What Does Cafe Mean On W2 When you receive your W 2 form at the end of the year to document your taxable income you might notice Cafe 125 with an amount next to it on your form That designation refers to amounts on which you don t have

How Do Cafeteria Plans Affect a W 2 Cafeteria or Section 125 plans include employer sponsored benefits that are exempt from federal and typically state taxes Your Cafe 125 refers to the Cafeteria Plan under Section 125 of the IRS tax code These plans allow employers to offer a range of pre tax benefits such as health insurance dependent care assistance and flexible spending

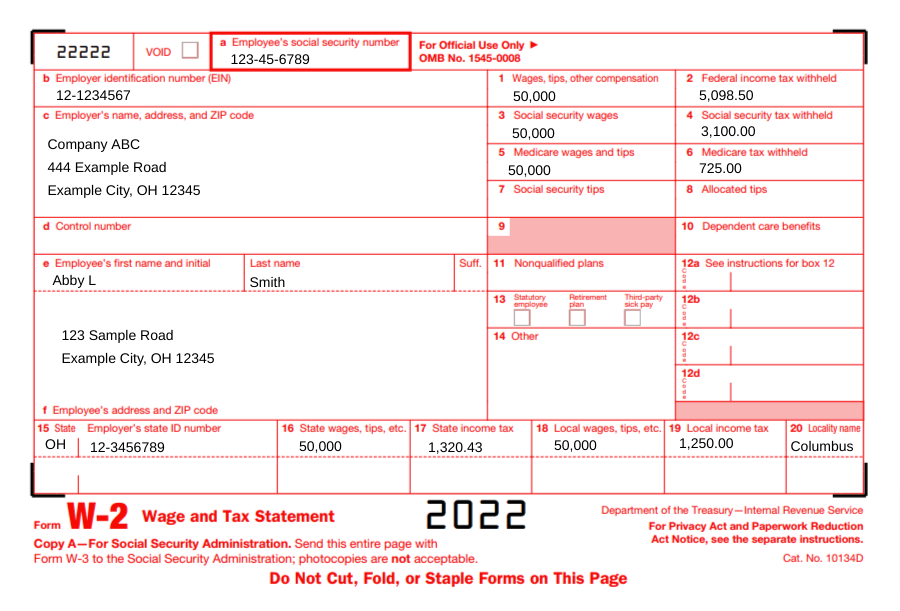

What Does Cafe Mean On W2

What Does Cafe Mean On W2

https://i.ytimg.com/vi/ZPObQAyG9M8/maxresdefault.jpg

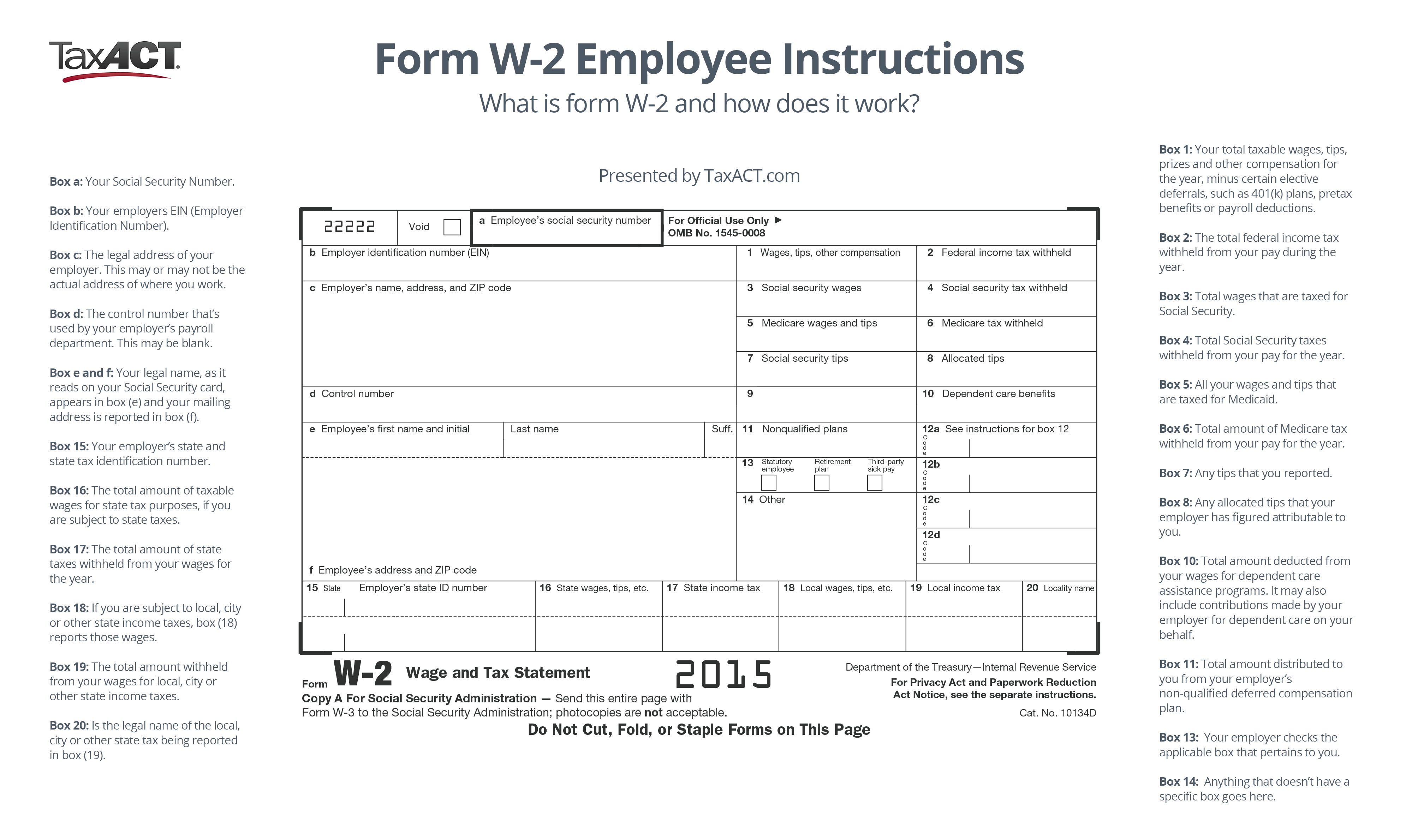

W 2right Saving For Retirement Retirement Planning Federal Retirement

https://i.pinimg.com/originals/05/fe/c8/05fec8bce62b72d5ca7dc5778f0562b3.png

What Is Form W 2 An Employer s Guide To The W 2 Tax Form 53 OFF

https://www.patriotsoftware.com/wp-content/uploads/2020/01/2022-Form-W-2-1.png

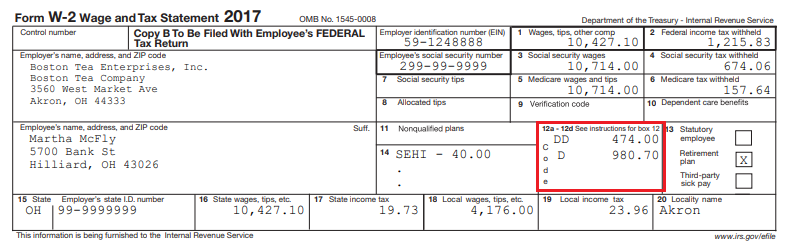

Understand cafeteria 125 on W2 to maximize your pre tax benefits and potentially reduce your tax liability Learn how to optimize your choices When you see Cafe 125 on your W 2 it signifies that your employer has a cafeteria plan in place This section might detail various pre tax deductions taken from your salary to fund these benefits indicating the portion of your income

Caf 125 refers to a cafeteria benefits plan based on Section 125 of the Internal Revenue Code Usually these benefits are tax free Section 125 plans provide a variety of Cafe 125 on a W2 refers to a section of the tax code that covers Cafeteria Plans A Cafeteria Plan also known as a Section 125 Plan allows employees to choose between different

More picture related to What Does Cafe Mean On W2

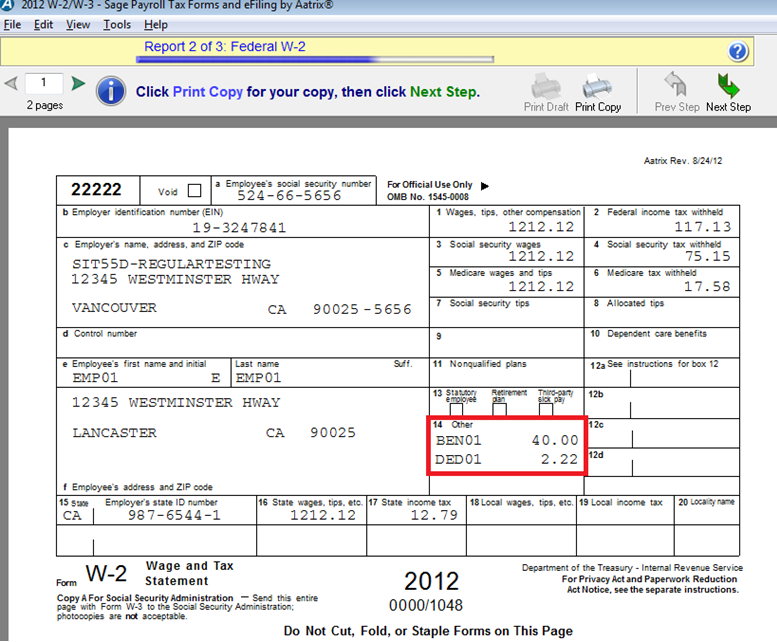

Corrections For Handling Of Multiple Box 14 On 2013 W 2 Form

https://support.na.sage.com/Platform/Publishing/images/26098_After.png

How To Get Target W2 Former Employee

http://blog.taxact.com/wp-content/uploads/Form-W-2-Employee-Instructions.png

Income Calculation Worksheet W2

https://www.financialsamurai.com/wp-content/uploads/2019/12/wage-and-tax-statement.png

It is also known as a cafeteria plan Usually what is reported there is your medical insurance premiums that are paid with pre tax income They are not taxed and are not Under a cafeteria or Section 125 plan you pay for your employer sponsored benefits with pretax money Your employer deducts your payments from your wages before

A Section 125 plan also known as a cafeteria plan allows employees to convert otherwise taxable items such as a salary into nontaxable benefits if they so choose If you re CAF refers to a cafeteria plan or section 125 plan This is an employer benefit that lets you choose between several tax deferred benefits if they are qualified from your

Free Restaurant Invitation Templates To Edit Wepik

https://content.wepik.com/statics/17813894/preview-page0.jpg

CAFE SCORE IAS GYAN

https://www.iasgyan.in/ig-uploads/images/dfvdfv.gif

https://www.sapling.com

When you receive your W 2 form at the end of the year to document your taxable income you might notice Cafe 125 with an amount next to it on your form That designation refers to amounts on which you don t have

https://smallbusiness.chron.com

How Do Cafeteria Plans Affect a W 2 Cafeteria or Section 125 plans include employer sponsored benefits that are exempt from federal and typically state taxes Your

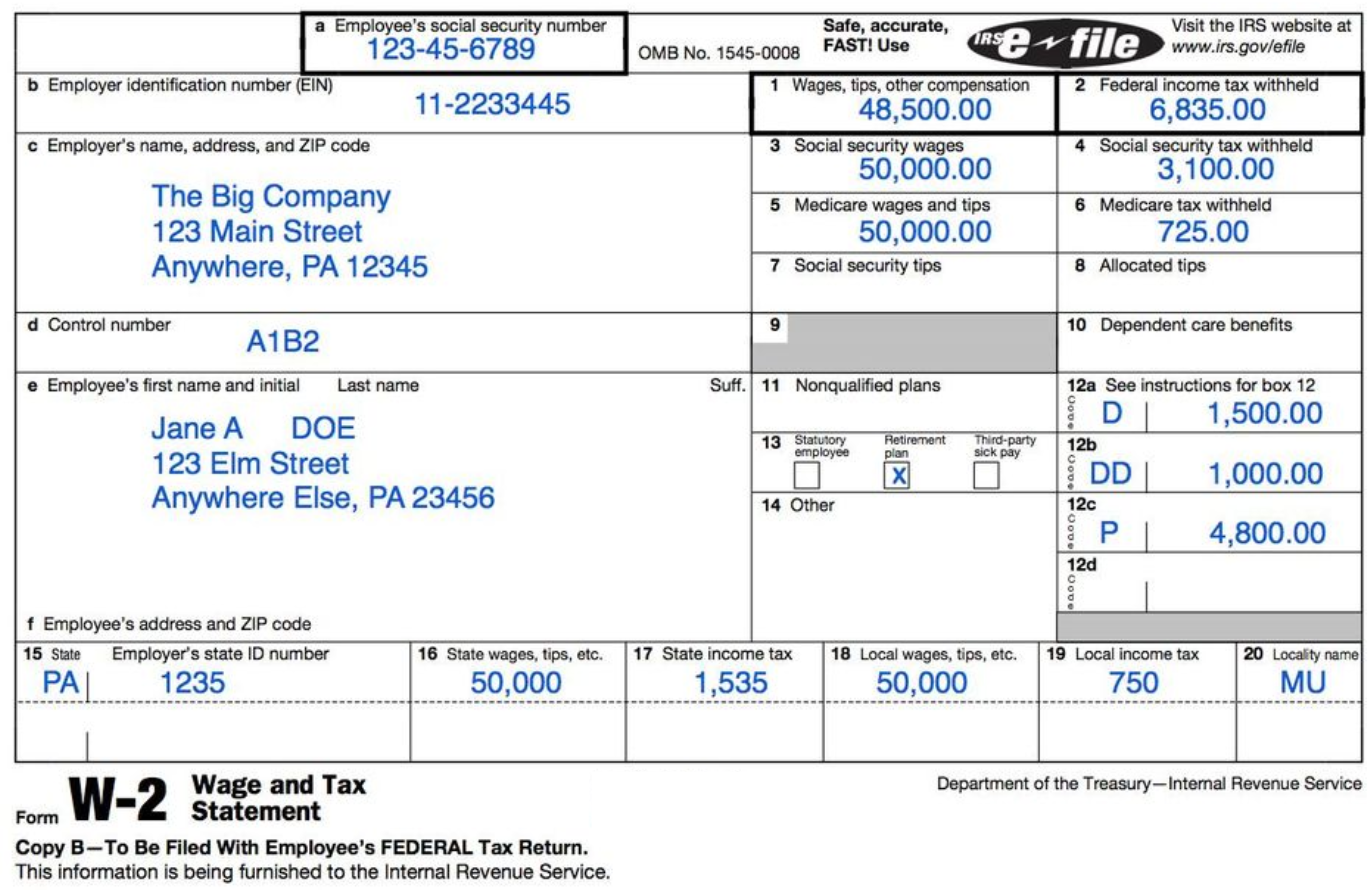

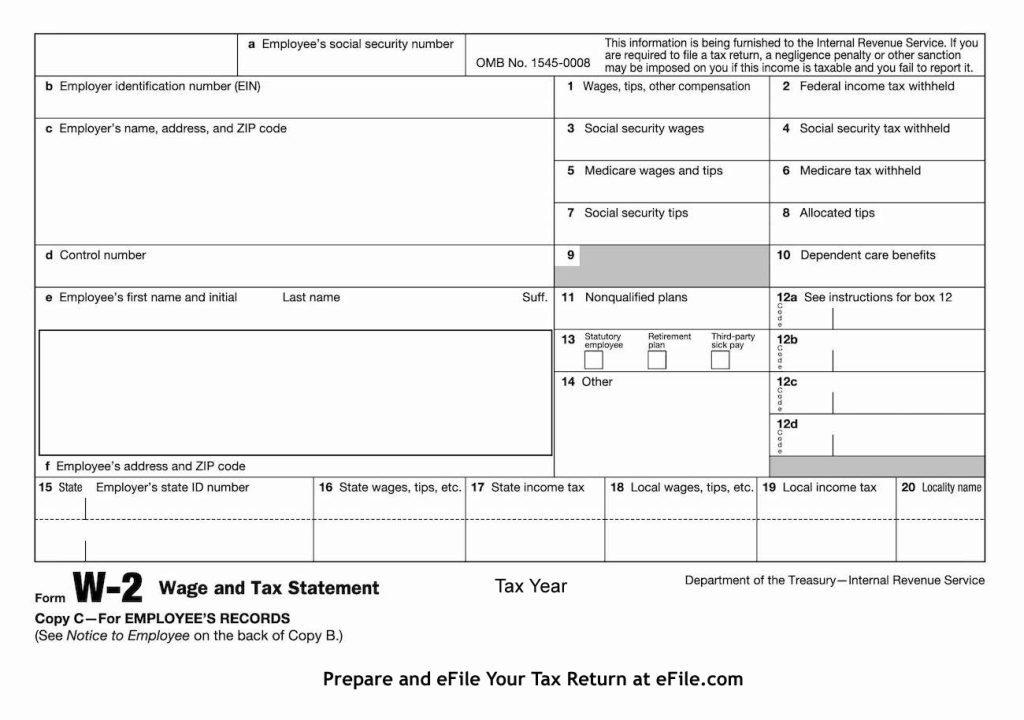

W2 Form 2025 Fillable Pdf Paul P Clark

Free Restaurant Invitation Templates To Edit Wepik

W 2 Example 2025 Anne Bond

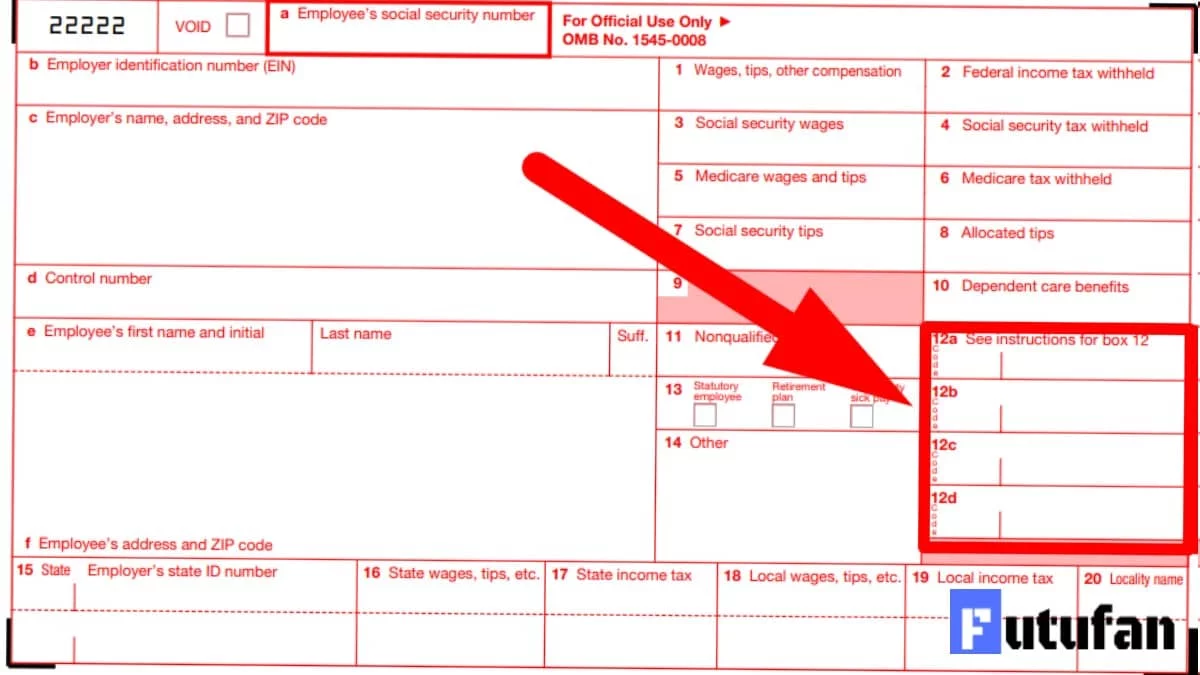

W 2 Box And Label Guidance For Deductions

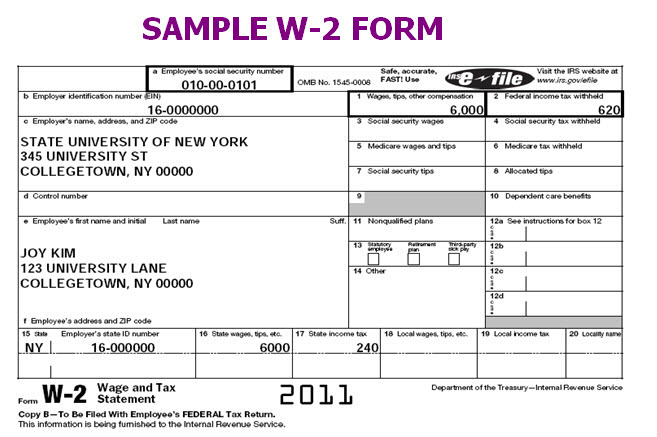

Qu Es El Formulario W2

CAFE Camaradas Arriba Falange Espa ola In Organizations Education

CAFE Camaradas Arriba Falange Espa ola In Organizations Education

W 9 Form 2025 Irs Lily Yara

W2 12 Codes

Dark And Atmospheric Interior Of The Cafe Cafe Interior Design

What Does Cafe Mean On W2 - Cafe 125 on a W2 refers to a section of the tax code that covers Cafeteria Plans A Cafeteria Plan also known as a Section 125 Plan allows employees to choose between different