What Is Credit Risk In that case the credit spread compares a riskless and a risky bond and the spread itself can be thought of as the price of risk for a bond with that specific coupon and maturity A credit spread is typically quoted in basis points where a basis point is

A credit default swap protects bondholders and lenders against the risk that the borrower will default The lender s insuring counterparty takes on this risk in return for income payments In this respect it is important for the insuring counterparty to fully assess the swap s risk return feature to ensure it is receiving fair compensation vis Credit derivatives allow a lender or borrower to transfer the default risk of a loan to a third party Though the terms differ from one credit derivative to another the general procedure is for a lending party to enter into an agreement with a counterparty usually another lender who agrees for a fee to cover any losses incurred in the

What Is Credit Risk

What Is Credit Risk

https://play.vidyard.com/UJvGEs7ayoxGWrNExeSsMY.jpg

:max_bytes(150000):strip_icc()/creditrisk-Final-18f65d6c12404b9cbccd5bb713b85ce4.jpg)

GitHub Akif23Hasan Module 20 Challenge Credit Risk Classification

https://www.investopedia.com/thmb/C_bFuBz5TbJphsxLFrlLx3S4zyM=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/creditrisk-Final-18f65d6c12404b9cbccd5bb713b85ce4.jpg

What Is Credit Risk Definition Importance Examples TheStreet

https://www.thestreet.com/.image/t_share/MTkxMTQ3NTUxMTgzODczMzkw/credit-risk.png

Some common types of financial risk include liquidity risk operational risk and credit risk Economic Risk vs Risk Tolerance Economic risk is the chance that macroeconomic conditions will affect investments Risk tolerance however is the ability and willingness of an investor to handle volatility in the market Underwriting is a critical step in the credit analysis and risk pricing process for almost all financial service companies For companies understanding the underwriting process and the requirements at each stage of the process will allow a company to prepare and present itself accordingly

The debt service coverage ratio is frequently used by analysts and investors to assess a company s credit risk and debt capacity A value greater than one means that the company has enough operating income to cover its short term debt obligations at least once whereas a number less than one means that it does not For example a senior tranche would appeal to investors with lower risk tolerance than a junior tranche How a Tranche Works in Investing Tranches are ranked according to credit risk Senior tranches are based on debt with less risk e g shorter maturities or higher quality debt than junior tranches

More picture related to What Is Credit Risk

:max_bytes(150000):strip_icc()/what-factors-are-taken-account-quantify-credit-risk.asp_V2-bfcbf24c1f2f42d1ba639fbfb830e67f.png)

Collateral Scale Money Risk

https://www.investopedia.com/thmb/gaDveb2qm5zmV1yJ4d49hlrdXY4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/what-factors-are-taken-account-quantify-credit-risk.asp_V2-bfcbf24c1f2f42d1ba639fbfb830e67f.png

Credit Risk YouTube

https://i.ytimg.com/vi/tcQLqDC0z1I/maxresdefault.jpg

What Is The Risk Of A Line Of Credit Leia Aqui What Is The Benefit Of

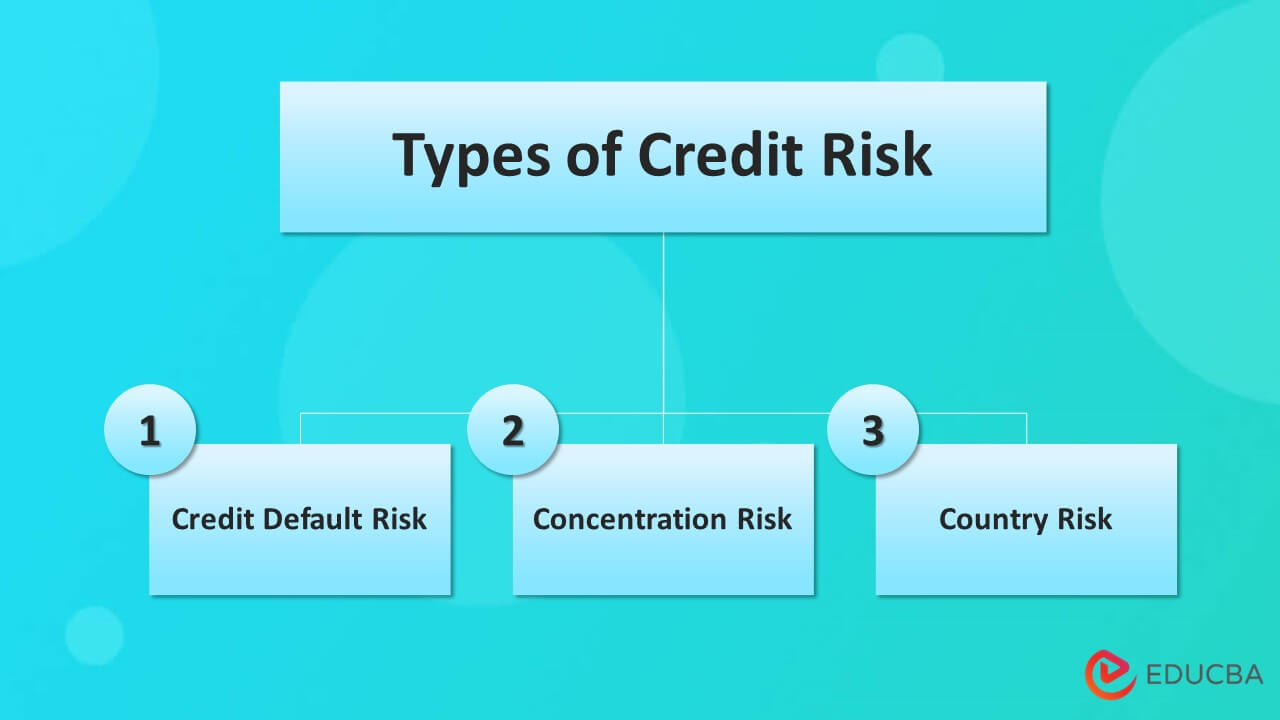

https://cdn.educba.com/academy/wp-content/uploads/2021/02/Types-of-Credit-Risk.jpg

The National Credit Union Administration NCUA acts in a similar manner as the FDIC insuring depositor funds at credit unions These deposits are also insured for up to 250 000 per individual per credit union per account type In the event a credit union fails the NCUA will reimburse depositors up to the insured amount An example of an unregulated activity is a credit default swap CDS Before the market collapse in 2008 one of the classic strategies employed by shadow institutions was borrowing via short term liquid markets typically commercial paper markets and using these short term funds to invest in longer term less liquid assets like

[desc-10] [desc-11]

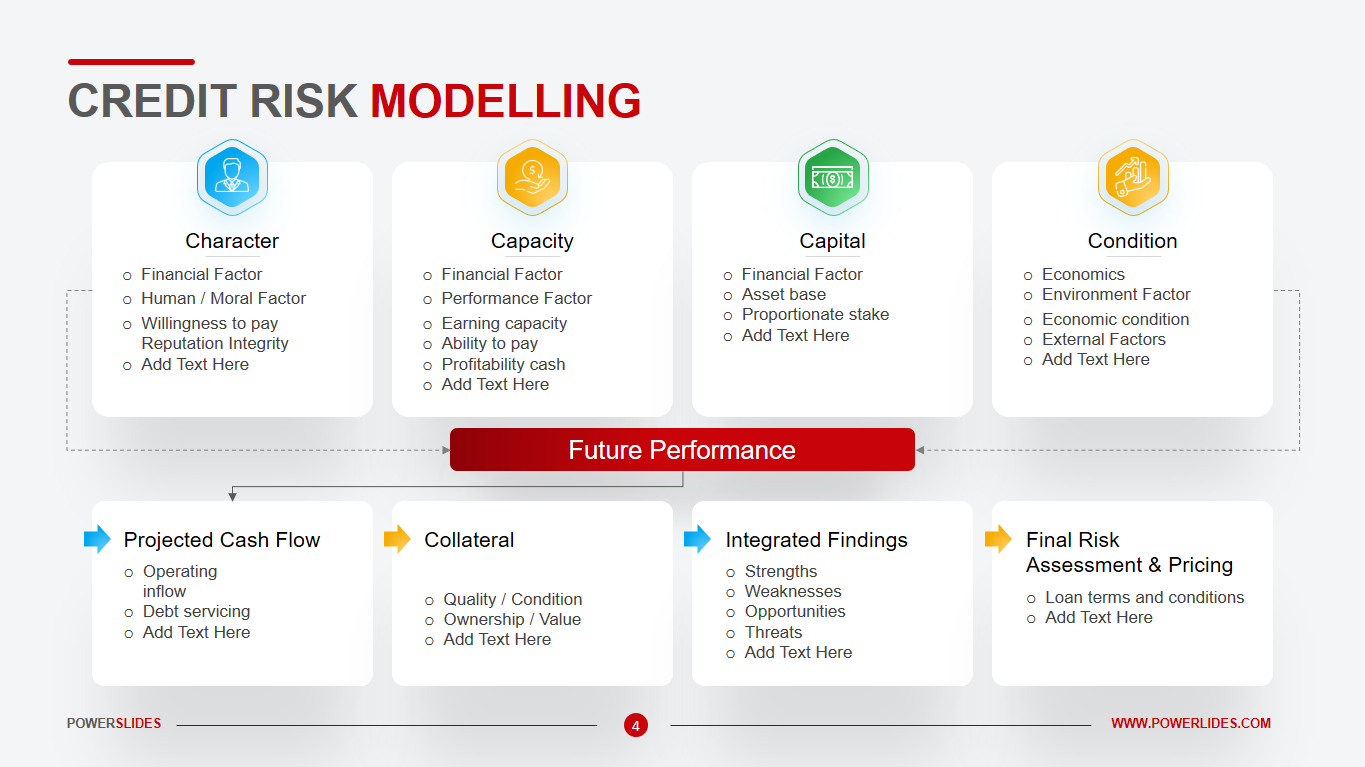

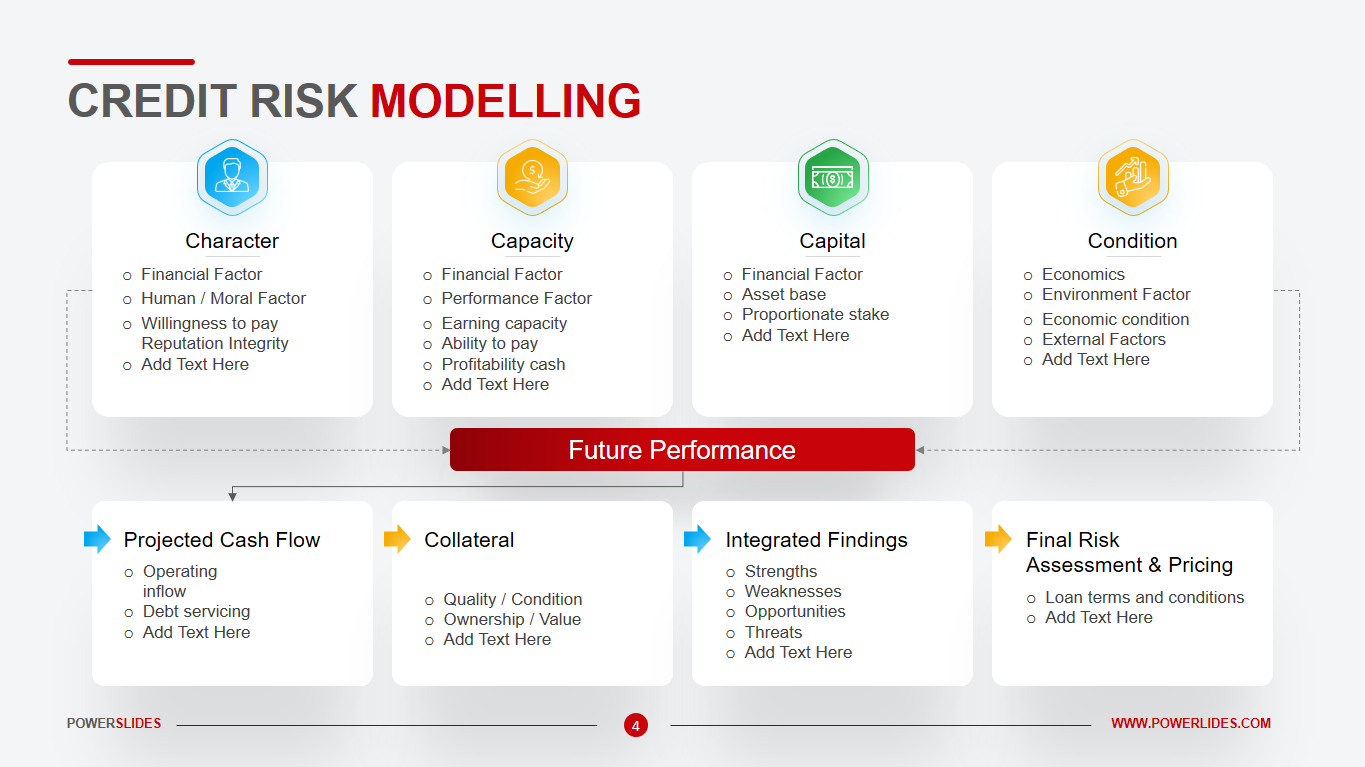

One Page Business Plan Template Easy To Edit Download

https://powerslides.com/wp-content/uploads/2021/11/Credit-Risk-Modelling-4.png

Best Practices For Improving Your Commercial Credit Risk Management MSCCM

https://www.msccm.com/wp-content/uploads/2019/04/shutterstock_635516519.jpg

https://investinganswers.com/dictionary/c/credit-spread

In that case the credit spread compares a riskless and a risky bond and the spread itself can be thought of as the price of risk for a bond with that specific coupon and maturity A credit spread is typically quoted in basis points where a basis point is

:max_bytes(150000):strip_icc()/creditrisk-Final-18f65d6c12404b9cbccd5bb713b85ce4.jpg?w=186)

https://investinganswers.com/dictionary/c/credit-default-swap-cds

A credit default swap protects bondholders and lenders against the risk that the borrower will default The lender s insuring counterparty takes on this risk in return for income payments In this respect it is important for the insuring counterparty to fully assess the swap s risk return feature to ensure it is receiving fair compensation vis

:max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)

Cinq C De Cr dit

One Page Business Plan Template Easy To Edit Download

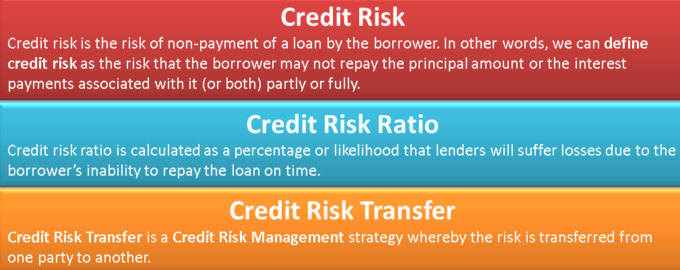

Credit Risk Ratio Counterparty Risk Risk Transfer Credit Rating

Credit Risk How To Measure Credit Risk With Types And Uses

Bank Credit Risk Management YouTube

What Is Credit Risk Management

What Is Credit Risk Management

Credit Risk

What Is Credit Risk And Types Leia Aqui What Is The Meaning Of Credit

Purpose Of Credit Risk Analysis Finance Tech Analytics Career

What Is Credit Risk - [desc-12]