What Is Considered Low Barometric Pressure For Fishing Roth IRAs are particularly helpful for people who expect to pay a fairly high tax rate after they retire including many self employed individuals and small business owners who

Here are some other options to consider SEP IRA A SEP IRA is a simplified employee pension plan that allows self employed individuals and small business owners to If the small business owner or farmer has an IRA there is a unique opportunity for a Roth conversion up to an amount equal to the carried over NOL thereby converting the

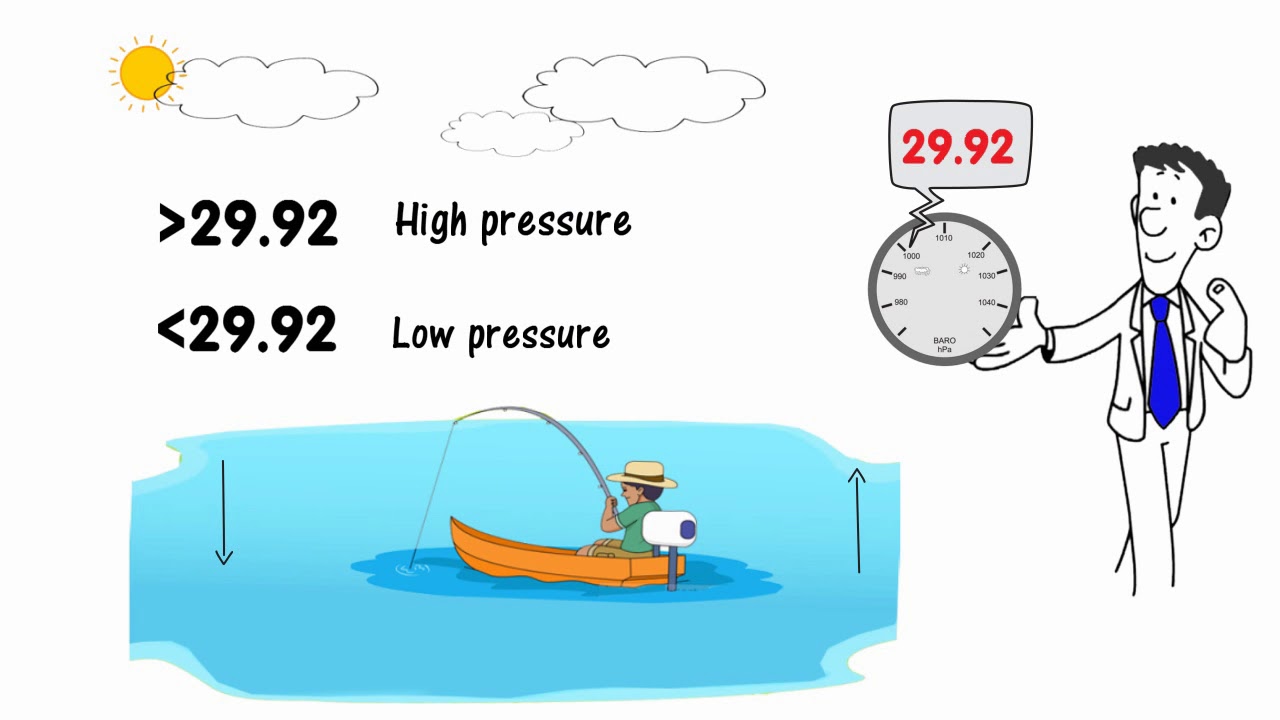

What Is Considered Low Barometric Pressure For Fishing

What Is Considered Low Barometric Pressure For Fishing

https://i.ytimg.com/vi/oGq_qnxyaDI/maxresdefault.jpg

Barometric Pressure And Fishing YouTube

https://i.ytimg.com/vi/uO97KQtTfPw/maxresdefault.jpg

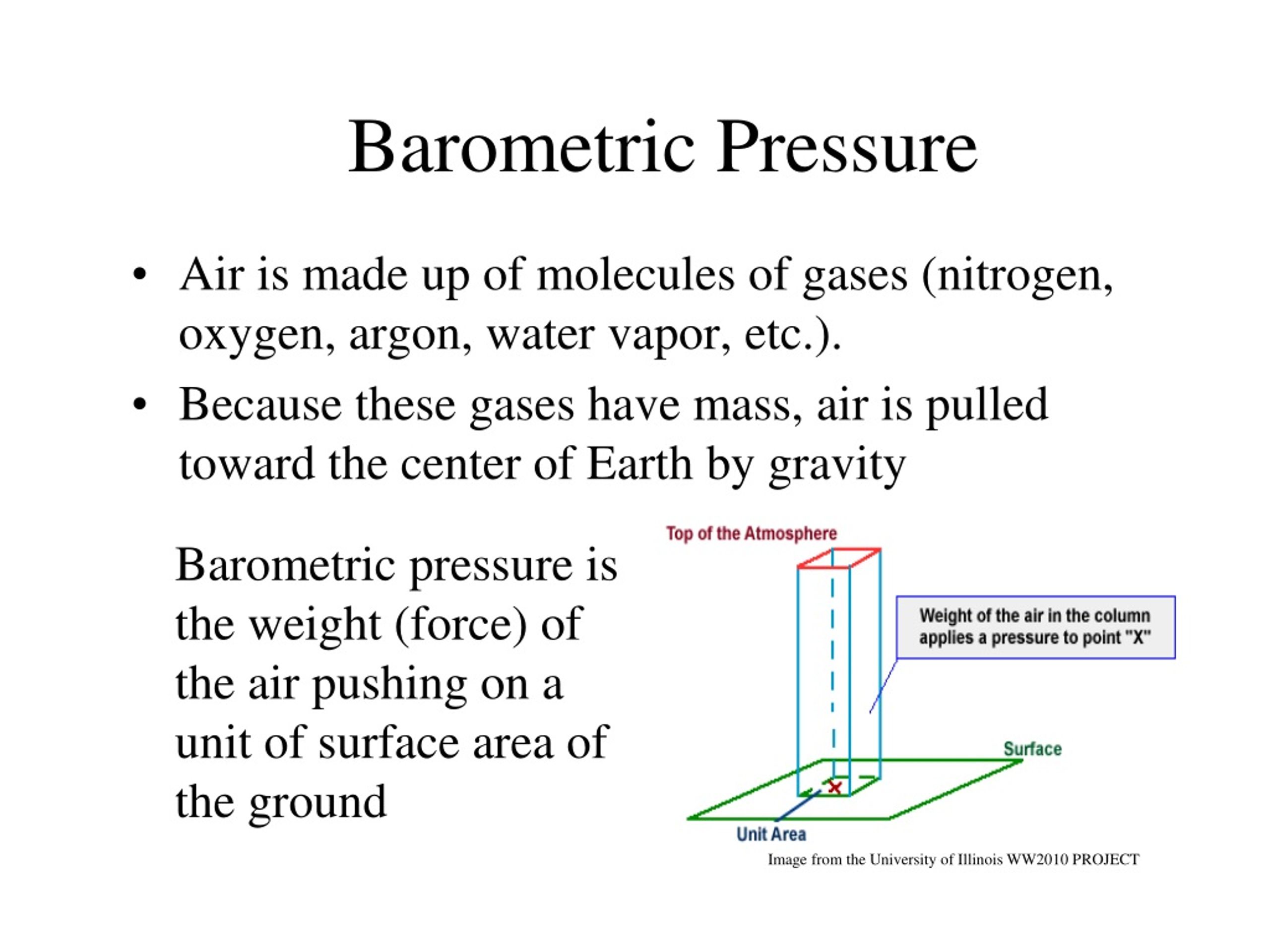

P0107 Manifold Air Pressure MAP Barometric Pressure Sensor Circuit

https://i.ytimg.com/vi/pvfhf0s8lTE/maxresdefault.jpg

At age 59 you can withdraw both contributions and earnings with no penalty Roth IRAs also have a yearly limit of up to 6 000 or 7 000 for those 50 and older A small A Roth IRA conversion can be a powerful tool for small business owners aiming to secure a financially stable retirement By understanding the steps benefits and financial implications

There are five main choices for the self employed or small business owners an IRA traditional or Roth a Solo 401 k a SEP IRA a SIMPLE IRA or a defined benefit plan Converting to a Roth IRA was an option later on However recent changes allow contributions to be designated as Roth IRA contributions after tax dollars upfront eliminating

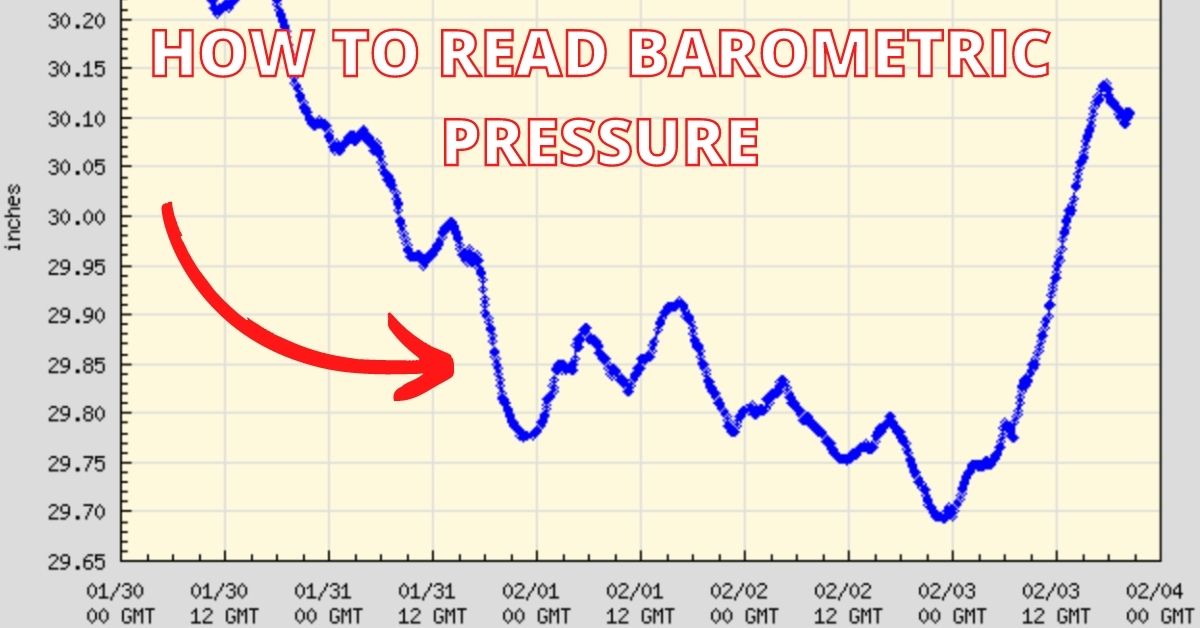

More picture related to What Is Considered Low Barometric Pressure For Fishing

Top 5 Best Barometric Pressure For Fishing Review 2024 YouTube

https://i.ytimg.com/vi/SekSKE1wwrQ/maxresdefault.jpg

Fishing How To Understanding Tidal Coefficient Barometric Pressure

https://i.ytimg.com/vi/x9t070LsMDo/maxresdefault.jpg

Barometric Pressure And Fishing Learn With Landers YouTube

https://i.ytimg.com/vi/g-Zn_6DoRqM/maxresdefault.jpg

When it comes to SEP IRA versus Roth IRA the main differences are tax status and whether employees are included Learn which may be best for your business situation Key Takeaways Like a Roth IRA a Roth SEP IRA allows your investments to grow tax free and qualified withdrawals in retirement are also without tax It combines the high

Whether you re self employed or a small business owner Fidelity has retirement plans to help you save more of what you earn while investing in your future Small business owners have diverse IRA options for retirement planning including SEP SIMPLE traditional and Roth IRAs each with unique benefits contribution limits and tax implications

A Weather Report Indicates The Barometric Pressure Is 28 54 Inches Of

https://i.ytimg.com/vi/v11u5t1ZhuE/maxresdefault.jpg

Causes And Fixes P0107 Code Manifold Absolute Pressure Barometric

https://i.ytimg.com/vi/3LDwwPzhRoQ/maxresdefault.jpg

https://www.business.com › articles › how-the-self-employed...

Roth IRAs are particularly helpful for people who expect to pay a fairly high tax rate after they retire including many self employed individuals and small business owners who

https://themoneyknowhow.com › can-i-open-a-roth-ira-if...

Here are some other options to consider SEP IRA A SEP IRA is a simplified employee pension plan that allows self employed individuals and small business owners to

Learning The Barometric Pressure Of Waters Are Important If You Want A

A Weather Report Indicates The Barometric Pressure Is 28 54 Inches Of

Current Barometric Pressure Minneapolis

Current Barometric Pressure Minneapolis

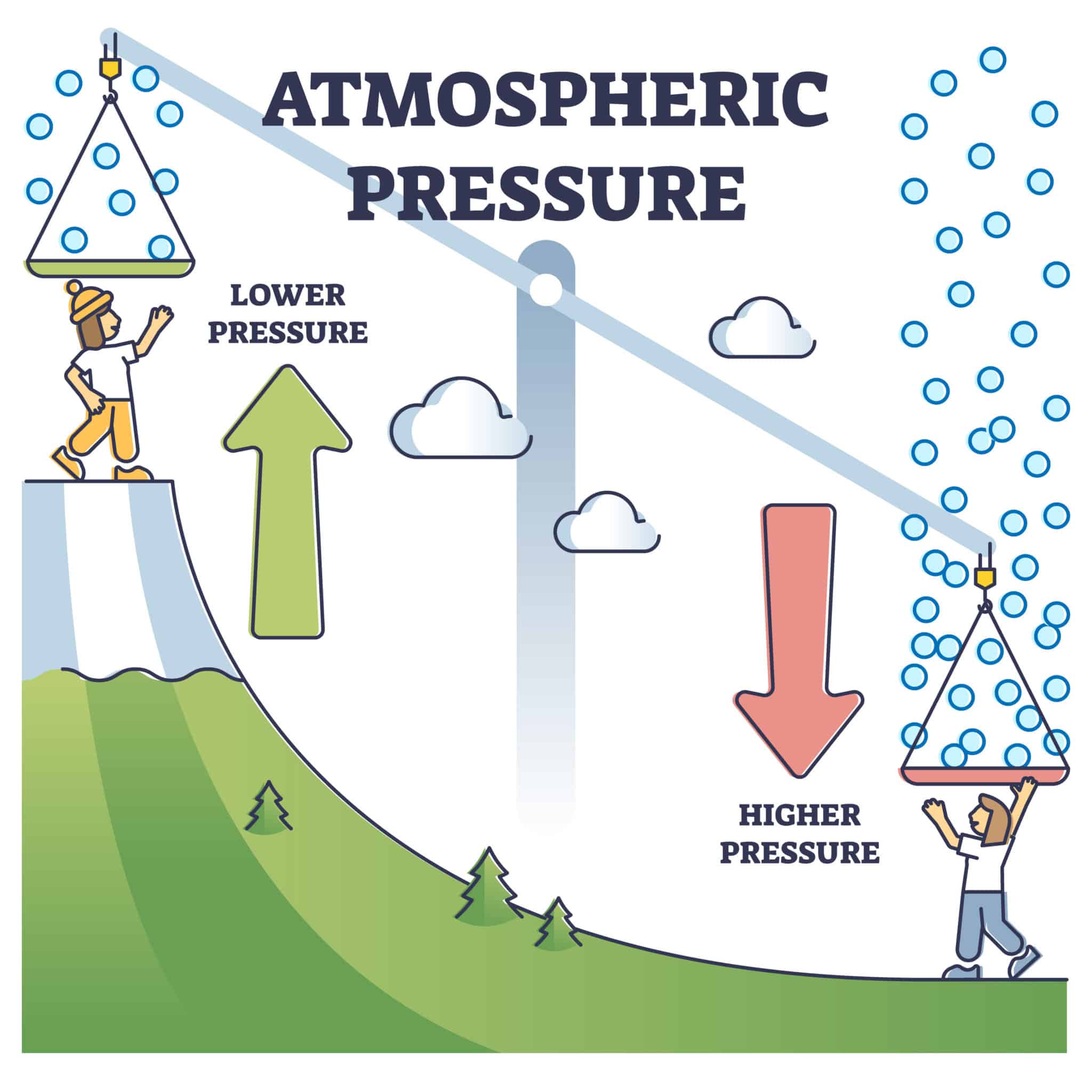

Everything You Need To Know About Barometric Pressure

How To Make A Barometer

How To Make A Barometer

Barometric Pressure Conversion Table Download Printable PDF

Barometric Pressure Readings

Barometric Pressure Readings

What Is Considered Low Barometric Pressure For Fishing - Self directed IRAs give small business owners the ability to grow their retirement funds tax deferred or tax free depending on whether they choose a Traditional or Roth account