Rooks Heath High School Term Dates When section 1231 property is sold at a gain the amount in excess of the property s basis and depreciation receives capital gains treatment which generally means lower tax rates while the

Section 1231 property as defined by the United States Internal Revenue Code is a type of depreciable business property or real property used in trade or business held for over Section 1231 property are tangible assets used in your business s operation and held for more than one year Common examples of 1231 assets are your office building the

Rooks Heath High School Term Dates

Rooks Heath High School Term Dates

https://i.ytimg.com/vi/q0iI-ugiyc0/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgXShOMA8=&rs=AOn4CLC4sNTOPwoAKwQonaNjC8jYQ7ivGw

Heath High School Class Of 1979 Public Group Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=10152735994487616

Rooks Heath School Sports News

https://www.rooksheath.harrow.sch.uk/_site/data/files/users/50/images/A62E2A3F7DF0535F35848D14937FA1B4.jpeg

All property used in a trade or business is considered section 1231 property and for taxation purposes either section 1245 or 1250 applies depending on the property s Section 1231 property is essentially a category of property defined in the IRS code of the same name and includes depreciable property and real property For property to qualify

Section 1231 Property refers to specific business assets or property used in a trade or business These assets include real estate depreciable property e g machinery Section 1231 of the IRC defines a category of business use property To qualify an asset must be real or depreciable property used in a trade or business and held for more

More picture related to Rooks Heath High School Term Dates

Rooks Heath School

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=764398392138020

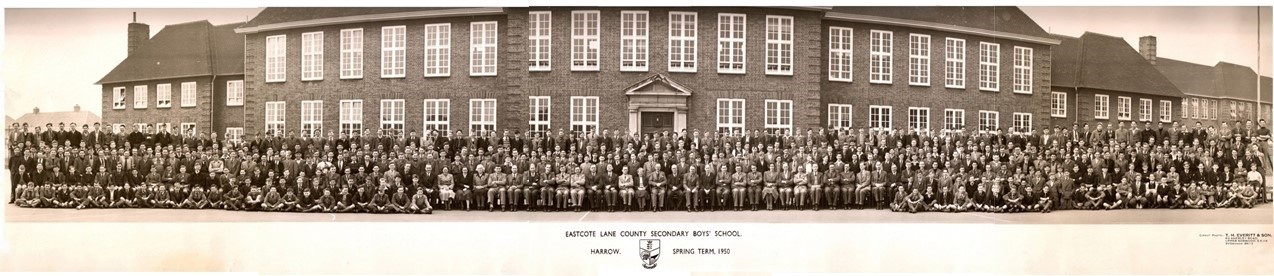

Rooks Heath School Photo Archives

https://www.rooksheath.harrow.sch.uk/_site/data/images/galleries/2/thumb-Party-742.jpg

Rooks Heath School On Twitter On Thursday 23 February A Group Of A

https://pbs.twimg.com/media/Fq3x5RvXsAAtwfZ.jpg:large

Section 1231 IRC applies to tangible properties held for more than 1 year and used in the trade or business and on which allowance for depreciation is claimed or claimable Section 1231 of the Internal Revenue Code IRC governs the tax treatment of certain types of property specifically related to real property used in business and depreciable property These

[desc-10] [desc-11]

Rooks Heath School Sky TV Studio Experience

https://www.rooksheath.harrow.sch.uk/_site/data/images/galleries/30/Camera roll.JPG

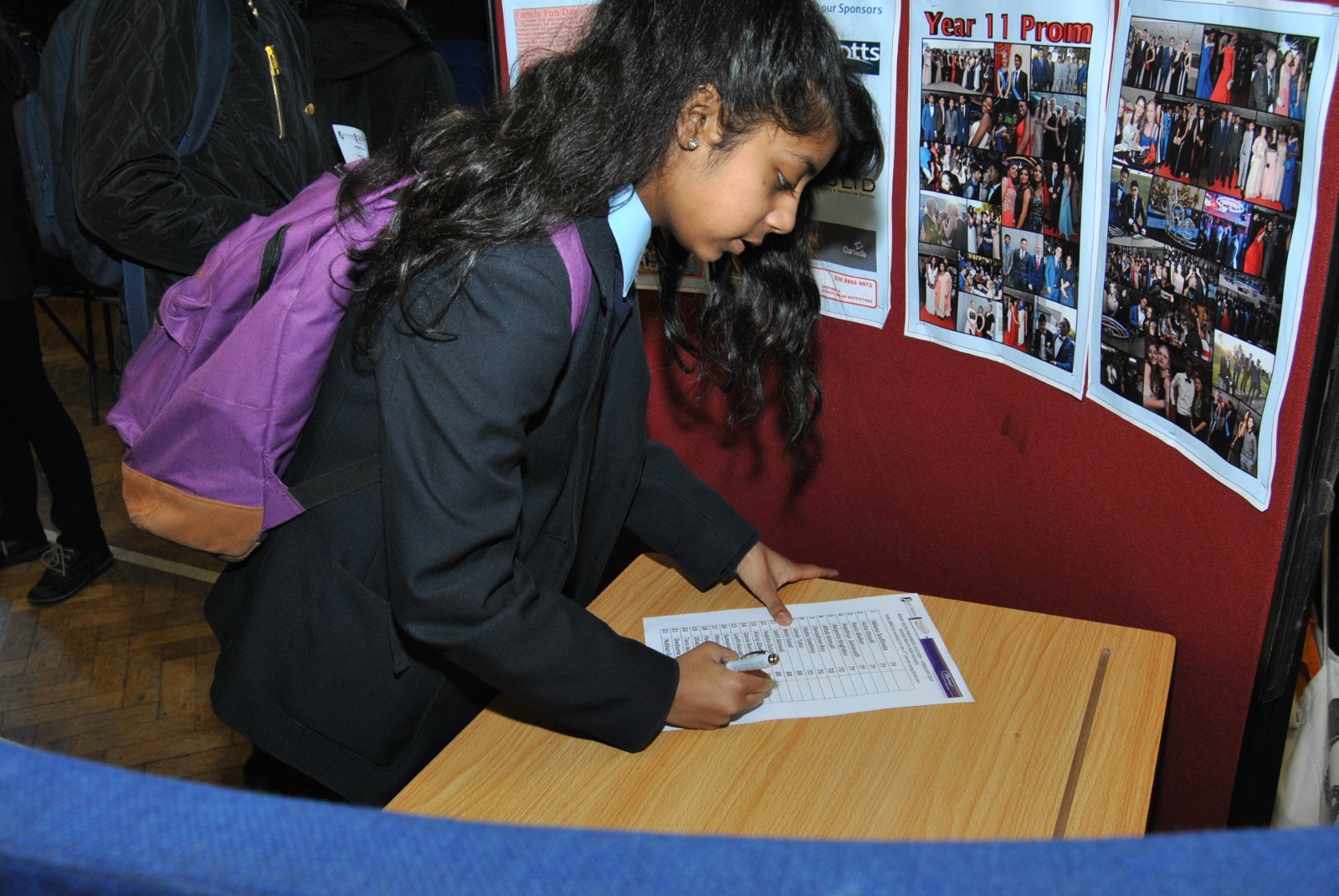

Rooks Heath School Harrow Youth Parliament Representatives Elections

https://www.rooksheath.harrow.sch.uk/_site/data/images/galleries/84/DSC_0047.JPG

https://www.taxaudit.com › ...

When section 1231 property is sold at a gain the amount in excess of the property s basis and depreciation receives capital gains treatment which generally means lower tax rates while the

https://www.financestrategists.com › ... › real-estate-investing

Section 1231 property as defined by the United States Internal Revenue Code is a type of depreciable business property or real property used in trade or business held for over

Rooks Heath School Harrow Youth Parliament Representatives Elections

Rooks Heath School Sky TV Studio Experience

Rooks Heath School

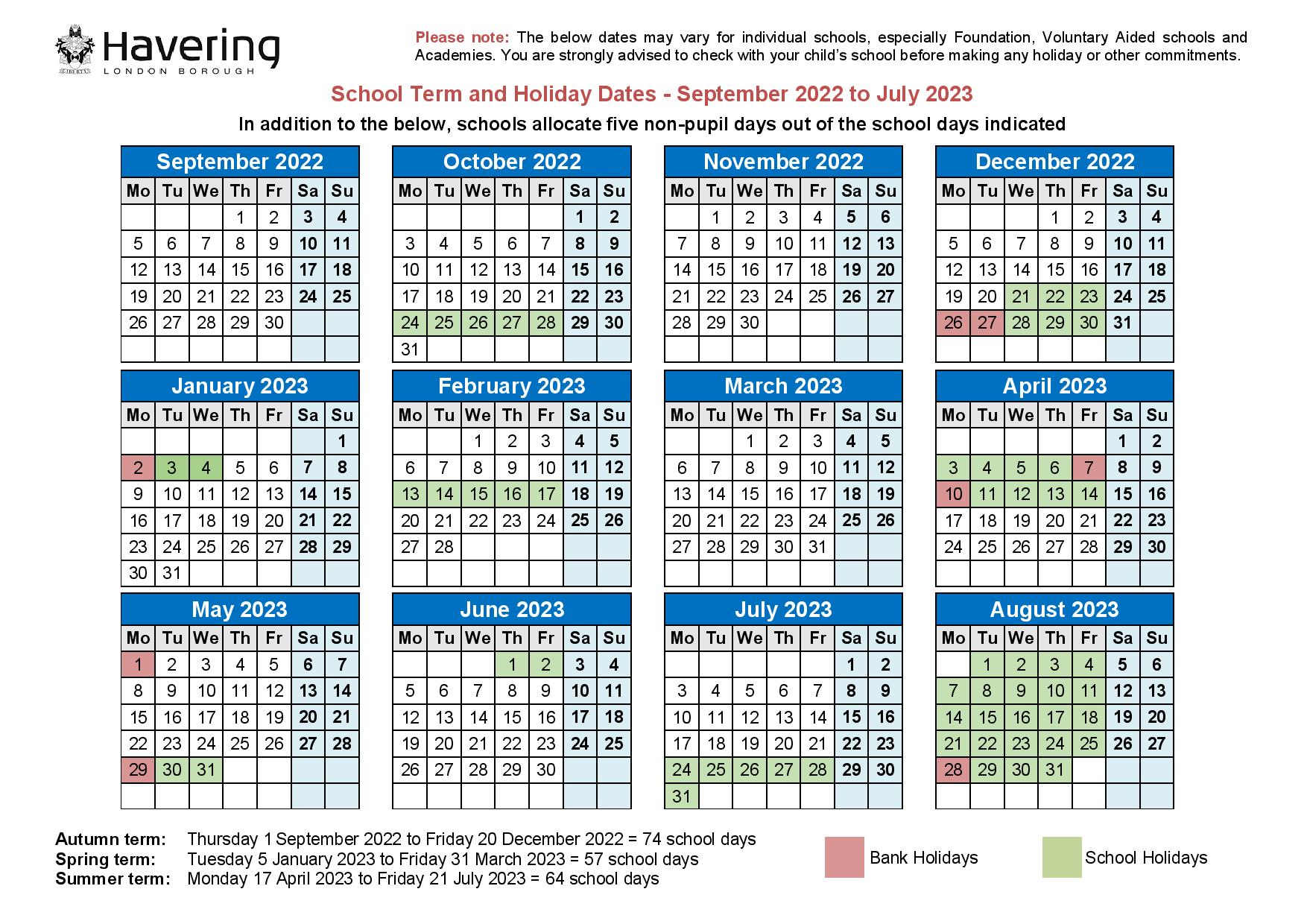

Hornchurch High School TERM DATES

Rooks Heath School Prospectuses

Rooks Heath School Diamond Jubilee Party 2012

Rooks Heath School Diamond Jubilee Party 2012

Rooks Heath School Harrow Neighbourly

Rooks Heath School World War II Headmaster s Log Book

Rooks Heath School Rooks Heath Achieves Centre Of Excellence For

Rooks Heath High School Term Dates - [desc-12]