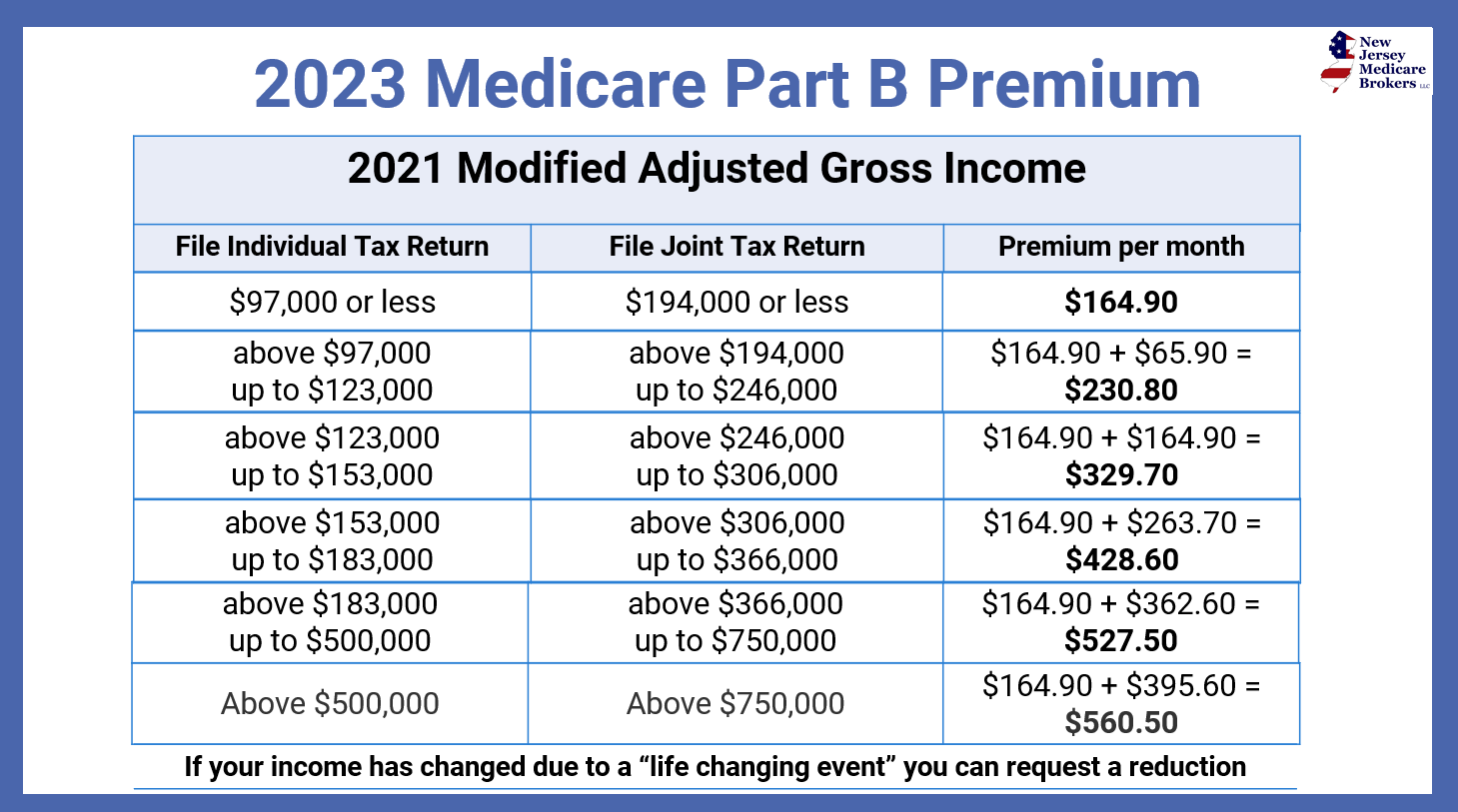

What Are The Income Limits For Medicare Part B In 2022 Medicare s IRMAA Brackets from 2007 to 2022 IRMAA is simply a tax on those who earn too much income The impact is simple the more you make the higher your Medicare costs The issue though is that your Social

Medicare Part B costs in 2022 are 170 10 an increase of 21 60 over 2021 The new Medicare Part B premium in 2022 will also be income adjusted for those earning a higher income Medicare Part B in 2021 was You pay higher Medicare Part B and Part D premiums if your income exceeds certain thresholds Here are the IRMAA income brackets for

What Are The Income Limits For Medicare Part B In 2022

What Are The Income Limits For Medicare Part B In 2022

https://www.tffn.net/wp-content/uploads/2023/01/what-are-the-income-limits-for-medicare-2022.jpg

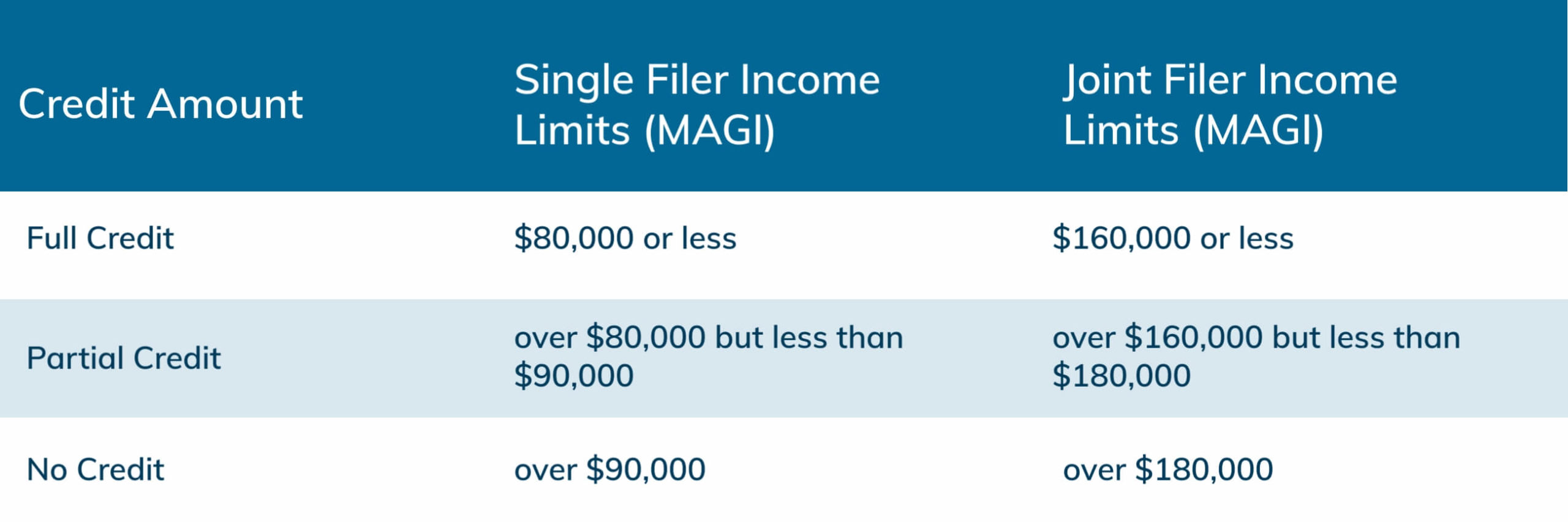

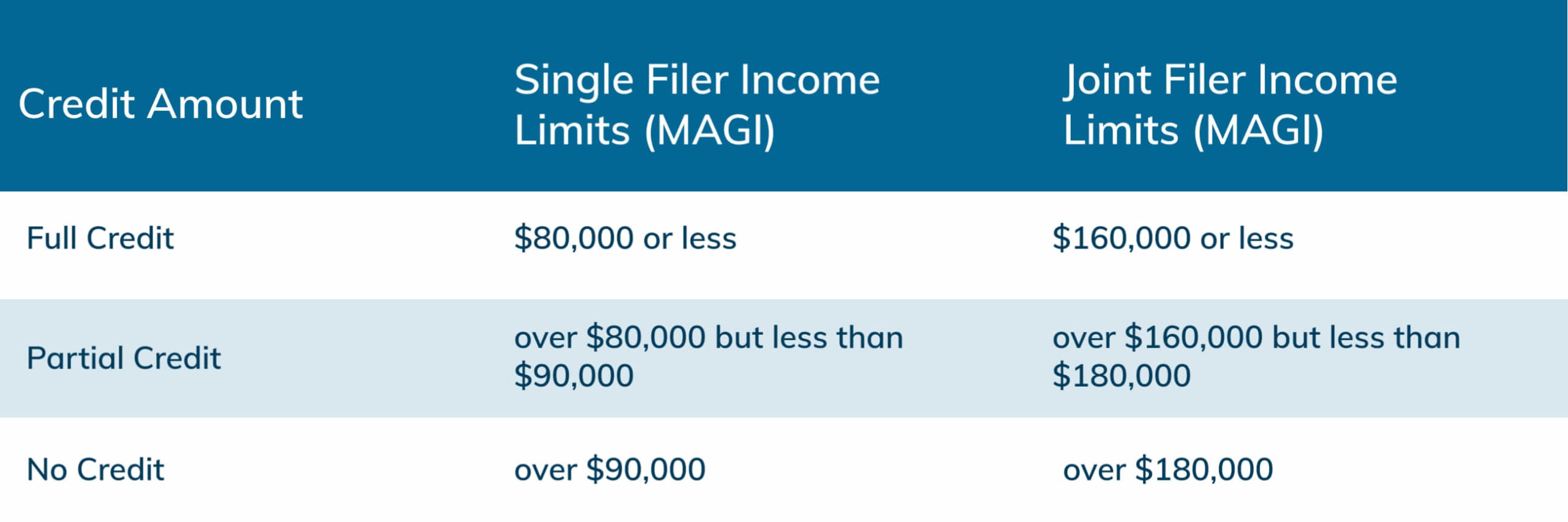

2022 Education Tax Credits Where s My Refund Tax News Information

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-AOTC-Income-Limits-scaled.jpg

2025 Medicare Part B Deductible Bonnee Stormie

https://www.retiremed.com/sites/default/files/2022-12/Part B IRMAA Chart_Cerkl.png

The Medicare Income Related Monthly Adjustment Amount IRMAA is an amount you may pay in addition to your Part B or Part D premium if your income is above a certain level The Social Each year the Medicare Part B premium deductible and coinsurance rates are determined according to provisions of the Social Security Act The standard monthly premium

This means that your Medicare Part B and Part D premiums in 2024 may be based on your reported income in 2022 In this guide we break down the costs of Medicare by income level including costs for Medicare Part What is the income limit for Medicare Part B If you make less than 1 308 a month and have less than 7 970 in resources you can qualify for SLMB Married couples need to make less than

More picture related to What Are The Income Limits For Medicare Part B In 2022

Medicare Part B Premium 2024 Cost Chart

https://agentmethods-production.s3.amazonaws.com/JgNSD4FHZjhZh3i1iCmAuPSQ

What Is The Income Limit For Free Health Insurance

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/FPL_chart_2022.png

Medicare Calendar 2024 Austin Yolande

https://medicarehero.com/wp-content/uploads/2022/09/2023-Medicare-Part-B-Premium-Chart.png

People with Medicare who earn a high income have to pay an IRMAA an extra charge on Medicare Parts B and D The fee kicks in if you make more than 106 000 up from 103 000 in 2024 or if you and your spouse However the premiums for Part B medical insurance and Part D prescription drug insurance can vary between individuals based on their income level If your income is above a specific limit the federal government adds an extra charge

For 2024 beneficiaries whose 2022 income exceeded 103 000 individual return or 206 000 joint return pay a total premium amount ranging from 244 60 to 594 The IRMAA surcharge for Part B and Part D health benefits coverage will increase for higher income earners in 2022 The brackets for both Part B and Part D have been adjusted for

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://www.irmaasolutions.com

Medicare s IRMAA Brackets from 2007 to 2022 IRMAA is simply a tax on those who earn too much income The impact is simple the more you make the higher your Medicare costs The issue though is that your Social

https://healthplancritic.com

Medicare Part B costs in 2022 are 170 10 an increase of 21 60 over 2021 The new Medicare Part B premium in 2022 will also be income adjusted for those earning a higher income Medicare Part B in 2021 was

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

What Are The Income Limits For Medicare Part B In 2022 - In 2024 if your 2022 income exceeded 103 000 for an individual return or 206 000 for a joint return you will pay an extra amount on top of your plan s Part B and Part