Tax And Money Exchange Formula Filing through a tax preparer If you don t do your taxes on your own an EFILE certified tax preparer like an accountant can file your income tax and benefit return for you Tax preparers

The Canada Revenue Agency CRA administers tax laws for the government providing contacts services and information related to payments taxes and benefits for individuals and businesses This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a

Tax And Money Exchange Formula

Tax And Money Exchange Formula

https://i.ytimg.com/vi/qqU4XwB4-Rs/maxresdefault.jpg

Speedy Math Class 10 Tax And Money Exchange solution YouTube

https://i.ytimg.com/vi/trQCnNLzRHM/maxresdefault.jpg

Tax And Money Exchange Class 10 SEE Money Exchange Class 10 In

https://i.ytimg.com/vi/kT6f5PUhJJ4/maxresdefault.jpg

Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services NETFILE service in tax software that allows most people to submit a personal income tax return electronically to the Canada Revenue Agency

Information on taxes including filing taxes and get tax information for individuals businesses charities and trusts Income tax How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund

More picture related to Tax And Money Exchange Formula

Grade 10 C Math Tax And Money Exchange Part 3

https://i.ytimg.com/vi/2waU19CG0ug/maxresdefault.jpg

Tax And Money Exchange Class 10 Value Added

https://i.ytimg.com/vi/DSc4y5kCKh4/maxresdefault.jpg

GRADE 10 COMPULSORY MATH TAX AND MONEY EXCHANGE 2 2 CHAIN RULE

https://i.ytimg.com/vi/ZWzSsJh950Y/maxresdefault.jpg

Canada Disability Benefit The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is Information for individuals and partners claiming capital cost allowance on the depreciable property used in their businesses and the criteria for each class

[desc-10] [desc-11]

SEE Mathematics Unit 2 Tax And Money Exchange Class10 Part 1 With Old

https://i.ytimg.com/vi/Zq6hG-iwAzw/maxresdefault.jpg

GRADE 10 COMPULSORY MATH TAX AND MONEY EXCHANGE 2 2 CHAIN RULE

https://i.ytimg.com/vi/UEYTAwqxydA/maxresdefault.jpg

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

Filing through a tax preparer If you don t do your taxes on your own an EFILE certified tax preparer like an accountant can file your income tax and benefit return for you Tax preparers

https://www.canada.ca › en › revenue-agency

The Canada Revenue Agency CRA administers tax laws for the government providing contacts services and information related to payments taxes and benefits for individuals and businesses

Tax And Money Exchange Problem Class 10 C math Nepali English

SEE Mathematics Unit 2 Tax And Money Exchange Class10 Part 1 With Old

Class 10 Chapter 2 Tax And Money Exchange Math Solution Class 10

Tax And Money Exchange Class 10 Exercise 2 1 In Nepali Teacher

Class 10 C Math Unit 2 Tax And Money Exchange Commission Money

Class 10 Compulsory Mathematics Unit 2 Tax And Money Exchange

Class 10 Compulsory Mathematics Unit 2 Tax And Money Exchange

Tax And Money Exchange By Dinesh YouTube

Comp Maths Tax And Money Exchange Part 2 SEE PREPARATION 2079

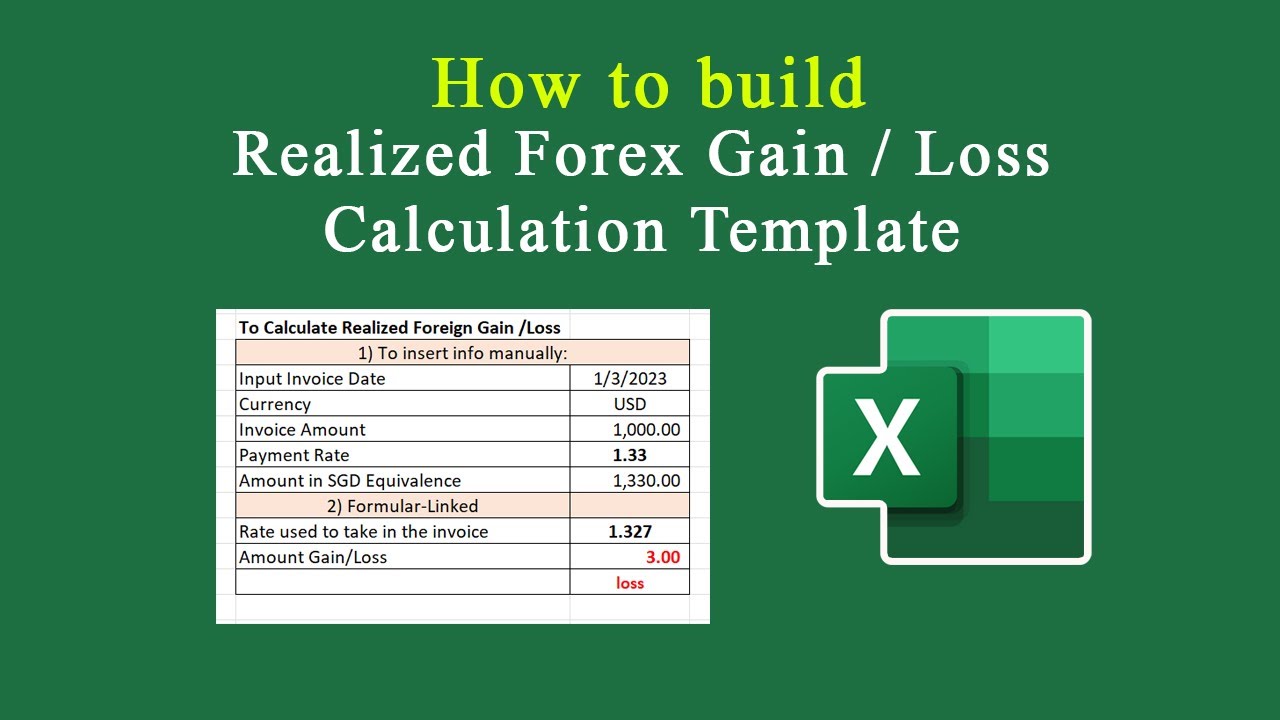

Excel How To Build Realized Foreign Exchange Gain Loss Calculation

Tax And Money Exchange Formula - [desc-13]