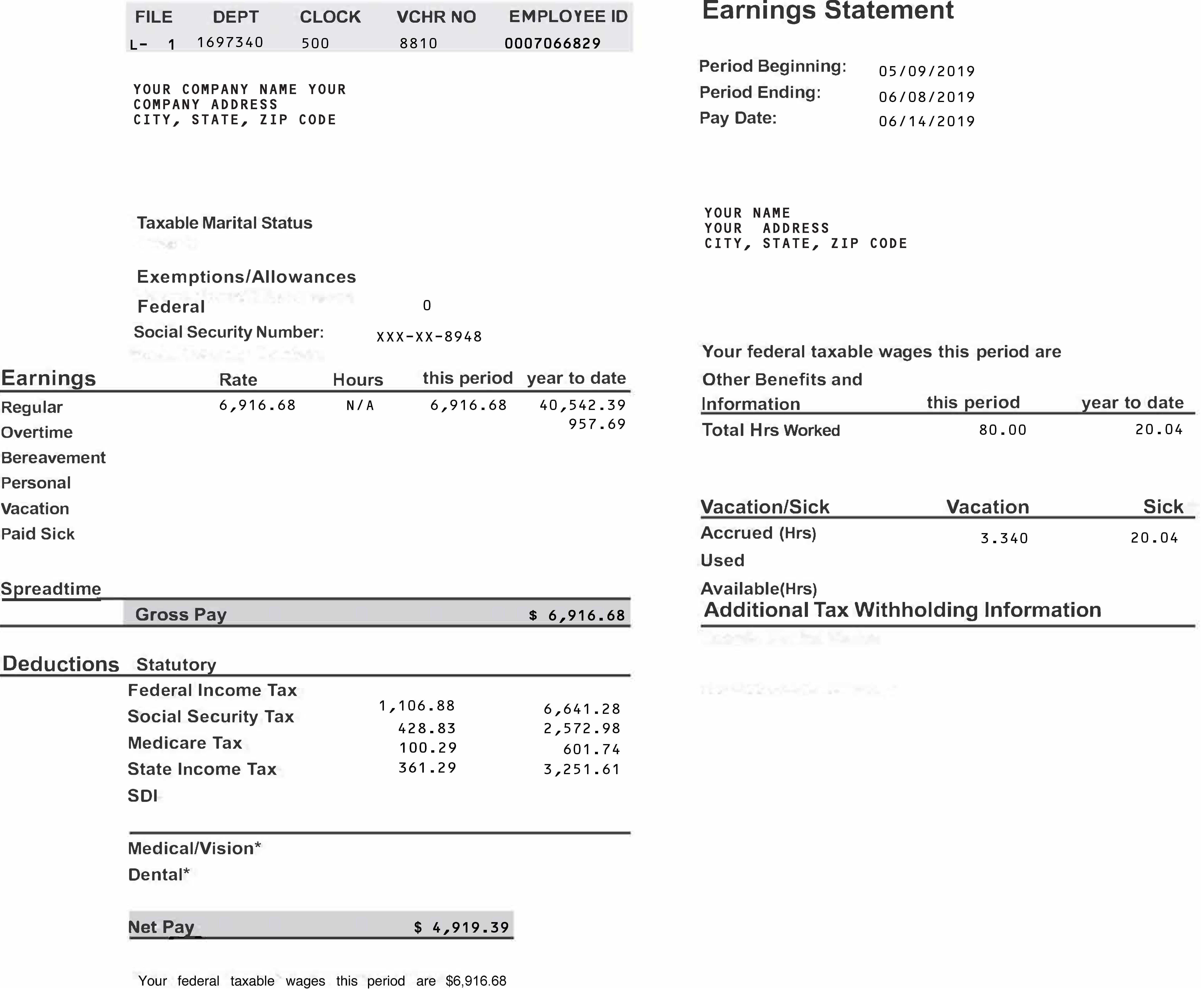

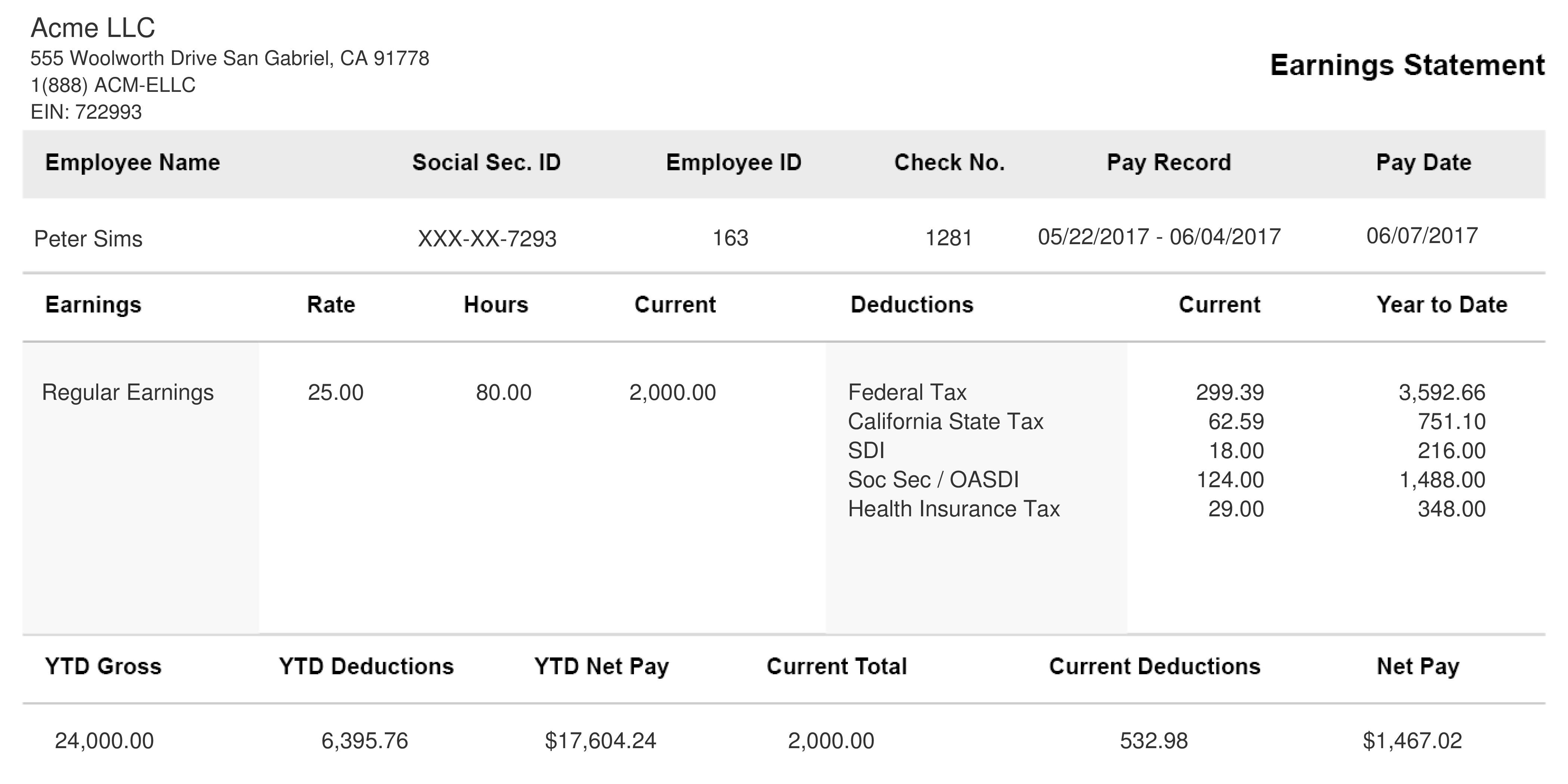

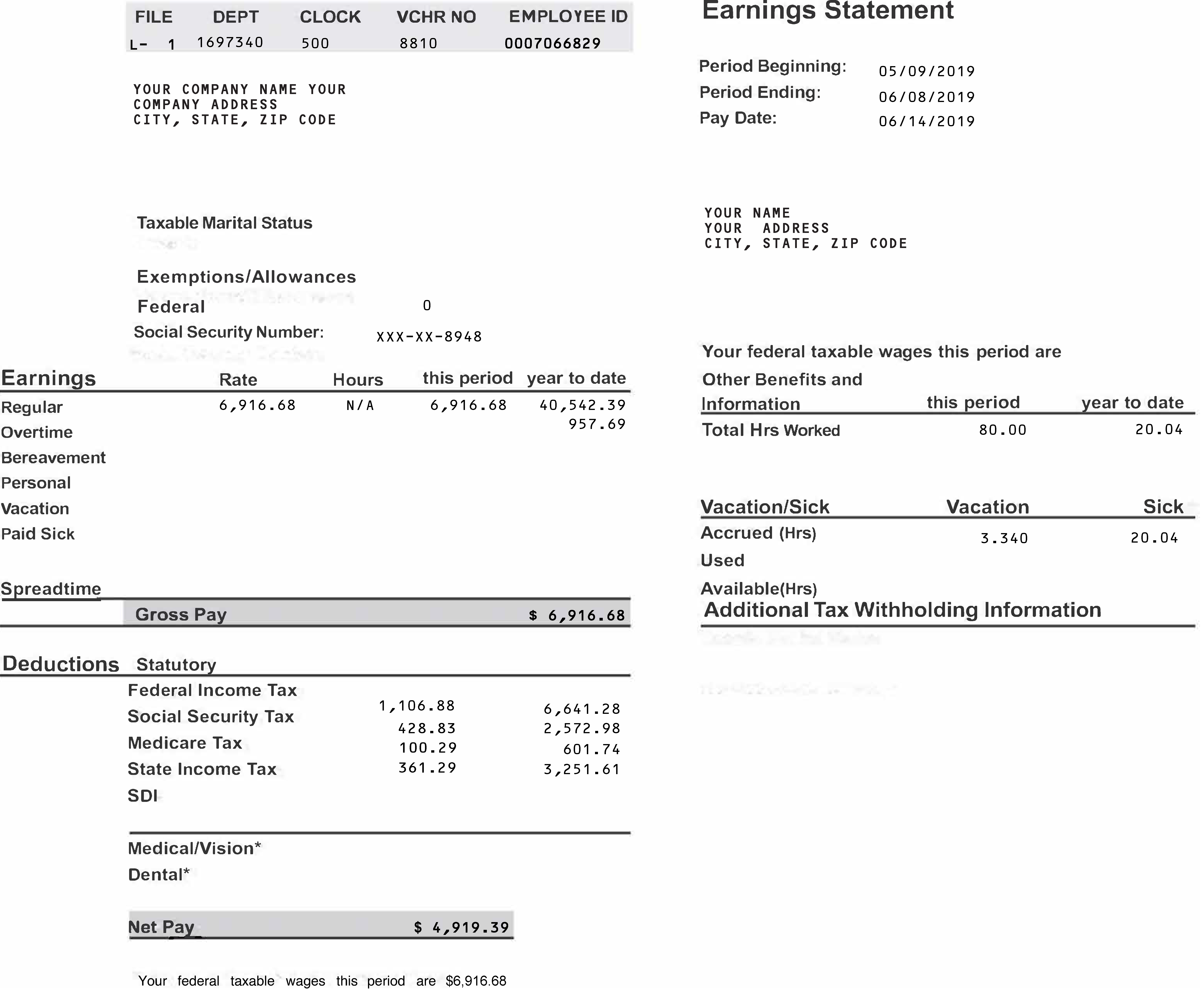

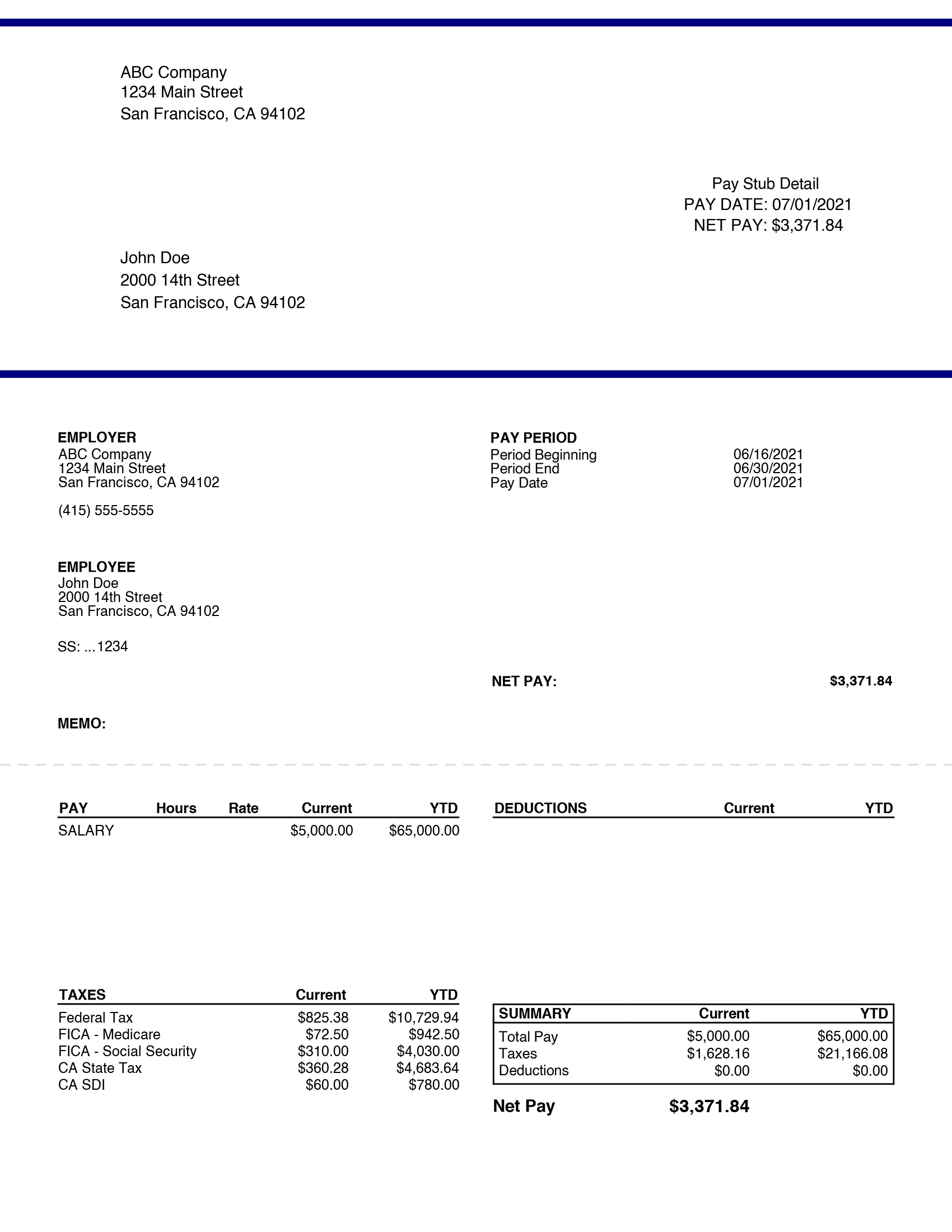

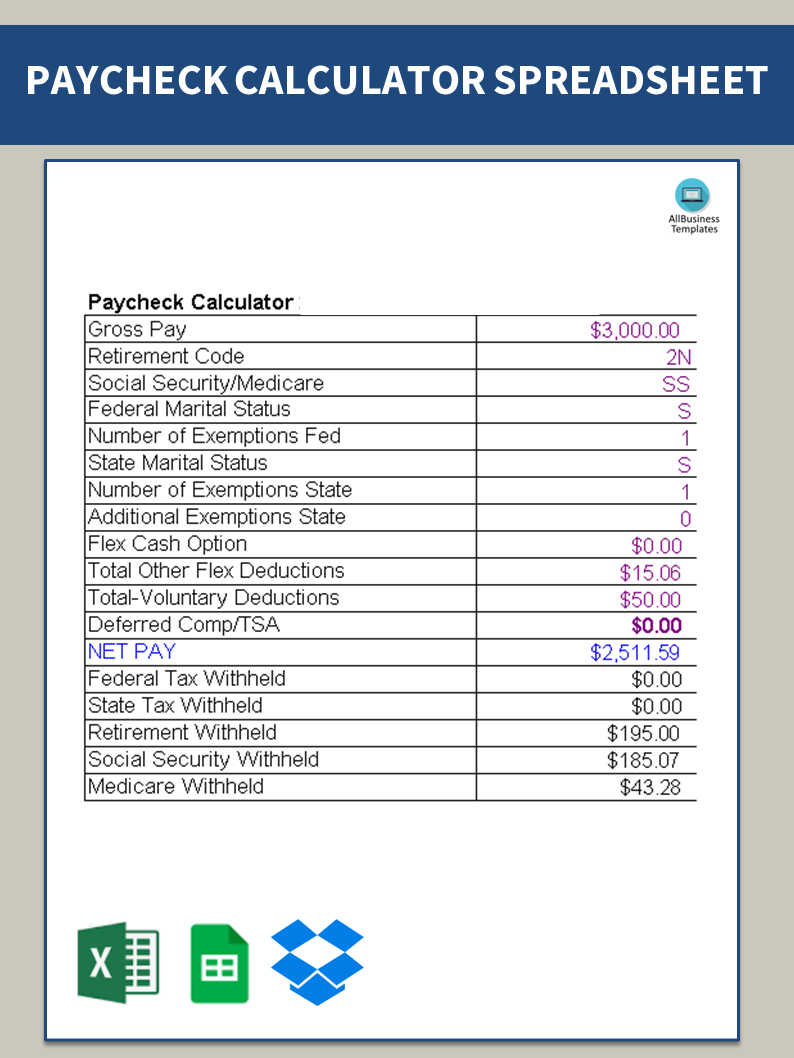

What Does Med R Mean On My Paycheck Medicare This amount of money goes toward Medicare taxes which are used to help fund health benefits for those who need financial assistance Year to Date This information shows the sum of your paychecks and other deductions so

What do all these pay stub abbreviations mean To get rid of confusion break down what each abbreviation and acronym stands for Not What does med R mean on my paycheck HSAR This is the employer s contribution to the Health Savings Account upon employee meeting criteria to receive it Med

What Does Med R Mean On My Paycheck

What Does Med R Mean On My Paycheck

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=763887755770132

Walgreens Paystub

https://www.speedystub.com/uploaded/sample_image/1569528714_TemplateA.png

Walgreens Paystub

https://www.vectortemplates.com/images/blogs/editor/5a55e99adf625-1.jpg

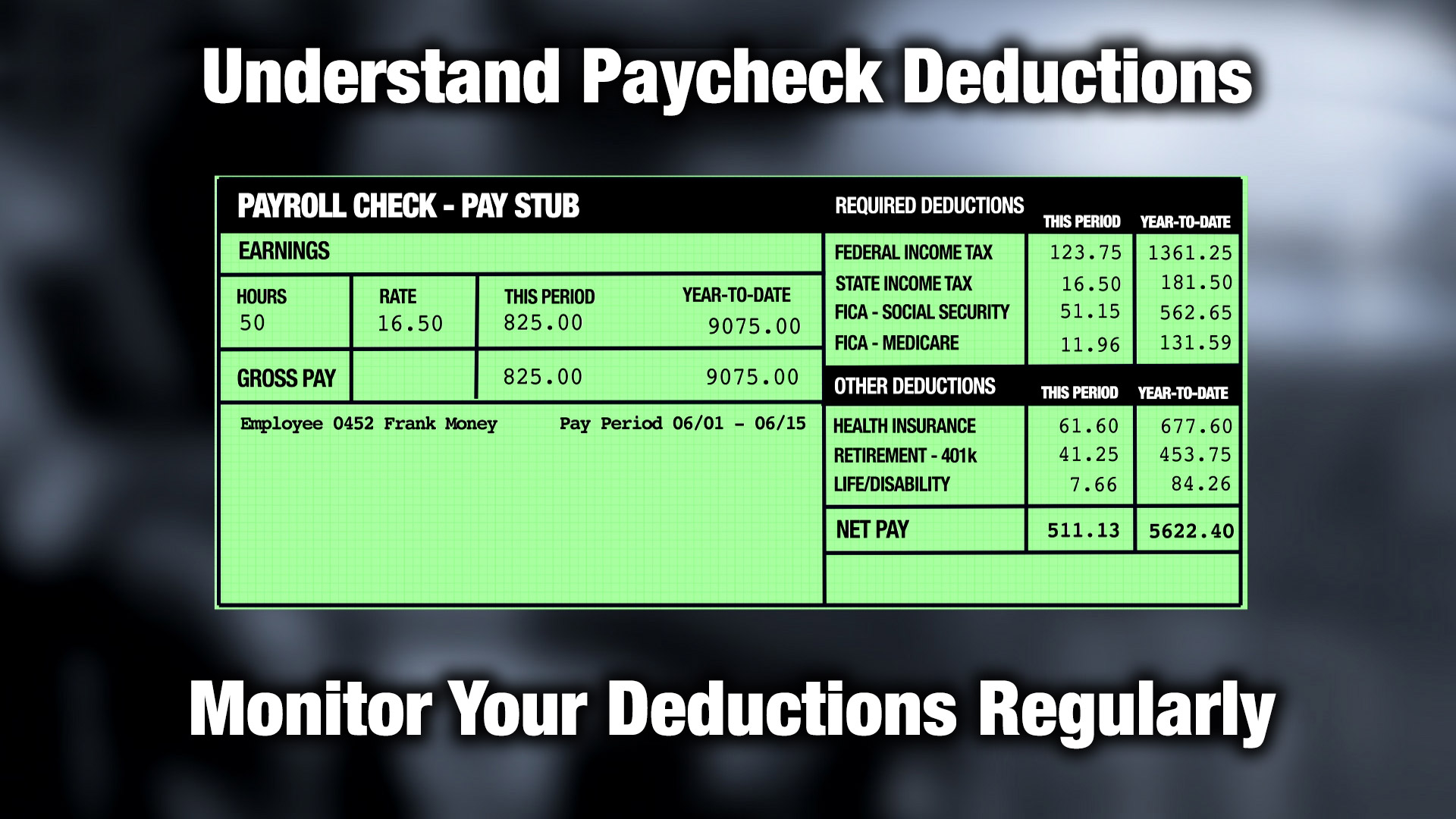

INS MED INS is the pay stub acronym for insurance or medical insurance deductions Medical insurance pays for an employee s medical surgical drug and other health fees LTD STD LTD stands for long term Learn how to distinguish payroll codes meant to describe specific tax deductions from the abbreviations used to represent all the adjustments and additional pay applied to an employee s regular earnings

MED stands for Medical It indicates deductions made from your salary for medical benefits or insurance coverage 2 Why am I seeing MED on my paycheck You see FICA Medicare these are mandatory salary withholdings in which each employee pays 1 45 of their paycheck toward Medicare and the employer also contributes 1 45 The number in this field of the paycheck will reflect this

More picture related to What Does Med R Mean On My Paycheck

What Does PS Mean In Writing 7ESL

https://7esl.com/wp-content/uploads/2023/06/What-Does-PS-Stand-For.jpg

Understand Paycheck Deductions Talkin Money Minutes

https://talkinmoneyminutes.org/wp-content/uploads/2018/04/Paycheck.jpg

10 Best U unforgottenrailroad Images On Pholder Aquariums Volvo And

https://i.redd.it/ljljgomitnk91.jpg

If you ve ever asked yourself what is FICA on my paycheck or wondered about the miscellaneous abbreviations on your ADP paystub you ve come to the right place Today we re setting out to demystify your paycheck We ll tackle the most common abbreviations explain their meanings and offer some tips on how you can review them to ensure accuracy So let s get to it Key Takeaways Pay stubs list important information about

FICA Medicare The pay withholding number made a compulsory requirement for this year is Medicare In it each employee pays 1 45 of his salary and his employer pays an equal amount The number will indicate the What Do Pay Stub Deduction Codes Mean Are acronyms getting you down Here are some of the most common pay stub deduction codes demystified FED FIT or

Understanding Your Paycheck YouTube

https://i.ytimg.com/vi/3fDrDZAqf-8/maxresdefault.jpg

Excel Template Budget

https://assets.freedominabudget.com/wp-content/uploads/2022/02/20073534/Budget-By-Paycheck-Spreadsheet-Template.png

https://www.paystubsnow.com › how-to-rea…

Medicare This amount of money goes toward Medicare taxes which are used to help fund health benefits for those who need financial assistance Year to Date This information shows the sum of your paychecks and other deductions so

https://www.yourdictionary.com › articles › p…

What do all these pay stub abbreviations mean To get rid of confusion break down what each abbreviation and acronym stands for Not

Wrench Icon On Dashboard

Understanding Your Paycheck YouTube

Sample Pay Stub Templates Mr Pay Stubs

What Is FICA On A Paycheck FICA Tax Defined Bizagility

Ontario Paycheck Calculator 2025 Willow Coleman

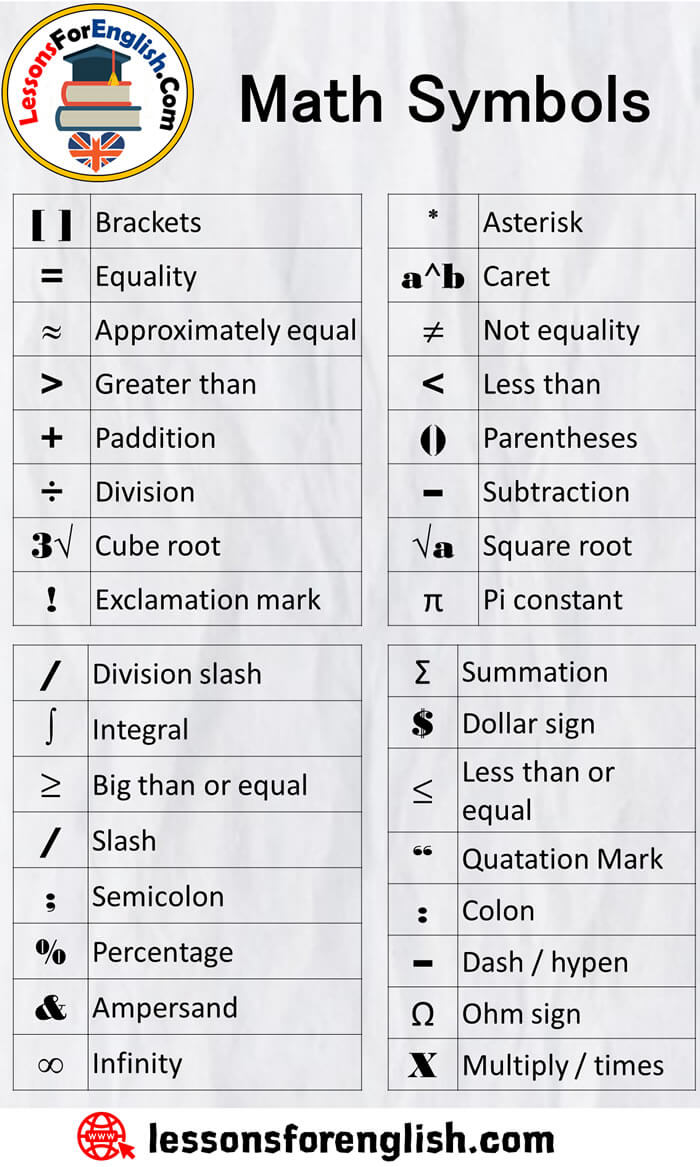

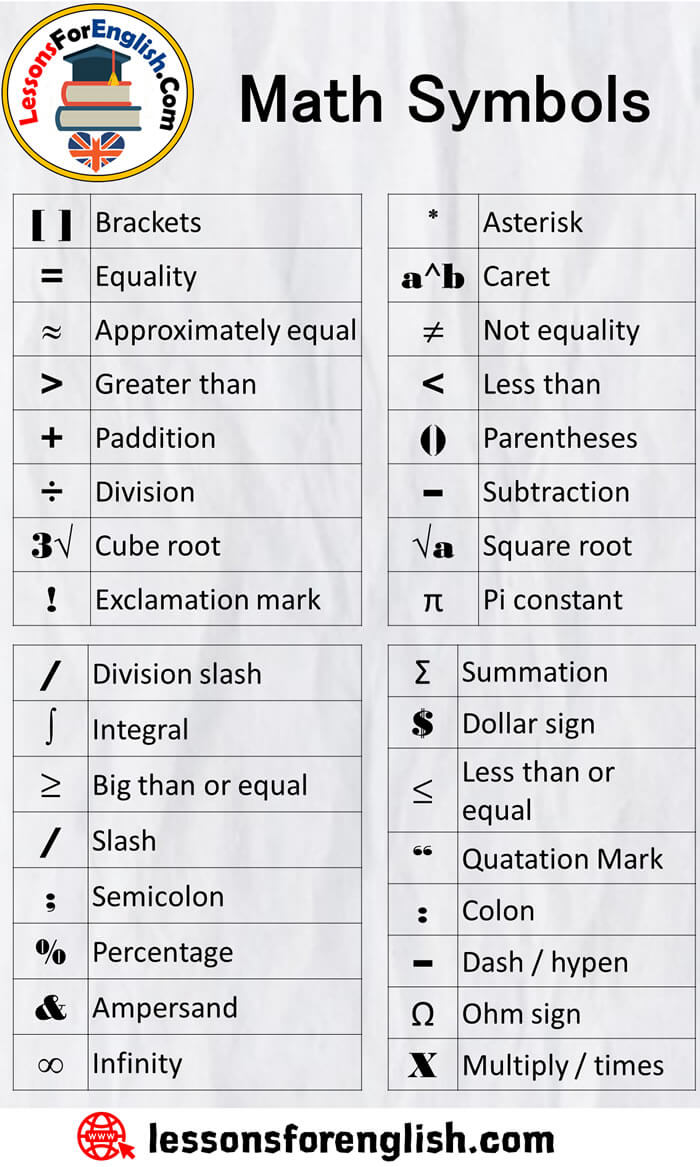

Math Comparison Symbols

Math Comparison Symbols

Debt Payoff Worksheet

Chicago Med Season 8 Where We Pick Up After The Fire What s Next

Federal Tax Taken Out Of Paycheck 2024 Estel Janella

What Does Med R Mean On My Paycheck - Medicare tax may be abbreviated as MWT or Med Most wages are subject to these two types of taxes even when the earnings are not subject to federal state and local taxes