What Is Income Tax Law And Practice Personal income tax Manitoba tax information for 2024 Use the information on this page to help you complete your provincial tax and credits form

Just how much tax can you save You save tax by investing in a retirement annuity But the amount of tax you save depends on your income level This table shows how much tax you Income from sources outside Canada must be determined in the same way net income is determined in Canada Kinship or close relationship programs programs of the Government

What Is Income Tax Law And Practice

What Is Income Tax Law And Practice

https://i.ytimg.com/vi/jqk6IsoxSic/maxresdefault.jpg

Income Tax Law And Practice Ryan Publishers

https://i0.wp.com/ryanpublishers.co.in/wp-content/uploads/2021/11/Income-Tax-Law-and-Practice.jpg?fit=1410%2C2250&ssl=1

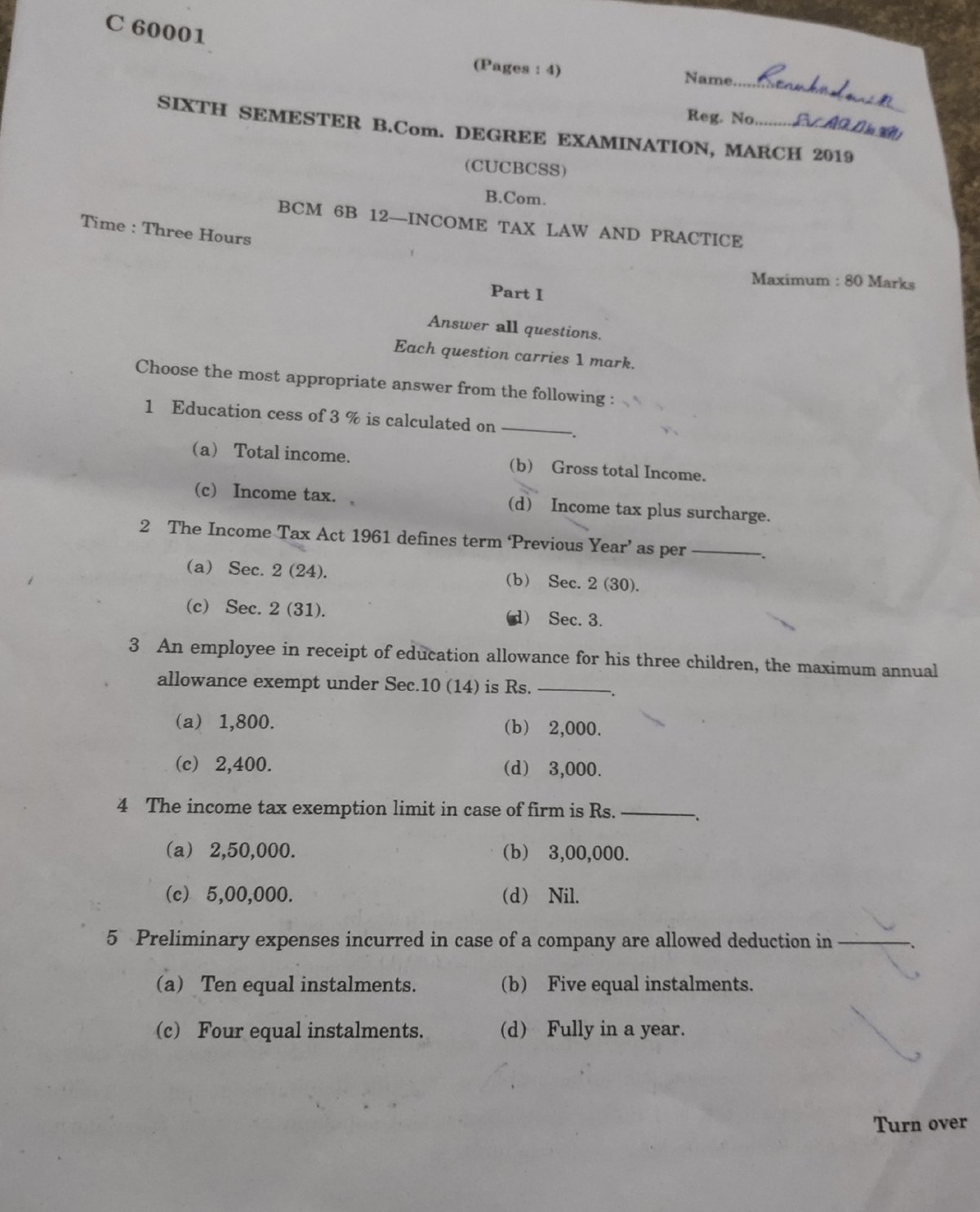

Income Tax Law And Practice Previous Year Question Paper 2022 23 Bcom

https://i.ytimg.com/vi/pQ3jRAqWlfg/maxresdefault.jpg

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full Information about the income tax rules that apply to non residents of Canada

Filing through a tax preparer If you don t do your taxes on your own an EFILE certified tax preparer like an accountant can file your income tax and benefit return for you Tax preparers Rental income income you earn from renting a property that you own or have use of Rental operation services you provide within your rental property to your tenants such as heat

More picture related to What Is Income Tax Law And Practice

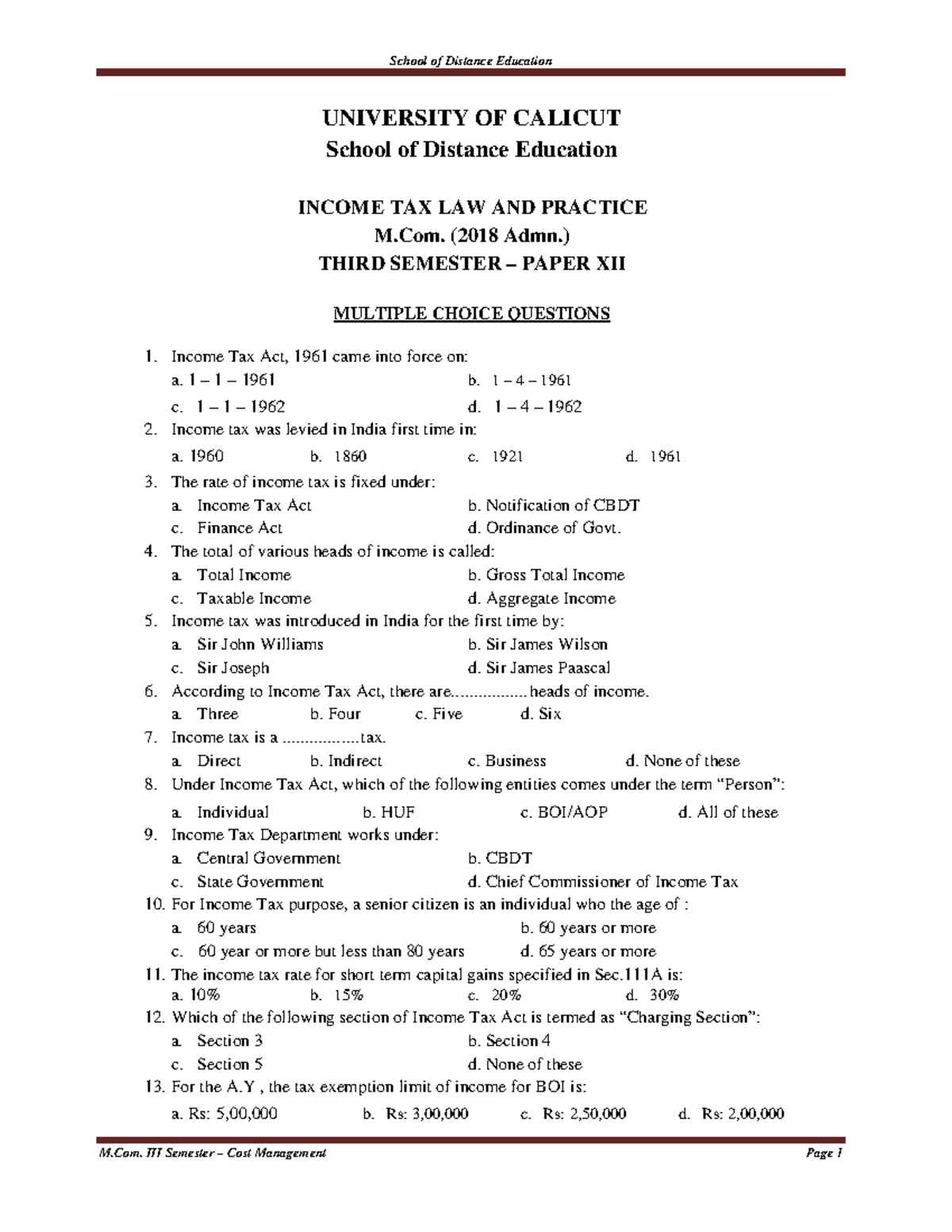

Income Tax Law And Practice Multiple Choice Questions Are Included

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/38d634eb46f72797acb204e72e06b676/thumb_1200_1553.png

New Reassessment Provisions Under Income Tax Law And Practice 28 01

https://kscaa.com/wp-content/uploads/2023/01/New-Reassessment-Provisions-under-Income-Tax-Law-and-Practice.jpeg

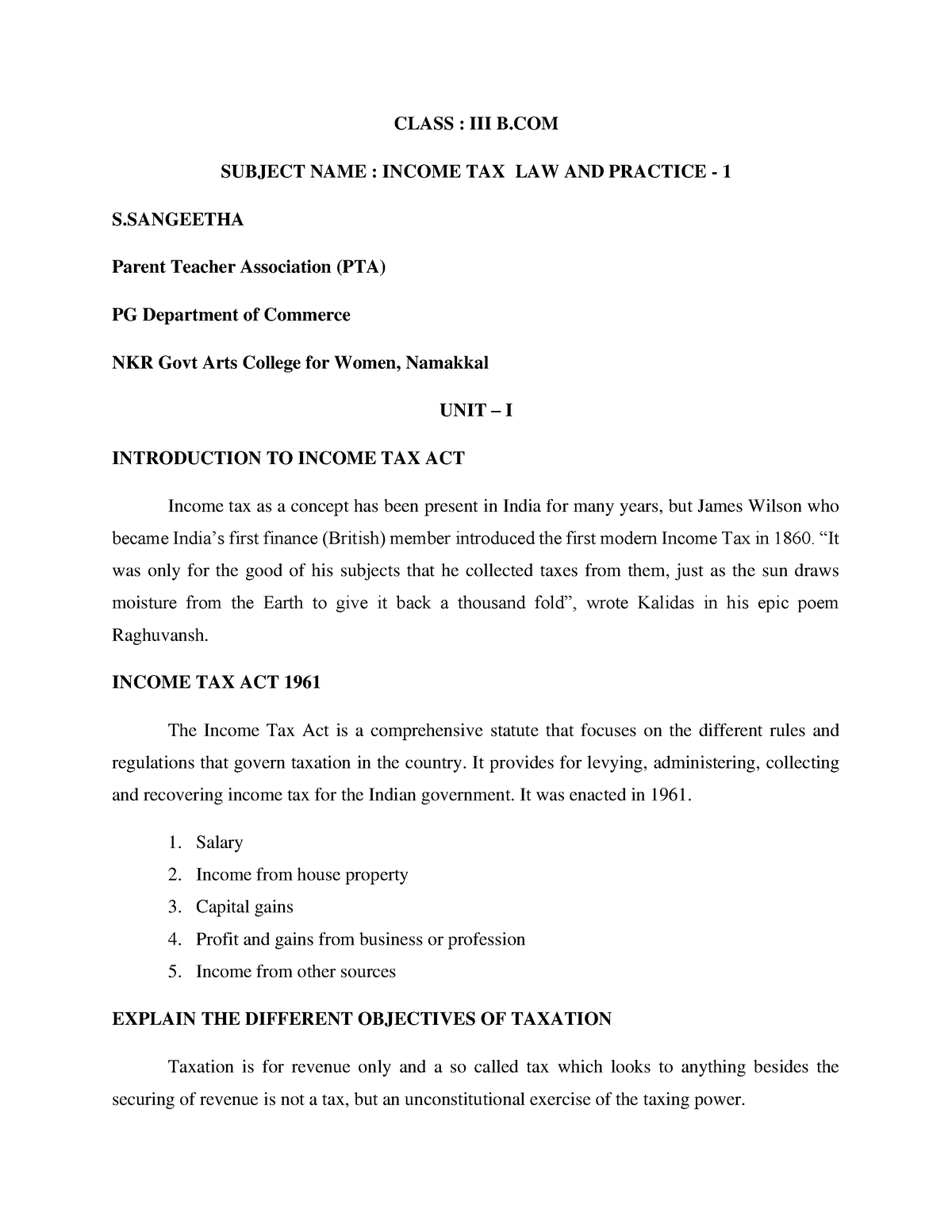

Income Tax Law And Practice 3 B COM CLASS III B SUBJECT NAME

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/d8b48e9fc3b9deaaf15d76c654ca6cb6/thumb_1200_1553.png

For combined Old Age Security pension and Guaranteed Income Supplement amounts consult the Quarterly report of Canada Pension Plan and Old Age Security monthly amounts and Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services

[desc-10] [desc-11]

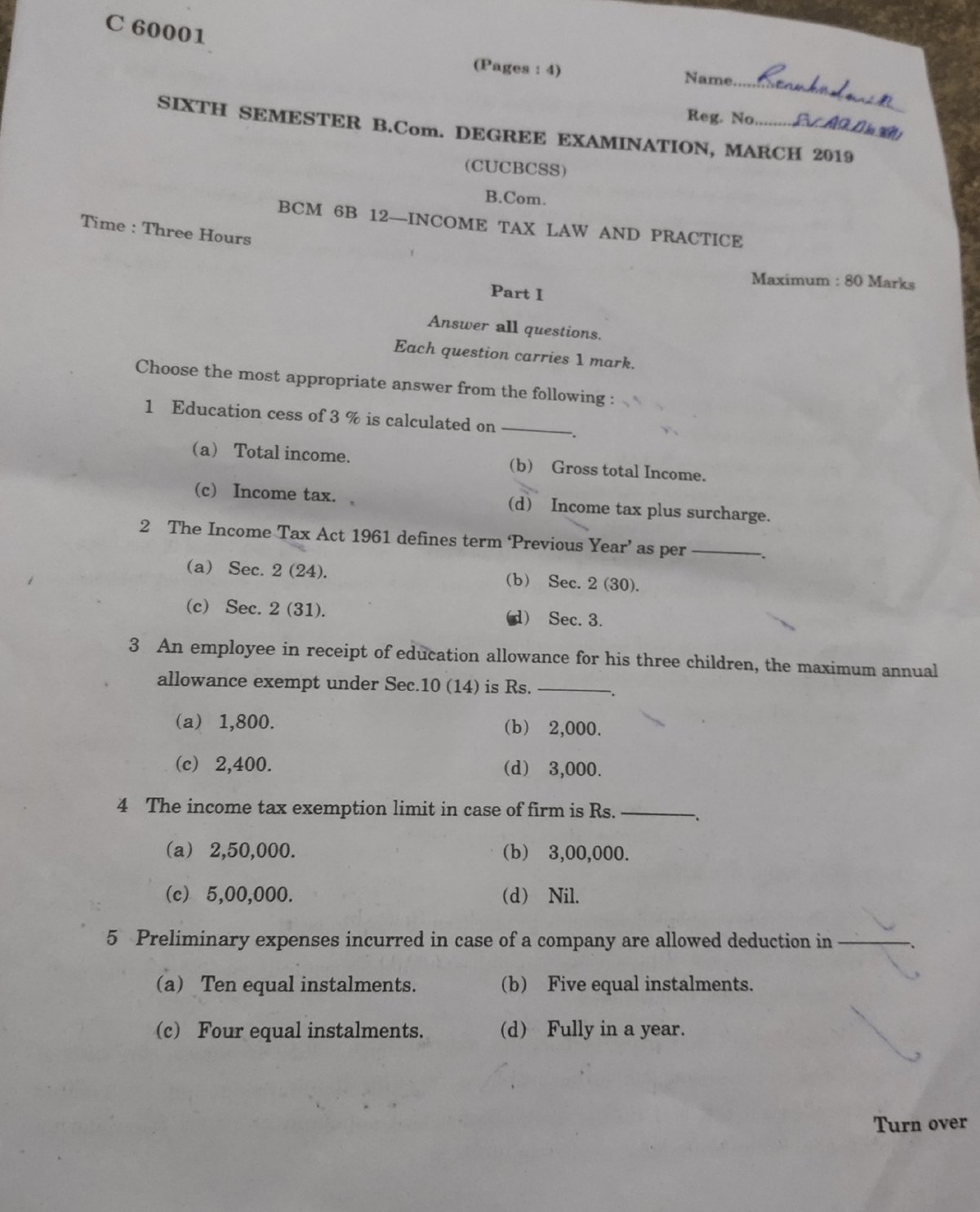

Income Tax Law And Practice Question Papers B COM Studocu

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/c867977bddfce2797b0e1d3247764e0d/thumb_1200_1484.png

Income Tax Law And Practice PDF Intellectual Works

https://imgv2-2-f.scribdassets.com/img/document/617969232/original/5d71fa0ef3/1687583444?v=1

https://www.canada.ca › ... › general-income-tax-benefit-package › mani…

Personal income tax Manitoba tax information for 2024 Use the information on this page to help you complete your provincial tax and credits form

https://howtaxworks.co.za › questions › tax-efficiency-ra

Just how much tax can you save You save tax by investing in a retirement annuity But the amount of tax you save depends on your income level This table shows how much tax you

2020 Income Tax Law And Practice Solved Paper B Com CBCS Pattern Hons

Income Tax Law And Practice Question Papers B COM Studocu

Buy Income Tax Law Practice BookFlow

Income Tax Law And Accounting By Virgilio D Reyes Hobbies Toys

Income Tax Law And Practice

BBA 208 Income Tax Notes GGSIPU All Clear Publication

BBA 208 Income Tax Notes GGSIPU All Clear Publication

What Do You Need To Know About Income Tax Benson Wood Co

Buy Income Tax Law Practice BookFlow

Direct Taxes Law And Practice DTLP For AYs 2023 24 2024 25 By Vinod

What Is Income Tax Law And Practice - Information about the income tax rules that apply to non residents of Canada