What Is A Qualified Business Income Deduction Carryforward The deduction allows eligible taxpayers to deduct up to 20 percent of their QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly traded partnership

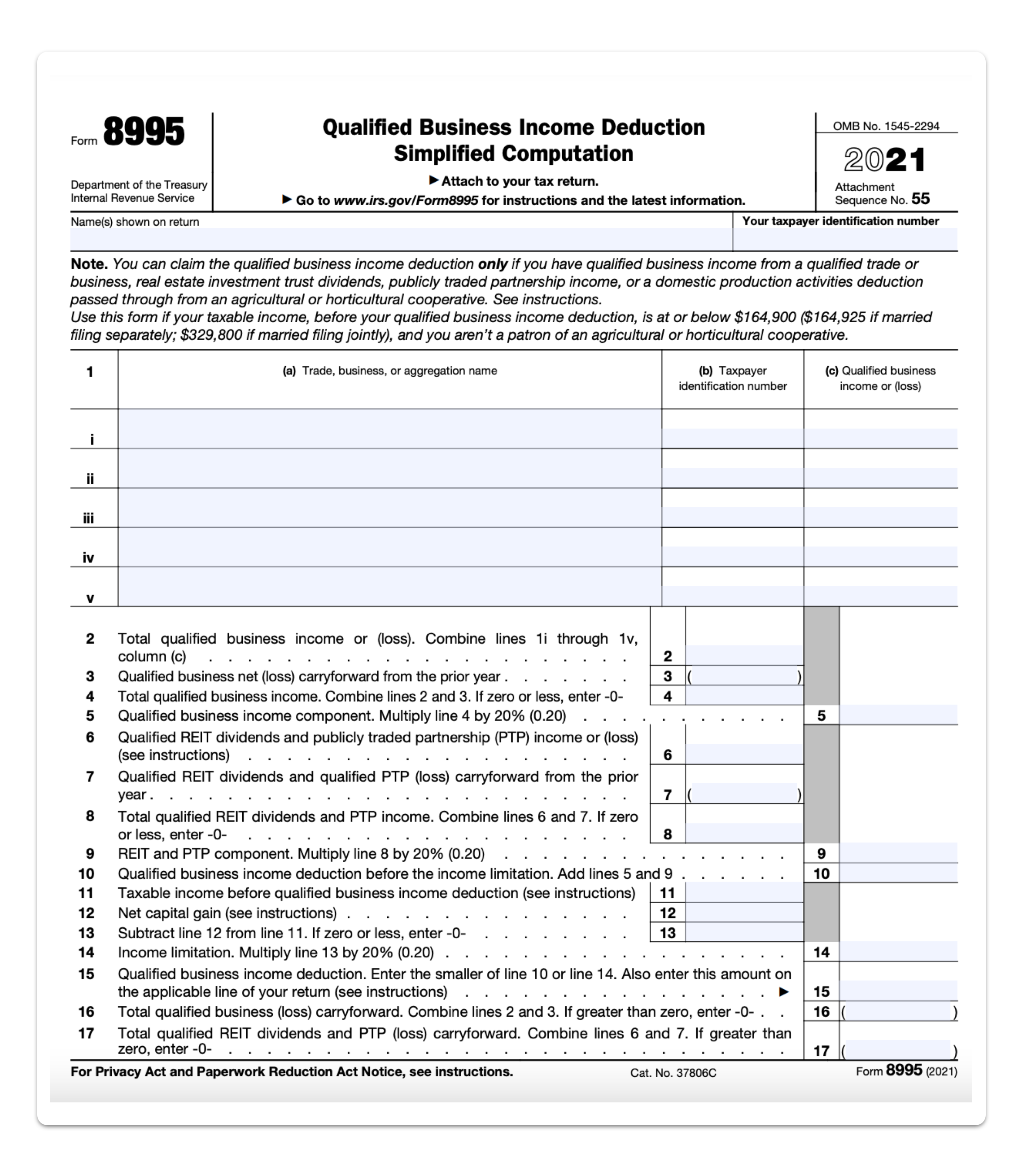

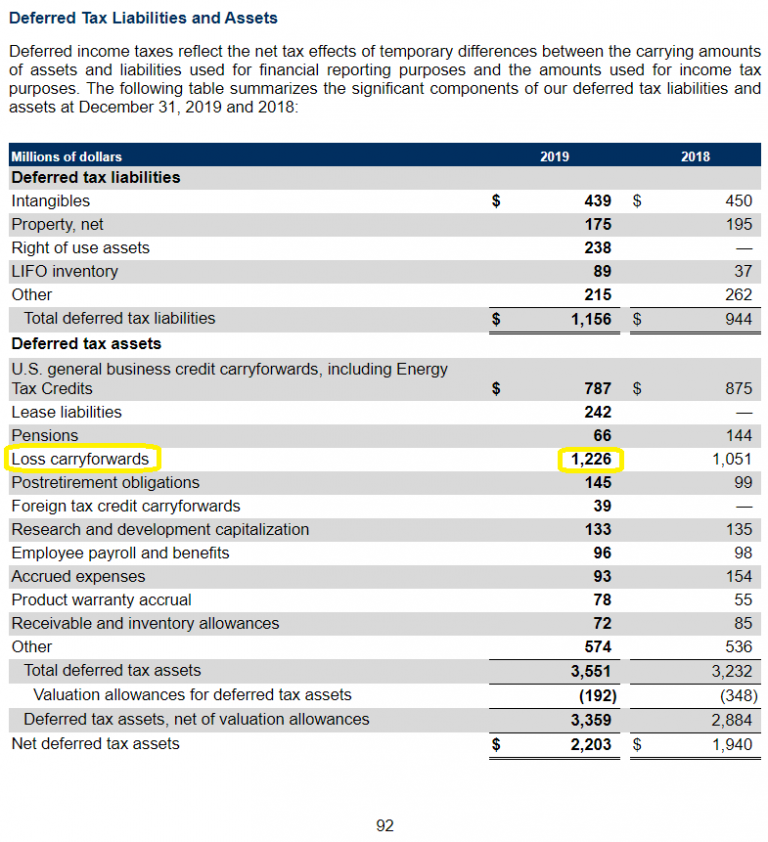

If you have a qualified business net loss for the year you don t qualify for the QBI deduction unless you have qualified REIT dividends or qualified PTP income The loss will be carried forward to next year A QBI deduction carryforward is when a business has a negative QBI or qualified business losses which adversely impacts the 20 deduction The losses carry forward

What Is A Qualified Business Income Deduction Carryforward

What Is A Qualified Business Income Deduction Carryforward

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t002.jpg

Qualified Business Income Deduction And The Self Employed 44 OFF

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/62e1a87a66b4e381ae917fa4_8995.png

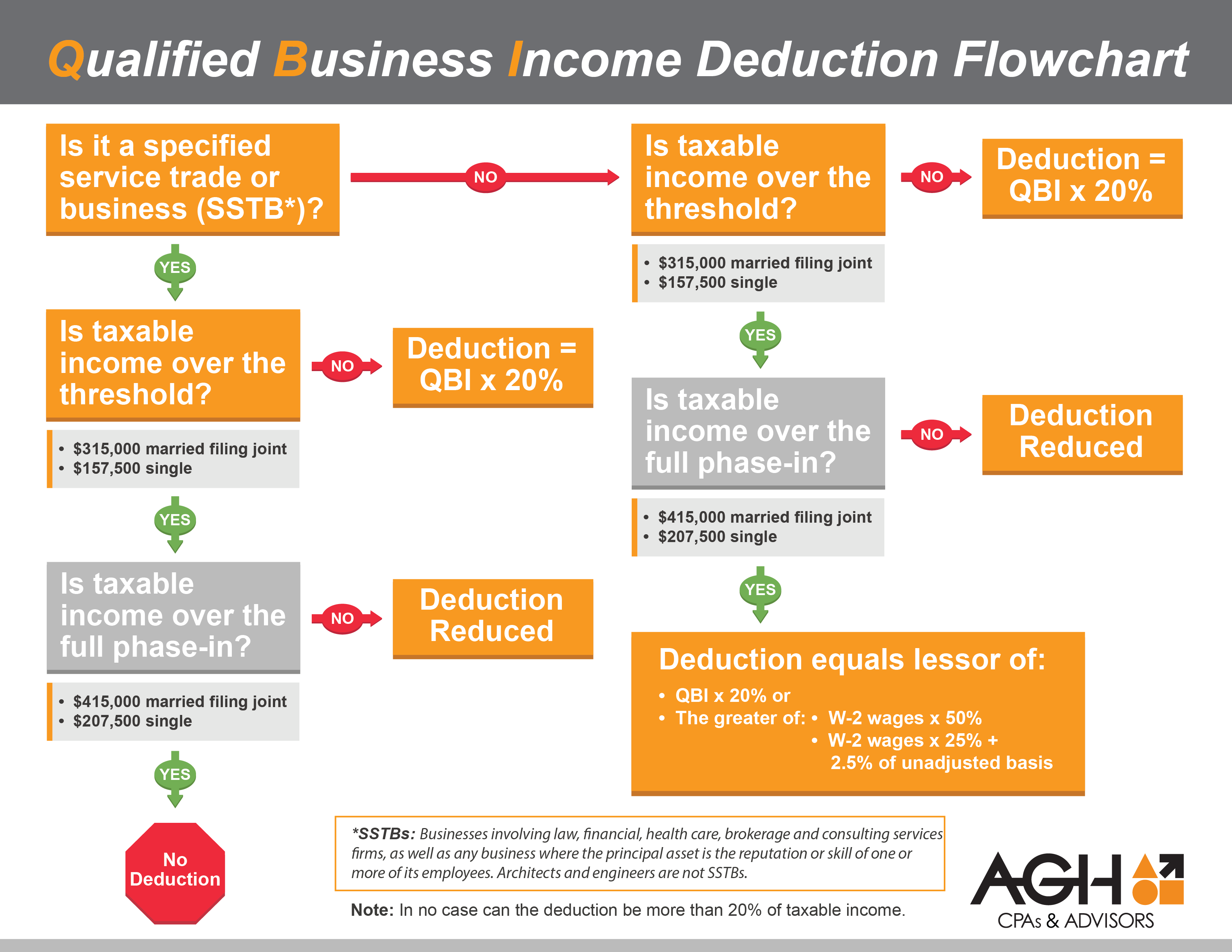

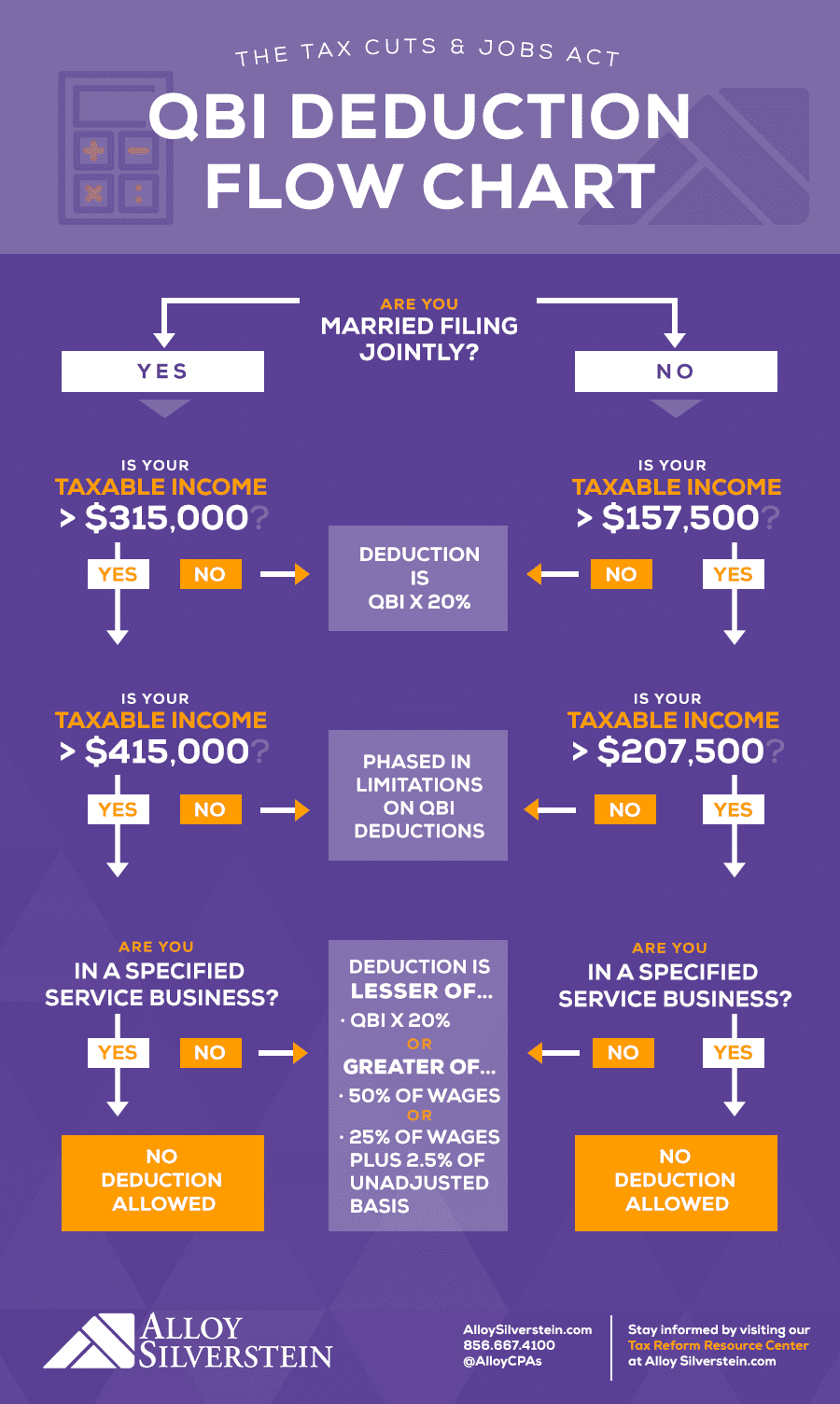

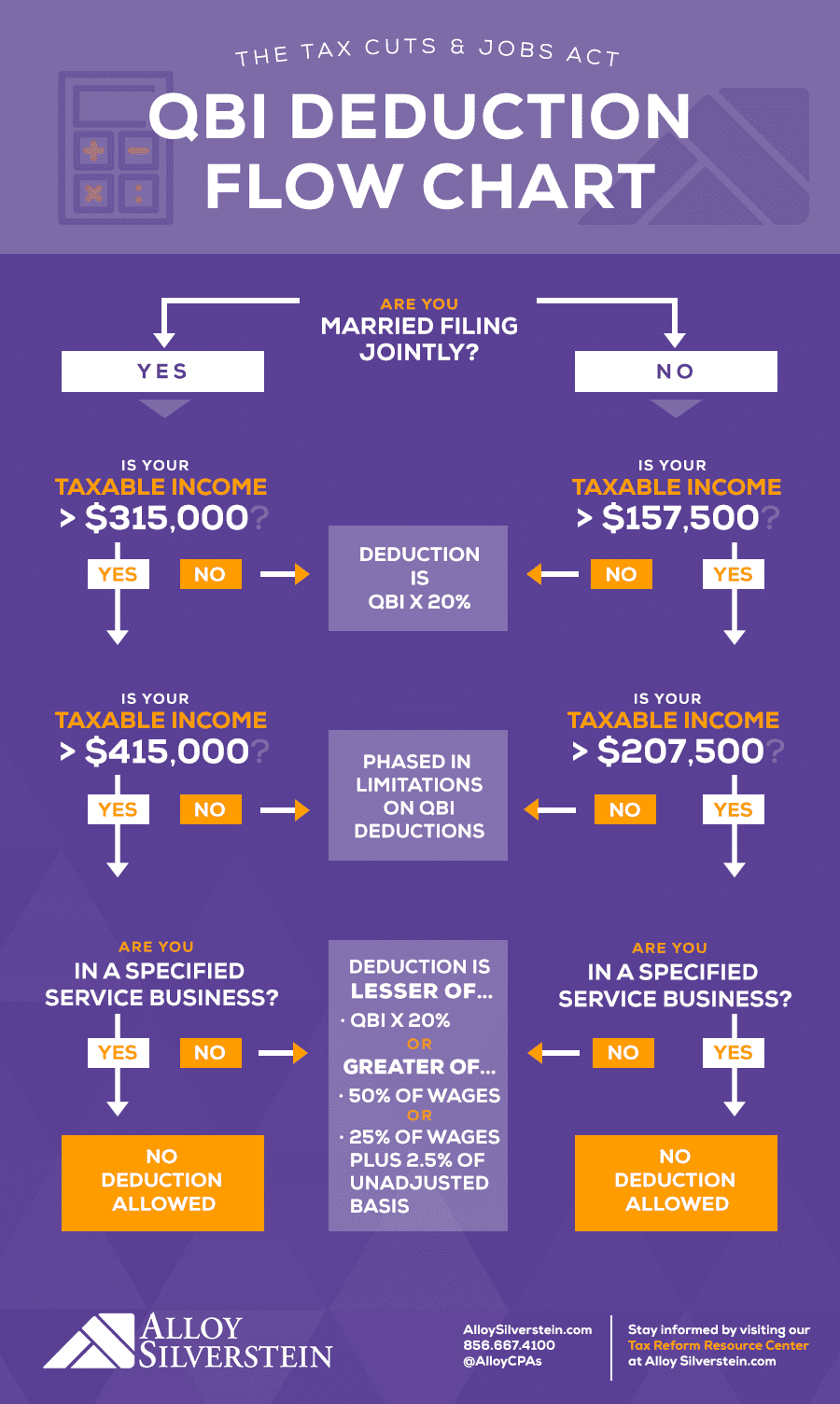

Qualified Business Income QBI Deduction

https://help.holistiplan.com/hs-fs/hubfs/image-png-Sep-06-2022-04-02-12-82-PM.png?width=688&name=image-png-Sep-06-2022-04-02-12-82-PM.png

Combined qualified business income amount The sum of the deductible amounts determined for each qualified trade or business of the taxpayer plus 20 of the aggregate amount of A business owner with negative overall qualified REIT dividends and PTP income receives a zero QBI deduction related to this category The overall loss amount carries forward to offset future qualified REIT dividends

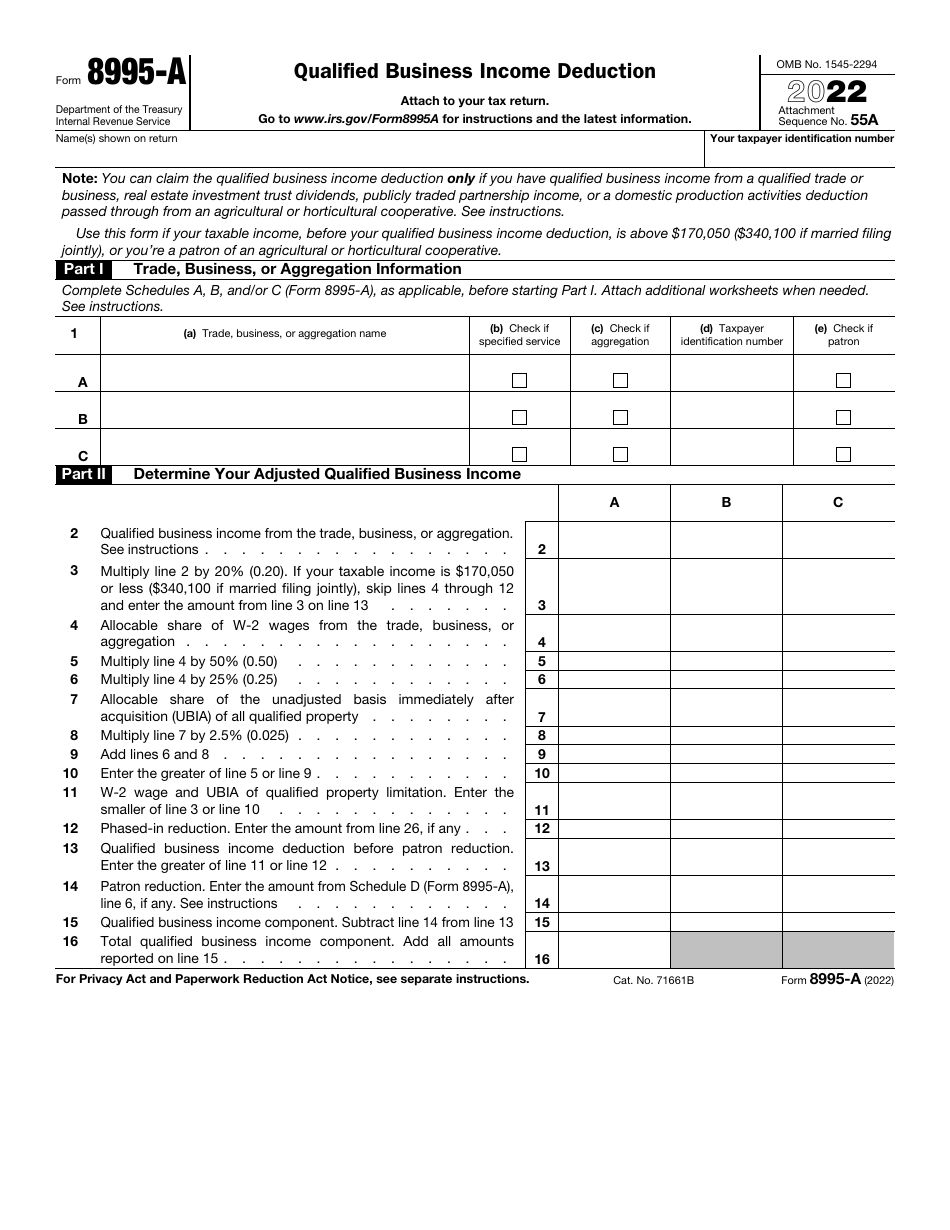

By completing IRS tax Form 8995 eligible small business owners can claim the qualified business income deduction or QBID which permits pass through business owners to deduct up to 20 of their share of qualified What is qualified business income QBI Qualified business income QBI is the net income or loss from a trade or business This includes income generated from partnerships S corporations sole proprietorships

More picture related to What Is A Qualified Business Income Deduction Carryforward

Qbi Deduction 2025 Lloyd G Stewart

https://media.smallbiztrends.com/2023/01/qbi-deduction-infographic-1000x525.png

Qbi Deduction Phase Out 2025 Bent T Carlsen

https://aghlc.com/images/infographics/2018/qualified-business-income-180328.png

Standard Deduction For Pensioners Ay 2023 24 Image To U

https://images.squarespace-cdn.com/content/v1/5e68f47ca0d8573682071426/db14bc39-72bb-4656-9ad5-416374313bf0/2023-retirement-account-contribution-limits-announced-10.25.2022.JPG

Taxpayers often seek ways to reduce their taxable income and the Qualified Business Income QBI deduction offers a significant opportunity for eligible individuals Qualified business income deduction loss carryover If the net QBI for the year from all entities is a negative then QBI is treated as a Qualified Business Loss QBL A QBL is carried forward to the following year it cannot be carried back

Section 199A is a qualified business income QBI deduction Using it domestic businesses can deduct roughly 20 of their QBI along with 20 of their publicly traded partnership income PTP and real estate investment trust The Qualified Business Income deduction also called the QBI deduction pass through deduction or section 199A deduction was created by the 2017 Tax Cuts and Jobs Act TCJA and is in

Qualified Business Income Deduction 2025 Elisa Helaine

https://alloysilverstein.com/wp-content/uploads/2018/04/AlloyCPA-Tax-Reform-QBI-Deduction.png

Qbi Calculation Worksheet Printable Word Searches

https://i2.wp.com/km-ext.ebs-dam.intuit.com/content/dam/km/external/pcg/LacerteImages/1-199/51896_06.jpg

https://www.irs.gov › newsroom › qualified-business...

The deduction allows eligible taxpayers to deduct up to 20 percent of their QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly traded partnership

https://www.irs.gov › instructions

If you have a qualified business net loss for the year you don t qualify for the QBI deduction unless you have qualified REIT dividends or qualified PTP income The loss will be carried forward to next year

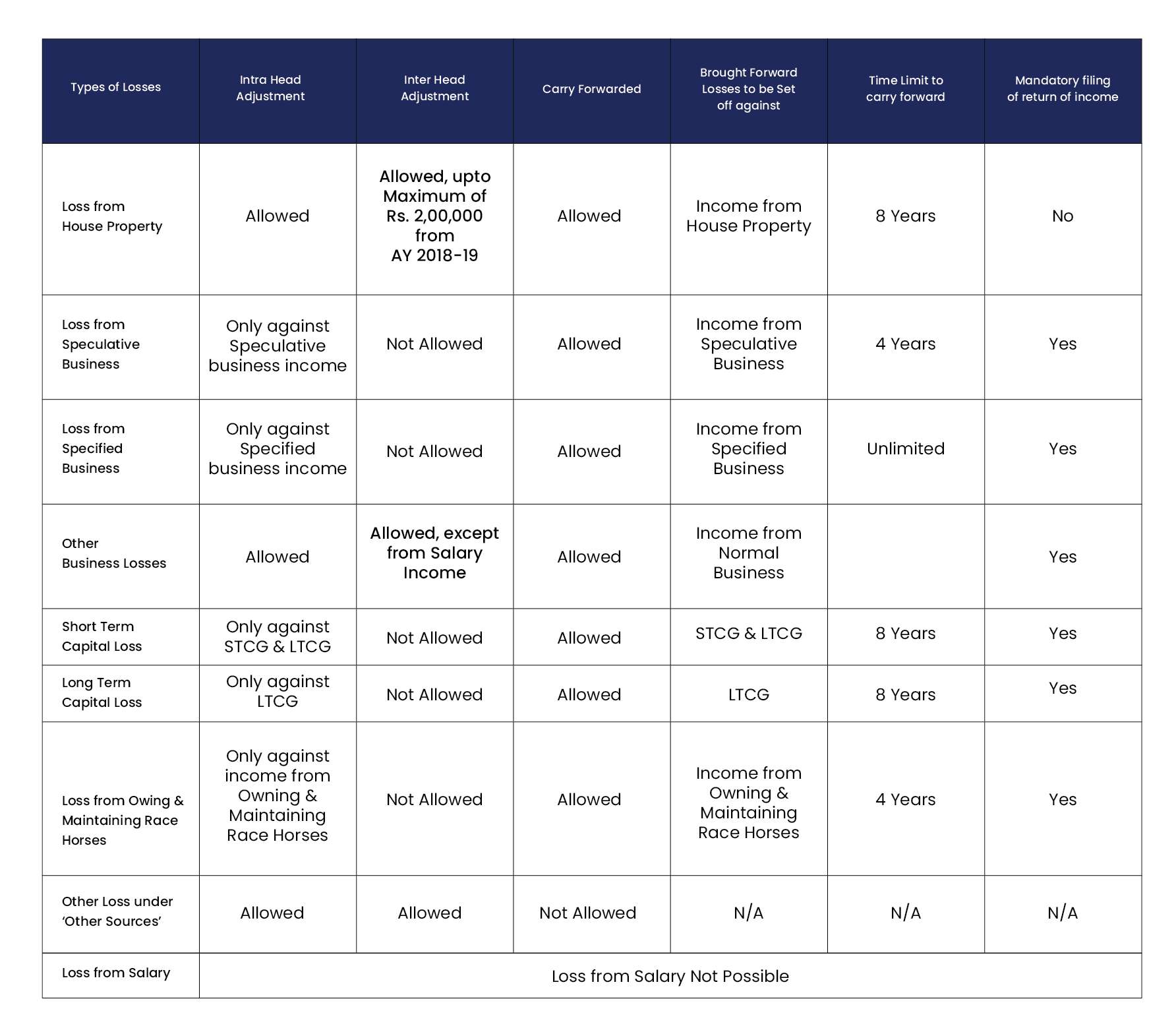

NOL Net Operating Loss Carryforward Explained Losses Become Assets

Qualified Business Income Deduction 2025 Elisa Helaine

What s With This 20 Deduction On Pass Through Income And Will It Help

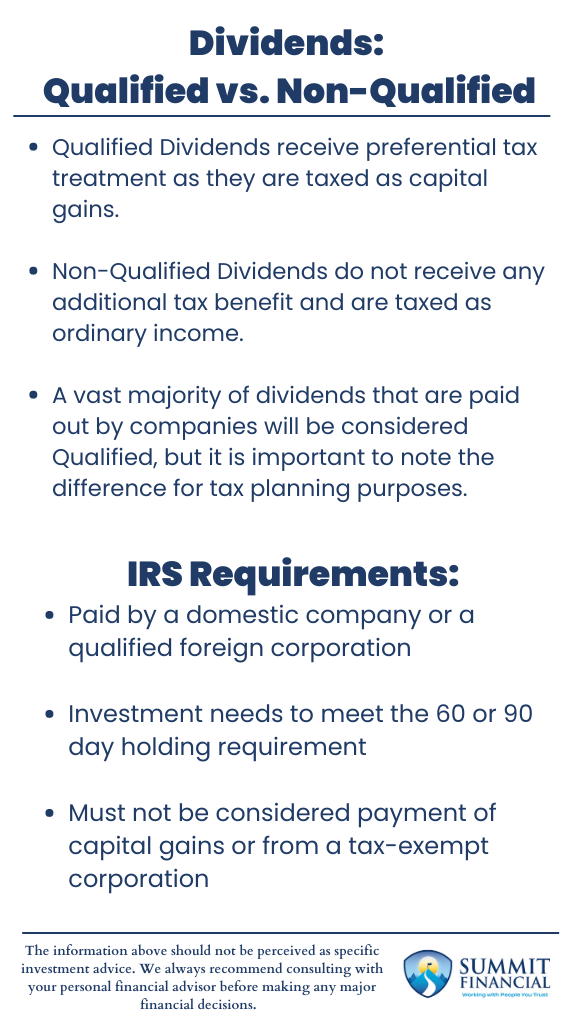

Understanding Dividends Qualified Vs Non Qualified Summit Financial

FAQs On Setoff And Carryforward Of Losses PKC Consulting

What Is The Qualified Business Income Deduction FlyFin

What Is The Qualified Business Income Deduction FlyFin

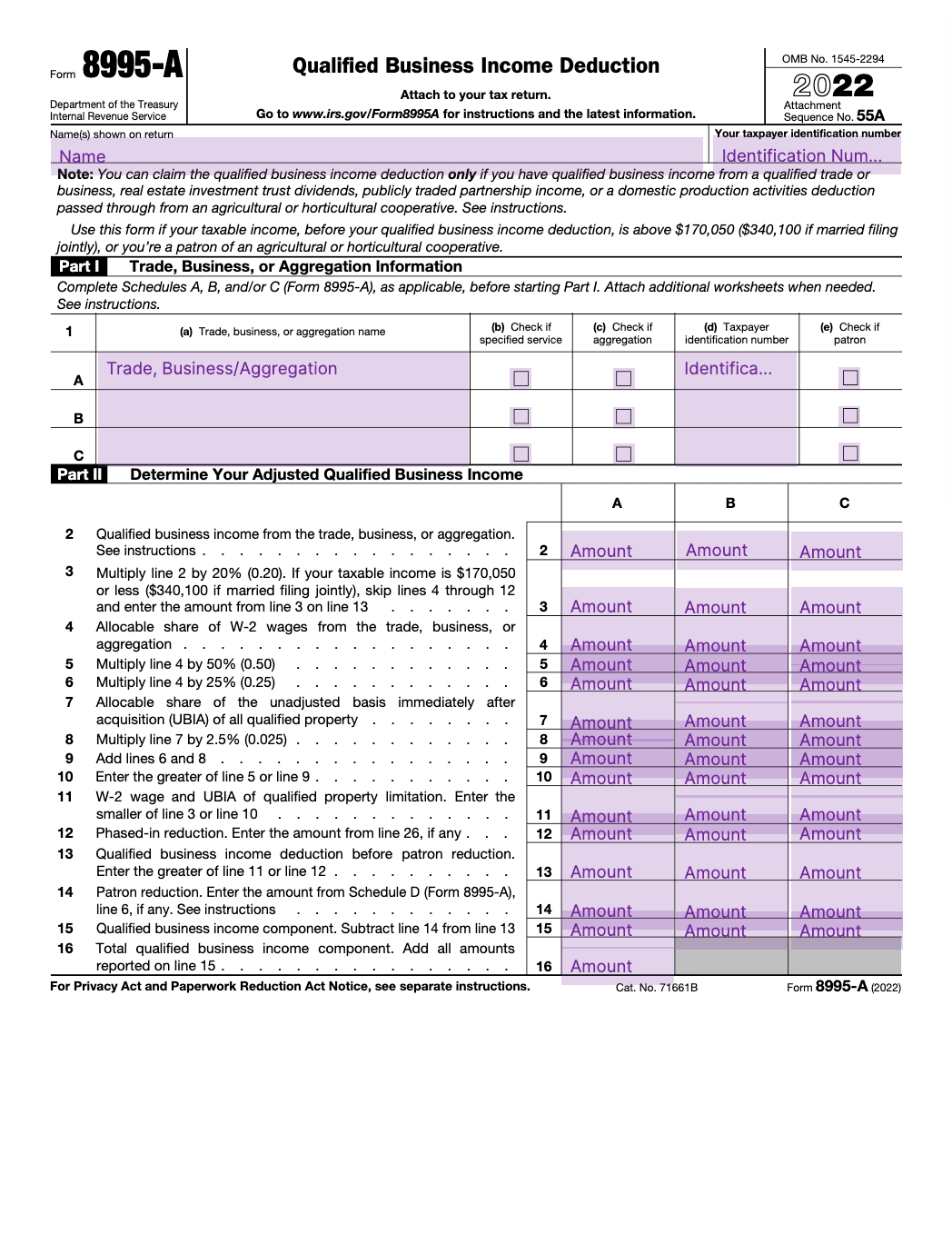

IRS Form 8995 A Download Fillable PDF Or Fill Online Qualified Business

QBI Deduction Frequently Asked Questions K1 QBI ScheduleC

Form 8995 A Qualified Business Income Deduction 2022 Fill

What Is A Qualified Business Income Deduction Carryforward - Combined qualified business income amount The sum of the deductible amounts determined for each qualified trade or business of the taxpayer plus 20 of the aggregate amount of