What Is A High Short Interest Days To Cover A high day to cover means that short sellers would take a long time to unwind their positions if the price were to suddenly rise Low days to cover means that short sellers could easily and quickly cover their positions even if the price

A high days to cover indicates that there are more short sellers than average which means there is potential for short squeezes if demand increases Conversely a low A short interest ratio above 5 is generally considered high meaning it would take more than five days of average trading volume to cover all shorted shares How often is short

What Is A High Short Interest Days To Cover

What Is A High Short Interest Days To Cover

https://s.hdnux.com/photos/01/33/50/66/24022440/3/rawImage.jpg

News What Is A High quality Vending Machine

https://www.ylvending.com/uploads/一拖二左视.png

What Is A High Statin Dose

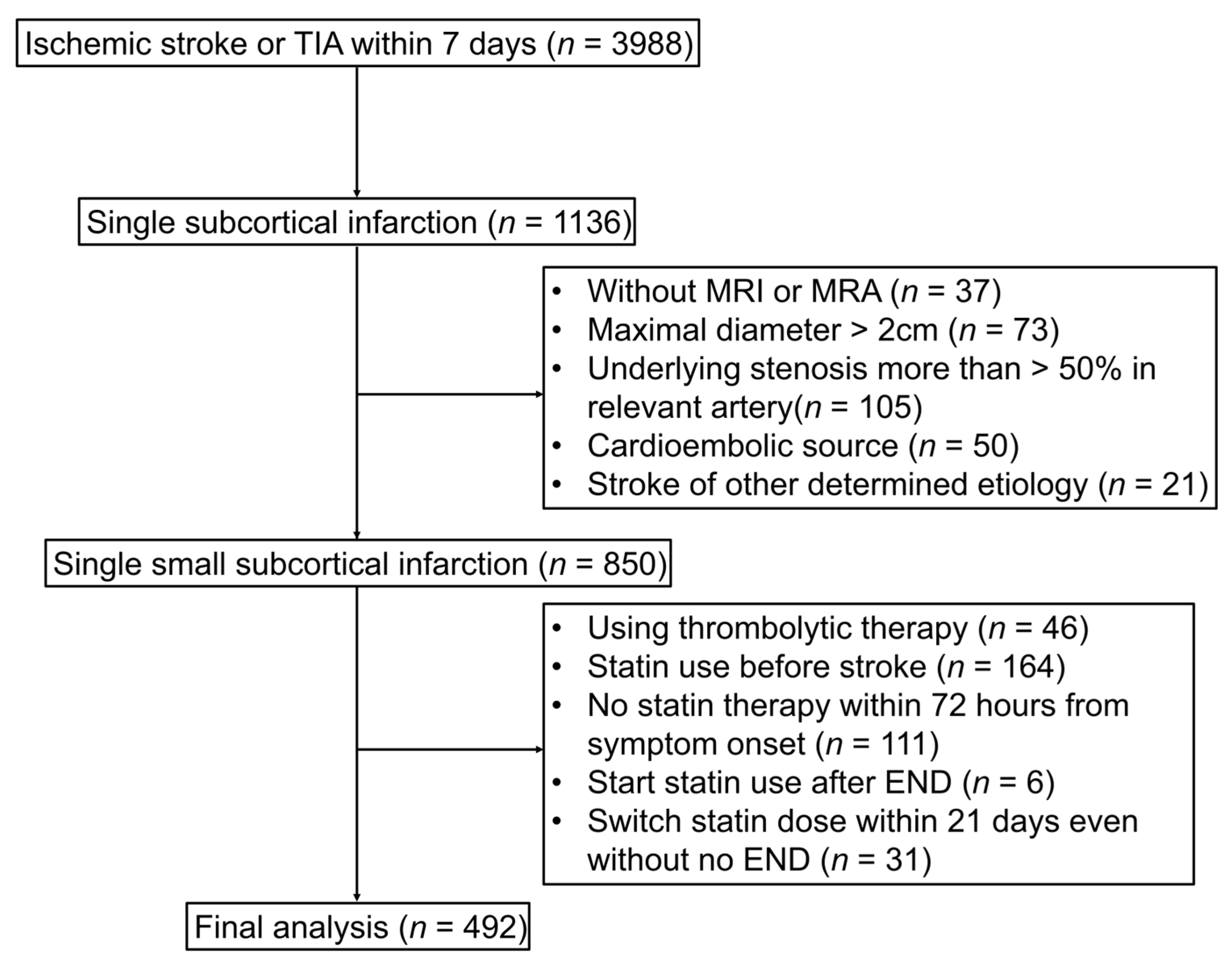

https://www.mdpi.com/jcm/jcm-12-03260/article_deploy/html/images/jcm-12-03260-g001.png

The days to cover is a ratio which displays how many days short sellers need to cover their positions Days to cover is calculated by dividing the current short interest average daily The short interest ratio indicates how many days it would take for all the shares short to be covered or repurchased in the open market The short interest ratio and short interest are not

Short interest is a measure of the amount of short selling against a company expressed as a percentage of the total trading volume Many trading firms use short interest as a gauge of market Days to cover also known as a stock s short interest ratio is a metric that expresses how many days it would take for all of a stock s open short positions

More picture related to What Is A High Short Interest Days To Cover

What Is A HIGH LIFT

https://kevinmurphy.com.au/dw/image/v2/BFSC_PRD/on/demandware.static/-/Library-Sites-km_b2c_library/default/dw0f4e86cd/Blog pictures/Highlift desktop.png?sw=1440&q=100

What Is A High Fiber Diet Health Benefits High Fiber Foods And More

https://media.post.rvohealth.io/wp-content/uploads/2023/11/bowls-of-beans-nuts-legumes-chickpeas-lentils-1296x728-header.jpg

What Can You Do With A High School Certificate Of Completion E Compeo

https://e-compeo.com/wp-content/uploads/2024/04/8-1.jpg

The short interest ratio also called days to cover ratio 1 represents the number of days it takes short sellers on average to cover their positions that is repurchase all of the borrowed shares What Is a Short Interest Ratio The Short Interest Ratio often referred to as the Days to Cover ratio is a popular metric in finance It s computed by taking the total number of

Days to Cover is a pivotal metric that gauges the expected time needed to close out short positions in a company s stock This comprehensive guide explores the intricacies of days to cover in stock trading covering its Days to cover is one of the basic indicators of short interest On its own short interest won t tell you much You need to add volume to the mix That gives you a more

What Is A High Lift Lawn Mower Blade For Improved Grass Cutting

https://www.backyardlord.com/wp-content/uploads/2024/02/what-is-a-high-lift-lawn-mower-blade.webp

High Short Interest Indicator Strategy QuantifiedStrategies

https://www.quantifiedstrategies.com/wp-content/uploads/2022/01/ShortInterest1.gif

https://www.powercycletrading.com › what-is-a-high...

A high day to cover means that short sellers would take a long time to unwind their positions if the price were to suddenly rise Low days to cover means that short sellers could easily and quickly cover their positions even if the price

https://www.litefinance.org › blog › for-beginners › days-to-cover

A high days to cover indicates that there are more short sellers than average which means there is potential for short squeezes if demand increases Conversely a low

Asesse Mdludla Ntonga On Instagram What Is A High Tea Without A Cup

What Is A High Lift Lawn Mower Blade For Improved Grass Cutting

Top 999 Michael Thomas Wallpapers Full HD 4K Free To Use

A Complete Guide To A High Frequency Skin Treatment Wrights Med Spa

Deep Dive The ICVCM s Core Carbon Principles

Mastering High Level Design Documents Examples And Best Practices

Mastering High Level Design Documents Examples And Best Practices

Low Fidelity Vs High Fidelity Wireframes What s The Difference

What Is A High School Degree GEGCalculators

What Short Interest Tells Us Should You Avoid Stocks With A High Short

What Is A High Short Interest Days To Cover - The days to cover is a ratio which displays how many days short sellers need to cover their positions Days to cover is calculated by dividing the current short interest average daily