What Is A Capital Asset Why Does the Capital Asset Pricing Model CAPM Matter CAPM is most often used to determine what the fair price of an investment should be When you calculate the risky asset s rate of return using CAPM that rate can then be used to discount the investment s future cash flows to their present value and thus arrive at the investment s fair value

Cost of Equity Formula Capital Asset Pricing Model CAPM The cost of equity CAPM formula is as follows This formula takes into account the volatility of a company relative to the market and calculates the expected risk when evaluating the cost of equity It also considers the risk free rate of return typically 10 year US treasury notes How Does Capital Loss Work The formula for capital loss is Purchase Price sale Price Capital Loss note that this formula assumes the purchase price is higher than the sale price If an investor sells an asset for more than he or she paid this is called a capital gain Let s assume you purchase 100 shares of XYZ Company for 5 per share

What Is A Capital Asset

What Is A Capital Asset

https://i.ytimg.com/vi/o-xU3Cz73kY/maxresdefault.jpg

Asset Liability And Capital Account Types YouTube

https://i.ytimg.com/vi/0c3PME2c_yQ/maxresdefault.jpg

Capital Assets Governmental Accounting YouTube

https://i.ytimg.com/vi/gfbvfc4Ph5c/maxresdefault.jpg

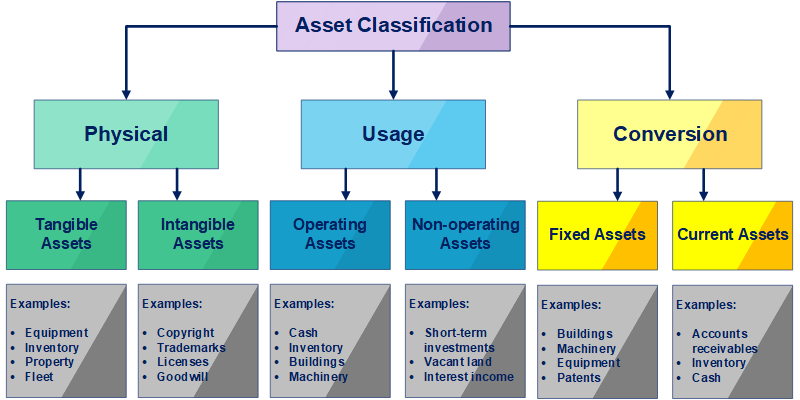

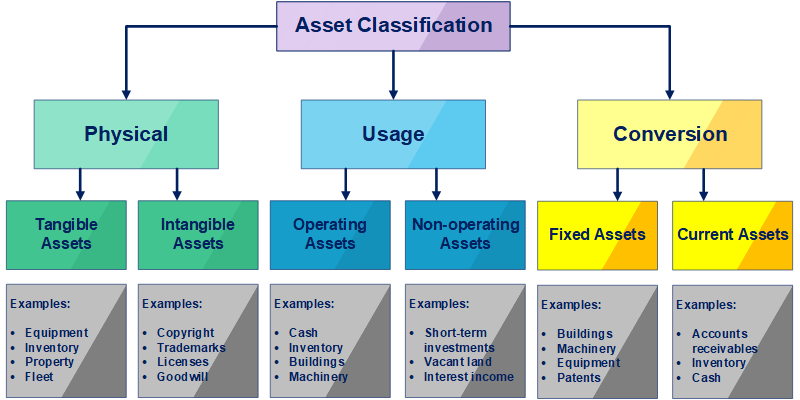

Working Capital Current assets are used to calculate working capital which determines how much money a company can put towards its financial obligations and its financing of operations Complications like uncollectible accounts or obsolete inventory can reduce current assets and therefore working capital In addition any time a business sells a capital asset the return up to the initial investment is considered a return of capital and the income generated from the sale of that asset is not taxable Return of Capital Example If you invested 10 in Company XYZ and received a 5 dividend that is a return of capital after one year that 5

However net working capital is determined by removing the cash from the asset category and short term debt from the liability side of the equation Net working capital can be calculated as follows Say that a company has 100 000 in current assets and 25 000 in cash Net fixed assets are useful for a company to keep track of what may need to be replaced in the future If this number is low but the total fixed asset number is high the fixed assets will need attention Basic Net Fixed Assets Formula At its most basic level net fixed assets equal gross fixed assets minus accumulated depreciation

More picture related to What Is A Capital Asset

Difference Between Capital And Assets Assets Vs Capital YouTube

https://i.ytimg.com/vi/tJAW9fArWQY/maxresdefault.jpg

Mikaela Fleming

https://www.accountancyknowledge.com/wp-content/uploads/2020/03/share-capital-journal-entries.jpg

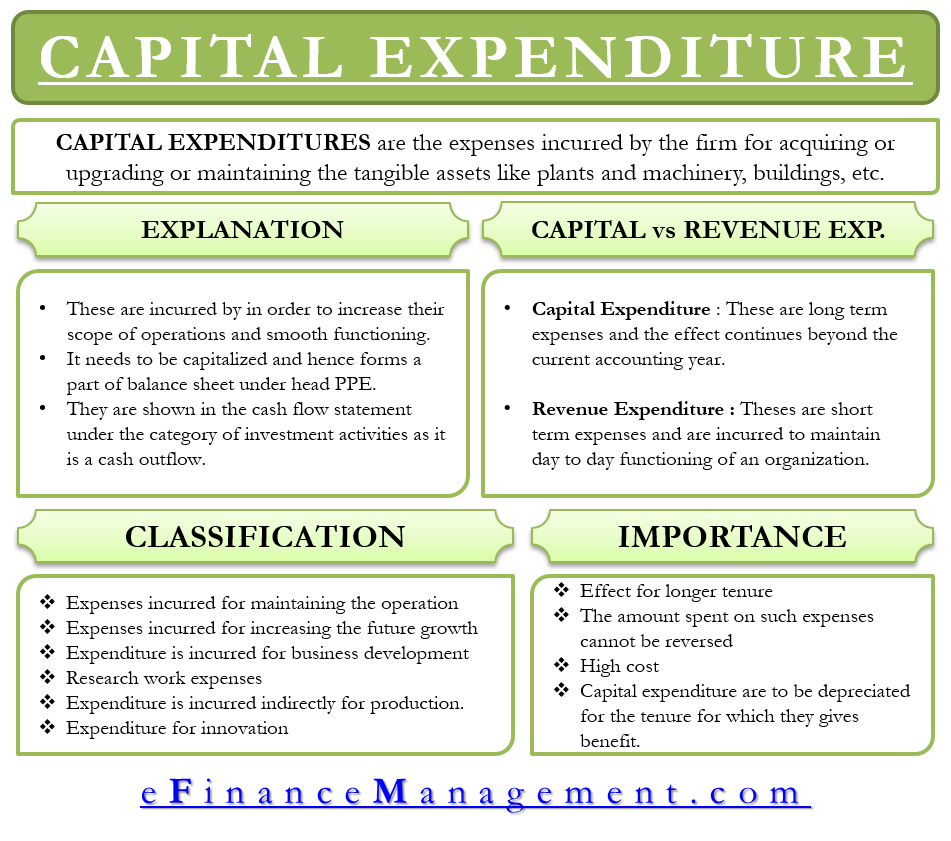

EFinanceManagement Financial Management Concepts In Layman s Terms

https://efinancemanagement.com/wp-content/uploads/2019/09/Capital-Expenditure.png

Cost of capital can best be described as the ability to cover both asset and liability expenditures while generating a profit A simpler cost of capital definition Companies can use this rate of return to decide whether to move forward with a project Investors can use this economic principle to determine the risk of investing in a company Mathematically Jensen s measure which was developed in 1968 by Michael Jensen is the rate of return that exceeds what was expected or predicted by models like the capital asset pricing model CAPM To understand how it works consider the CAPM formula r R f beta x R m R f Jensen s measure alpha where r the security s or

[desc-10] [desc-11]

Capital A

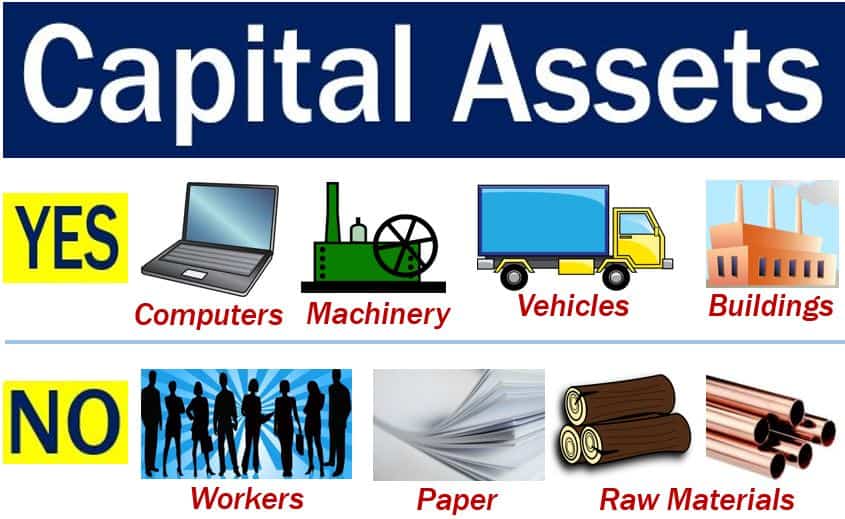

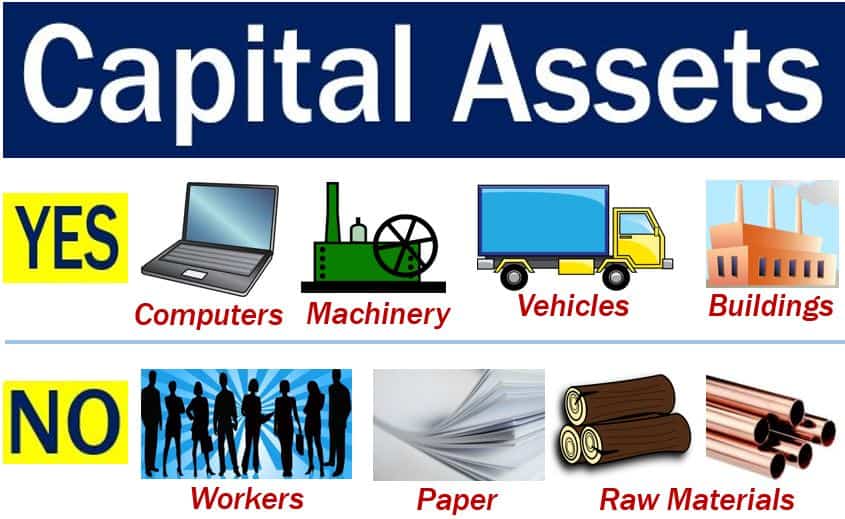

https://marketbusinessnews.com/wp-content/uploads/2015/09/Capital-Assets-what-is-and-what-is-not.jpg

Asset turnover formula

http://accountingcorner.org/wp-content/uploads/2016/04/asset_turnover_formula.png

https://investinganswers.com › dictionary › capital-asset-pricing-model-c…

Why Does the Capital Asset Pricing Model CAPM Matter CAPM is most often used to determine what the fair price of an investment should be When you calculate the risky asset s rate of return using CAPM that rate can then be used to discount the investment s future cash flows to their present value and thus arrive at the investment s fair value

https://investinganswers.com › dictionary › cost-equity

Cost of Equity Formula Capital Asset Pricing Model CAPM The cost of equity CAPM formula is as follows This formula takes into account the volatility of a company relative to the market and calculates the expected risk when evaluating the cost of equity It also considers the risk free rate of return typically 10 year US treasury notes

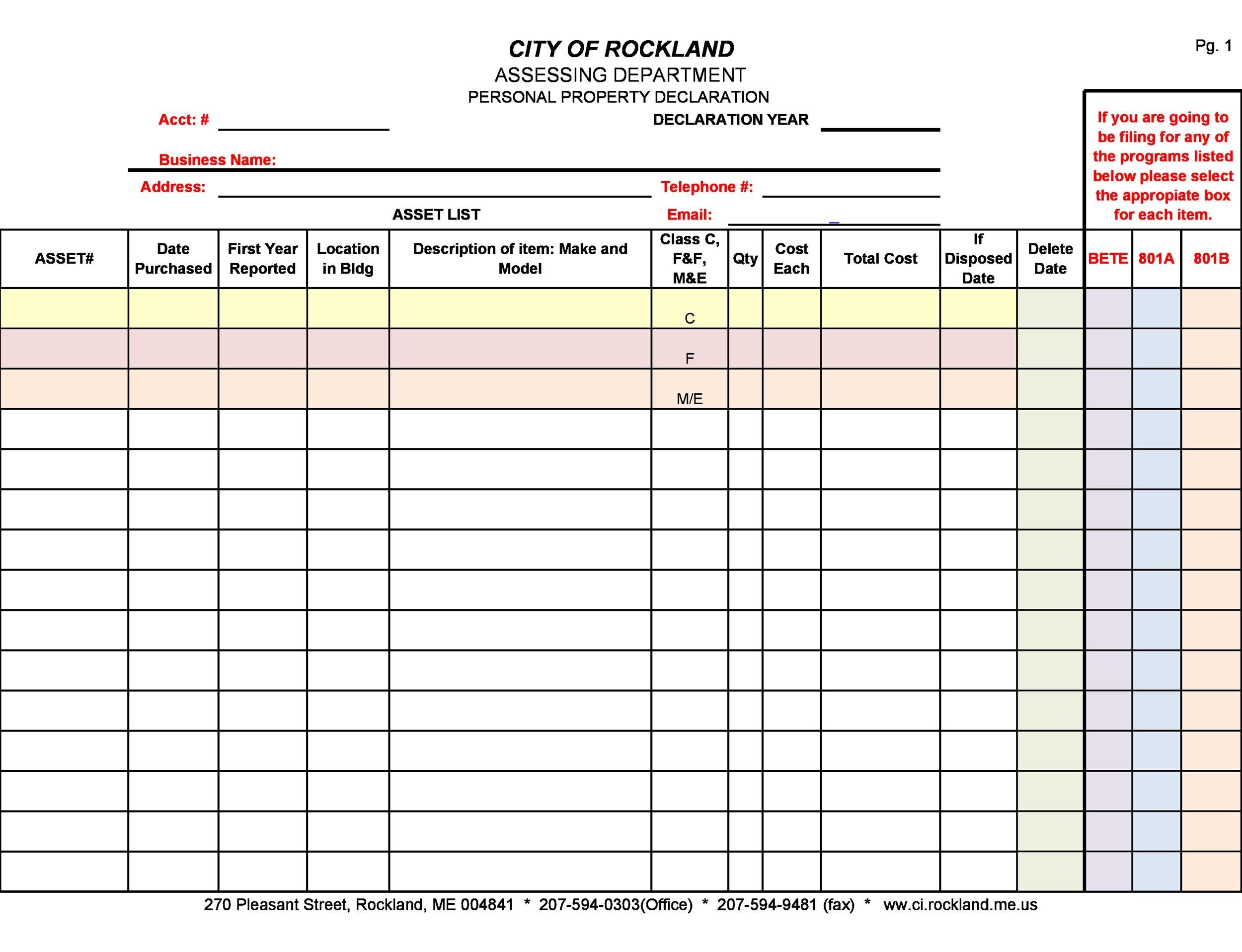

21 Personal Property Inventory Sheet Free To Edit Download

Capital A

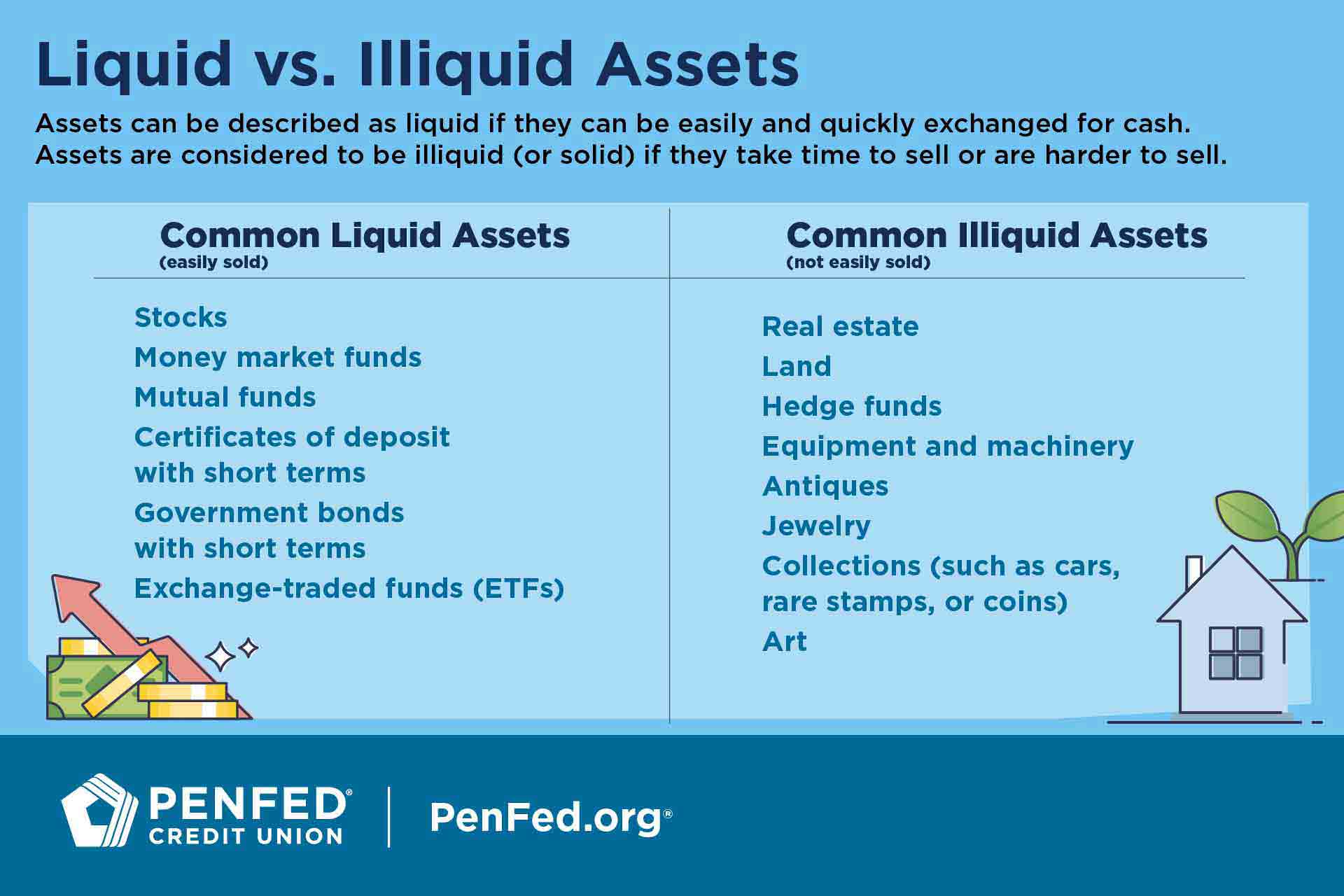

Liquid Assets

EXCEL Of Asset Tracking Template xlsx WPS Free Templates

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg)

EXPANSI N COMERCIAL Bet Capital

Fixed Assets

Fixed Assets

:max_bytes(150000):strip_icc()/Capitalasset_final-0493a34ead814f6ab6179b09d6445cfe.png)

Fixed Assets

Fixed Assets

:max_bytes(150000):strip_icc()/fixedasset-edit-3fa5166c806b4897921df1a7dbcb5826.jpg)

Fixed Assets

What Is A Capital Asset - [desc-14]