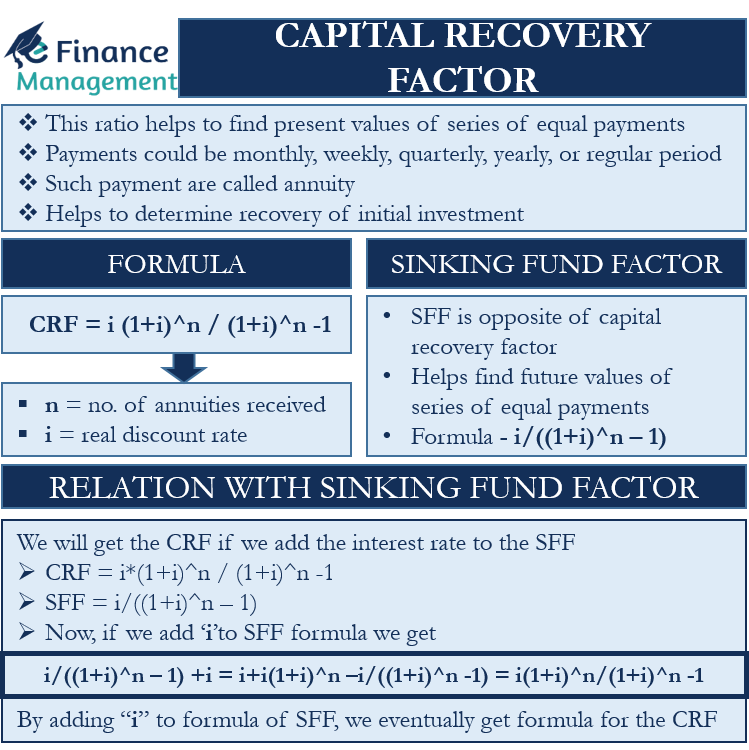

Capital Recovery Factor Meaning Formula Example And More

How Do Recovery Rates Affect The Economics Of A Loan Support Center

Overhead Absorption Rate Formula Examples And Guide

How To Calculate Overhead Rate

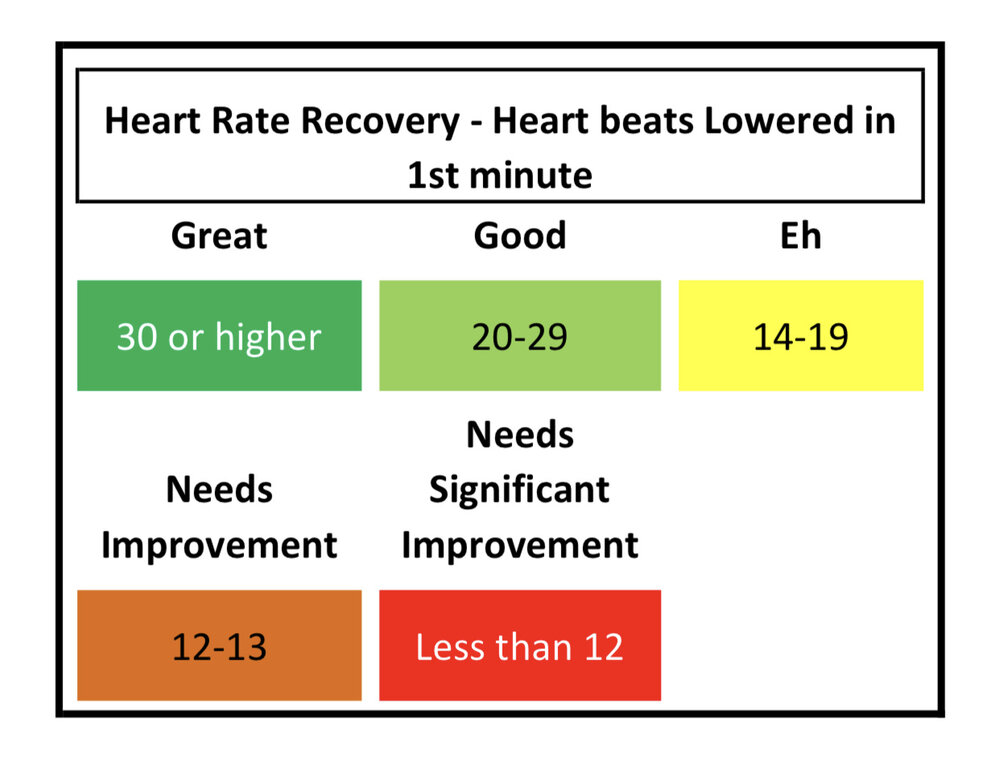

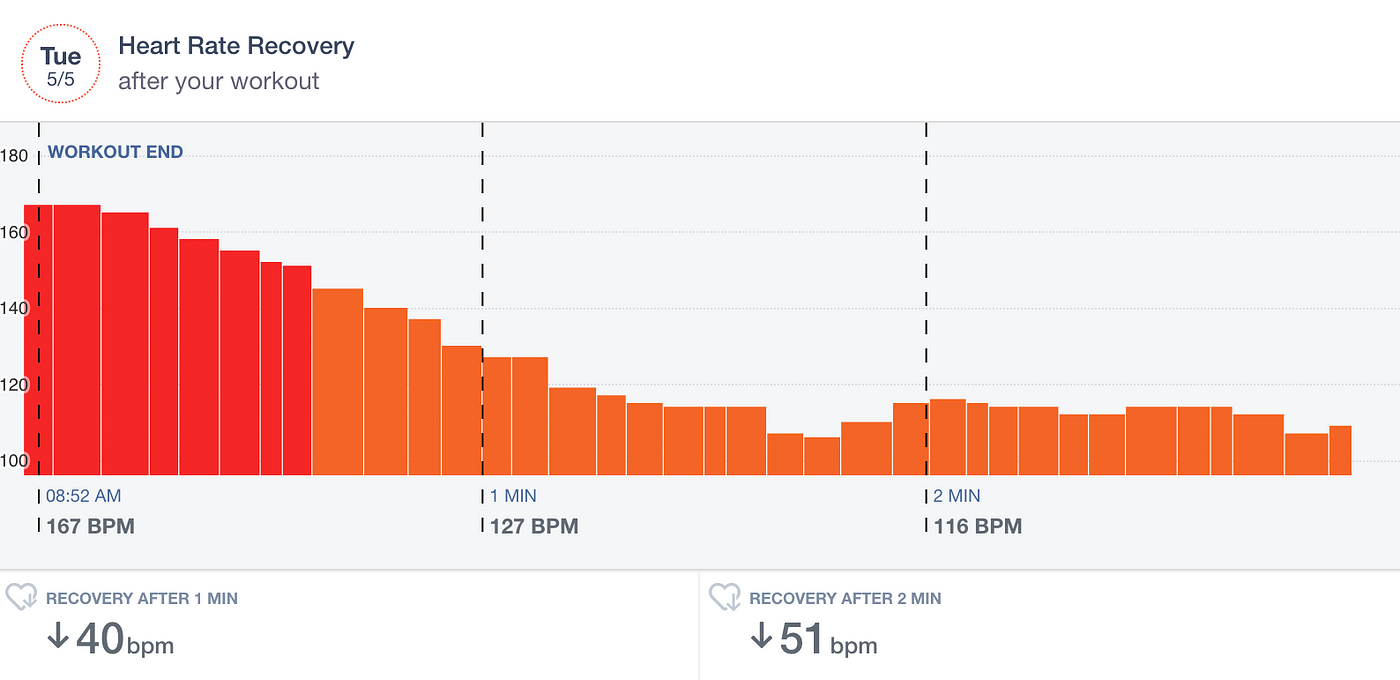

Heart Rate Recovery Chart By Age

Recovery Rate More Than 72 Percent Three Crore Sampled Tests ANN

Recovery Rate More Than 72 Percent Three Crore Sampled Tests ANN

Heart Rate Recovery Chart By Age

What Is Percentage Recovery In Commercial RO Systems

What Is The Global Recovery Rate Darwin s Data

Recovery Rate Formula - Recovery rates can be calculated using either the final recovery amount or the average market price post default Key factors influencing recovery rate include the macroeconomic environment industry conditions and characteristics of the bond issuer and the bond itself