Sales Tax Rate Definition Sales tax is a state and local government imposed tax added to the selling price of taxable goods and services at the time of sale at retail In the United States it is collected by the seller and

A sales tax is one that applies to the purchase of goods and services It s a type of consumption tax meaning it taxes people for spending money Sales tax can be calculated by converting the sales tax percentage to a decimal and then multiplying it by the retail price of a good or service

Sales Tax Rate Definition

Sales Tax Rate Definition

https://photo.cdn.1st-social.com/1001840/1001840248-21-7203683552465746556.webp

NCRM Bootcamp LIVE

https://cc.sj-cdn.net/instructor/8s4121m3bfgc-neon-one-academy/themes/2vqrnfftcdjyd/header-logo.1654005898.png

Cool Tattooed Artist HD Wallpaper

https://images5.alphacoders.com/134/1340378.png

Sales tax is a tax imposed on the sale of goods and services It is typically a percentage of the purchase price and is added to the final cost of the product or service The rate of sales tax varies by location with different Sales tax levy imposed upon the sale of goods and services Sales taxes are commonly classified according to the level of business activity at which they are imposed at the manufacturing or

The sales tax is an indirect form of tax imposed on goods and services at the point of sale Although it is paid by the seller it is later charged to the customer It is applied to retail sales also However customers who purchase raw A sales tax is levied on retail sales of goods and services and ideally should apply to all final consumption with few exemptions Many governments exempt goods like groceries base broadening such as including groceries could

More picture related to Sales Tax Rate Definition

Remote Support Session GYTD CPA Tax

https://gytd.cpa/wp-content/uploads/2023/10/gytdcpa-logos_transparent.png

Tax Brackets Table Brokeasshome

https://study.com/cimages/multimages/16/rates.png

Miscellaneous Charge Huntington Bank 34

https://assets-global.website-files.com/63e56114746188c54e2936e0/641181fb84bd9957d62c524c_img-purchase-order-template.jpeg

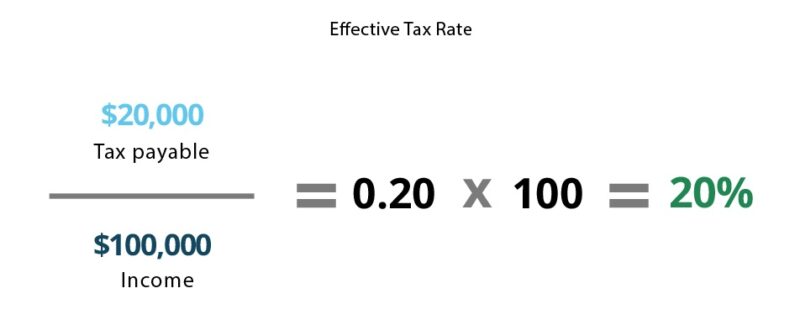

A sales tax is a consumption tax on goods and services Sales tax rates vary by jurisdiction and can be affected by local laws Businesses must collect and remit sales tax based on their presence in a state Four U S states The sales tax rate is the percentage of the total purchase price that is added to the cost of a good or service as a tax collected by the government It is an important factor in calculating the total

What is a sales tax A sales tax is the percentage of the price of goods or services that is added to the final cost of the item when purchased by an individual at a retail location The purpose of Sales Tax Rates For a business owner to meet their sales tax obligations they must first know what rates apply to them All but five states charge a state sales tax but often local

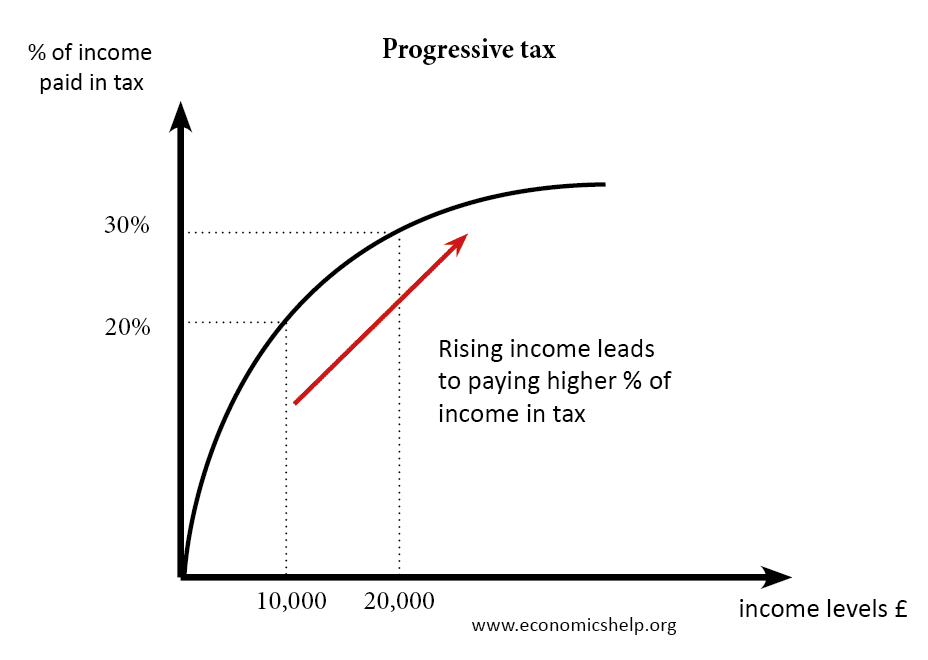

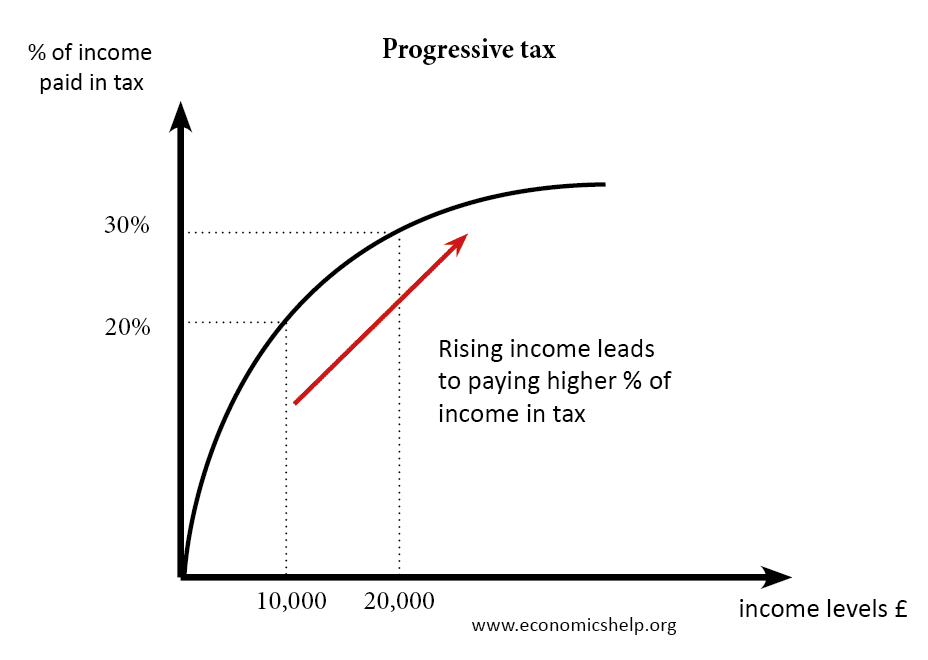

Types Of Tax In UK Economics Help

https://www.economicshelp.org/wp-content/uploads/2017/12/progressive-tax.png

Board Approves 5 Percent Pay Raise For Teachers Staff Foster Middle

https://w3.lisd.org/sites/default/files/2023-01/Shalona McCray headshot.jpg

https://www.salestaxinstitute.com › what-is-sales-tax

Sales tax is a state and local government imposed tax added to the selling price of taxable goods and services at the time of sale at retail In the United States it is collected by the seller and

https://www.bankrate.com › taxes › what-is-sales-tax

A sales tax is one that applies to the purchase of goods and services It s a type of consumption tax meaning it taxes people for spending money

:max_bytes(150000):strip_icc()/effectivetaxrate_final-cf3facabd80c4116bbf5923934956c34.png)

Income Tax Rates 2021 22 Calculator Infoupdate

Types Of Tax In UK Economics Help

.png)

California State Sales Tax 2025 Rate Abigail Rees

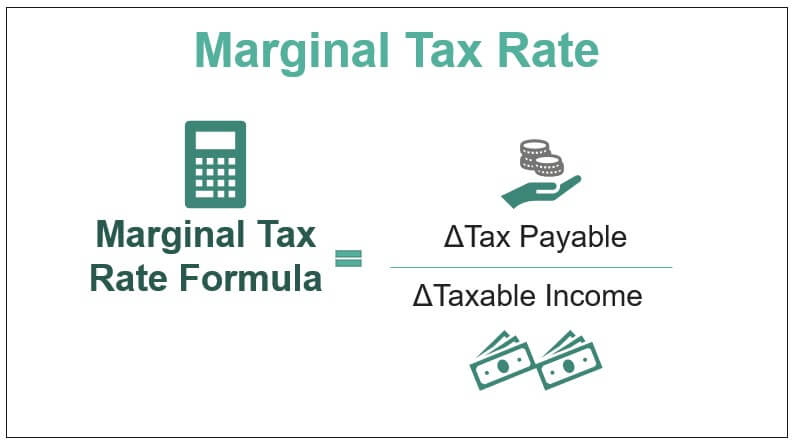

Marginal Tax Rate Definition Formula How To Calculate

Marginal Tax Rate Formula Definition InvestingAnswers

Contoh Tanda Tangan Di Atas Materai Untuk Dokumen Resmi

Marginal Tax Rate Definition Formula How To Calculate

Irs 2025 Tax Deductions Khalil Brooklyn

Sales Tax Rate Definition - Sales tax refers to a tax imposed on the sale of goods and services It is typically a percentage added to the price of a product or service at the point of sale The responsibility for