Tax Benefits For Salaried Employees The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of The first R550 000 of your retirement lump sum is tax free as of 1 March 2024 Any previous withdrawals or retirement lump sums you ve taken will reduce your tax free amount The

Tax Benefits For Salaried Employees

Tax Benefits For Salaried Employees

https://www.valueresearchonline.com/content-assets/images/52110_468973008-old-vs-new-1__w1000__.png

Farm Tax Deductions 2025 Steve A Johnson

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

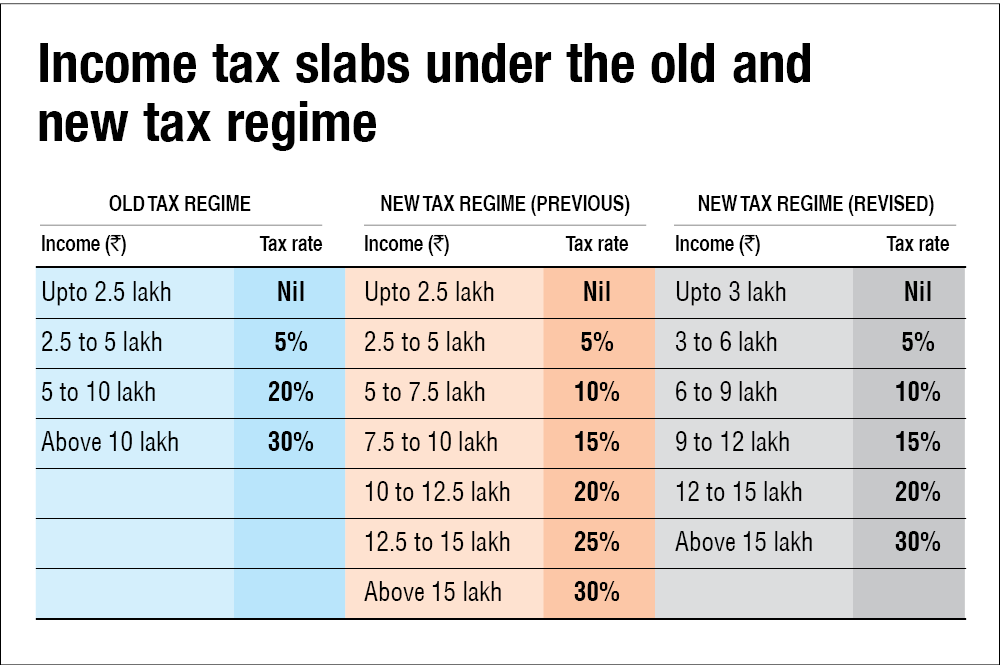

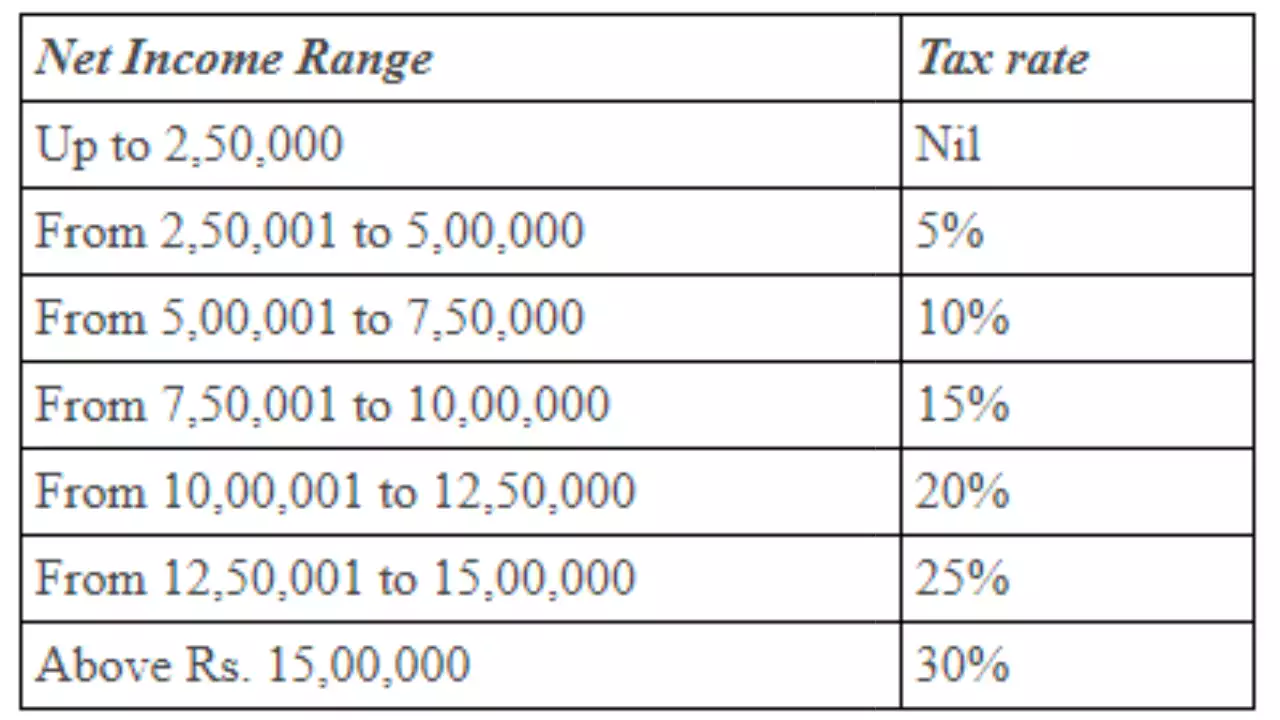

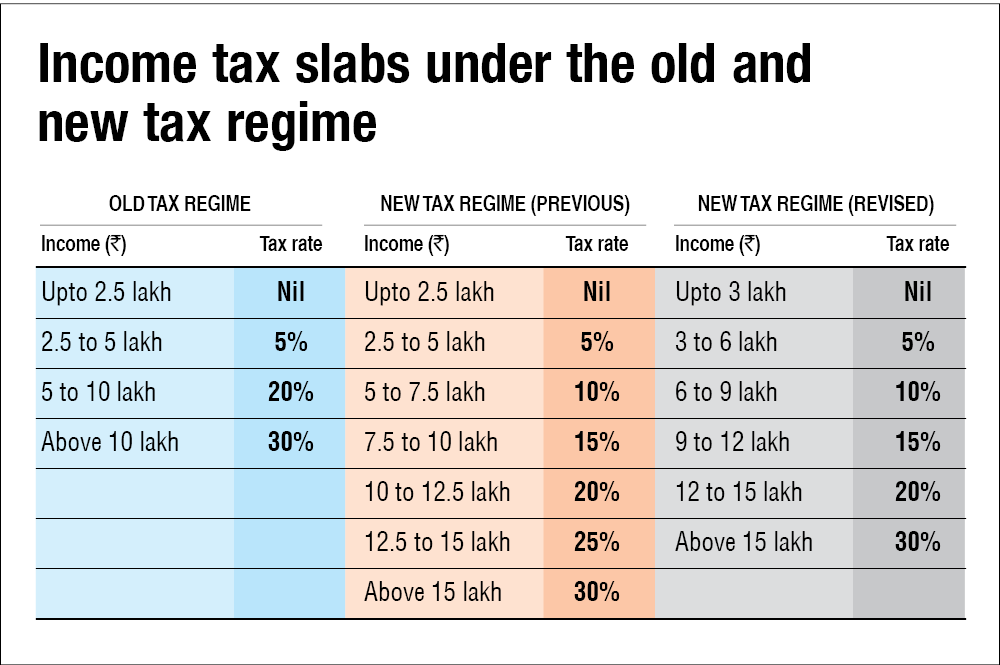

2024 Tax Slab India Gelya Juliann

https://static.tnn.in/photo/msid-107317246/107317246.jpg

If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on Tax free savings accounts registered savings plans pooled pension plans and plan administration Excise and specialty taxes Duties customs charges tax on underused

The bulk of tax relief will go to those with incomes in the two lowest tax brackets i e those with taxable income under 114 750 in 2025 including nearly half to those in the Personal information is collected pursuant to the Income Tax Act and Excise Tax Act Personal information is described in program specific Personal Information Banks which can be found

More picture related to Tax Benefits For Salaried Employees

What Is A Salaried Employee AIHR HR Glossary

https://www.aihr.com/wp-content/uploads/Salaried-Employee-vs-Hourly-Employee.png

Taxation Strategies For Salaried Employees MPVD Associates

https://mpvdassociates.com/wp-content/uploads/2024/01/Taxation-Strategies-for-Salaried-Employees-980x551.jpg

Hra Exemption For Salaried Employees Factzone

https://blog.shoonya.com/wp-content/uploads/2024/03/Tax-Saving-Options-for-Salaried-Employees.jpg

Throughout the following text for purposes of the tax exemption under section 87 of the Indian Act the Canada Revenue Agency CRA uses the term Indian because it has a legal The 25 Part XIII tax also applies to payees in countries with which Canada has a tax treaty that is not yet in effect A Part XIII tax rate of 23 applies to the gross amounts paid credited or

[desc-10] [desc-11]

Tax Planning 2025 Yvonne Moss

https://www.taxscan.in/wp-content/uploads/2023/01/Tax-Planning-Income-Tax-Savings-Salaried-Individuals-FY-2022-23-TAXSCAN.jpg

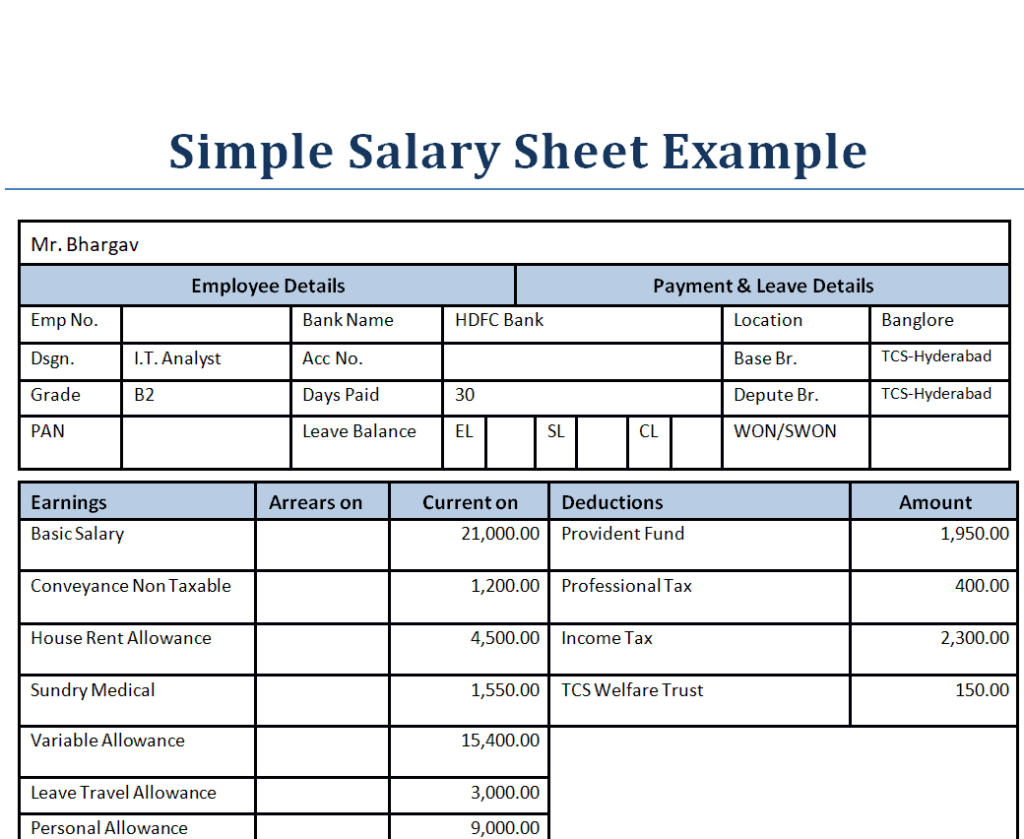

10 Salary Sheet Templates In Pdf Vrogue co

https://www.dailylifedocs.com/wp-content/uploads/2022/08/salary-sheet-template-34542913-1024x839.png

https://www.canada.ca › en › department-finance › news › delivering-a-…

The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

https://www.canada.ca › en › services › taxes › income-tax

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

Salary Guide Salary Increase Holiday Pay Paid Time Off Higher

Tax Planning 2025 Yvonne Moss

Budget 2024 Tax Slabs India Elena Heather

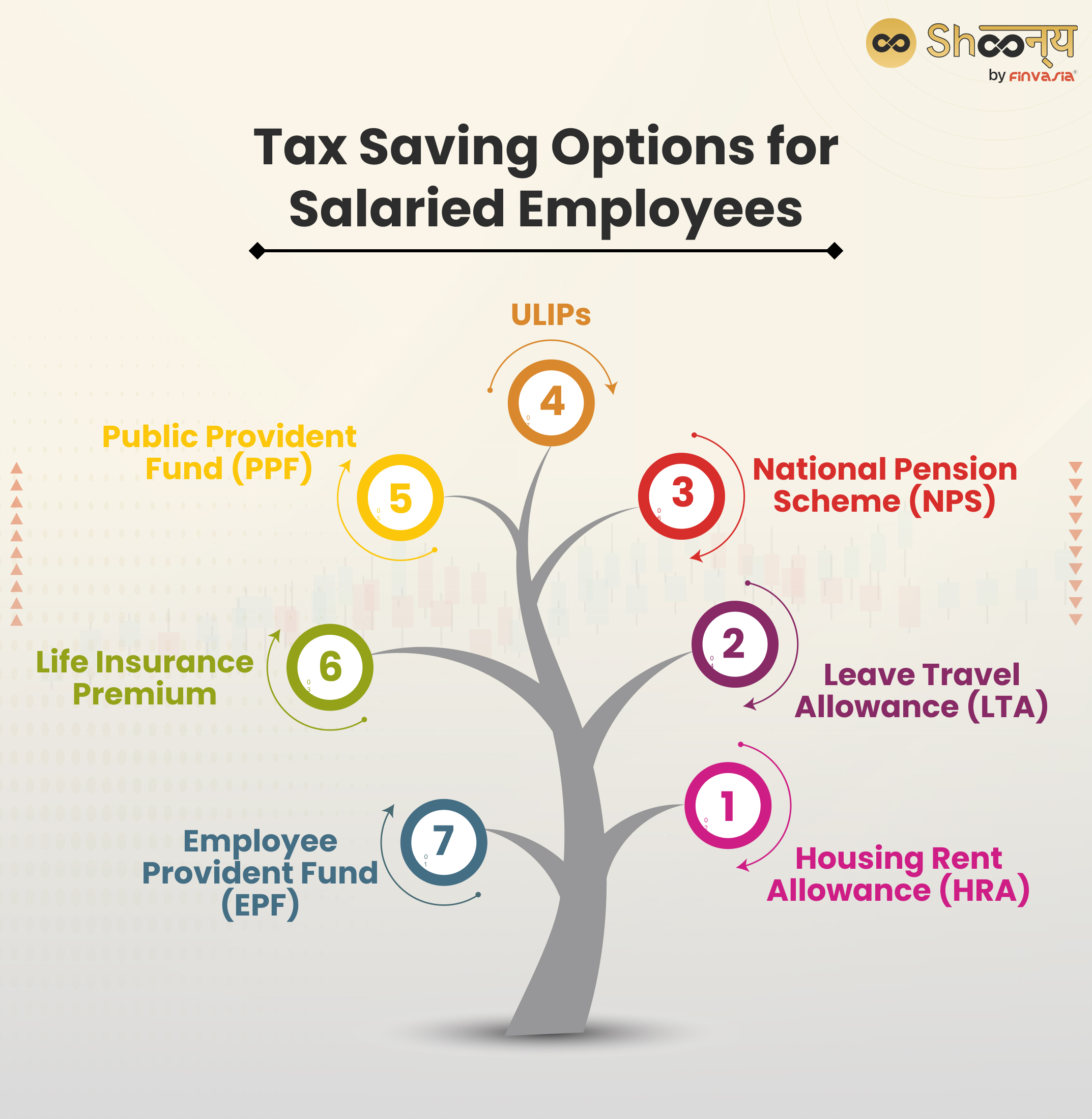

5 Tax Saving Options For Salaried Employees Zaggle Save Employee

Tax Planning For Salaried Employees Saffollya

Tax Planning Tips For Salaried Employees ComparePolicy

Tax Planning Tips For Salaried Employees ComparePolicy

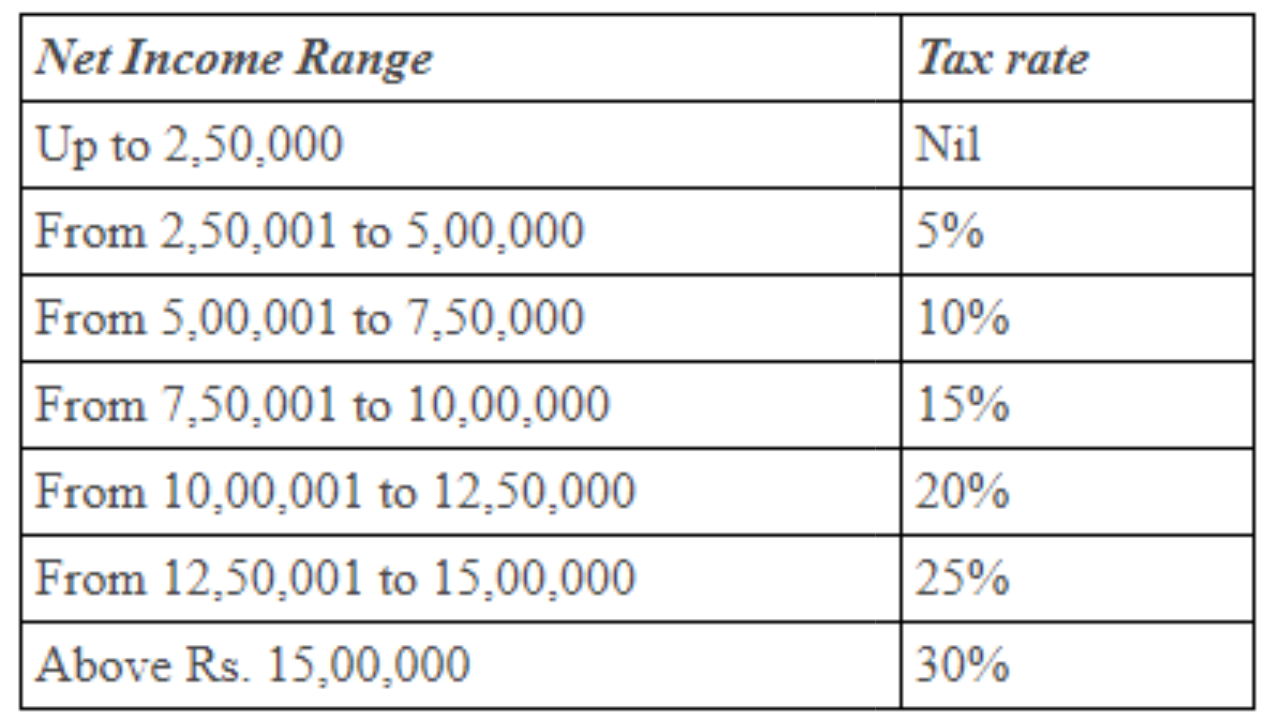

How To Calculate Income Tax On Salary With Example

How To Calculate Income Tax On Salary With Example

Salary Vs Hourly The Difference How To Calculate Hourly Rate From

Tax Benefits For Salaried Employees - [desc-12]