Tax Brackets For 2025 Vs 2024 Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper return If online filing is not an

April 30 2025 Deadline for most individuals to file their tax return and pay any taxes owed June 15 2025 Deadline to file your tax return if you or your spouse or common law partner are The first R550 000 of your retirement lump sum is tax free as of 1 March 2024 Any previous withdrawals or retirement lump sums you ve taken will reduce your tax free amount The

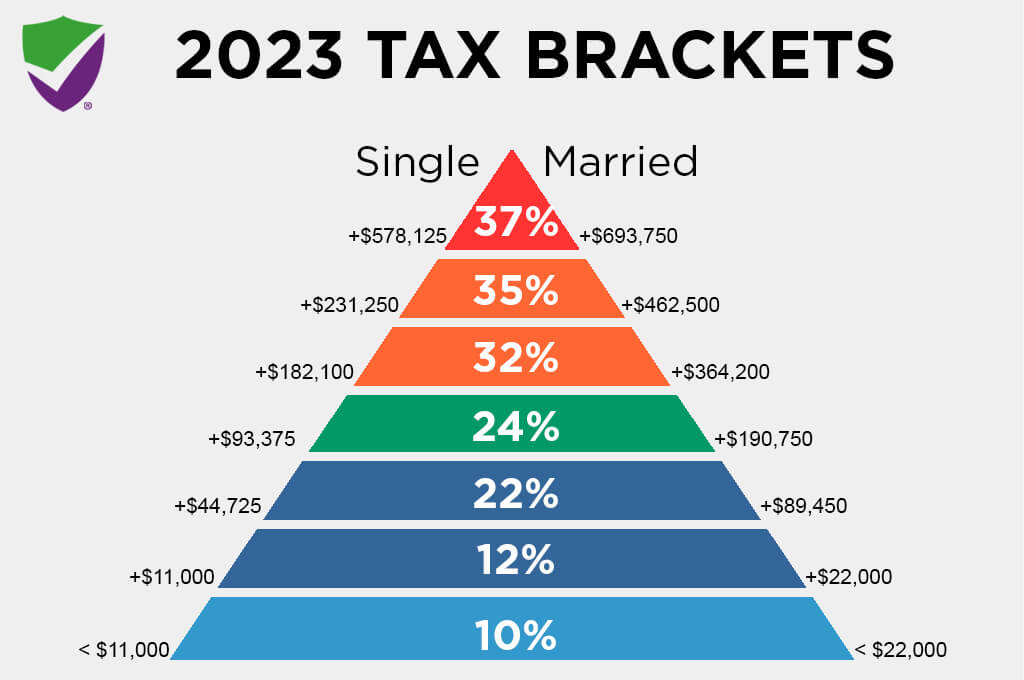

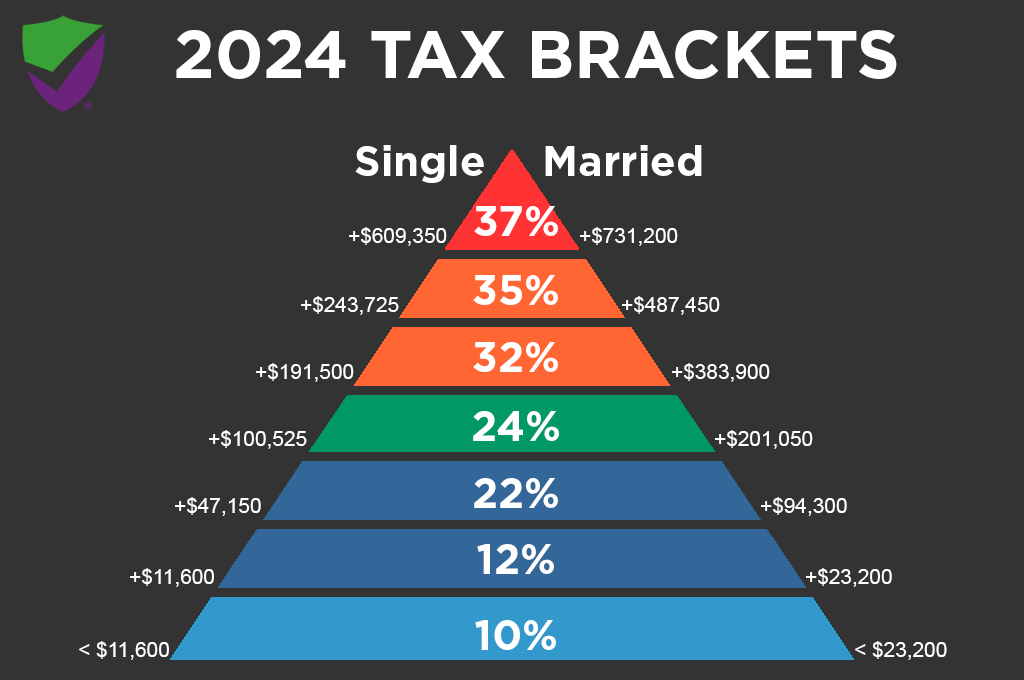

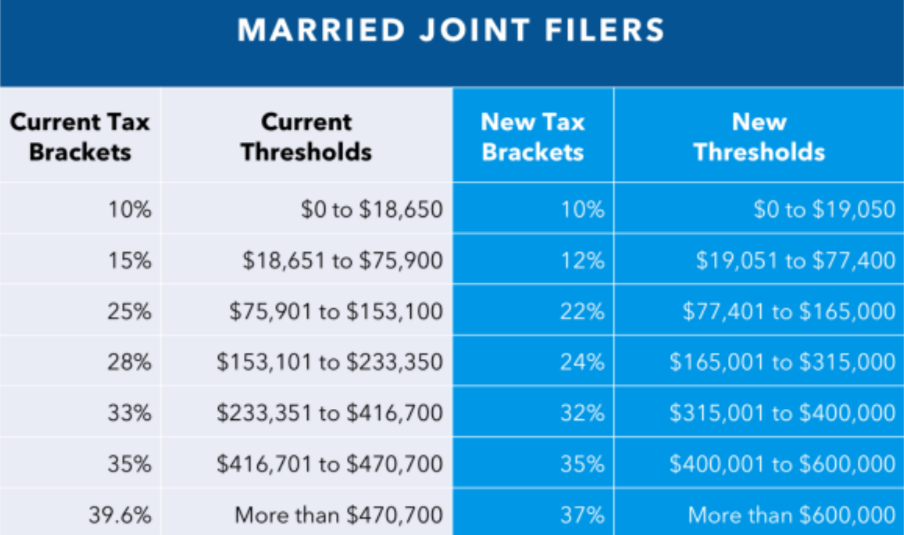

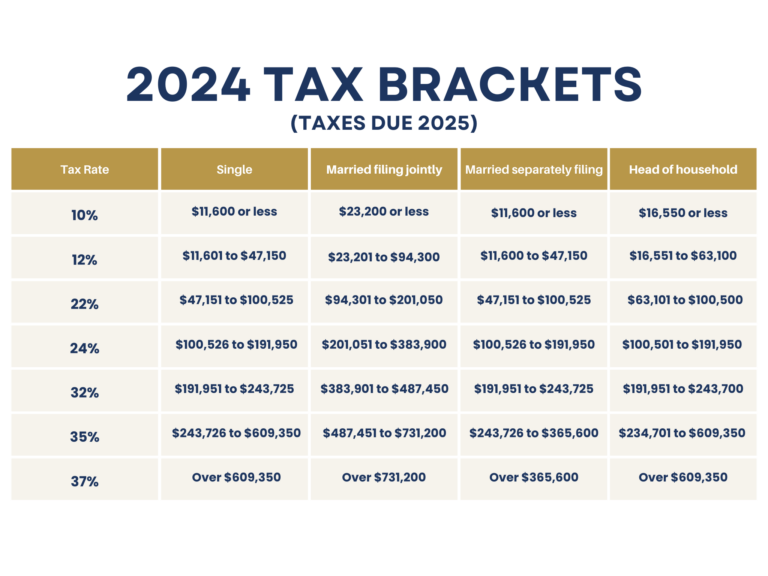

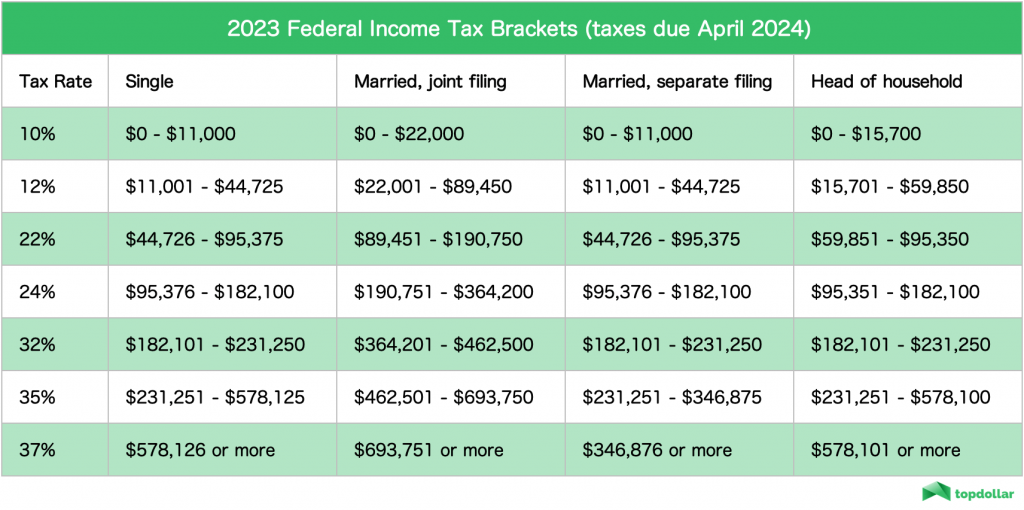

Tax Brackets For 2025 Vs 2024

Tax Brackets For 2025 Vs 2024

https://thehill.com/wp-content/uploads/sites/2/2022/10/Tax-Bracket-form-3.png?w=900

Irs 2025 Tax Credits And Deductions Eugene S Santos

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Federal_Tax_Brackets_1600x974.png

Tax Brackets 2025 Australia Single Tamera B Wardlow

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets.jpg

Do you need to register for income tax If your income exceeds the tax thresholds then you will need to register as a tax payer with SARS Do you need to submit a tax return for the 2024 25 Assessed tax return notice of assessment or reassessment other tax document or be signed in to CRA My Account If you are calling on behalf of someone else The person you re calling on

If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on If you have a modest income and a simple tax situation the Community Volunteer Income Tax Program CVITP or Income Tax Assistance Volunteer Program for residents of Quebec can

More picture related to Tax Brackets For 2025 Vs 2024

Irs Tax Brackets 2025 Over 65 Gonzalo Nash

https://www.investors.com/wp-content/uploads/2017/12/TAXBRACKETS-2-Single-122617-1024x574.png

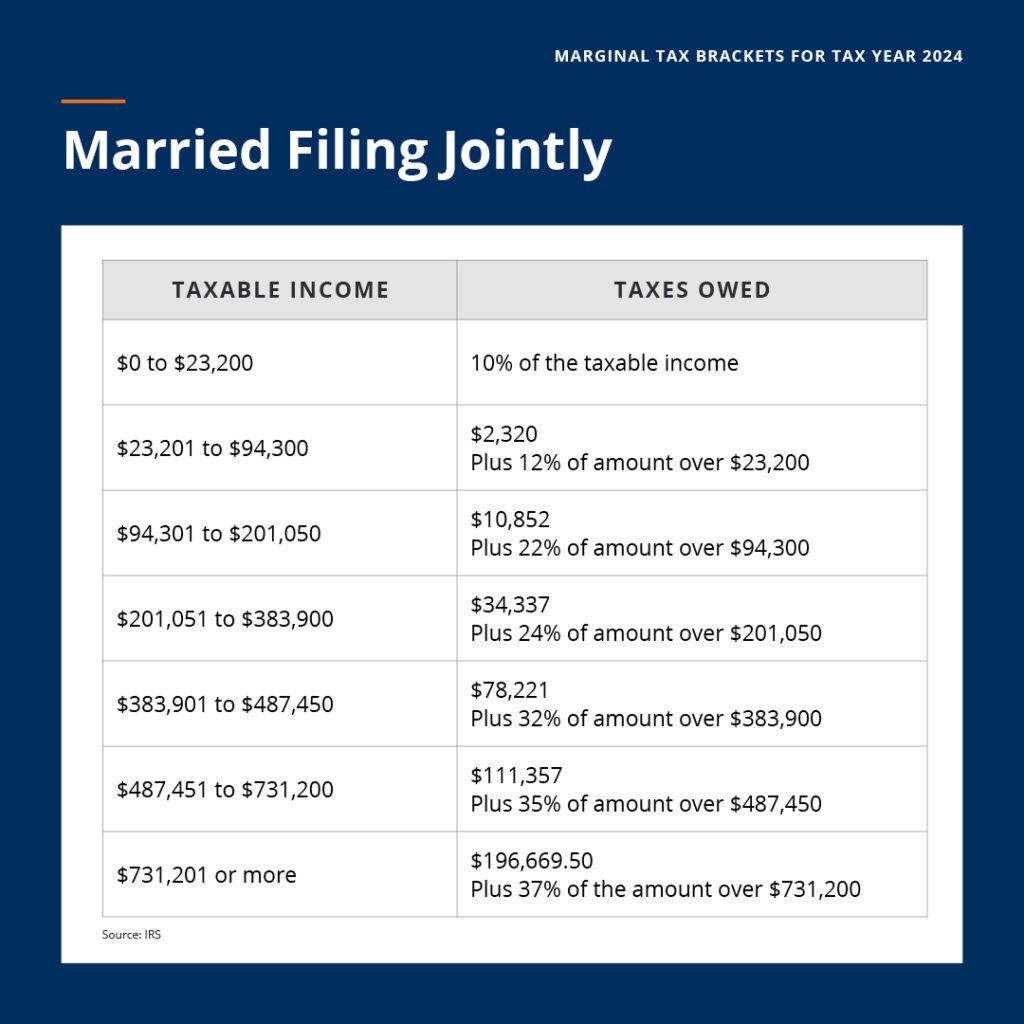

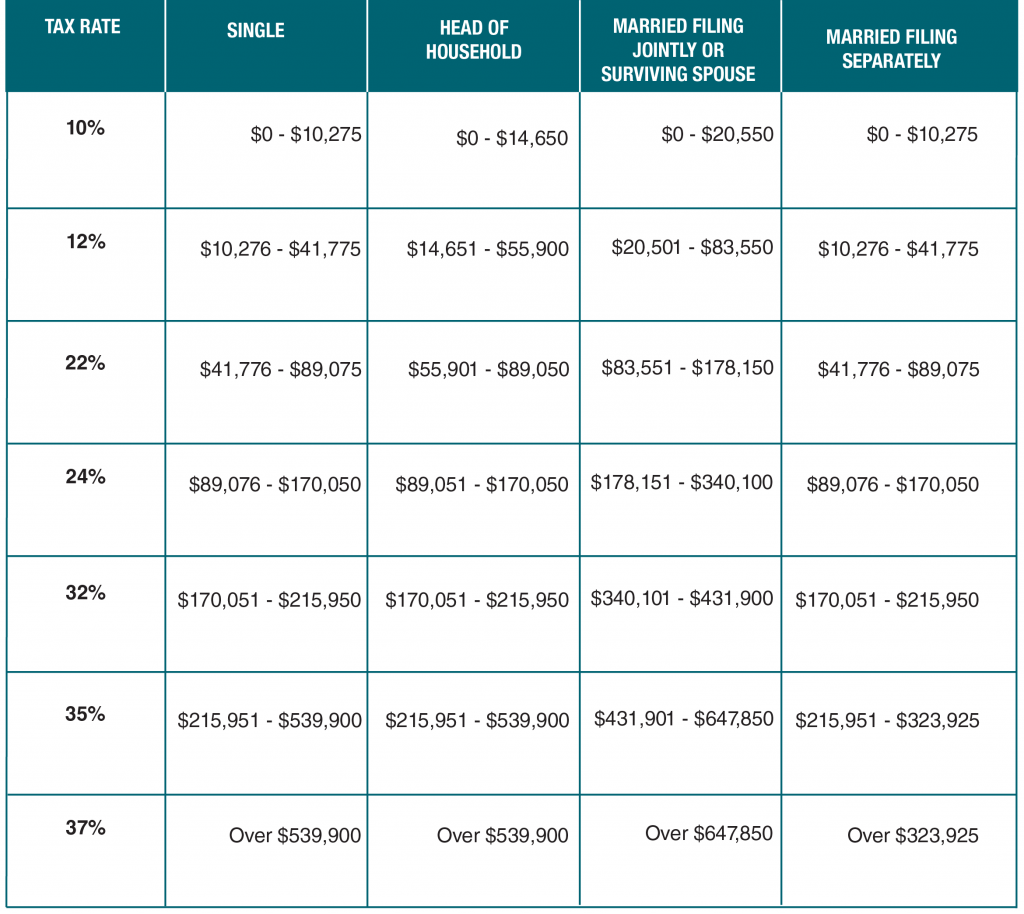

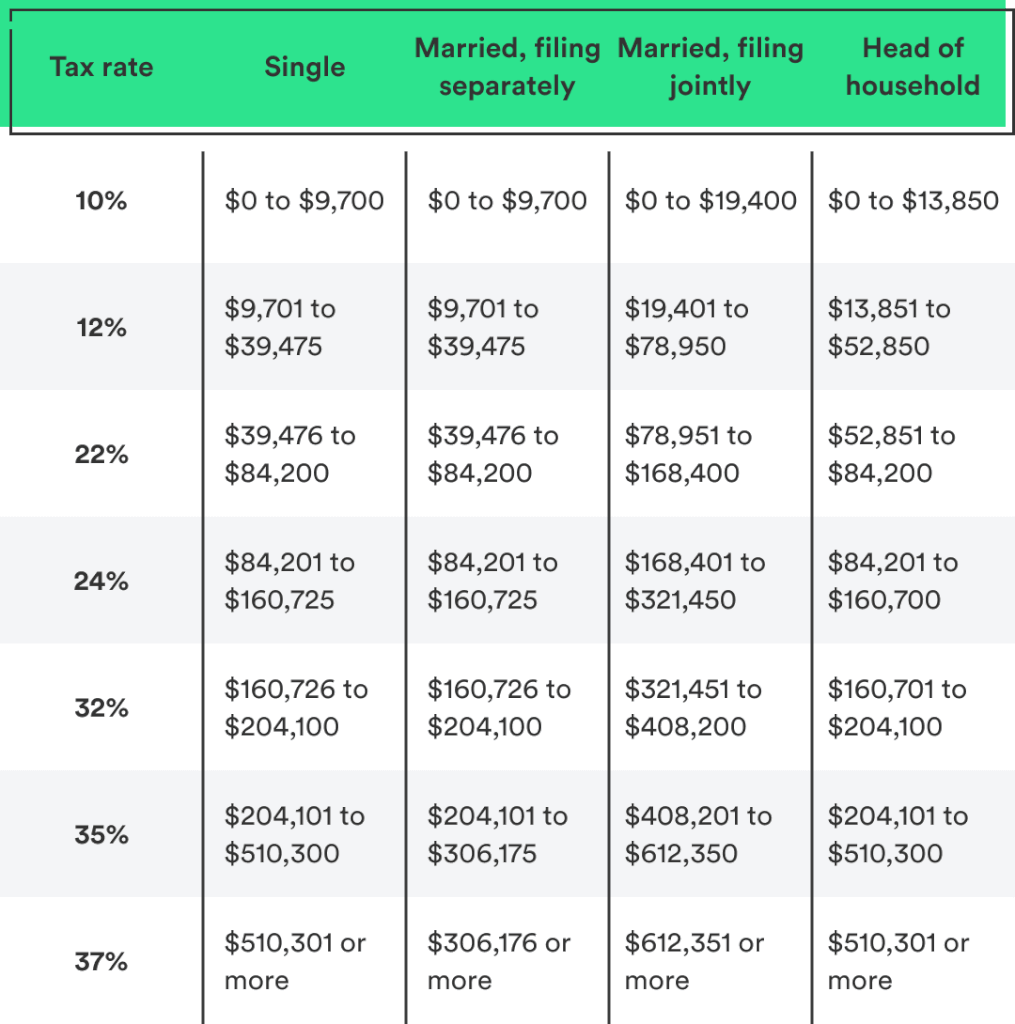

Tax Brackets 2024 Married Vs Single Ardene Ludovika

https://static6.businessinsider.com/image/5c33ac822a5b7403ce13413e-2400/married filers tax 2018 vs 2019.png

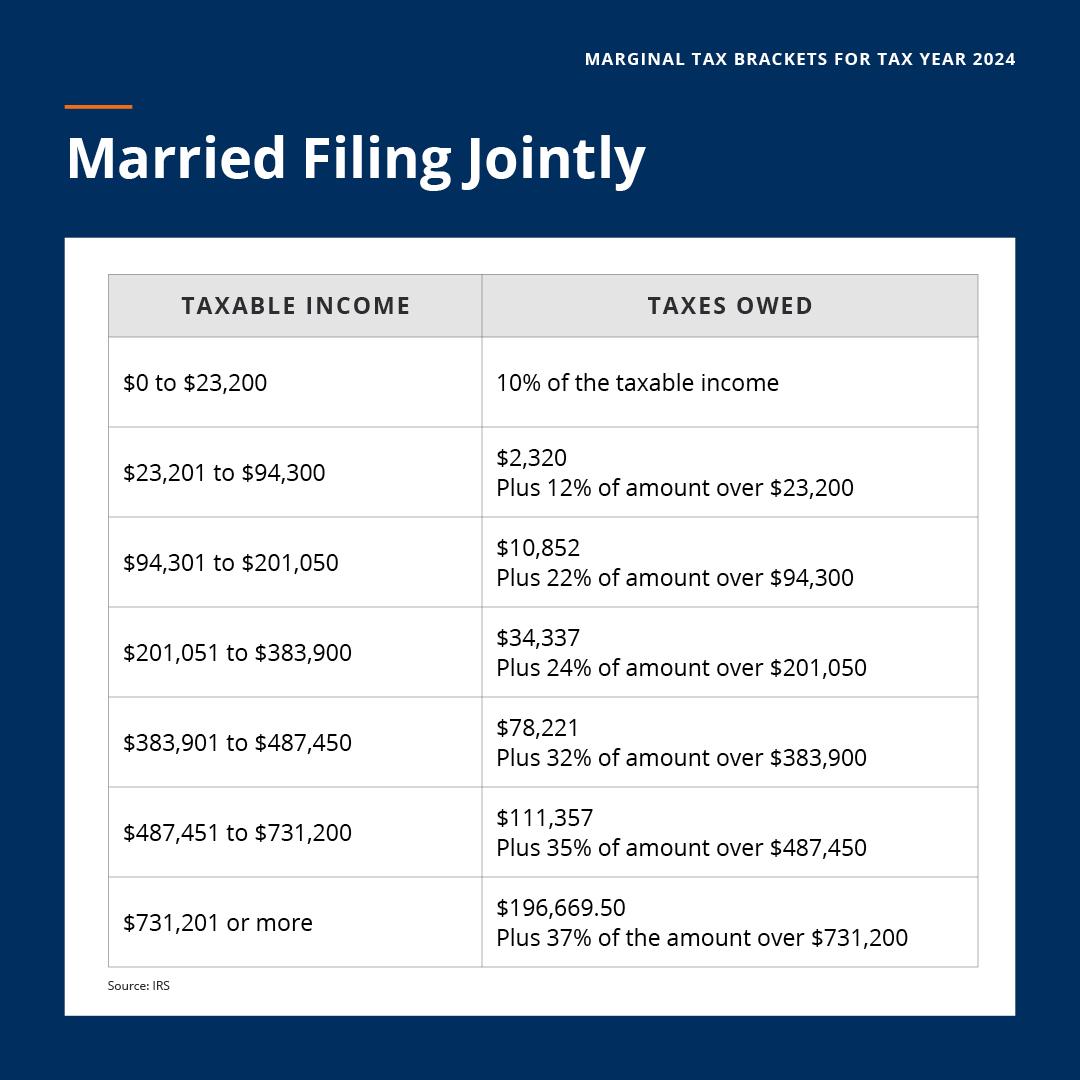

2024 Tax Brackets For Seniors Married Jointly Lorri Rebekah

https://www.trustetc.com/wp-content/uploads/2023/11/2024_Tax_Brackets_Carousel_3-1024x1024.jpg

The 25 Part XIII tax also applies to payees in countries with which Canada has a tax treaty that is not yet in effect A Part XIII tax rate of 23 applies to the gross amounts paid credited or The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

[desc-10] [desc-11]

United States Tax Brackets 2025 Katherine J Stevenson

https://static-ssl.businessinsider.com/image/5c33833ebd7730076d294700-2400/2019 tax brackets table 1.png

2025 California Tax Calculator Jennifer J Brown

https://www.millerkaplan.com/wp-content/uploads/2021/11/Ordinary-Income-Tax-Brackets_2022-1024x914.png

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper return If online filing is not an

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-tips

April 30 2025 Deadline for most individuals to file their tax return and pay any taxes owed June 15 2025 Deadline to file your tax return if you or your spouse or common law partner are

Tax Brackets 2025 Australian Government James P Walker

United States Tax Brackets 2025 Katherine J Stevenson

New York 2025 Tax Brackets For Individuals Jessika U Durr

Current Standard Deduction 2024 For Seniors Prudy Ortensia

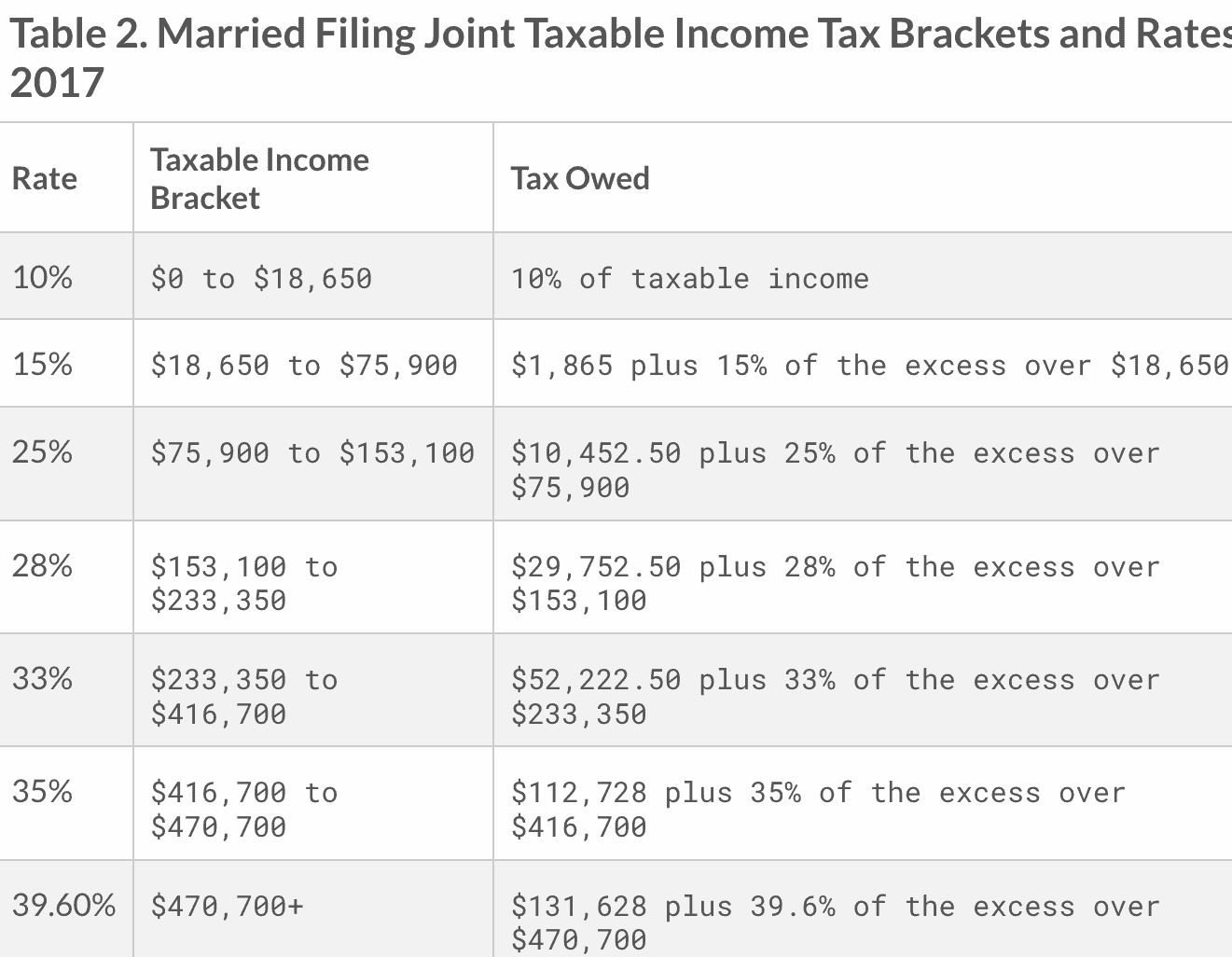

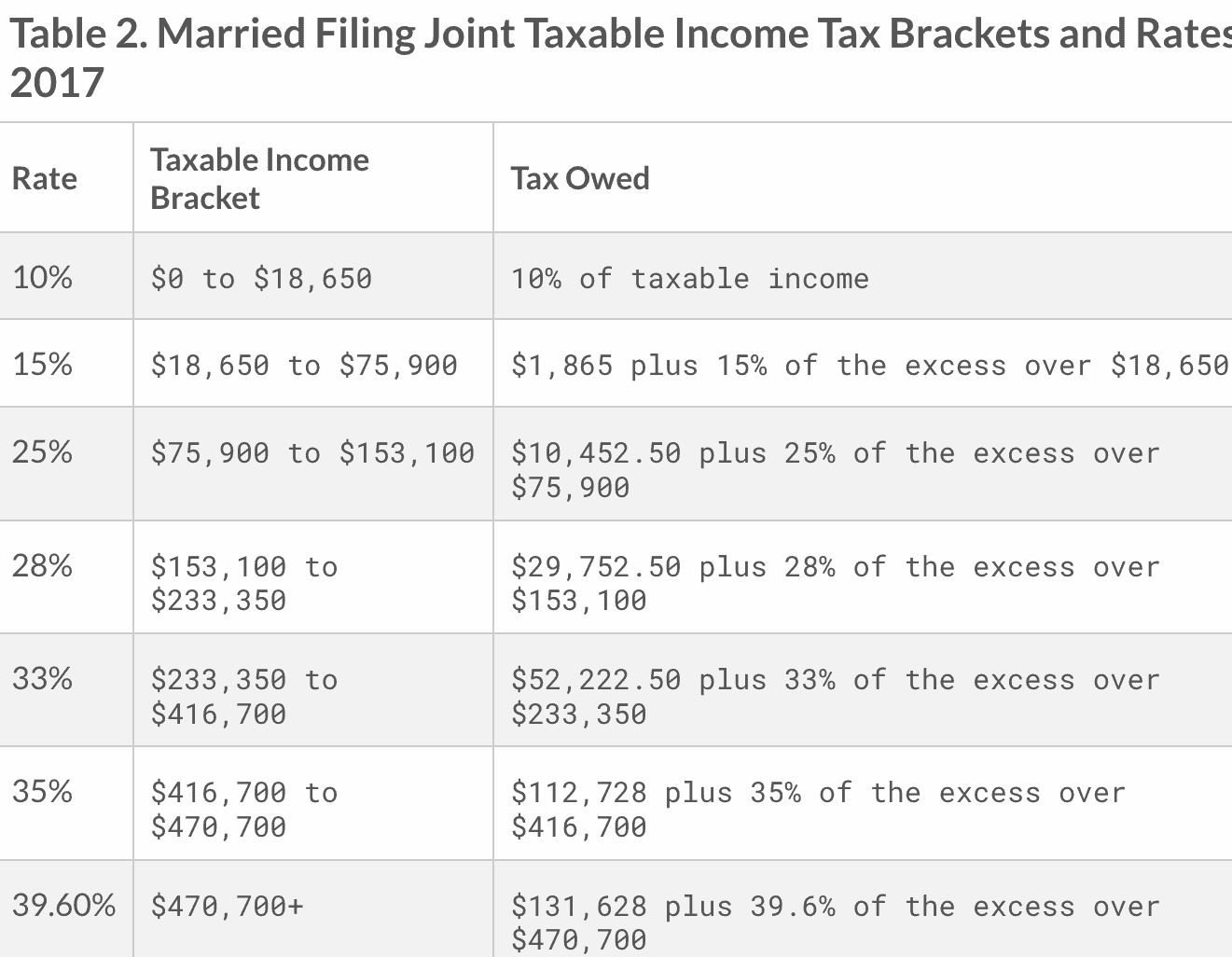

Mfj Tax Brackets 2025 Images References Fadi Radical

Tax Bracket 2025 Head Of Household Married Filing Jointly Karen Klein

Tax Bracket 2025 Head Of Household Married Filing Jointly Karen Klein

2025 Standard Deduction Married Joint Senior Halona Moon

2025 Tax Brackets Calculator Usa Helen A Bruch

How Many Years Is 2025 To 2025 Tax Brackets Dorian Wood

Tax Brackets For 2025 Vs 2024 - If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on