Tax Office Reference Number 120 This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a

Canada Disability Benefit The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is Income tax Personal business corporation trust international and non resident income tax

Tax Office Reference Number 120

Tax Office Reference Number 120

https://i.ytimg.com/vi/2BpMMwHXJ3c/maxresdefault.jpg

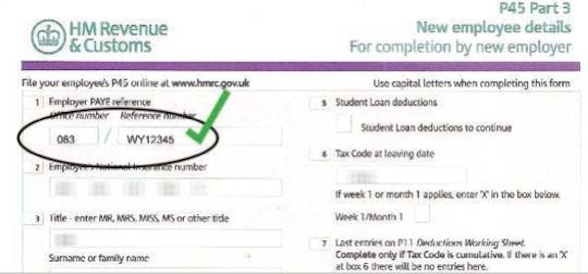

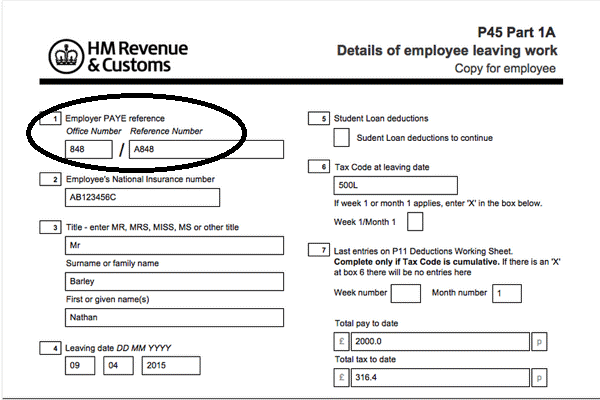

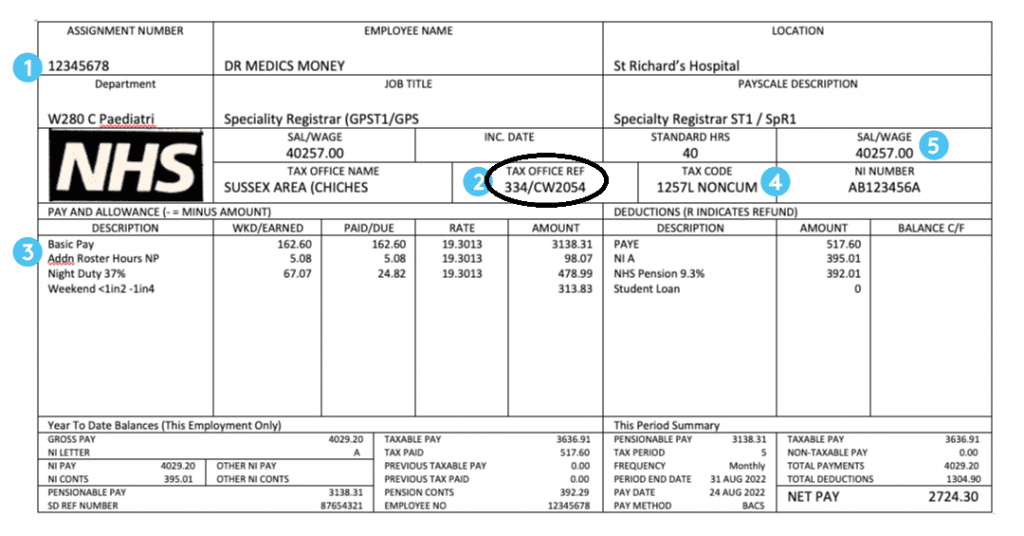

Payroll Numbers IDs References What They Are What They Re Used For

https://www.datocms-assets.com/50397/1697187854-p45-ern.jpeg?auto=format&dpr=1&q=90&w=588

If You Have Not Received By The End Of May Ask For It If You Need A

https://i.pinimg.com/originals/cb/9c/d2/cb9cd23db3bc1c51bf671320e2090586.png

Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services TD1 2025 Personal Tax Credits Return Notice to the reader Notice for employers Instead of giving paper copies of Form TD1 to your employees give them the link to this webpage Ask them to

How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund Effective March 13 2025 the Government of Canada is imposing 25 per cent tariffs on 29 8 billion in products imported from the United States U S

More picture related to Tax Office Reference Number 120

Mailer P60 Payslip Plus

https://payslips-plus.co.uk/wp-content/uploads/2022/04/Mailer-P60-min.jpg

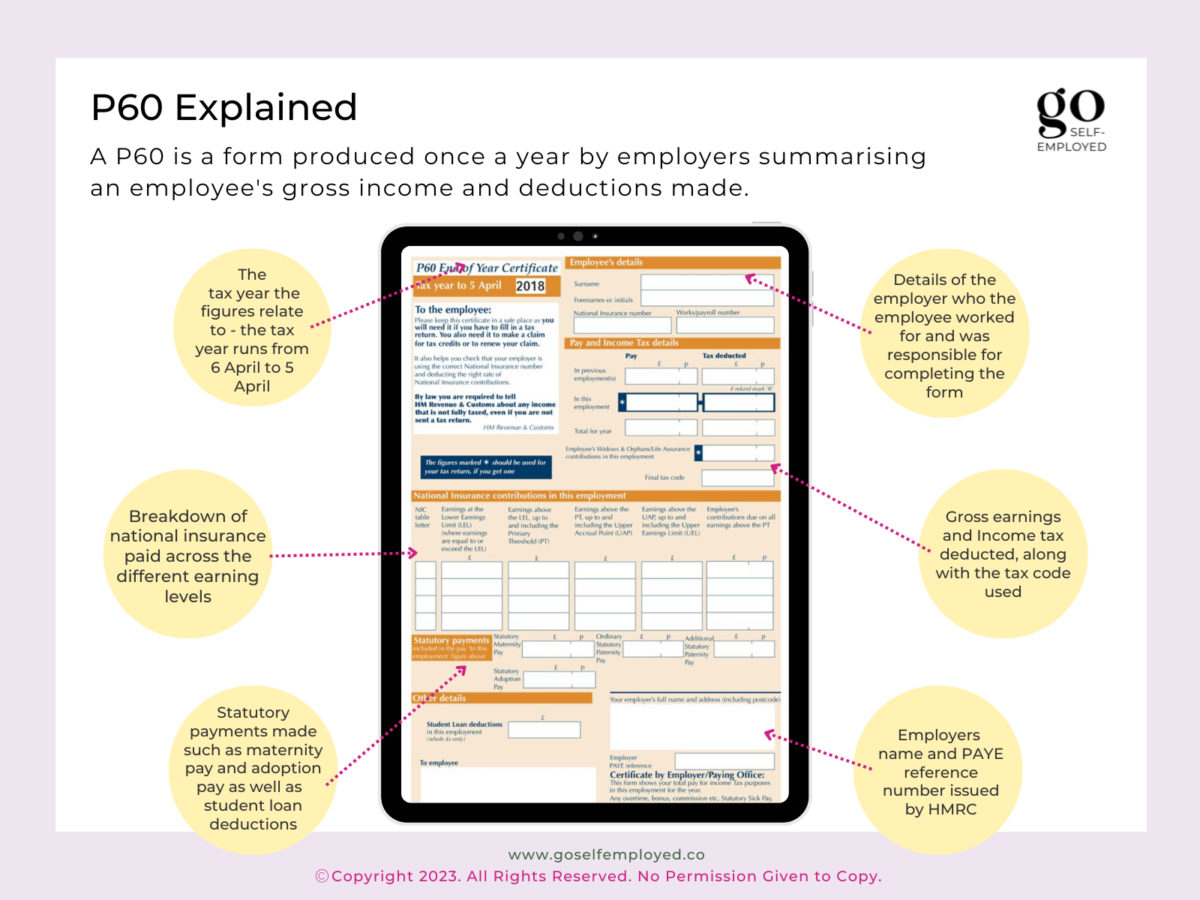

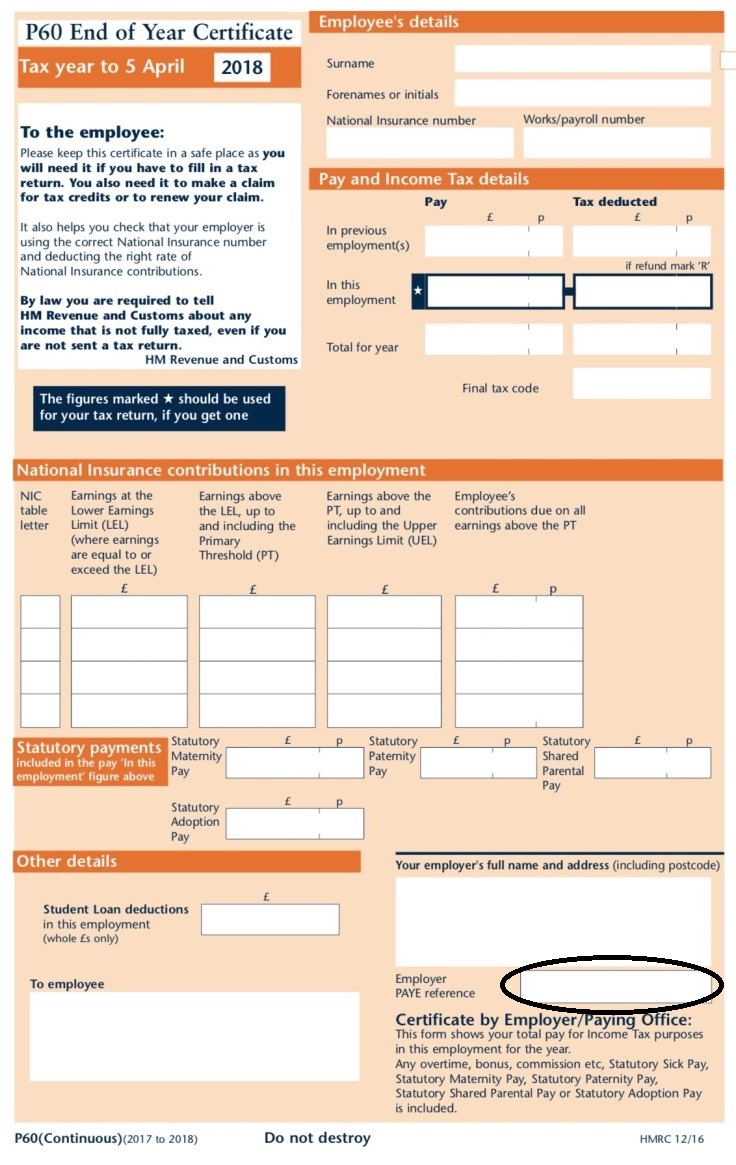

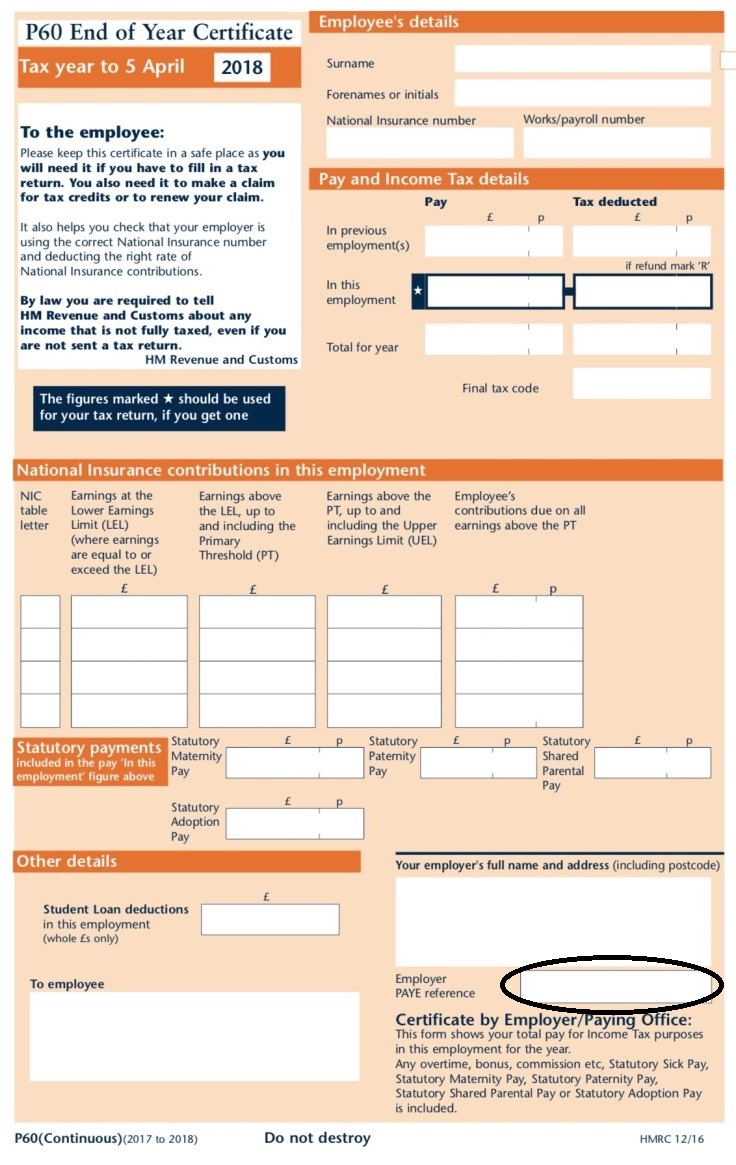

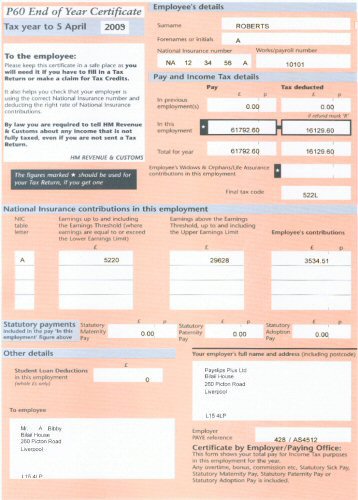

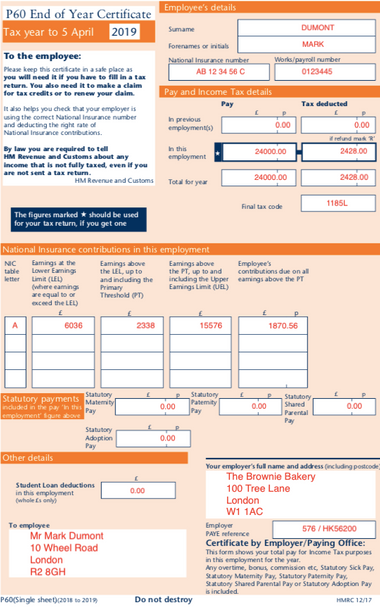

P60 Form Explained

https://goselfemployed.co/wp-content/uploads/2018/02/P60-Form-Explained-1200x900.png

Employer s PAYE Ref Number Claim My Tax Back

https://claimmytaxback.co.uk/wp-content/uploads/2022/12/p45.png

The tax deductions for CPP additional contributions are imbedded in the tables The users are not required to take any additional steps to include these deductions You can Learn how to file your GST HST return using the online NETFILE form and whether this method meets your needs

[desc-10] [desc-11]

Employer s PAYE Ref Number Claim My Tax Back

https://claimmytaxback.co.uk/wp-content/uploads/2022/12/p60.jpg

Employer s PAYE Ref Number Claim My Tax Back

https://claimmytaxback.co.uk/wp-content/uploads/2022/12/wage-slip-1024x536.png

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a

https://www.canada.ca › en › services › benefits › disability › canada-dis…

Canada Disability Benefit The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is

P60 Standard Red Payslip Plus

Employer s PAYE Ref Number Claim My Tax Back

Hmrc Lifetime Allowance 2023 24 Image To U

P60 Standard Red Payslips Plus

OS Payroll Your P60 Document Explained

How Do I Find Out My Company Tax Reference Number MymagesVertical

How Do I Find Out My Company Tax Reference Number MymagesVertical

How Do I Find Out My Company Tax Reference Number MymagesVertical

What Are PAYE UTR And Tax Payroll Reference Numbers

How Do I Find My Home Office Reference Number You

Tax Office Reference Number 120 - [desc-14]