Tax 10 Year Rule Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services

Income tax Personal business corporation trust international and non resident income tax Information on taxes including filing taxes and get tax information for individuals businesses charities and trusts Income tax

Tax 10 Year Rule

Tax 10 Year Rule

http://www.jhwfs.com/wp-content/uploads/2018/06/Inherited-IRA-Flowchart.jpg

Jack Daniel s BOURBON BANTER

https://www.bourbonbanter.com/content/images/2023/10/BB_8_gray-1--1--1.png

Research And Publication IPHRC

https://www.iphrc.org/wp-content/uploads/2022/10/IPHRC-logo1.png

How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

When using certified tax software the Auto fill my return service automatically fills in parts of your income tax and benefit return with information that the CRA has available at Personal income tax Who should file a tax return how to get ready and file taxes payment and filing due dates reporting income and claiming deductions and how to make payments or

More picture related to Tax 10 Year Rule

TopXGun F16 D WHEEL Impeller Sensor

https://www.spiridonakis.com/image/cache/catalog/logo/th-epipethos-isios-agrolux-95000474-20-o70-4tr-bellota-ispanias-571-1400x1400.png

About Flaaa co uk

https://flaaa.co.uk/wp-content/uploads/2023/11/enlarge_flaaa_logo-white-landscape.png

![]()

Census Records And Family History

https://census.gov/ratingtool/images/exclamation-icon.png

This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

[desc-10] [desc-11]

The Downtown Defrost 2023 Night Vision

https://images.squarespace-cdn.com/content/v1/5281a6c0e4b04f95c72324ac/ae71a9af-beb7-49b0-b682-53ffe10acb00/White+Circle+Logo+-+web.png?format=1500w

How To Find Your Motivation

https://media.beehiiv.com/cdn-cgi/image/fit=scale-down,format=auto,onerror=redirect,quality=80/uploads/asset/file/4ea6f911-eb28-4339-873c-d18c3c641ab4/IMG_9163_2.jpg?t=1713683758

https://www.canada.ca › en › revenue-agency › services › e-services › cr…

Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services

https://www.canada.ca › en › services › taxes › income-tax

Income tax Personal business corporation trust international and non resident income tax

Immigration Advice Line Notre Dame Refugee Centre

The Downtown Defrost 2023 Night Vision

I Told My Date About My Specific 3 Year Rule But He Immediately Left

I Told My Date About My Specific 3 Year Rule But He Immediately Left

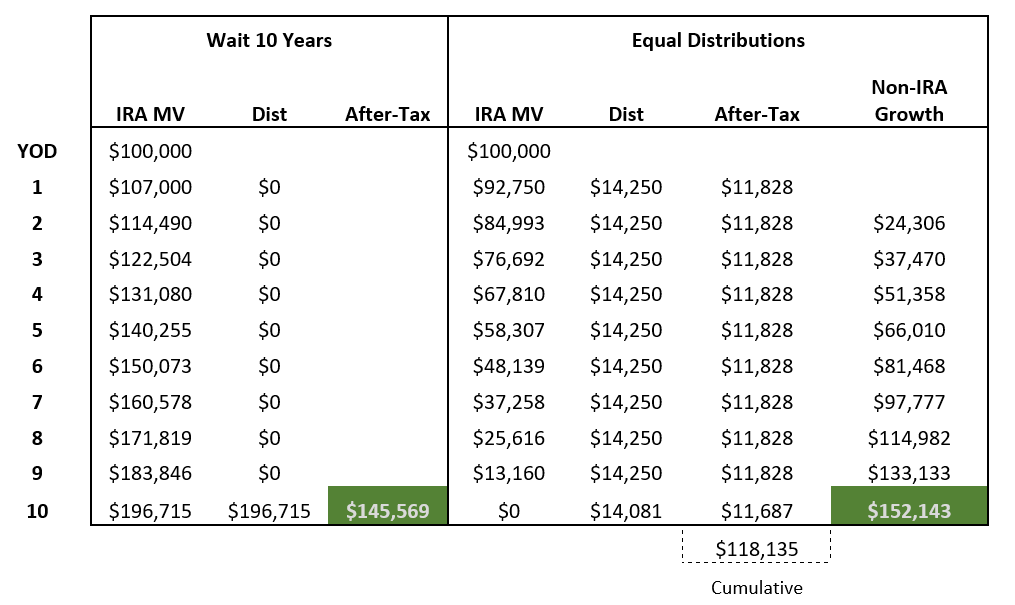

Understanding The SECURE Act Managing The 10 Year Rule Financial

Kalakasy Super Perfume 100ML Jamr Al Oud Perfumes

Kalakasy Super Perfume 100ML Jamr Al Oud Perfumes

Rmd Calculator 2025 Table Pdf 2025 Easton Nasir

PhD Candidate Awarded Fulbright Scholarship Mirage News

Vomm SA52 SA53 Fuse Tweezers

Tax 10 Year Rule - Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year