Sales And Use Tax Rules Sales Sales Volume Definition Sales or revenue is the total amount revenue in dollars or any currency which a company makes in a reporting period specific time period Sales volume

What is Sales Process The sale process is more than just selling products or services and closing the deal It is a step by step process which begins long before the contact of the Making the Sales This is indeed the basic motive to conclude the sale In fact the number of sales is the measure of success in personal selling Sales Repetition As mentioned earlier It

Sales And Use Tax Rules

Sales And Use Tax Rules

https://fastfilings.com/wp-content/uploads/2022/08/Sales-Tax-vs-Use-Tax-Cover-Image.png

What Is Sales Tax

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2023/07/What-is-Sales-Tax-scaled.jpeg

Sales And Use Tax 2024

https://www.taxuni.com/wp-content/uploads/2023/06/Sales-and-Use-Tax.jpg

After Sales Service Examples Now that we have discussed the types of after sales service let s have a look at few prime examples of after sales service These companies are acing this What is a Sales Analysis As the name implies sales analysis means analyzing the company s sales over time Different companies create sales analysis reports at different times it might

Market penetration strategy uses for company growth by increasing sales of the current product to the current market with changing the product Companies use a penetration strategy for the More sales coming in every day means you ll certainly need more staff to manage things The effective management of the sales department precedes the need for more human resources

More picture related to Sales And Use Tax Rules

How To File Sales And Use Tax Filing Sales Tax Returns

https://www.taxconnex.com/hubfs/pexels-oleg-magni-2058128.jpg

DAY 6 HOW TO USE TAX RULES TAX TREATMENTS IN SALESFORCE BILLING

https://i.ytimg.com/vi/SHoZBu8Wspc/maxresdefault.jpg

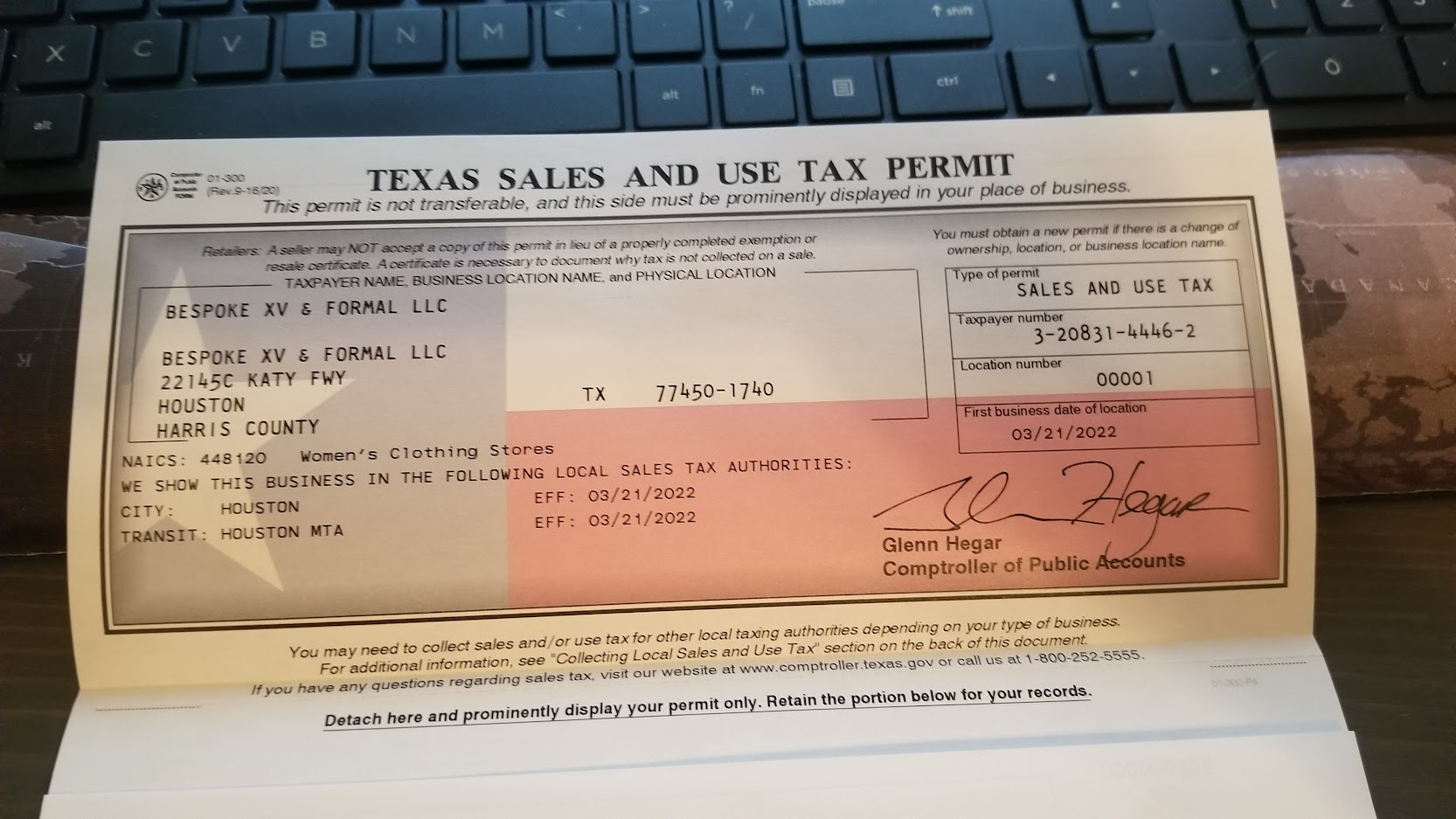

Bespoke Sales And Use Tax Certificate png Eva USA

https://evausacollection.com/wp-content/uploads/2022/10/Bespoke-Sales-and-use-tax-certificate-1.png

What is Sales Process According to an estimate approximately more than 13 of the employees in the US are working in the field of sales It doesn t matter whether you re an experienced Host Party Plan Sales This selling practice basically focuses on group settings That said the sales representatives organize a social event or a party and then offer the products for sales

[desc-10] [desc-11]

State sales tax rates The Arizona Ground Game

https://azgroundgame.org/wp-content/uploads/2021/03/state-sales-tax-rates.png

Sales Tax And Use Tax Definition Similarities Differences PandaDoc

https://public-site.marketing.pandadoc-static.com/app/uploads/sites/3/BP_Sales-and-use-tax.png

https://www.marketingtutor.net › sales-volume

Sales Sales Volume Definition Sales or revenue is the total amount revenue in dollars or any currency which a company makes in a reporting period specific time period Sales volume

https://www.marketingtutor.net › what-is-sales-process

What is Sales Process The sale process is more than just selling products or services and closing the deal It is a step by step process which begins long before the contact of the

Sales Tax Vs Use Tax What s The Difference With Table

State sales tax rates The Arizona Ground Game

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

More Than 30 New Services Will Soon Be Subject To Sales And Use Tax

Use Tax Vs Sales Tax What s The Difference Agile Consuting

Sales Tax Vs Use Tax The Differences

Sales Tax Vs Use Tax The Differences

Guide To Texas Sales Tax Reporting Paying Penalties More

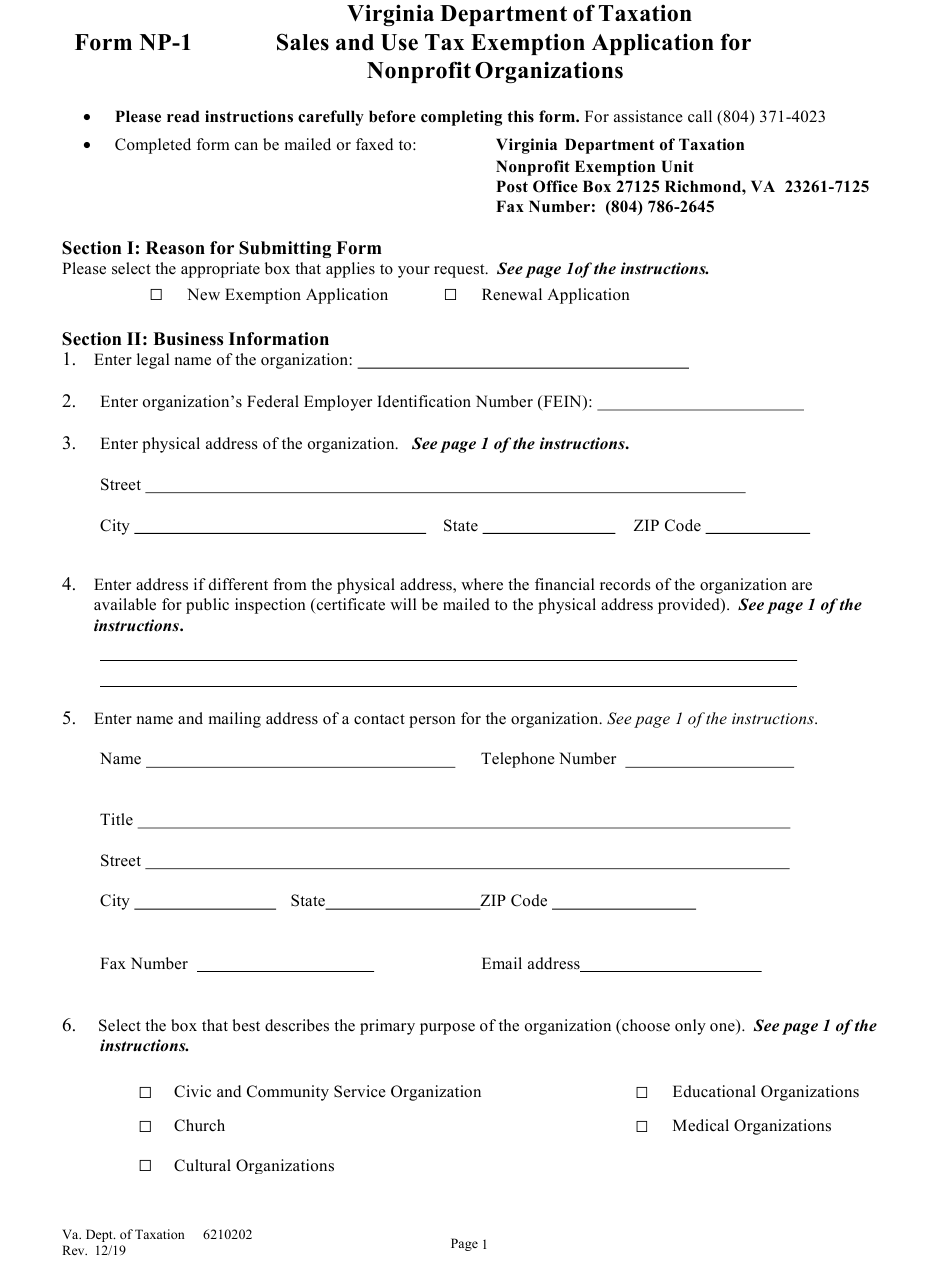

Virginia Sales Tax Exemption Form For Non Profit ExemptForm

Clarifying Sales Tax Assessments On Clothing ClarusPartners

Sales And Use Tax Rules - After Sales Service Examples Now that we have discussed the types of after sales service let s have a look at few prime examples of after sales service These companies are acing this