Tariff Code For Hair Brush A tariff or import tax is a duty imposed by a national government customs territory or supranational union on imports of goods and is paid by the importer Exceptionally an export

A 10 tariff means a 10 product would have a 1 tax on top taking the total cost to 11 8 35 Companies that bring foreign goods into the US have to pay the tax to the Tariff tax levied upon goods as they cross national boundaries usually by the government of the importing country The words tariff duty and customs can be used

Tariff Code For Hair Brush

Tariff Code For Hair Brush

https://i.ytimg.com/vi/CqYPmjfkUVQ/maxresdefault.jpg

Avalara Managed Tariff Code Classification YouTube

https://i.ytimg.com/vi/xDf6BdOzgOs/maxresdefault.jpg

ELECTRICITY TARIFFS GRADE 12 MATHS LIT THUNDEREDUC T KENNETH YouTube

https://i.ytimg.com/vi/18Ync2Us5XY/maxresdefault.jpg

A tariff is a tax placed on goods when they cross national borders The most common type is an import tariff which taxes goods brought into a country There are also export tariffs which are An ad valorem tariff is a percentage based tax on the value of the imported goods For example if an imported good is valued at 1 000 and the tariff rate is 10 then the tariff is

A tariff is a trade barrier the government imposes taxes on the procurement of goods or services from foreign countries It is a strategic decision using trade governments History of Tariffs Tariffs are a major source of income for nearly all countries The word tariff comes from Medieval Latin tariffe which referred to a list or register of prices and

More picture related to Tariff Code For Hair Brush

Tamil Nadu Electricity Board New Tariff Full Details 2022 YouTube

https://i.ytimg.com/vi/mE6WhETlAzM/maxresdefault.jpg

How To Find A Port Code On Harmonized Tariff Schedule Of The United

https://i.ytimg.com/vi/JzEjl6mrTfk/maxresdefault.jpg

Brush QR Code For Hair IbisPaint

https://cdn.ibispaint.com/movie/513/174/513174922/image513174922l.png

TARIFF definition 1 a charge or list of charges either for services or on goods entering a country 2 a charge or Learn more The tariff book can also be accessed on this website www mra mw One may also call 01822588 to get more clarification from MRA or sending an email to tax mra mw You can also visit

[desc-10] [desc-11]

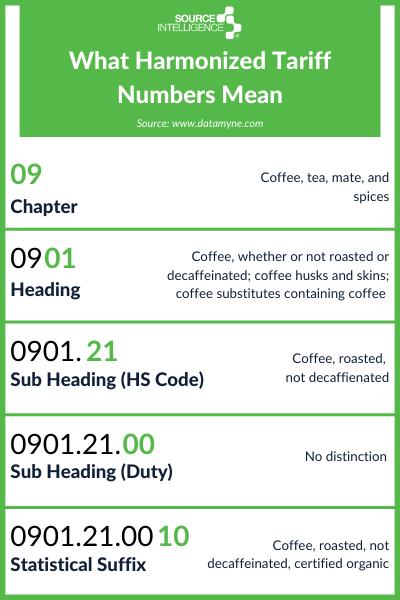

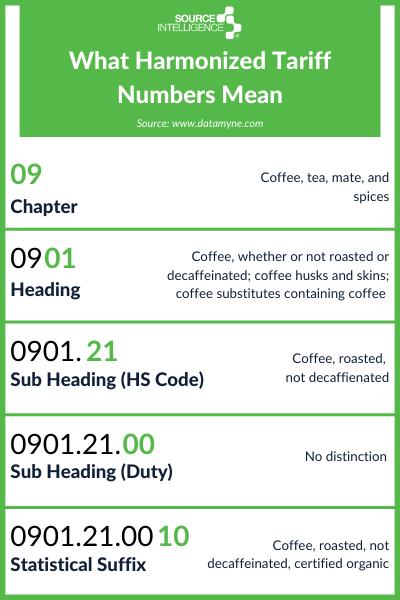

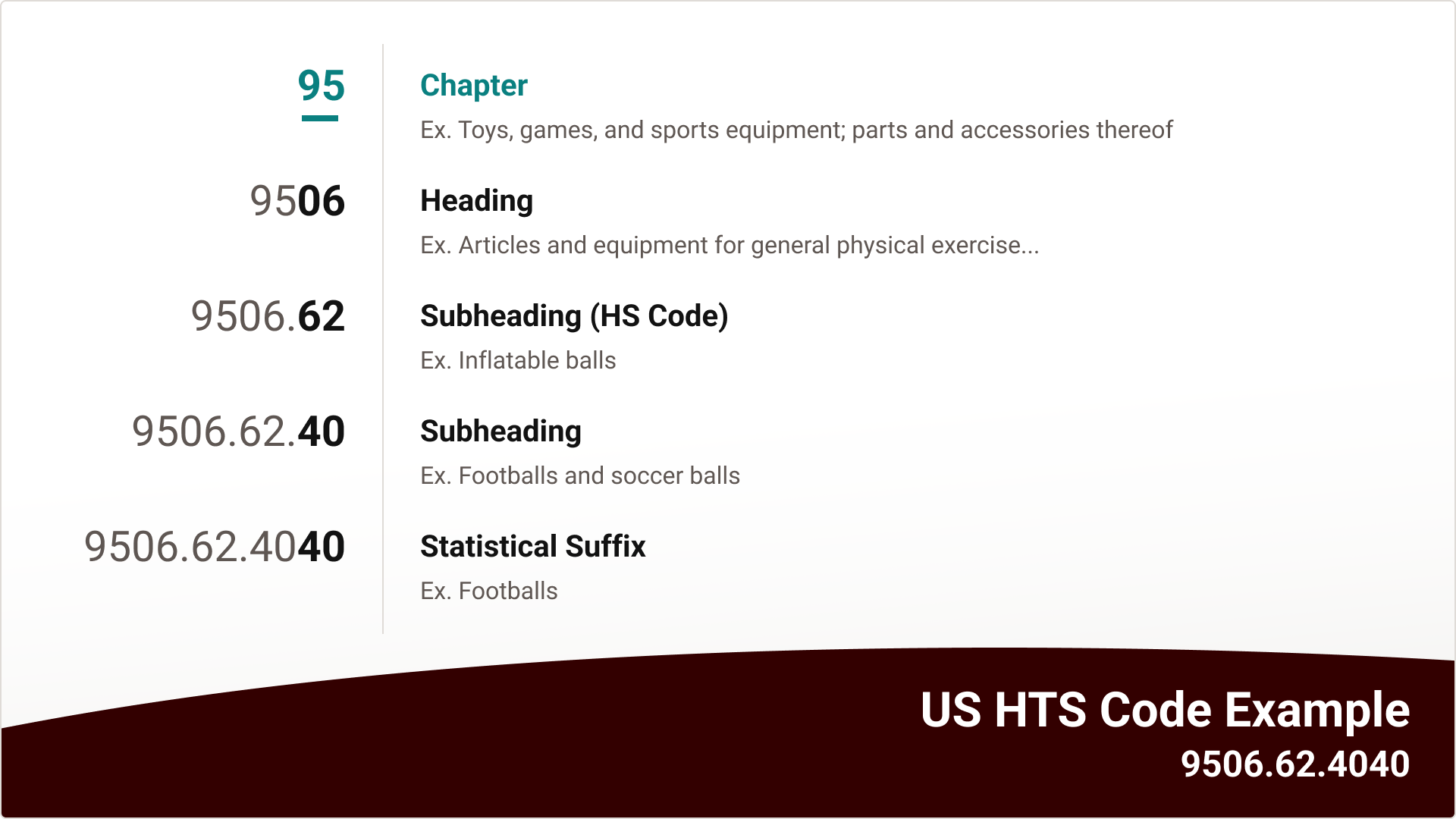

What Are HTS Codes

https://compliance.sourceintelligence.com/hubfs/Imported_Blog_Media/What-HTS-Numbers-Mean.png

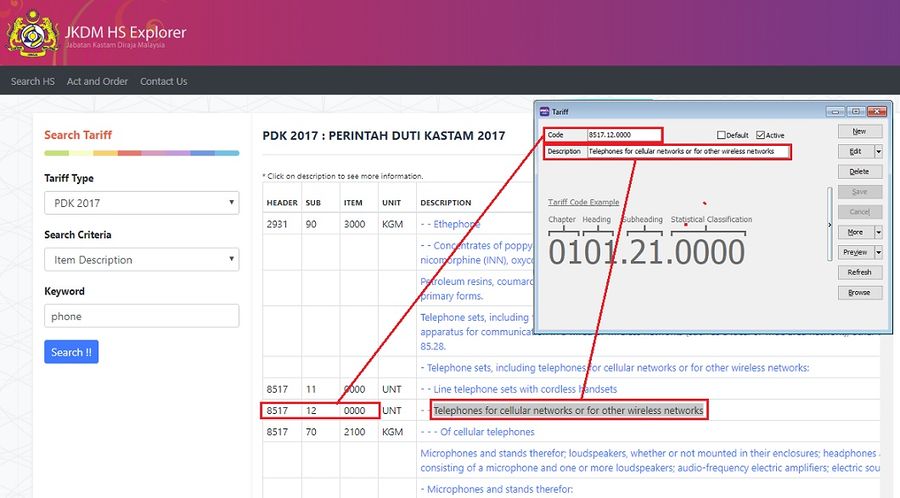

SST Tariff Code EStream Software

https://wiki.sql.com.my/images/thumb/d/d7/SST-Tariff_Code-01.jpg/900px-SST-Tariff_Code-01.jpg

https://en.wikipedia.org › wiki › Tariff

A tariff or import tax is a duty imposed by a national government customs territory or supranational union on imports of goods and is paid by the importer Exceptionally an export

https://www.bbc.com › news › articles

A 10 tariff means a 10 product would have a 1 tax on top taking the total cost to 11 8 35 Companies that bring foreign goods into the US have to pay the tax to the

bis Paint Hair Brushes

What Are HTS Codes

Hair Brush By Newtdog Download Free STL Model Printables

2025 Hts By Chapter Sam Churchill

Pin On Abby Roblox Codes Coding Black Hair Roblox

Motor Tariff PDF

Motor Tariff PDF

Etsy Codes 2025 Joshua Pullman

Hello Kitty Drawing Paint Brush Art Code Art

Tariff Codes Gov Website

Tariff Code For Hair Brush - An ad valorem tariff is a percentage based tax on the value of the imported goods For example if an imported good is valued at 1 000 and the tariff rate is 10 then the tariff is